simon2579

A Quick Take On Root

Root (NASDAQ:ROOT) reported its Q3 2022 financial results on November 9, 2022, missing revenue but beating EPS consensus estimates.

The firm provides personal insurance solutions in the United States via a mobile-first approach.

Management has undertaken major cost reduction initiatives, including another large layoff and sharply reduced marketing spend.

Until we see meaningful progress toward operating breakeven, I’m on Hold for ROOT.

Root Overview

Columbus, Ohio-based Root was founded to utilize car data to adjust car insurance pricing based on the driver’s personal driving habits.

Management is headed by co-founder and CEO Alexander Timm, who was previously in various management roles at Nationwide Mutual Insurance Company.

The company says it is a ‘full-stack insurance carrier…[that owns] nearly every aspect of policy design, origination, underwriting, claims and back-end processing, which enables us to iterate constantly.’

The firm obtains a large percentage of its customers direct [DTC] via online digital marketing through Facebook and Google.

Management believes that over time more of its business ‘will naturally mature as renewal premiums outweigh new premiums, driving profitability.’

Root’s Market & Competition

According to a 2020 market research report by Allied Market Research, the global auto insurance market was an estimated $739 billion in 2019 and is expected to reach more than $1 trillion by 2027.

This represents a forecast CAGR of 8.5% from 2020 to 2027.

The main drivers for this expected growth are an increasing number of road accidents in many countries as well as mandated insurance coverage in more regions and the implementation of stringent government regulations.

Also, emerging economies will also see an increase in discretionary income producing growing demand for motor vehicles and their attendant insurance coverage requirements.

The Asia Pacific region is expected to produce the fastest growth through 2027 as it increases its adoption of mobile telematics technologies.

Root faces competition from traditional automobile insurers that may adjust their go-to-market and technology offerings to cater to those drivers who wish to include their telematics information in their policy calculations.

