Alena Kravchenko

In my last article, I called Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) a buying opportunity, but was pointing out it might get even cheaper. At the beginning of May, when the article was published, the stock was trading for $117. Now, pre-market on Wednesday, as I am starting to write this article, the stock is trading for $98 and, therefore, almost 20% lower. And this is begging the question whether Alphabet is now cheap enough and can be bought, as the stock seems to trade for a reasonable valuation multiple.

Quarterly Results

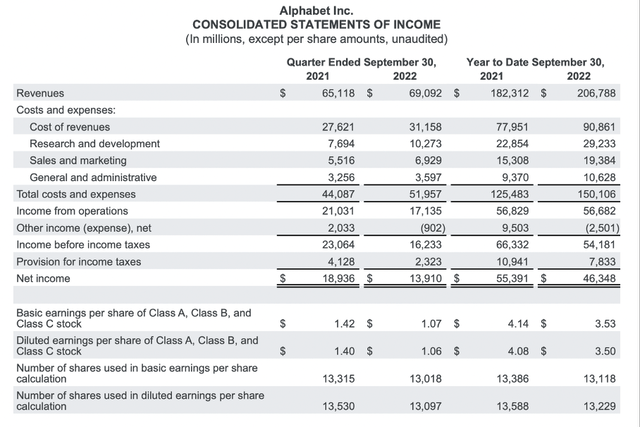

On Tuesday, Alphabet reported its third quarter results, and when looking at the price action in the first few hours after the results and earnings call, investors seemed to be disappointed. This is not surprising, as Alphabet missed expectations for revenue as well as earnings per share. And while revenue estimates were missed by $1.56 billion, earnings per share were $0.20 lower than expected.

Alphabet generated $69,092 million in revenue in Q3/22 and, compared to $65,118 million in Q3/21, this is an increase of 6.1% year-over-year. While revenue could still increase, income from operations declined 18.5% year-over-year, from $21,031 million in the same quarter last year to $17,135 million this quarter. And diluted earnings per share also declined from $1.40 in Q3/21 to $1.06 in Q3/22 – a decline of 25.7%.

When discussing these results, we should not forget that a strong U.S. dollar had a negative effect on the business, and on a constant currency basis revenue growth was 11%. And we are still comparing to exceptional good quarters in fiscal 2021 (in the same quarter last year, revenue growth was 39%), which is making a reverse to the mean likely. On the other hand, operating margin declined from 32.3% in Q3/21 to only 24.8% in Q3/22, which is not a good sign. Alphabet also increased the number of employees from 150k one year ago to 187k right now, which should usually be seen as a positive sign for a growing and expanding business.

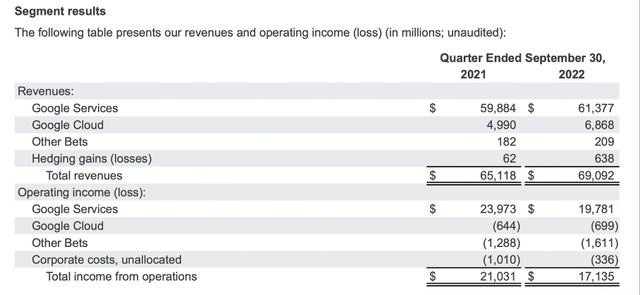

The biggest part of revenue still stems from Google Services, which generated $61,337 million in revenue (compared to $59,884 million in the same quarter last year). Google Cloud, on the other hand, is responsible for only 10% of total revenue ($6,868 million) but compared to the same quarter last year ($4,990 million in revenue) it could report 37.6% year-over-year growth. Other bets generated $209 million in revenue and hedging gains were $638 million. And although Google Cloud could improve its operating margin, it is still not profitable and operating income is solely stemming from Google Services.

YouTube

While growth was clearly slowing down for Alphabet in many of its business segments (and sub-segments), YouTube appears to be a problem-child for Alphabet right now. Google Search is almost unrivaled with a market share above 90%, while Android is also its market leader with a market share of 42%. However, YouTube, on the other hand, has several serious competitors. And in the third quarter of fiscal 2022, revenue from YouTube ads declined from $7,205 million in the same quarter last year to $7,071 million this quarter (1.9% decline). Revenue from “Google other” – which is including YouTube subscriptions – increased slightly from $6,754 million to $6,895 million.

However, Alphabet is clearly trying to fight this trend and is prioritizing the monetization of Shorts. In September, Alphabet has started ads on Shorts, and the monetization and revenue sharing on Shorts will be introduced early next year (making YouTube the only platform where creators can also monetize short formats). Right now, Shorts has 1.5 billion users every month and about 30 billion daily views.

Recession

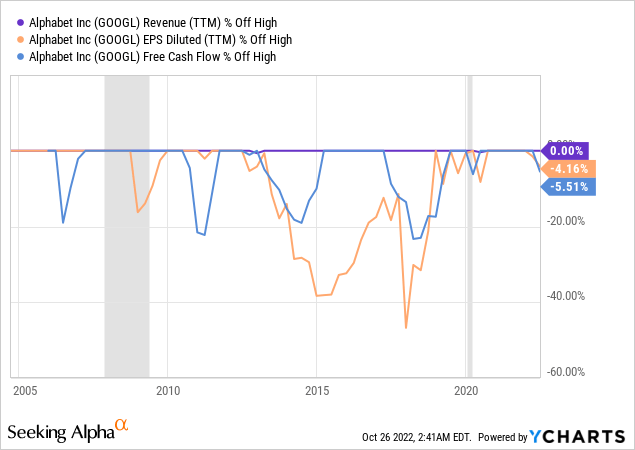

Another problem for Alphabet will probably be the looming recession. In the case of Alphabet (or Google), we only have the data from one real recession – the Great Financial Crisis. The COVID-19 recession can’t be seen as a real recession for Alphabet, as the businesses profited immensely from lockdowns – like most other technology companies. And to conclude Alphabet will perform in a similar way in the next recession as in 2020 would be a huge and dangerous mistake.

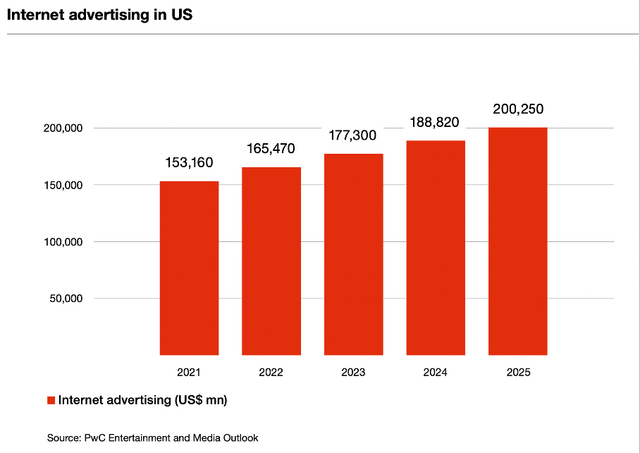

And we are already seeing first signs in the results of Alphabet – and also other companies like Meta Platforms (META) and Amazon.com (AMZN). Spendings for advertisement usually declines during a recession, as companies will cut costs and, aside from firing people, cutting costs on advertisement is a typical step. And although people might actually use YouTube even more during a recession (when people get laid off and spend more time at home), Alphabet is depending on companies that are willing to spend more money on advertisement.

Regulatory Pressure

A third aspect is the ongoing regulatory pressures. Apparently, the European Union is preparing charges against Google once again, and it will issue the charges early next year. According to a Reuters article, the company could face its fourth fine in the EU of more than €1 billion. In September, it was also reported that Google will face damages claims up to €25 billion over its digital advertising practices in two suits to be filed in British and Dutch courts. It is filed by a law firm on behalf of publishers against the AdTech practices of Google. The company was also ordered to pay $162 million in fines by the Indian antitrust agency.

But Alphabet had $21,984 million in cash and cash equivalents as well as $94,275 million in marketable securities and, therefore, fines – even several billion dollars – are not really a problem for Alphabet and almost have no impact on the intrinsic value of the stock.

