ANNVIPS

Wolverine World Wide (NYSE:WWW) provides a wide range of footwear, apparel, athletic footwear, Industrial work boots, and various related products. With its strong distribution network, licensees and joint ventures, the company markets its products worldwide in over 170 countries. Also, the company sources most of its products from its manufacturing facility and third-party low-cost suppliers. It operates globally recognized brands such as Bates, Cat, Harley Davidson, and various known brands.

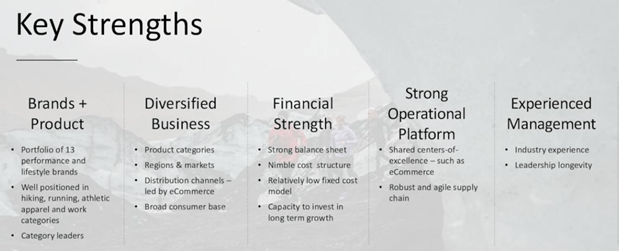

Also, strong brand recognition, large number of patents, and a diversified product portfolio provide the company with a significant competitive advantage.

Business structure (investors presentation)

In the last year, the company acquired the women’s activewear brand sweaty betty for about $410 million; this acquisition is expected to drive business growth in the upcoming years. Although the company has strong operating cash flows and a well-recognized brand portfolio, recently increased inventory levels might affect the business performance in the upcoming quarters. But the overall long-term prospect remains much more favorable.

Due to the inflationary environment that started in early 2021, the stock price has dropped significantly from its all-time high levels and is currently trading for just $813 million. In contrast, it has produced over $174 million in net profits in the last nine months.

Furthermore, based on the historical data, I assume the company could earn about $100 million in stable economic conditions. Therefore, it seems that the stock has been trading for just eight times its stable year earnings, which is substantially undervalued as compared to its historical valuation. I assign a buy rating to the stock.

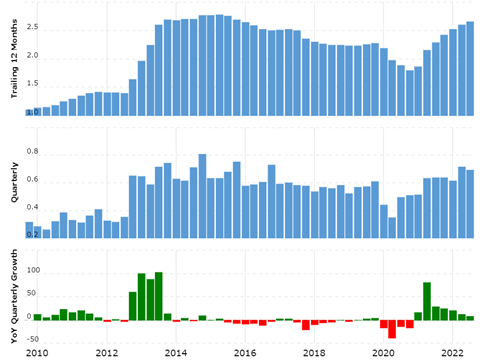

Historical performance

revenue growth (macrotrends.net)

From 2013 onwards, revenue has remained volatile and has reduced from $2.69 billion in 2013 to about $2.4 billion by 2021. Also, net profits have seen significant fluctuations over the same period and have dropped substantially in the last two years. In 2018 net profits reached an all-time high of $200 million, but it couldn’t sustain such levels and has been declining since then. Note that over the period of time, management has been focusing on share buyback, which has created massive value for the shareholders.

Also, keeping cash reserves at moderate levels has been a policy for the company. Still, with the recent increase in inventory, the net cash holding has been reduced to $136 million now. Also, the company has long-term debt of about $725 million, whereas the total balance sheet is about $3.1 billion, comprised of over $1.2 billion in intangibles and $1.5 billion in current assets. The debt levels are moderate, but the significantly high goodwill might bring concern about considerable impairment Charges.

Over the last ten years, cash flow from operations has been considerably attractive, and the company has produced $222 million, $309 million and $86 million in 2019, 2020, and 2021 respectively; such a strong and consistent CFO gives the business model a significant strength. Also, the generated cash has been used for stock repurchases and dividend payments, producing considerable value for the shareholders.

As the profitability has remained volatile over the period, the stock price has fluctuated significantly; after dropping to $12.75 per share in 2020, it reached an all-time high of $42 per share in early 2021, but as the economic situation started turning negative stock price dropped sharply and has reached to $10.33 per share by now.