Root’s Recent Financial Performance

-

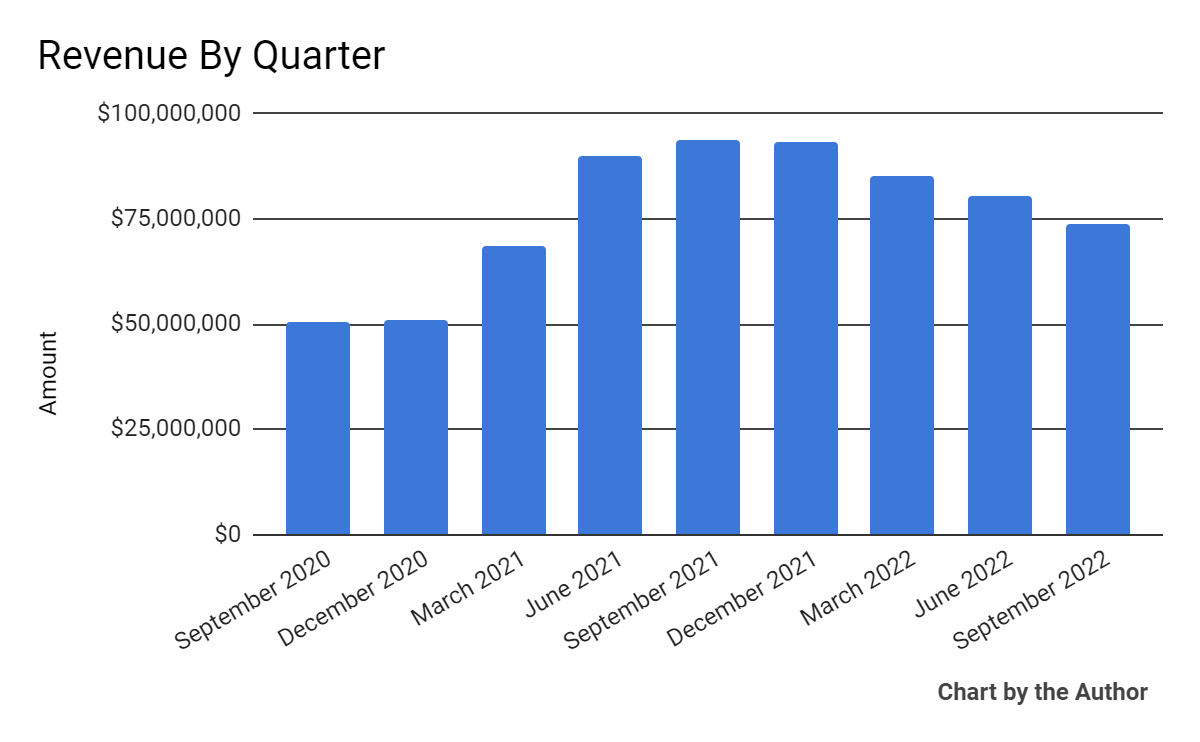

Total revenue by quarter has fallen in recent quarters:

Total Revenue (Seeking Alpha)

-

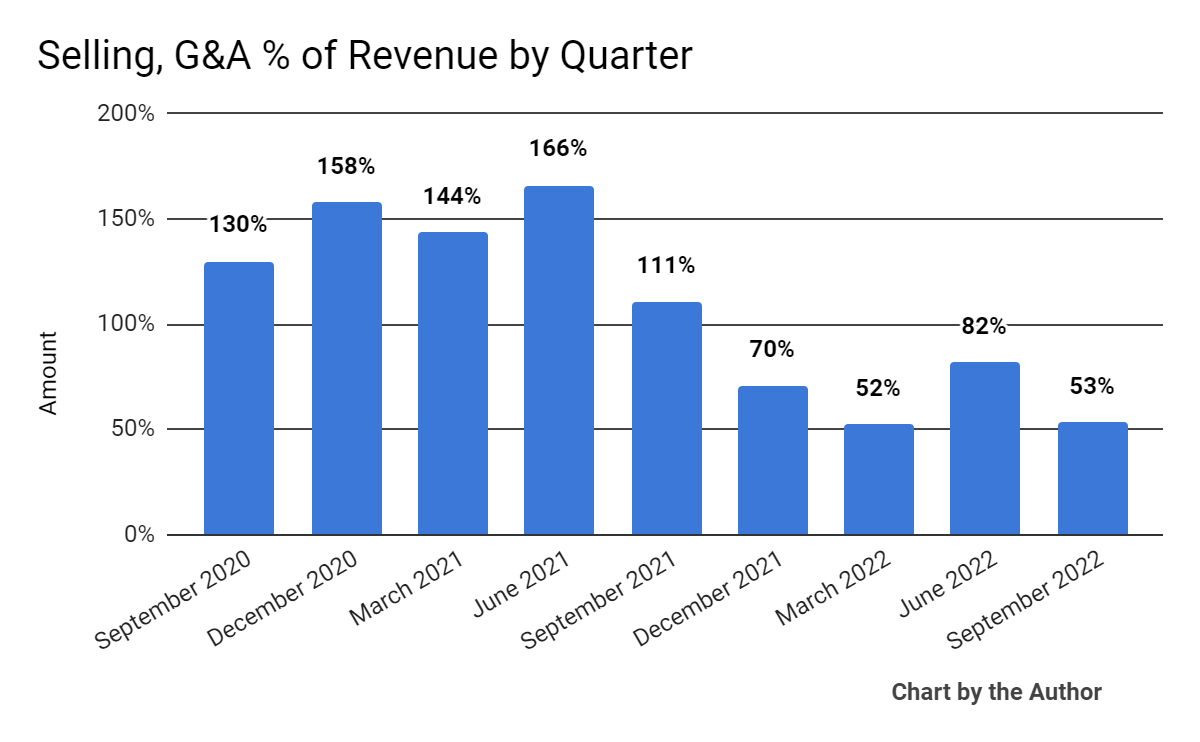

Selling, G&A expenses as a percentage of total revenue by quarter have fallen recently:

Selling, G&A % Of Revenue (Seeking Alpha)

