wellesenterprises/iStock Editorial via Getty Images

Underlying Security Symbol: NYSE:ADM

My portfolio has almost no exposure to food. I sold SYY (Sysco) when their debt ballooned, I replaced that with SpartanNash (SPTN) and had all my shares assigned as the price of Spartan ballooned. I started a position in ADM today.

ADM meets all my criteria:

- A catalyst, low agricultural supplies here and abroad, to help growth

- A growing dividend

- Growing revenue, income, and EPS that beat analyst estimates

- Call premiums that make up for a relatively low dividend yield

- Low P/E Ratio

- Low D/E Ratio

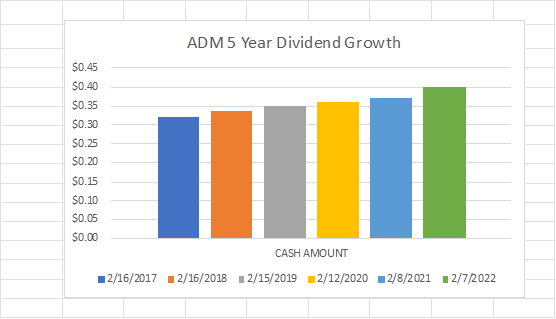

Dividend growth is important and ADM has delivered 5% dividend growth on average over the past 5 years. This alone will not offset inflation but it sure is a help.

Author

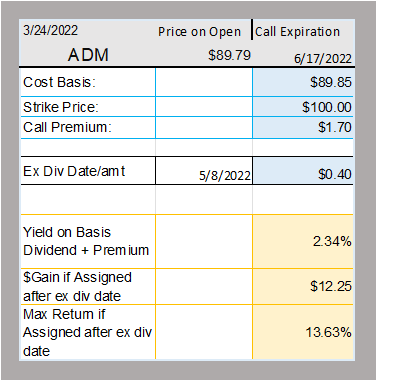

When you add in call premiums, the income potential is good. Remember I am an income investor first and foremost. In the case of ADM, I chose an expiration date further out, June 17, 2022. I almost never go out further than 90 days. With the value of time, I was able to select a strike price of a little more than 10% above my basis. Also, the longer strike price should allow me to also receive the dividend.

Author

Unlike recent calls I posted about, I don’t want this one taken. If it is assigned, I will find another stock to buy. But I am hoping for a gradual increase in stock price so if this call expires, I can sell another call.

Constantly working your portfolio is the way to make a living with less risk.

MM MoneyMadam

Data from Schwab.com and Marketxls

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment