JHVEPhoto

Growth Slowdown In 2022

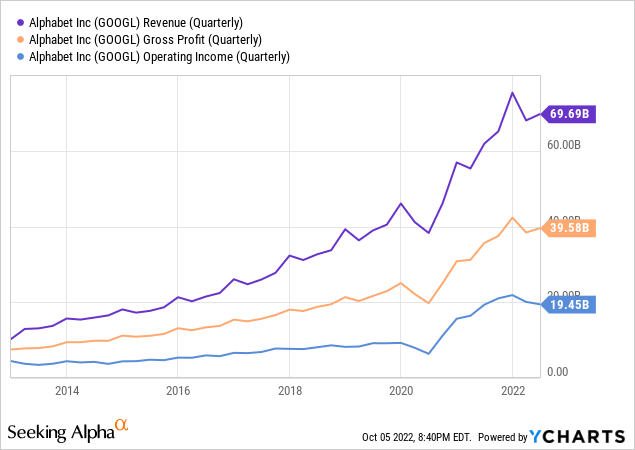

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) was a major beneficiary of the “stay-at-home” trend of 2021, as consumers spent more time online engaging in Google searches, watching YouTube, and downloading apps from the Google Play store. As we see on the chart below, the company showed steady growth from 2012-2019. Revenue grew about 20% per year on average, Gross Profit grew by about 17.5%, and Operating Income by 14.5%. Following the lockdowns of 1Q 2020 however, growth kicked into high gear through the end of 2021. In the first two quarters of 2022, growth has slowed considerably.

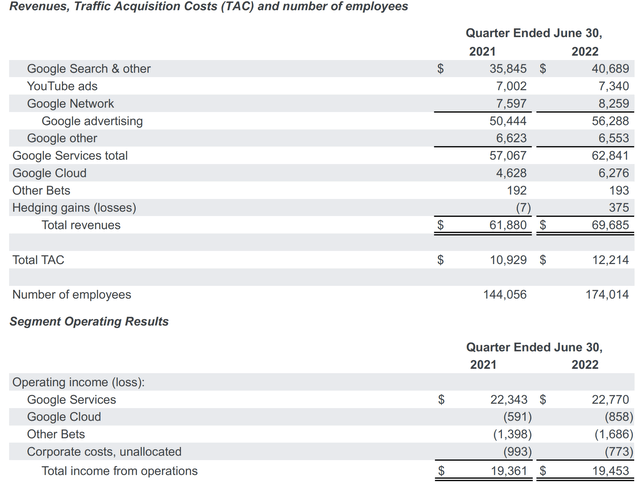

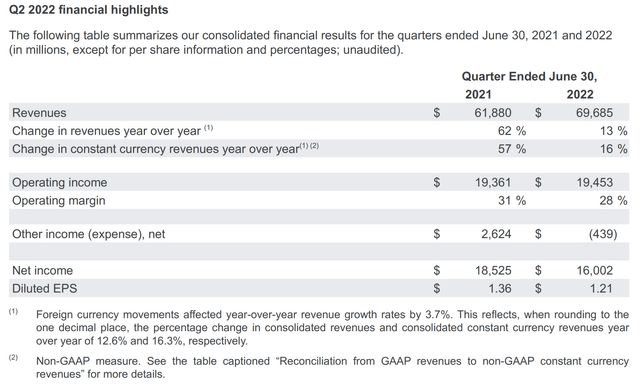

From the 2Q financial results released in July, we see that revenue growth slowed to 13% year-on-year, including a 3% hit from foreign exchange effects. Further, operating margin decreased to 28% from 31% last year. Data center costs impacted cost of services while headcount grew in all categories. For the company overall, the number of employees increased 30,000 year-on-year, from 144k in 2Q 2021 to 174k in 2Q 2022. Finally, the bottom line was most impacted by a -$3 billion swing in non-operating income, largely from a loss on equity investments.

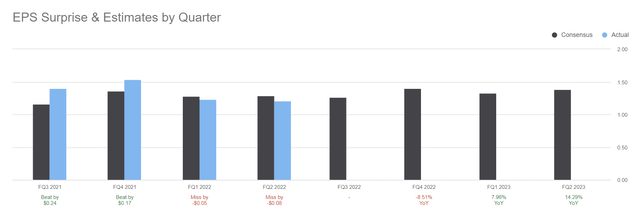

The 2Q EPS result was not only below 2Q 2021 but was the second quarter in a row where earnings missed estimates. Looking forward, the remaining two quarters of 2022 are also expected to be lower year-on-year before EPS growth resumes in 2023.

GOOGL Earnings Page (Seeking Alpha)

Due to this slowing growth, increasing interest rates, and general macro issues, GOOG and GOOGL stock are trading about 1/3 below their all-time high reached in November 2021. After years of being a mega-cap growth and momentum stock, Alphabet is nearing a level where it is a good buy for value investors. Still, the company has plenty of runway for EPS growth, including productivity initiatives its smaller businesses Google Cloud and Other Bets reaching profitability.

Reasons For Optimism

Alphabet gets 90% of its revenue (and over 100% of its operating profits) from Google services. Advertising, which consists of Google Search placements, YouTube ads, and Google Network ads on third party web pages makes up 90% of Google Services. Google Other, which consists of hardware sales, app sales on Google Play and content sales on YouTube makes up the other 10%. The remaining portion of Alphabet consists of Google Cloud and Other Bets, both of which currently generate operating losses but have the most future growth potential.

Alphabet 2Q 2022 Earnings Release

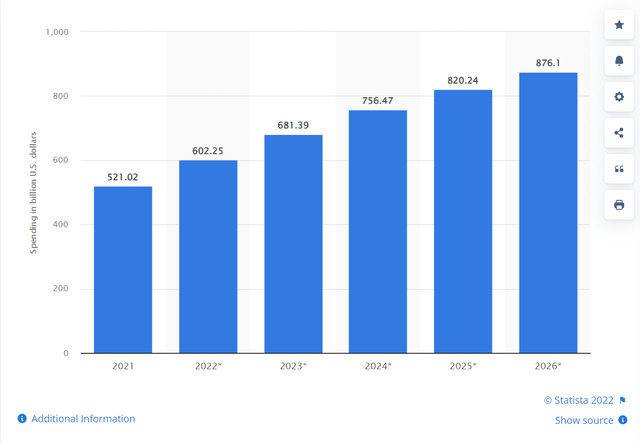

Google’s online advertising business is well-followed and well-analyzed. The company has an 84% share of the online search market. While this is down from 90% 10 years ago, it should remain a strong market leader for the foreseeable future. While advertisers may slow their spending during economic downturns, the digital advertising market remains in secular growth mode with projections of 11% annualized growth from 2021-2026.

Digital advertising spending worldwide from 2021 to 2026 (Statista)

With Google’s dominant position and the secular growth of the business, any stock weakness from cyclical economic downturns are potential opportunities for value investors.

A silver lining to economic downturns is that they often promote cost cutting and efficiency initiatives. This includes Alphabet where the CEO recently announced a goal of becoming “20% more productive“. While cost cuts in physical infrastructure and R&D could be detrimental to future growth, there should be plenty of room in the advertising business to become more efficient. If the company could trim 20% just from its sales and marketing and General and administrative functions, they could increase net income by about $6.8 billion per year, which works out to about $0.50 per share or nearly 10%.

Moving beyond advertising, Alphabet’s other businesses are currently not profitable but have the potential to add to the company’s bottom line in the future. Google Cloud is the largest of these. The segment grew revenues by 35.6% in 2Q, although it remains a distant third in market share behind Amazon Web Services (AMZN) and Microsoft Azure (MSFT).

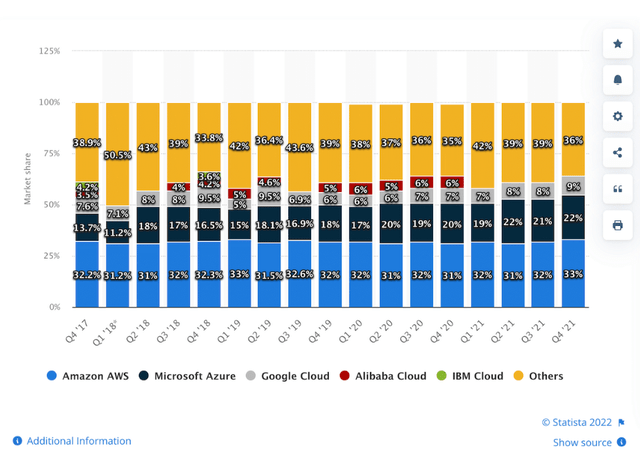

Cloud services market share (Statista)

Despite the small market share, the overall cloud market is growing faster than the advertising business, at over 19%. With its affordability and simple user interface, Google Cloud could occupy a niche for small businesses while Azure and AWS cater more to large enterprises.

Alphabet’s Other Bets segment is the most speculative and farthest from profitability, but it is like an embedded call option on new technologies. Some of these may go on to be significant profit sources for the company while others may not pan out. These include autonomous driving company Waymo and its DeepMind artificial intelligence service.

Alphabet’s core advertising business still has many years of market dominance and secular growth ahead of it, even as the company looks to cut costs and boost productivity. Still, the company is developing its Cloud and Other Bets businesses as future sources of growth. While these are hard to value, they offer free upside to the fairly valued core business.

Valuation

A pitfall of being too focused on valuation is that while you usually avoid overpaying, you occasionally leave big money on the table. That was certainly my case with Apple (AAPL) as I discussed in 2020 and was also the case in Google’s 2004 IPO. While I was interested in the stock and participated in the Dutch auction, I bid $55 compared to the IPO price of $85. In split-adjusted terms, I bid $1.38 rather than $2.13. Nevertheless, when a growth stock reaches a reasonable valuation, it is the best of both worlds.

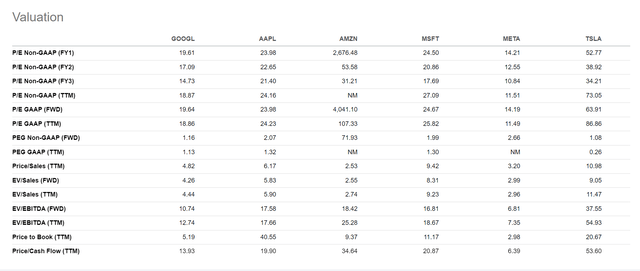

Compared to its mega-cap growth neighbors at the top of the S&P 500 (SPY) Alphabet is clearly the cheapest of the top 5. Meta (META) is a few notches below the top 5 in market cap, but I include it here because it is in the Communications Services sector like Alphabet and has an even cheaper valuation.

Nevertheless, I prefer Alphabet over Meta because, while they are both primarily advertising businesses, Google Search feels like a stickier and more universal application than Facebook or Instagram. I also see higher potential for Google Cloud and Other Bets than I do for Meta’s Oculus and metaverse-related projects.

In the current market environment, you hear that a lot of stocks are trading at a lower P/E than they have in many years. This is also the case with Alphabet which is near a 10-year low P/E.

Before proclaiming the stock a buy on this basis however, it is important to remember that P/E ratios are dependent on interest rates, as I discussed back in June. In a higher interest rate environment, you should expect P/E ratios to be lower than recent history when interest rates were not as high. I prefer to consider the gap between the earnings yield (E/P) and the 10-year Treasury as a better indicator of cheapness. Let’s look at a few local minima in the above chart and see how attractive the earnings yield was relative to treasuries.

| Earnings Yield | 10-year | Yield | ||

| Date | P/E | (E/P) | Treasury | Premium |

| 11/16/2012 | 20.22 | 4.95% | 1.65% | 3.30% |

| 7/5/2016 | 27.31 | 3.66% | 1.50% | 2.16% |

| 1/2/2019 | 24.13 | 4.14% | 2.71% | 1.43% |

| 7/3/2019 | 22.67 | 4.41% | 2.06% | 2.35% |

| 3/20/2020 | 21.73 | 4.60% | 0.87% | 3.73% |

| 9/30/2022 | 17.79 | 5.62% | 3.83% | 1.79% |

In the last 10 years, we see that Alphabet was cheapest at the bottom of the March 2020 COVID crash based on earnings yield premium of 3.73% over the 10-year Treasury. We can probably exclude this data point because of unusual market conditions we hope don’t recur anytime soon. That leaves November 2012 as the next cheapest bottom with an earnings yield premium of 3.30% over treasuries.

Applying that premium to the current 10-year Treasury rate of 3.8%, we get an earnings yield of 7.1%, or a P/E of 14.08. Using the analyst consensus earnings estimate of $5.93 for 2023, we get a fair value of $83.49 per share. Having said that, I recognize that Alphabet was a different company 10 years ago. YouTube was barely generating revenue and Google Cloud was in its infancy. I am willing to go a bit narrower on the earnings yield premium to reflect the higher quality company Alphabet is today. Here is the price target estimate for different yield premia from 2.5% to 3%:

| Earnings Yield | 10-year | Yield | 2023 | |

| P/E | (E/P) | Treasury | Premium | Price Target |

| 14.71 | 6.80% | 3.80% | 3.00% | $ 87.21 |

| 14.93 | 6.70% | 3.80% | 2.90% | $ 88.51 |

| 15.15 | 6.60% | 3.80% | 2.80% | $ 89.85 |

| 15.38 | 6.50% | 3.80% | 2.70% | $ 91.23 |

| 15.63 | 6.40% | 3.80% | 2.60% | $ 92.66 |

| 15.87 | 6.30% | 3.80% | 2.50% | $ 94.13 |

At the end of the day, I am still a value investor and don’t want to pay up, even if I miss out on what would have been a great buying opportunity. However, if I can acquire the stock at the low end of the above range around $88, I would be satisfied. Fortunately, there is a way to do that while still earning an attractive return if the stock never trades that low.

Option Strategy

The volatile market has led to some attractive premiums for option sellers. Selling an out of the money put on a stock you would like to buy lower is a great way to lower your cost basis. If you never get assigned because the stock does not end up below the strike price, the option premium still represents a nice return. To be safe, I would do this as a cash secured put sale, meaning you have a source of cash set aside to buy the stock if you do get assigned. Fortunately, the current interest rate environment also provides attractive returns on cash between trade execution and options expiry. Here’s how I am trading it.

I recently sold Feb. 2023 $95 Puts on GOOGL. I chose this option for several reasons:

- It’s past the next two earnings reports which as discussed above may show low year-on-year growth due to tough prior year comparisons.

- The premium is high enough to either give me my desired cost basis if assigned stock or provide an attractive return on the cash I have set aside if the option expires unexercised.

- I have a bond getting called in February which will provide part of the cash needed to buy the stock if necessary

- I chose GOOGL instead of GOOG because GOOGL is about 1% cheaper even though it has voting rights where GOOG does not.

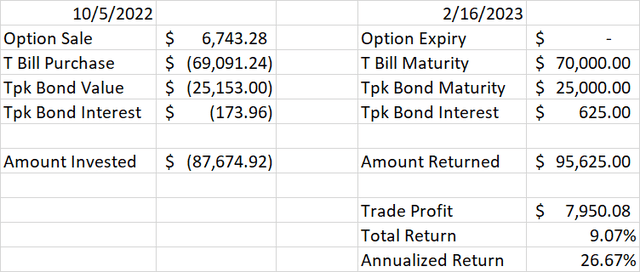

I opened the trade on 10/5/22 selling the options for $6.75. I also put most of the cash needed to cover a future stock assignment into a Treasury bill maturing on 2/16/2023 with a yield to maturity of 3.61% annualized. The remaining cash needed will come from a municipal bond I already held which will be called on 2/15/2023 that has a yield to call around 2.95%.

If GOOGL closes below $95 on 2/17/2023, then I end up buying it at an effective cost basis of $95 – $6.75 = $88.25. If it doesn’t, I keep the option premium, the face value of the T-bill, and the final interest payment and maturity of the muni bond. This is a total return of 9.07% in a little over 4 months, or 26.67% annualized. This math is shown below normalized to 1000 underlying shares of GOOGL. You may scale it up or down yourself depending on your desired position size.

As a value investor, this would be a satisfactory result if I happen to miss out on buying GOOGL as cheap as I would like. It’s less risky than most arb trades currently available and unlike arb trades has a defined end date. The only “bad” outcome of this trade would be for GOOGL to trade under $88.25 on 2/17/2023. In that case it would have been better to just hang on to cash and buy the stock below that price, rather than selling the option. Still, that would be only a temporary setback as long as I expect Alphabet to recover in the long term.

Conclusion

The run-up from 2020 to 2022 provided few chances to get into the mega-cap growth stocks at anything resembling a fair price based on traditional valuation metrics. The current bear market has brought Alphabet share prices closer to a good value but with a few dollars to go. Selling put options allows the value investor to get into the stock at a more attractive valuation but also provides a good return on cash if the stock never trades that low.

Be the first to comment