Chris Hondros/Getty Images News

Last week, OpenAI’s ChatGPT released to the public and immediately generated a lot of publicity. OpenAI’s servers went down as the company struggled to handle the web traffic it received. Later, when the app was up and running, people took to Twitter to share cool things the chatbot was able to build for them. Many Twitter users celebrated the new app and the technological innovation it represented.

Other Twitter users took a different view. Noting how good the app was at finding information, they claimed that ChatGPT would “kill” Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google Search. ChatGPT not only retrieved accurate information, but it also presented it in a format that was more usable than Google’s typical results. An example of this can be seen below:

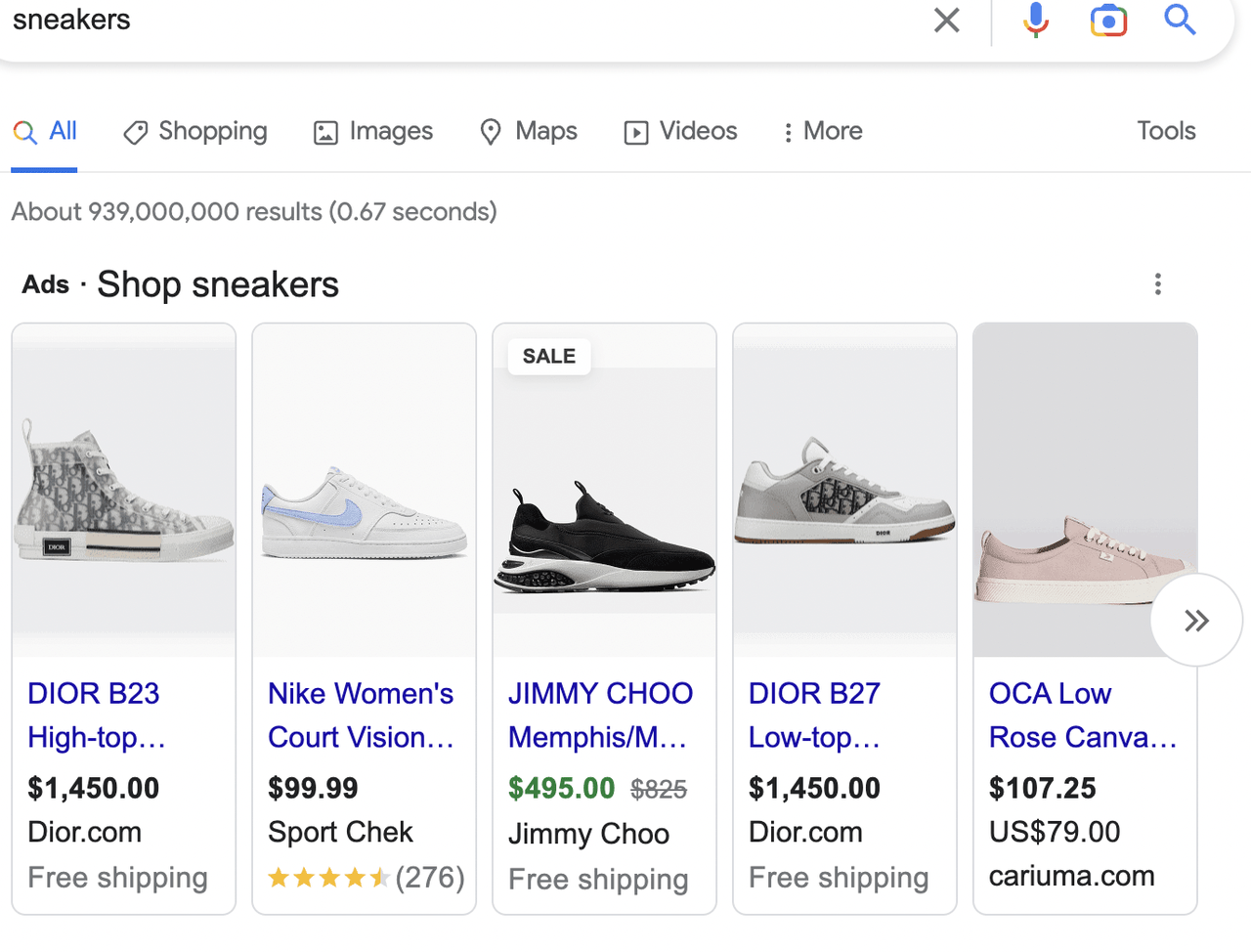

Clearly, people got great results using ChatGPT to retrieve information. However, this fact does not mean that people are going to stop using Google Search. ChatGPT’s training data ends in 2021, which means that it can’t give you information on current events, recent social media posts or, crucially, new products. That last item is particularly important because one of the main ways Google serves ads is by putting them on product related searches. An example of this is shown in the series of images below:

Sneakers search part 1 (Google) Sneakers search part 2 (Google) Sneakers search part 3 (Google) Sneakers search part 4 (Google)

As you can see, I searched for ‘sneakers’ and was shown targeted ads, organic results, news, and related questions. These kinds of results wouldn’t be possible on ChatGPT. Breaking news couldn’t be shown due to the 2021 data cut off, ads couldn’t be shown because ChatGPT is not currently ad supported. If you look at OpenAI’s website, you will see that its business model involves charging users for access to its models. It does not run ads on ChatGPT; the current free public use of the chatbot may not last forever. It could be that OpenAI will start running ads on ChatGPT, but given that the organization’s current business model involves charging users directly, that seems unlikely.

Additionally, Google has invested vast sums of money into AI research itself. Its AI division, Deepmind, has some of the most advanced capabilities in the world, and has itself done research on language models. It’s only natural that Google would keep its LLM research close to its chest: for Google, the path to monetization is to work AI into its existing products, rather than release it directly to the public like OpenAI has.

Deepmind YouTube info (Alphabet)

None of this is to say that ChatGPT is no threat to Google at all. Its efficiency in retrieving information could take eyeballs away from Google search, and fewer eyeballs could translate into lower revenue. However, it’s not an existential threat, and it’s not any kind of threat in the immediate term. Provided that Google’s AI research is at least as good as OpenAI’s, then Google should be able to retain its dominant position in search advertising. For this reason, I consider GOOG’s recent pullback a buying opportunity rather than a rational response to risk.

Alphabet – Competitive Position

I’ve written about Alphabet’s competitive position extensively in past articles. Previously, I tended to touch on the company’s advantages in mobile operating systems, search and overall advertising. Combined, it’s a significant moat, but since I’m talking about one specific competitive threat in this article, I should focus on the one part of Google’s business that is affected by that competitive threat:

Search.

As of right now, ChatGPT can’t host or create videos, host cloud services, or run an email client. These aspects of Google’s business are not affected by ChatGPT one way or the other. However, ChatGPT does overlap with search to an extent, so it helps to look at where Google’s competitive position in search is now.

Google search has been described as a monopoly. It has an 83% market share worldwide; the percentage is higher in the United States, and in Western countries generally. Based on search market share, you would think that Google is in fact a monopoly, but things aren’t that simple. Google is not a product that is sold to users; rather, it is a platform used to sell ads to businesses. If you view advertising as the ‘market,’ then Google’s share is large but not monopolistic: 27.5%.

In advertising, Google competes with the following companies:

-

Meta Platforms (META) – the #2 player in the space.

-

Amazon (AMZN) – whose ad platform serves ads to users based on what they searched for, similar to Google.

-

Microsoft (MSFT) – which runs ads on a variety of platforms ranging from Bing to LinkedIn.

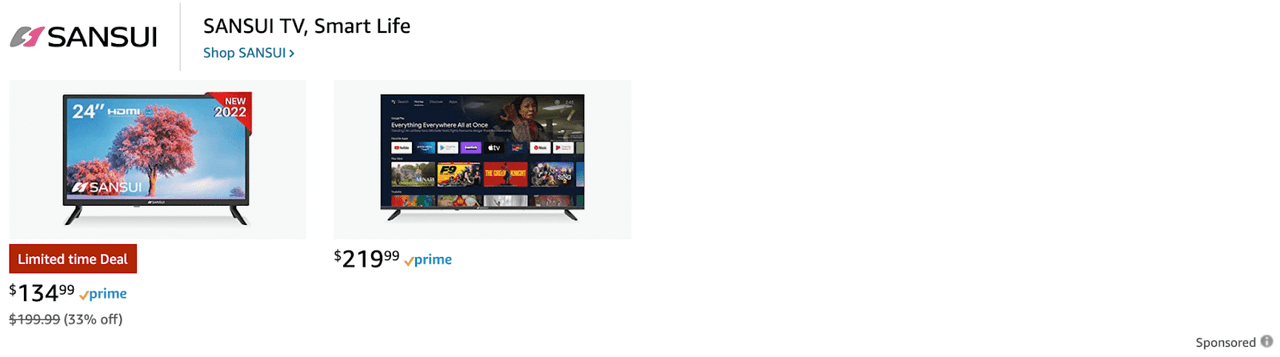

There is considerable competition in online advertising. Google is in the lead, but it’s only a few percentage points ahead of Meta. There is less competition in search advertising specifically. As mentioned, there just aren’t that many people using non-Google searches out there. The closest ad platform to Google’s own would probably be Amazon’s: Amazon has a search bar in which you enter an item you’re looking for and get served an ad based on the keyword. An example of an Amazon ad is shown below.

Amazon ad (Amazon)

The line that says ‘sponsored’ in the lower right corner lets you know it’s an ad. On Amazon, customers search for something, and then see ads for it. This is similar to what happens on Google. It’s quite different from Meta, Twitter, and other platforms, which generally target ads based on user data, without the benefit of user intent generated by search queries. With that said, Amazon’s search bar is no Google search. It only surfaces products listed on Amazon’s platform: you wouldn’t use it to search for a Doctor or lawyer. As far as those kinds of searches go, people overwhelmingly prefer to use Google.

