Galeanu Mihai/iStock via Getty Images

Co-produced with Treading Softly

Yesterday we highlighted two excellent high-yield preferreds that offered solid income. Preferred shares have sold off as investors fear rising rates, offering investors an opportunity to buy income at lower prices.

Today, we want to highlight two more outstanding opportunities from within the High Dividend Opportunities fixed-income vault. I like fixed-rate preferreds for the ease of knowing my future income, however, when rates are set to rise, fixed-to-float or resetting rate preferreds can offer a boost in future income as rates begin their climb. Reset rate preferreds are something Canadian investors will be more accustomed to as they are very common to our Northern friends. The reset feature protects preferred investors from rising rates.

Both of these preferreds have a reset feature, so if rates rise, your income will too! We have been buying up these shares and locking them away as they provide excellent income in all market conditions. Let’s dive right in.

Pick #1: ARGO-A – Yield 6.8%

Argo Group International Holdings, Ltd. (ARGO) is the issuing company of one of our target preferreds today. We are all familiar with insurance. We insure our houses, cars, health, and even our lives. Nearly everything can be insured. Yachts, airplanes, businesses, manufacturing liability, commercial equipment, and more.

ARGO offers numerous specialty insurance products as well as “reinsurance” (insurance for insurance companies). They are an investment-grade company that has issued Argo Group International Holdings, Ltd. – Redeemable 7.0% Non-Cumulative Resettable Fixed Rate Preferred Shares (ARGO.PA). ARGO-A is attractive for a number of reasons and its recent price slide provides an excellent entry point.

Why the slide? ARGO is in the midst of a transition, winding down old segments and focusing on what management feels will be the most profitable core. ARGO’s 4th quarter results took a heavy impact from old policies having claims come against them, driving results negative. Overall ARGO continues to pay a regular common dividend and is focused on getting the new core in place. Rarely does a business transition go off without any hitches and this recent quarter can show the impact of old policies waiting in the wings to expire.

With a high yield now – 6.8%, it also offers investors the chance to benefit from rising rates. If not redeemed on the 9/15/2025 call date, ARGO-A‘s dividend rate resets to the sum of the 5-year U.S. Treasury Rate plus 6.712%, and resetting every 5 years thereafter. This is also the opportunity for ARGO to call ARGO-A. If they do not call it in 2025, they are forced to wait until 2030 for another chance.

Additionally, ARGO-A pays “qualified” dividends (‘QDI’), which in a taxable account can benefit from the lower capital gains tax rates. We can collect a high-yield today and if ARGO chooses not to call, our yield will be adjusted – likely higher.

Pick #2: FTAI-C – Yield 8.1%

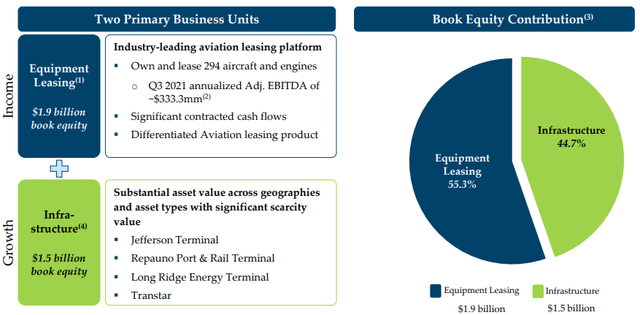

Fortress Transportation and Infrastructure Investors LLC (FTAI) is a Master Limited Partnership that is a sub-company of Lockheed Martin (LMT). As such their primary focus is the leasing of aviation engines and aircraft. FTAI also operates other critical infrastructure.

FTAI Investor Presentation – Feb. 23, 2022

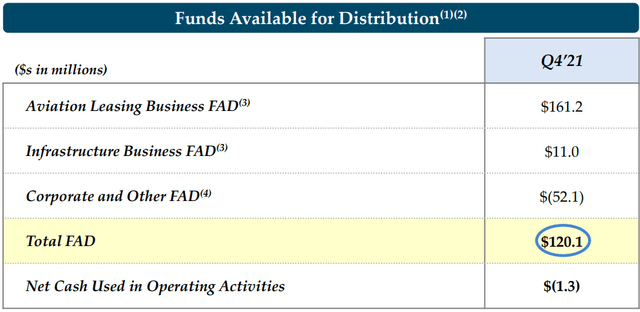

As a total whole the infrastructure business provides more book value to FTAI holders, but in reality, the real income driver currently is FTAI’s leasing business, providing the lion’s share of the cash available to be distributed:

FTAI Supplemental Information Fourth Quarter 2021

Currently, FTAI is strongly covering its preferred distributions. This is why we like Fortress Transportation and Infrastructure Investors, Reset Rate Cumulative Series C Preferred (FTAI.PC).

FTAI is planning to split its infrastructure and leasing businesses into two separate companies and remove its K-1 tax structure. Currently, FTAI and its various preferreds all still issue a K-1 at tax time. Management recently stated this split should occur next month – April – giving FTAI-C a “qualified” dividend and removing its K-1 structure. The preferreds will move into the leasing company, where most of the revenue is earned currently.

Why else do we like FTAI-C? It has a resetting rate structure, much like ARGO-A. If it isn’t called, then on 6/15/2025 its dividend rate will be reset to the sum of the 5-year Treasury rate plus 7.378%, and resetting every 5 years thereafter. Unlike ARGO-A however, FTAI-C can be called any time after the initial call date. No five-year lock-up period here.

FTAI-C has dropped in price since the Russo-Ukraine war started and its price has moved attractively below par last week. We see this move as extreme – less than 7% of FTAI’s entire portfolio is exposed to Russia, about 8 planes in total. So FTAI has plenty of room to “recover” from any potential issues all while paying our preferred dividends. Now is an excellent time to get it at a high yield and if it isn’t called – enjoy even higher income as rates are set to rise in the near future.

Shutterstock

Conclusion

With ARGO-A we get excellent income from an investment-grade rated company paying qualified dividends. With FTAI-C, we get a preferred with a well-covered dividend and the benefits of the K-1 structure for just a little longer. Overall both tie their resetting rates to the 5-year Treasury rate, which we foresee rising as 2025 approaches. This is the best kind of delayed gratification, we get high yield income now and even higher income in a few years!

When planning your retirement income streams, don’t forget preferreds, bonds, and other forms of fixed income. These sources of income provide extra income security and capital protection with their par values. I currently encourage High Dividend Opportunities members to have 40-50% of their portfolio in fixed income. These aren’t stale, low-yield bonds. You can find excellent high yield opportunities many with resetting, fixed-to-float, or floating rate features. Allowing you to have a portfolio of income generators that allow your portfolio to be dynamic and resistant to the risks rising rates pose to fixed-income investments.

Lock in this income.

Then go enjoy your retirement! Take a trip. Hit the golf course.

I enjoy seeing the income pouring in from these excellent opportunities from within the High Dividend Opportunities fixed income vault. We buy them and lock them in there. They provide the income we rely upon and they can do the same for you.

Be the first to comment