Prykhodov

Key Takeaway

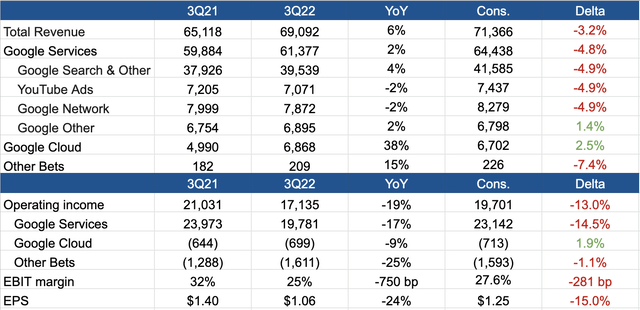

Alphabet Inc. (NASDAQ:GOOGL, NASDAQ:GOOG) (“Google”) reported 3Q22 revenue and EPS that were 3% and 15% below consensus estimates. Revenue of $69 billion saw a 6% YoY growth due to a tough 3Q21 comp, where sales grew 41%, and a challenging macro environment and a strong dollar. Operating margin of 25% missed consensus by 281bps and was a material contraction from 32% in 3Q21. GAAP EPS of $1.06 was down 24% YoY, highlighting the fact that Google very much over-earned in 2021 and is seeing margins normalizing to pre-pandemic levels in 2022.

The lower margin profile of Google Services was due to unfavorable mix shift from Search and Google Play to lower-margin activities like hardware and subscription. As the macro narrative gets worse, margins will likely experience further pressure in the next few quarters, but Google should come out the other end a stronger company. At 18x 2023 P/E (16.5x ex-cash), shares continue to be attractive as markets will likely find valuation support given Google’s enviable advertising margin, cash position, and buyback program.

Positives

#1 Within the advertising business, search displayed its resiliency as revenue grew 10% ex-FX (4% reported) in a global digital advertising slowdown. Management highlighted strength in the travel and retail sector, but this was offset by weaker ad spend in the financials vertical as a result of rising interest rates. Nevertheless, Google’s search business remains in a dominant position with limited competition, which should help cushion the degree of margin normalization and reduce cash flow concerns.

#2 Google Cloud was another bright spot where revenue grew 38% and 45% ex-FX on better-than-expected operating margin that was a step closer to break-even. In Q3, Cloud operating margin of -10% was an improvement from -14% in Q2 and -16% in Q1. While Google noted longer sales cycles and shorter deals due to macro uncertainty, management seemed committed to profitability and free cash flow.

#3 Google finished the quarter with a strong net cash position of $101 billion or $7.76 net cash per share. Using the current Street estimate of $5.47 for 2023 EPS, this comes down to a 2023 P/E of 16.5x ex-cash. In Q3, Google repurchased ~$15.4 billion worth of shares, which brings the total YTD buybacks to around $44 billion. Given Google’s massive cash balance, it should be reasonable to expect more buybacks when the $70-billion-dollar program (announced in April) approaches maturity.

Negatives

#1 YouTube faced stronger headwinds as revenue of $7 billion represented a 2% decline YoY and just 4% growth ex-FX, given top-funnel ad budgets are more likely to be cut vs. down-funnel dollars (e.g., search) in a downturn. Early monetization of YouTube Shorts were encouraging but this potentially had some cannibalizing effect on core YouTube advertising. Nevertheless, Shorts has more than 1.5 billion monthly users and over 30 billion daily views, which should help alleviate some concerns around TikTok.

It’s also important to note that TikTok has extended the length of its videos to 10 minutes, which brings the Chinese app a step closer to competing with YouTube’s long-form videos where YouTube has a massive content advantage. Going forward, Google will introduce revenue sharing on YouTube Shorts in early 2023, making YouTube the only platform that shares ad dollars with creators across long, short, and live content. In addition, Nielsen reported that YouTube had the largest streaming viewership in the U.S. in September. Globally, viewers spend more than 700 million hours watching YouTube on TV every day.

#2 From a margin perspective, it’s important to recognize that Google Services make up 100% of Google’s margin while the majority of profits come from Search and Play, which are also facing a tougher outlook due to softer digital ad spend and slowing gaming app downloads/spend given lower gaming activities post-pandemic that may also impact YouTube ads. At the end of Q3, Google had ~187k employees, up 25% YoY, and management expects to add around 6k people in Q4. This seems a bit aggressive and will likely continue to put pressure on margins going forward, even though headcount growth is expected to slow in 2023.

#3 Given a slowing macro, Q4 revenue growth will likely again face tough comps considering revenue grew 32% in 4Q21. However, comps are set to become easier as Google finishes lapping strong 2021 numbers. Given revenue growth is likely to remain muted at least in the next 1-2 quarters, investors will likely focus more on the bottom-line but it may take some time for Google to reduce spending.

Conclusion

Google is going through some tough times as revenue is challenged by slowing macroeconomics and margins are normalizing with a strong dollar introducing further pressure. However, management is well aware of these issues and will likely embrace a more defensive attitude on corporate spending just like what they did during the 2008 recession (analysis here). Under the current macro narrative, markets are unlikely to assign much value to Google’s Cloud business and Other Bets as these segments still remain unprofitable, so any sources of valuation support will likely come from the core advertising business where Google Search should exhibit some resiliency given its almost indestructible moat. Overall, I still find shares attractive at less than 17x next year’s earnings ex-cash, and believe management will continue to generate shareholder returns via generous buybacks.

Be the first to comment