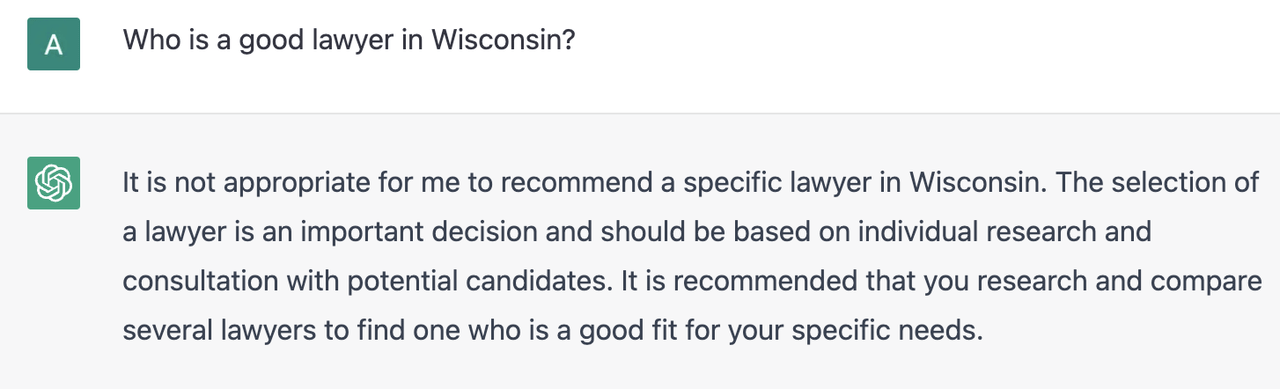

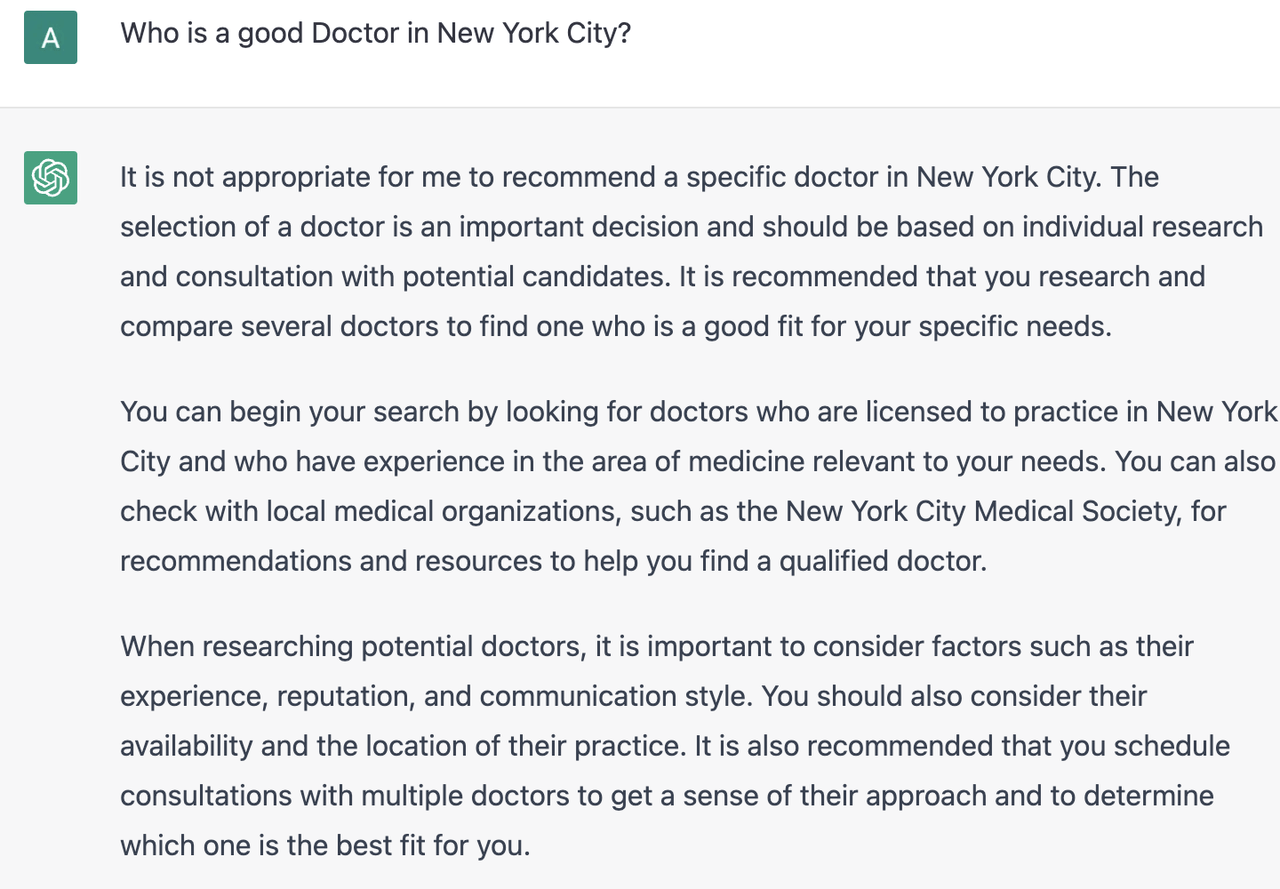

ChatGPT does not appear to have access to data that would replace Google for product searches. I did a number of searches for professionals in various local areas on ChatGPT, it couldn’t find any.

ChatGPT lawyer search: no result! (OpenAI)

ChatGPT doctor search: no result! (OpenAI)

Now, the obvious counter-point here is that ChatGPT is good for answers to programming questions, general knowledge queries and other such things. People use Google search for these things, and may get shown ads when they search for them. That’s certainly true, but remember that Google makes money by advertising products. ChatGPT is not great at recommending specific products, it doesn’t even know about products that were released after 2021. When it comes to product searches, Google is still on top.