-

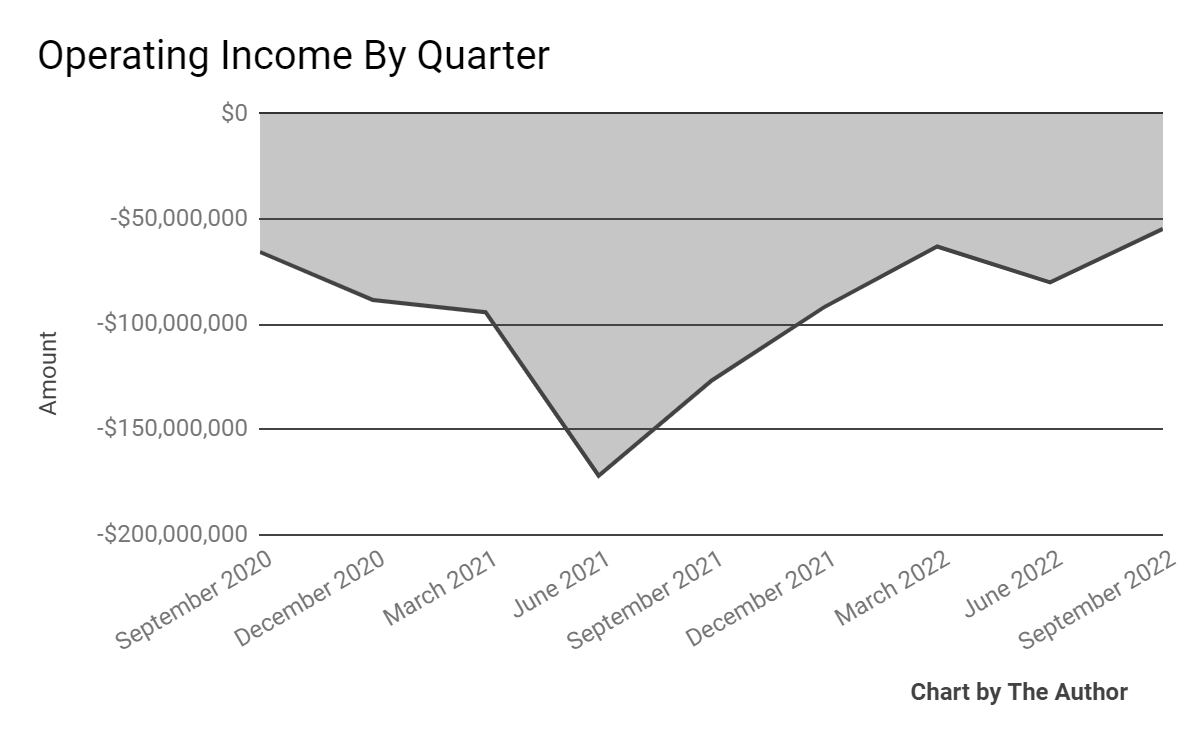

Operating income by quarter has remained heavily negative, but has improved in recent reporting periods:

Operating Income (Seeking Alpha)

