Sean Gallup/Getty Images News

Investment Thesis

Google (NASDAQ:GOOGL) (NASDAQ:GOOG) stock has been somewhat of an enigma. The stock seems undervalued based on our DCF model. In addition, it has also been trading well below the most conservative price targets (PTs). Yet, its upward momentum has stalled markedly, as it seems to be consolidating after a highly impressive 2021.

Notably, the Russia-Ukraine conflict and YouTube’s competition with TikTok (BDNCE) have added more uncertainty to a challenging digital ad spending landscape in 2022. Moreover, Google Cloud is still striving for profitability while scaling up, therefore unable to lift the company’s overall profitability meaningfully.

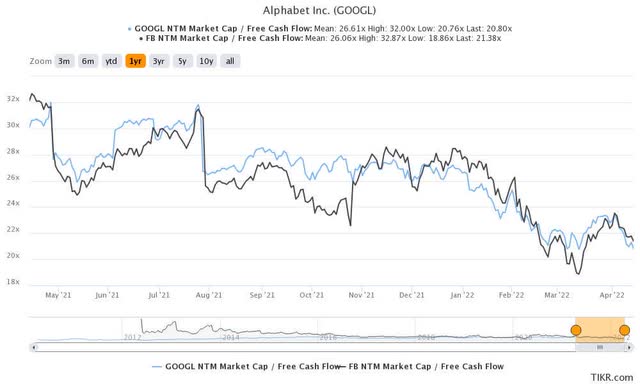

But we think the market could also have de-rated GOOGL stock as Meta (FB) stock has continued to struggle. We observe that the FCF multiples of both stocks have exhibited an astoundingly similar trend recently. Consensus estimates also suggest a steep deceleration of its EPS growth in 2022 as Google’s growth normalizes.

Therefore, we believe that Google stock is unlikely to achieve significant lift-off as it heads into its FQ1 report card on April 26. Instead, we believe that the stock would likely consolidate within a trading range throughout the year. Therefore, we encourage investors to consider adding exposure only when the stock drops back to its critical support level.

As a result of the recent retracement, we believe it’s an appropriate level for GOOGL investors to add exposure.

Why The Market Is Lukewarm Over GOOGL Stock

GOOGL stock NTM FCF multiples (TIKR) GOOGL stock consensus price targets Vs. stock performance (TIKR)

Despite the re-rating by Street analysts, GOOGL stock has continued to trade well below its most conservative PTs, as seen above. GOOGL stock last traded at $2,534 (offering a 17% implied upside to its most conservative PTs). In addition, it also offered an implied upside of 36.9% to its average PTs. Therefore, it’s arguable that Street considers GOOGL stock as undervalued.

However, we think the market has de-rated the digital ad leaders. As seen above, we can clearly observe similar trends in the FCF multiples between FB and GOOGL stock over the past year. Furthermore, the communications industry was also de-rated as the market digested the pandemic premium. Therefore, despite Google’s fundamentally strong business model, it has faced significant valuation headwinds from its #2 digital ad peer and the industry.

Recent Headwinds Intensified Their Impact

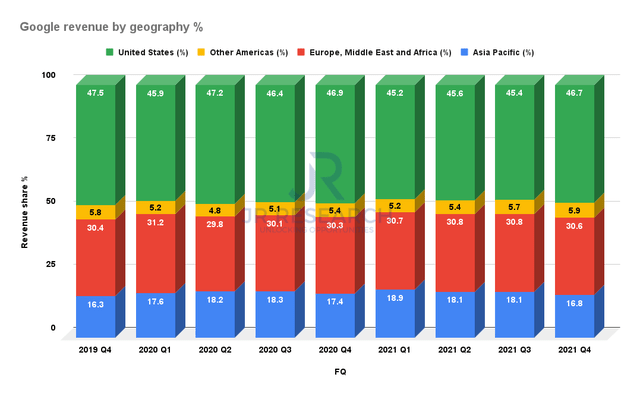

Google revenue share by geography % (Company filings)

Notably, GOOGL stock has completely lost its gains from FQ4, as it reported robust results, coupled with a 20-for-1 stock split in early February. Also, the market’s attention has turned to the impact of the Russia-Ukraine conflict on the online ad market. Given Google’s #1 position among its peers, investors’ concerns are justified. Furthermore, MKM Partners also highlighted the impact, as it added (edited):

We believe online ad companies are facing four incremental macro headwinds: (1) direct impact of the Russia/Ukraine war; (2) indirect impact and potential contagion from the war into Europe; (3) soft brand ad spend, particularly around geopolitical content; and (4) likely impact from soft consumer spend in Europe, driven by inflation and higher oil prices. – Seeking Alpha

Moreover, the EMEA region has consistently been a significant revenue driver for Google. The company reported that EMEA accounted for 30.6% of its FQ4’21 revenue. Therefore, the market remains skittish over the region’s impact, particularly in Europe.