Google Stock Valuation

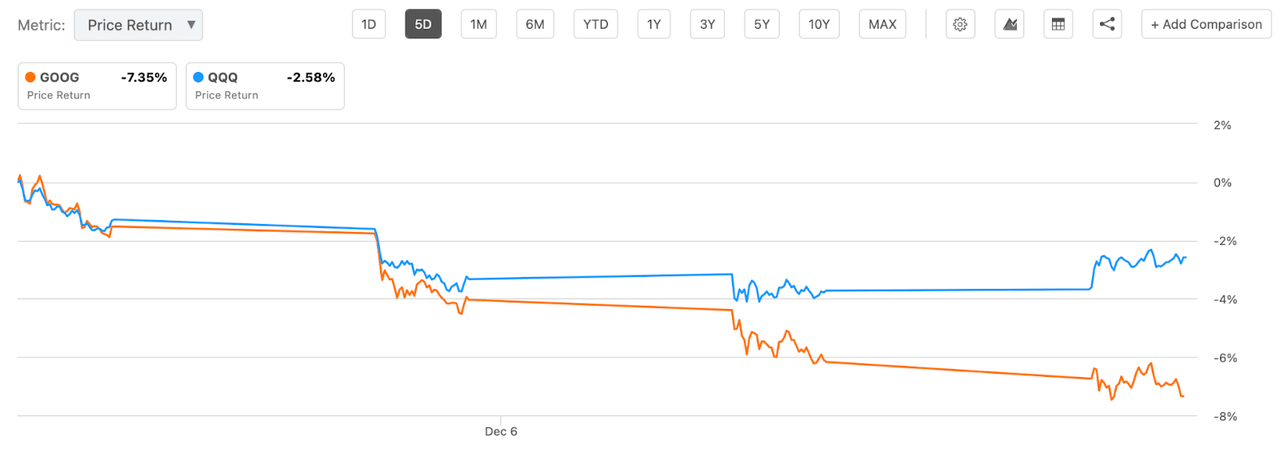

Having looked at the competitive threat Google faces from ChatGPT, we can now discuss its valuation. As you might know, Google stock fell considerably this week, significantly more than big tech’s QQQ (QQQ) benchmark did.

Google vs QQQ (Seeking Alpha Quant)

So, Google stock is now cheaper than it was a week ago. If you find my analysis of GPT’s competitive threat convincing, then you’ll conclude that the price went down with no measurable increase in risk, at least not in the near term.

So, how cheap has Google gotten with the recent selloff?

According to Seeking Alpha Quant, it trades at the following multiples:

-

P/E: 18.8.

-

Adjusted P/E: 18.9.

-

4.43 times sales.

-

4.86 times book value.

-

13.24 times operating cash flow.

These multiples give mixed signals if we’re comparing Google to all stocks. The P/E ratio is lower than that of the S&P 500, but the sales and book value multiples are a little high.

As for discounted cash flows: given the lack of material earnings-related news since the last time I wrote about GOOG, I’ll just point to my previous article on the stock. In that article, I found that if you assume 0% growth in free cash flow and discount at the treasury yield (it was about 4%) then, you get a $116 terminal value. If you assume 5% growth for five years and 0% after that, with a 5% discount rate, you get a $123 fair value estimate. If the 10-year treasury goes above 5%, then this analysis would cease to work, but the 10-year yield has actually fallen since I last wrote about Google. The 10-year yields just 3.4% now, so you could say that my previous model now includes a small risk premium!

The Bottom Line

The bottom line on Google, in the era of ChatGPT, is that it’s still a great company. ChatGPT in no way interferes with YouTube, Gmail, Google Drive, Android, or any of the other 1 billion plus user products Alphabet owns. It does seem to threaten some of Google search’s use cases. Google Search is still Google’s #1 revenue driver, at 57% of the total. However, Google Cloud is growing at 37% year over year, and other segments are still going strong. Even if ChatGPT takes away a small percentage of Google’s revenue, the company as a whole can still thrive.

Amid all of this ChatGPT confusion, Google is approaching the lowest lows it has seen in years. The COVID-19 low was $53, at this point we’re less than a 50% drop away from that level. Google would be an absolute slam dunk buy if it ever fell to $53. If today’s price is the lowest we’ll see, that’s fine too, because it’s a decent buy already. There are some risks inherent in buying Google, but mostly, there’s a great opportunity.

Be the first to comment