-

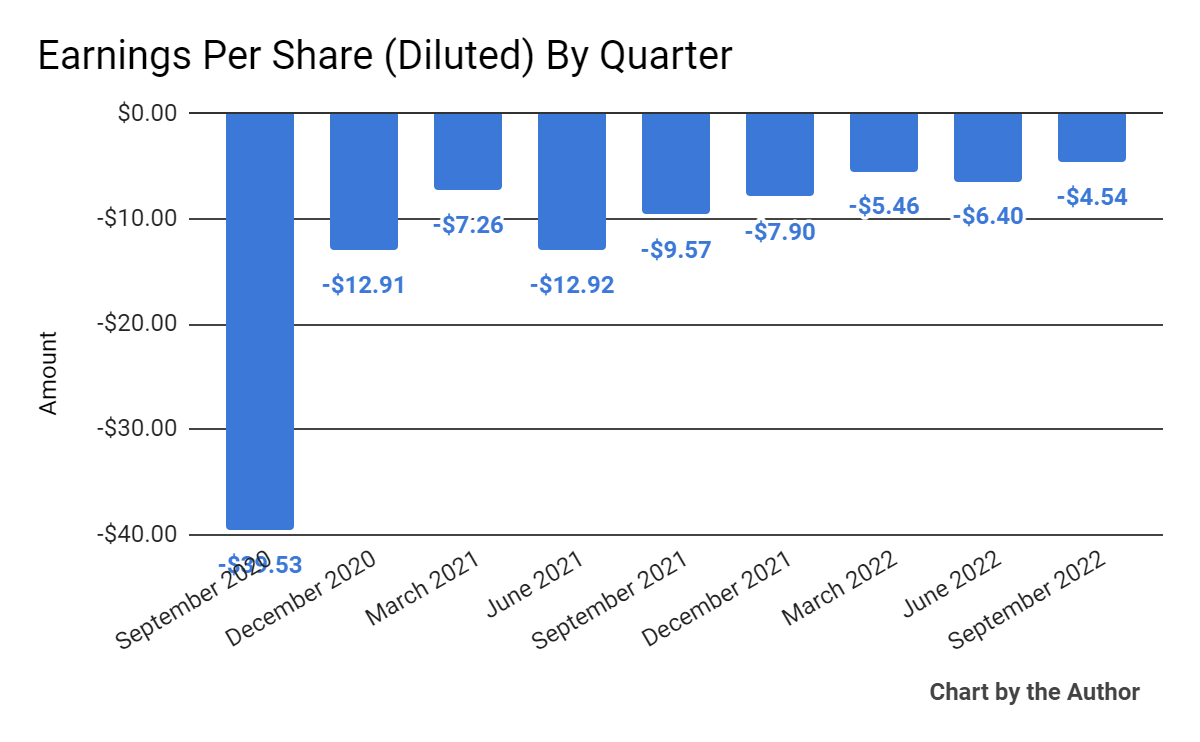

Earnings per share (Diluted) have also remained negative but have improved in recent quarters:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

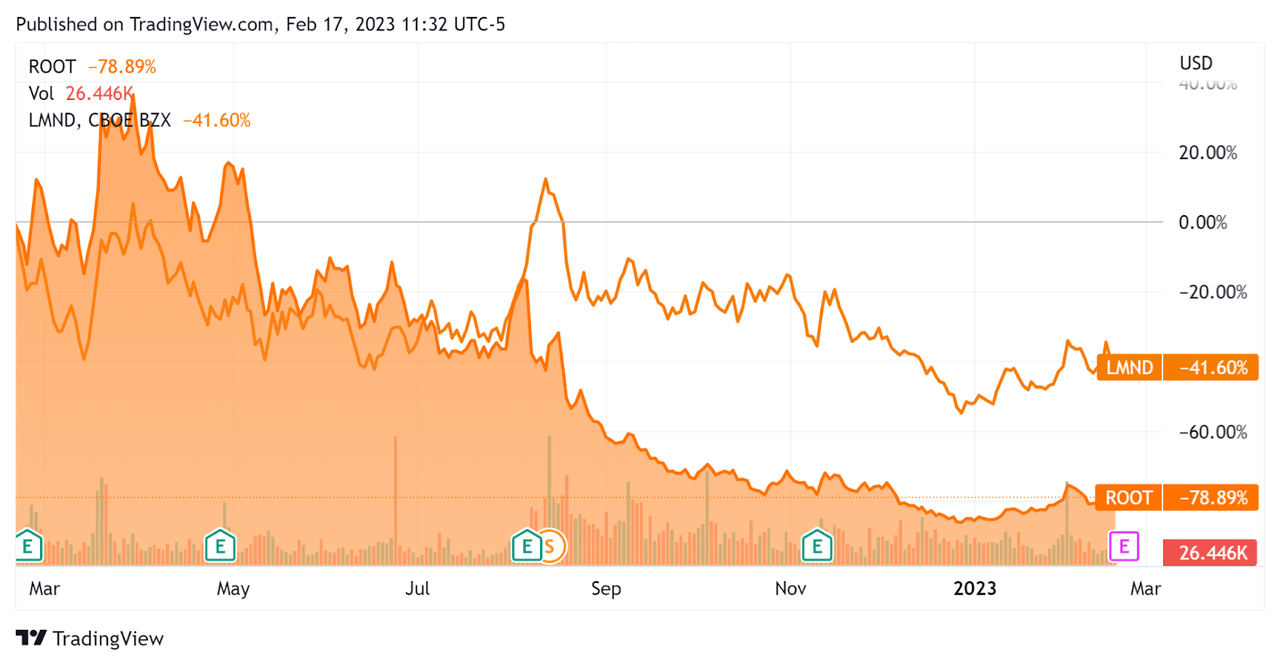

In the past 12 months, ROOT’s stock price has fallen 78.9% vs. that of Lemonade’s drop of 41.6%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Root