Growing Business

All these challenges – YouTube, the looming recession and the regulatory pressures – seem to be rather short-to-mid-term challenges and manageable for Alphabet. And when looking at the bigger picture, we actually see a company with a wide economic moat and high growth potential.

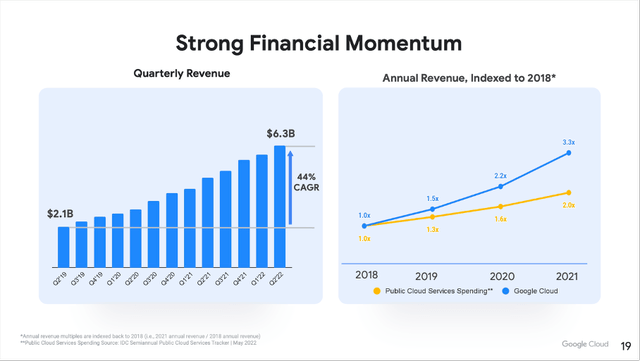

Especially the cloud market is promising high growth rates in the years to come. Since 2019, Alphabet could grow revenue for “Google Cloud” with a CAGR of 44% and has outperformed the public cloud services spendings in the last few years.

Alphabet Investor Presentation

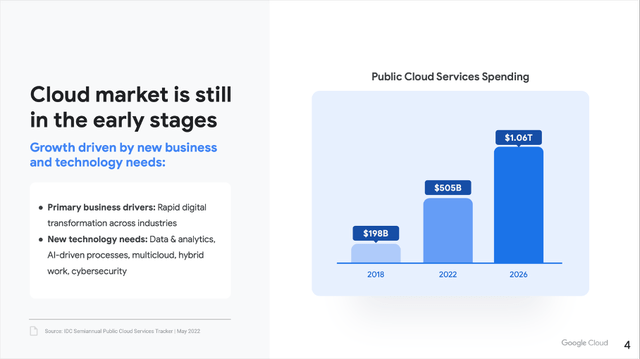

And Alphabet is expecting these high growth rates to continue in the years to come, as the cloud market is probably still in the early stages. Between 2022 and 2026, the public cloud services spendings are expected to double once again, and Alphabet might be one of the companies profiting from this trend.

Alphabet Investor Presentation

And there are several different studies (see here and here) and forecasts that also expect high growth rates for the cloud business in the years to come. And aside from the cloud business, which has great growth potential, the advertising market will also grow with a solid pace in the years to come.

Overall, we can be confident that Alphabet will be able to grow its top line with a solid pace – especially as the wide economic moat will keep competitors at bay.

Intrinsic Value Calculation

And not only does Alphabet have a wide economic moat around its business and growth potential in the years (and probably decades) to come – it also seems to be trading below its intrinsic value. As basis for our calculation, we can take the free cash flow of the last four quarters (which was $62,542 million). To be fairly valued, Alphabet must grow its free cash flow about 5% from now till perpetuity, which seems like a realistic and achievable target for Alphabet.

However, we must assume a declining free cash flow in fiscal 2023 as revenue from advertisement will decline in case of a recession (and after the yield curve inverted recently, the probability for a recession is rather high). Let’s be cautious and assume a 20% decline in 2023. However, I am also optimistic for Alphabet having a strong recovery after a recession – assuming 20% growth in fiscal 2024, 15% in 2025 and 10% in 2026. And for the following years, we assume growth is slowing down to 6% in 10 years from now (and staying at that level till perpetuity). When calculating with these assumptions (and 10% discount rate), we get an intrinsic value of $121.59 for Alphabet.

But, of course, you can argue these assumptions are extremely cautious. First, Alphabet will be able to grow its top line at least in the mid-single digits (probably even higher). Not only has Alphabet reported 20% growth on average in the past – without any signs of growth slowing down (until recently). Especially the cloud business could contribute to growth for several years to come.

Second, Alphabet might also be able to increase its bottom line by using share buybacks. Over the last few years, Alphabet spent more and more money on share buybacks, and during the last quarter (Q3/22), Alphabet spent $15,392 million on share buybacks. When assuming Alphabet is using similar amounts on share buybacks and spending about $61 billion annually, the company can buy back almost 5% of its outstanding shares every year. This will certainly contribute to bottom line growth, and with an annual free cash flow of $65 billion right now (and more than $100 billion in extremely liquid assets on the balance sheet), share buybacks should be possible in a similar way as in the past.

When combining top line growth and share buybacks, growth rates of 10% annually seem realistic for the years to come (excluding 2023). And when calculating with these assumptions and 6% till perpetuity, we get an intrinsic value of $130 to $135 for Alphabet.

Still Downside Risk

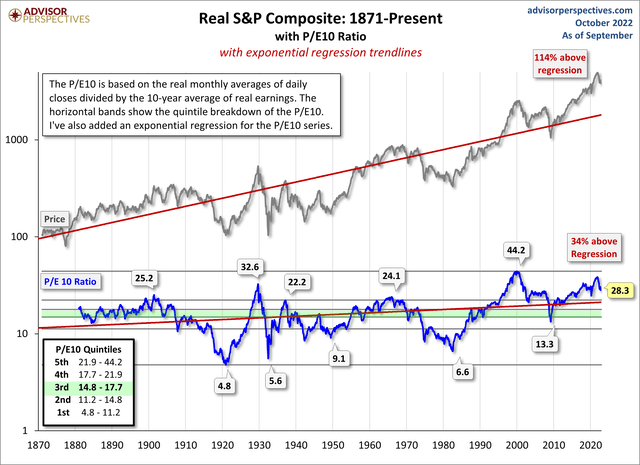

And although Alphabet is probably already trading below its intrinsic value, we should be extremely cautious. First, we should not forget that current valuation multiples are not the norm but are one of the most extreme outliers in the last 150 years. We must be prepared for valuation multiples returning to the mean again, and such a scenario will hit almost every business – including high growth companies like Alphabet.

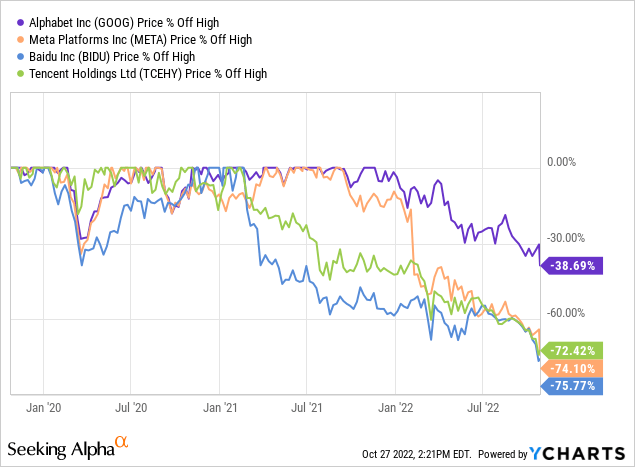

And I know the comparison is not completely accurate, but we should keep in mind that other companies with a similar business model declined extremely steeply – Meta Platforms (META) or Baidu, Inc. (BIDU), as well as Tencent Holdings (OTCPK:TCEHY), might be examples. And although the businesses are different, there are also similarities – Alphabet as well as Meta Platforms depend heavily on advertisement for generating revenue. In my opinion, the risk of Alphabet’s stock price declining further as the economy will be tumbling into a recession in the next few quarters is rather high.

Conclusion

While I see Meta Platforms as a clear buy (it is extremely cheap and the downside potential is limited), I am not so sure about Alphabet. The business is certainly not overvalued, but the stock could decline lower, and earnings could fall in the coming quarters. And a valuation multiple around 20 (while sounding reasonable) could suddenly be considered too high by investors, and the stock would decline further. And although it sounds unrealistic right now, we should not rule out a P/E ratio or P/FCF ratio of 15 or 10 for Alphabet.

Be the first to comment