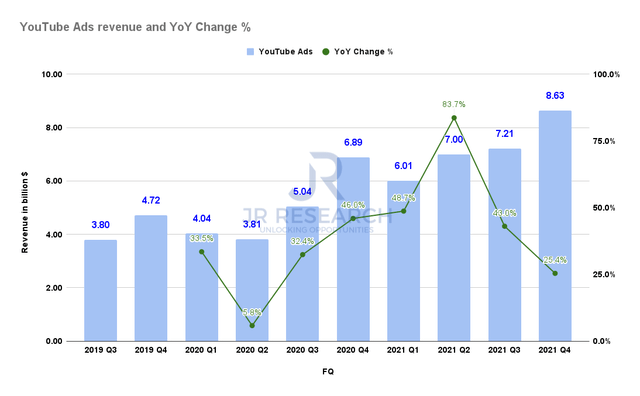

YouTube ad revenue (Company filings)

Furthermore, a recent Business Insider/Lotame report also accentuated the likely impact of TikTok on YouTube’s ads business. YouTube has already seen a deceleration in its CTV revenue in FQ4, up by just 25.4% YoY. Insider stressed that YouTube could be hit by a further $2.2B impact, representing 6.5% of revenue in 2022. Therefore, we believe the market also needs to include TikTok’s potential headwinds, given its massive growth. We believe this uncertainty, coupled with Meta’s de-rating and the ad spending headwinds, would likely hold GOOGL stock back in the near term.

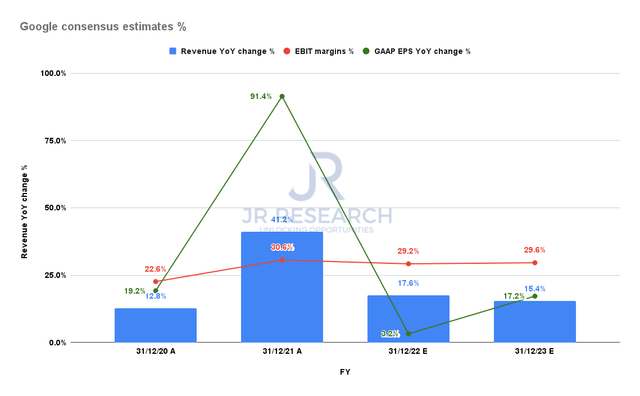

Consensus Estimates Suggest A Challenging FY22 EPS Growth For Google

Google consensus estimates % (S&P Capital IQ)

After last year’s impressive growth, it would be unreasonable to expect GOOGL stock to maintain its FY21 growth cadence. As a result, we believe that investors are focusing on the company’s GAAP EPS growth for FY22. Notably, Google is projected to achieve only a 3.2% increase in its EPS. However, revenue is expected to increase by 17.8%, while its EBIT margin is estimated to remain stable. Thus, Google would be using FY22 as an opportunity to ramp investments, as CFO Ruth Porat stressed in a recent conference (edited):

So across the board, we’re seeing opportunities, and we want to make sure we’re setting ourselves up to continue to really extend that runway by investing where we see it makes sense. So you’re going to see it really in OpEx and in CapEx. (Morgan Stanley TMT Conference 2022)

Is GOOGL Stock A Buy, Sell, Or Hold?

GOOGL stock remains a Buy. But, we must caution investors that the stock could likely consolidate in a trading range throughout 2022 as the market digests its near-term headwinds.

Furthermore, given its investment mode, we do not expect any near-term catalysts that could jolt the stock to break convincingly above its critical $3,000 resistance level.

Some investors could point out the massive growth of Google Cloud. Yes, but we think that’s unlikely to move the needle in the near term as it’s still scaling up. Therefore, the market’s primary focus is likely to remain predicated on its online ad business.

Nevertheless, we believe that long-term investors should capitalize on the market’s near-term uncertainties and add exposure to this long-term leader.

Be the first to comment