Risk factors

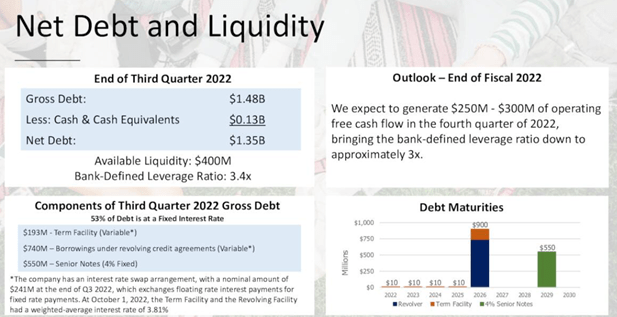

Debt maturity (Investors presentation)

As a result of an increase in working capital, borrowing from revolving credit has increased significantly. Therefore, any weakness in managing working capital might affect the company’s financial position. Although there isn’t any significant debt maturity in the upcoming years, the increased interest costs might affect the operating performance.

As a result of supply chain constraints, overall inventory levels have reached significantly higher levels. Therefore, there comes a risk of inventory write-off; if the company can’t reduce the inventory levels efficiently, the company will have to incur a huge write-off loss. In such cases, net profits might get affected enormously. Therefore, upcoming quarters might not produce considerable profits, but the overall long-term view remains much more favorable; management’s ability to effectively manage inventory levels with keeping new and attractive products remains the primary key to the company’s success.

Recent development

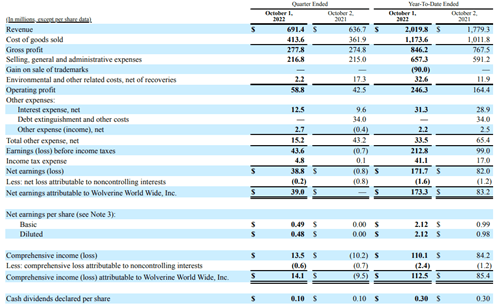

Quarterly results (Quarterly report)

In the latest quarter, the revenue increased from $691 million to $636 million. Also, net profits reached $38.8 million from a net loss in the same quarter last year. Note that the loss in the last year is attributed to high environmental-related costs and debt extinguishment costs. Also, in the last nine months, the company achieved $173 million in net profits, which is a substantially strong performance in adverse economic conditions.

In the inflationary environment where various retailers face massive headwinds, the overall results of wolverine seem attractive. The company ends the quarter with over 1.35 billion in net debt and $400 million in liquidity.

Also, as a result, the inventory levels increased significantly from $354 million in the same quarter last year to $871 million by now. Such a huge increment in working capital requirements has led to an increase in borrowing from revolving credit to $740 million. A substantial rise in inventory levels resulted from supply chain constraints and logistics issues, but the inventory quality remains high, and over 80% will be carried out into 2023.

Furthermore, management has been working on reducing the inventory levels and identified about $125 million of inventory to liquidate, such an act is expected to affect gross margins for the upcoming quarters, but the overall next year’s result is expected to be considerably positive.

Despite the significant headwind, the company-operated brands have been producing significant profits for the business. As the management strategically prioritizes the brands with high growth prospects, the overall results might bring significant value in the upcoming years.

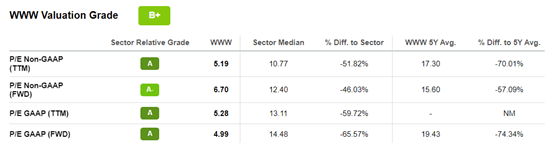

valuation (seeking alpha)

I believe the company might face considerable problems in the next few quarters due to a higher working capital load, but the long-term outlook remains intact. As the situation normalizes, cash flow will return to its historical levels. Currently, the company has been trading for $813 million, whereas it has produced over $173 million in net profits, and if we assume that it could earn about $100 million in the upcoming years, then it seems that the stock has been trading for just eight times earnings, which is substantially undervalued than its historical valuation. Therefore, I assign buy ratings to the stock.

Be the first to comment