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Price / Sales |

0.3 |

|

Revenue Growth Rate |

9.8% |

|

Market Capitalization |

$96,303,000 |

|

Enterprise Value |

-$317,496,992 |

|

Operating Cash Flow |

-$203,000,000 |

|

Earnings Per Share (Fully Diluted) |

-$24.30 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Lemonade (LMND); shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Lemonade |

Root, Inc. |

Variance |

|

Price / Sales |

5.2% |

0.3% |

-94.2% |

|

Revenue Growth Rate |

94.0% |

9.8% |

-89.6% |

|

Operating Cash Flow |

-$184,300,000 |

-$203,000,000 |

10.1% |

(Source – Seeking Alpha)

Commentary On Root

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted its slightly improved loss ratio compared to industry competitors.

Leadership echoes others in the industry seeing ‘a massive shift in auto insurance distribution’ to online sources.

Despite this, the company instituted another headcount reduction of 17%, which management believes will reduce its annual run rate expenses by approximately $50 million when completed.

As to its financial results, total revenue dropped 21.4% year-over-year.

Management did not disclose any company or customer retention rate metrics.

SG&A expenses as a percentage of total revenue continued to fall, a positive sign on the expense side of the business as the firm lowered its cost structure to adjust to current business conditions.

Operating losses, while still large, continued to be reduced, although the company has a long way to go to achieve breakeven.

For the balance sheet, the firm ended the quarter with $819.7 million in cash and $293.9 million in long-term debt.

Over the trailing twelve months, free cash used was $205.3 million, of which capital expenditures accounted for $2.3 million.

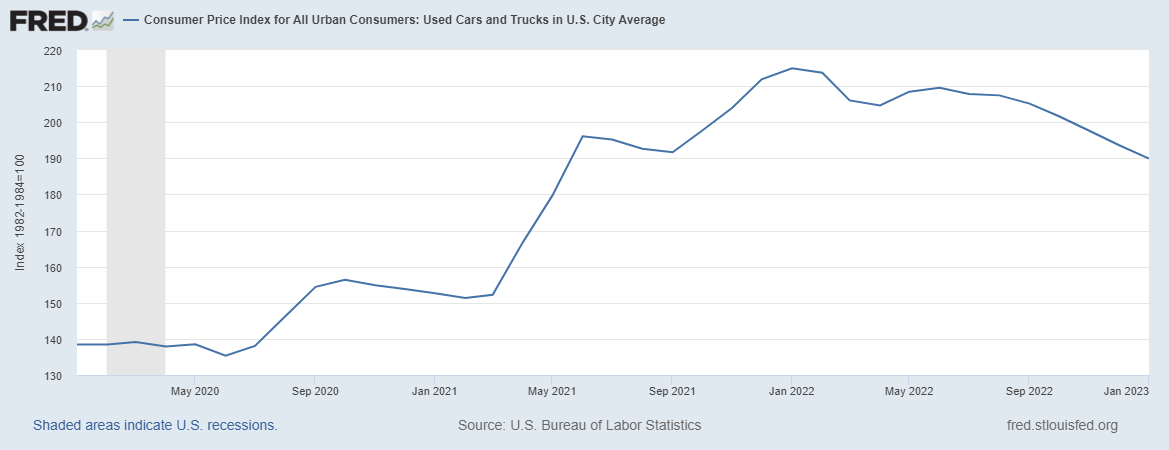

The primary risk to the company’s outlook is a continued high inflationary environment despite a rise in the cost of capital, although used automobile prices have recently come off their recent highs as the chart shows below:

Used Car And Truck CPI – U.S. (U.S. Bureau of Labor Statistics)

A potential upside catalyst to the stock could include continued improved loss ratio performance compared to peers, which would likely need to be demonstrated for several quarters before investors could discern a real trend.

However, given Root’s large operating losses, the firm has a long way to go to achieve operating breakeven; those losses have been severely penalized in the current market environment.

Until we see meaningful progress toward operating breakeven, I’m on Hold for ROOT.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment