William_Potter

Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) is a “buy and hold forever” stock to me. But as the stock market has shown over and over in the past, even for the best companies, there are times they get expensive, and other times they get cheap(er).

Some of the examples in the past include:

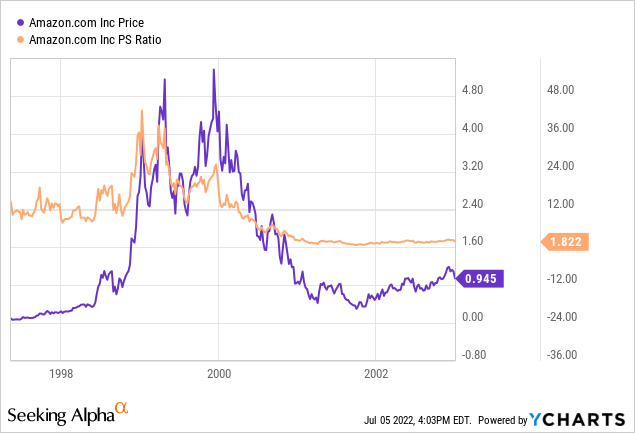

Amazon (AMZN):

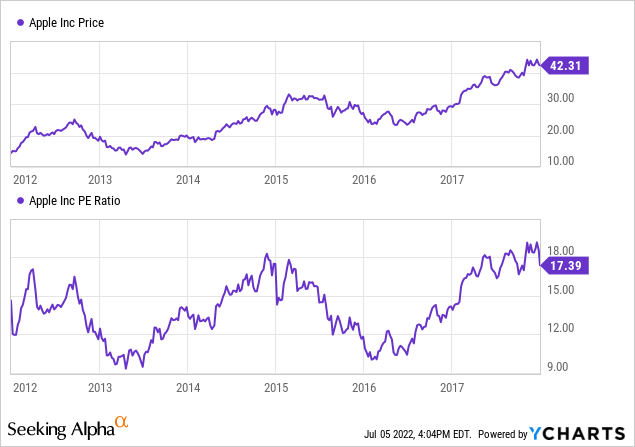

Apple (AAPL):

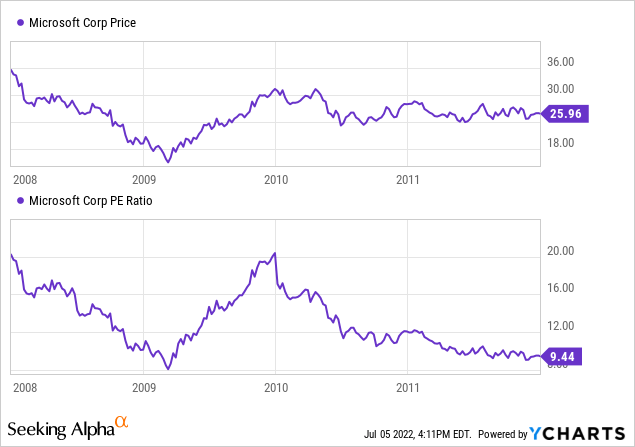

Microsoft (MSFT):

These companies now trade at a much higher multiple than their past valuation. The drawdowns were often incited by market fear rather than company-specific performance. It makes sense that good businesses will be affected by a general economic downturn. In hindsight, the effect is often only temporary, and they get back on track quickly.

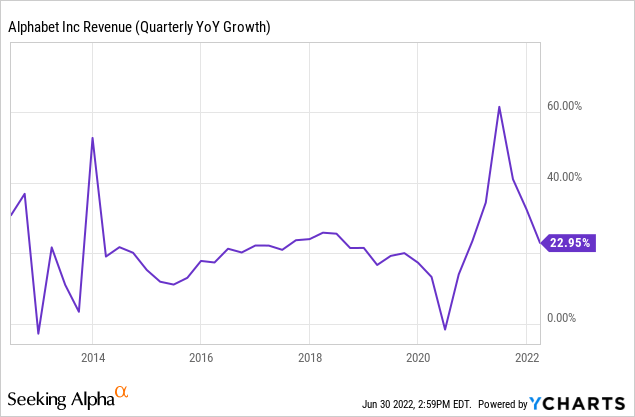

Alphabet isn’t at its cheapest point (in valuation) yet, but it trades enough below its average to be an opportunity.

Strong Past Growth, Strong Outlook

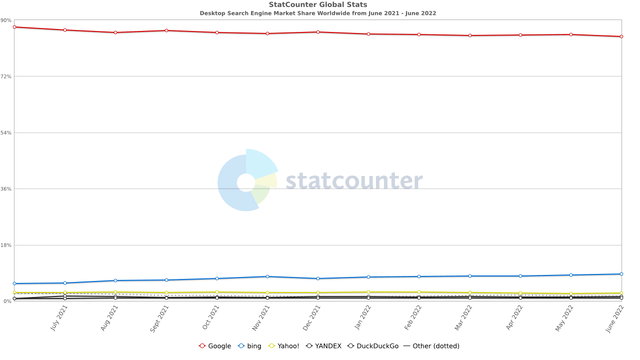

The past growth of Alphabet comes from online advertising. It’s a fast-growing market with a few dominant players. Google’s search engine is the standard for most mobile phones, and its browser is the most used as well.

Google’s search history speaks for itself, there is no notable competitor, and it seems unlikely there will be one soon. The high usage delivers the best results and encourages more usage.

The strong integration of Google in mobile phones through Android ensures network effects. To list a few of the Alphabet apps I use daily: Gmail, Calendar, Waze, and YouTube. It’s just too easy as they integrate smoothly and offer the best experience.

Outlook

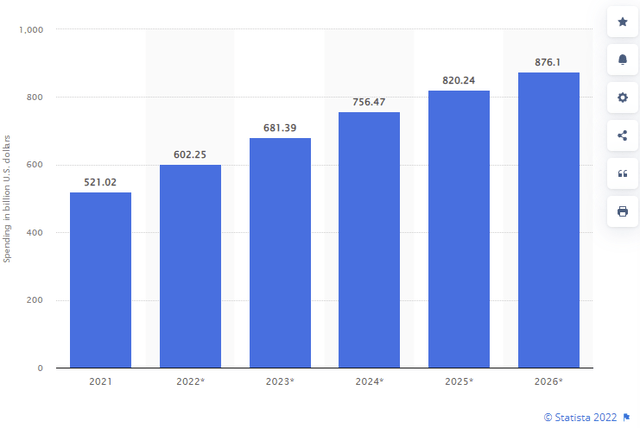

The online advertising market is projected to grow at a 10.9% CAGR up to 2026. The projections diverge a bit weather on the source. Strong growth expectations make sense as online advertising still gains over traditional advertising. Advertising is Google’s core business that accounts for ~80% of its revenue. Other revenue is slowly gaining on advertising but was recently set back by the fee reduction in the Play Store.

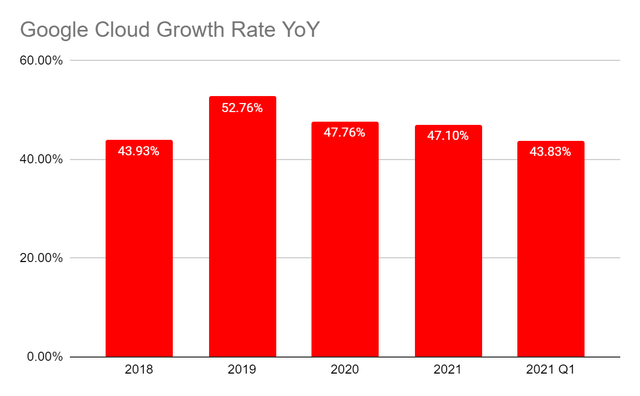

Reaching For The Clouds

Google Cloud is an important growth segment for Alphabet. Cloud revenues increased 40-50% YoY over the past few years. The cloud services are still unprofitable, but the negative operating margin evolved favorably from -52.08% in 2019 to -15.99% in Q1 2022. It should only take a few more strong growth years for Cloud Services to become profitable.

Subscription Growth

Subscription services like YouTube TV and YouTube Premium show strong growth too. YouTube TV just hit 5 million subscribers, up from 3 million in 2020. YouTube Music and Premium already surpassed 50 million subscribers in September 2021. Alphabet has many other apps it could potentially turn into subscription businesses.

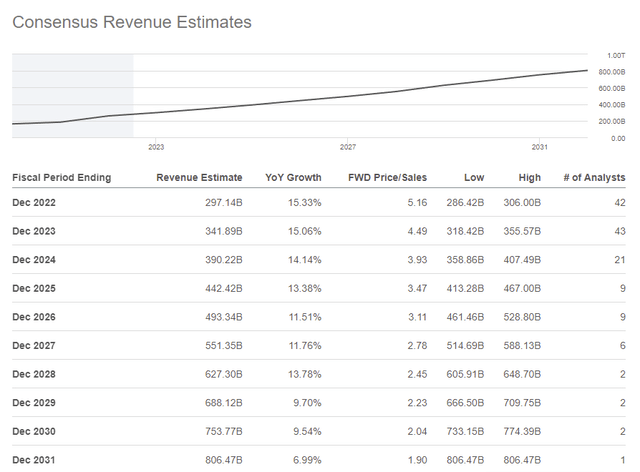

Analysts View

Analysts are relatively optimistic about GOOG’s future growth rate. The near term is very uncertain and could be too optimistic as the economy has to process high inflation and rising interest rates. The long term could turn out even better for Alphabet. It has several other bets or moonshots like Waymo, DeepMind, and Wing that could turn into substantial future revenues. Most moonshots will probably fail, but if one succeeds as YouTube or Android did, it will create a lot of shareholder value.

Free Cash Flow Generation

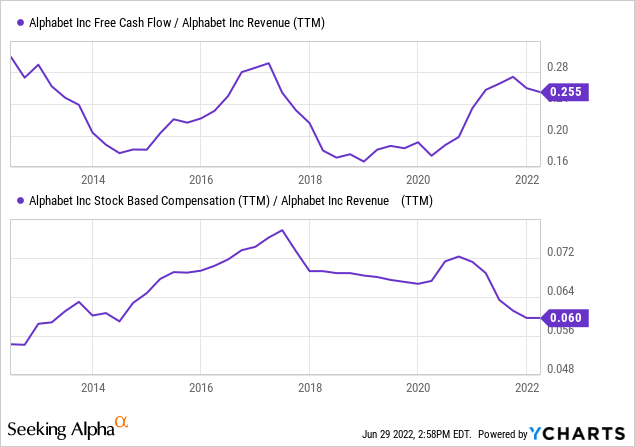

Free cash flow is vital as this is what a company could use for shareholder returns. Potential buybacks or dividends are only possible if the company produces enough cash. I also look at stock-based compensation because this could deform the free cash flow.

Both metrics look pretty good for Alphabet. It turns 0.25 of every dollar revenue into FCF and the SBC is reasonable.

Shareholder Returns

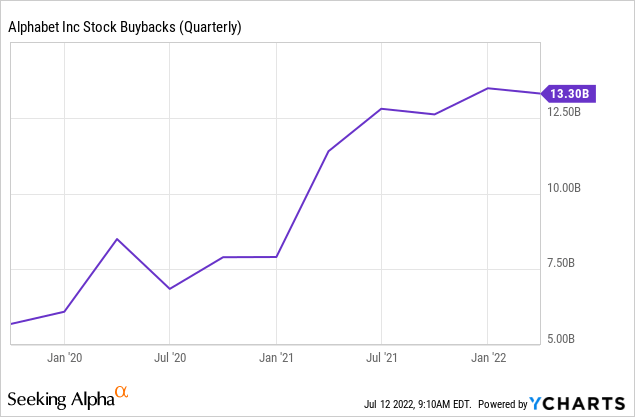

Alphabet only offers a return to shareholders in the form of share repurchases. It hasn’t paid a dividend and doesn’t anticipate paying a dividend soon. The firm grip of the founders with Class B shares with most voting rights makes a change to this policy unlikely. It has become very active with these buybacks using approximately all free cash flow.

The rate of buybacks can easily continue as Alphabet carries a net cash position. It approved a new $70B program in April that I expect to be executed over a year like the previous program. It more than offsets the $15B SBC in 2021 and offers an excellent shareholder return.

Balance Sheet: Swimming in Cash

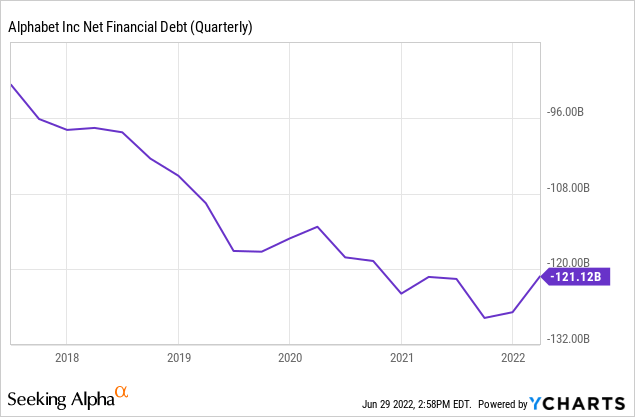

Alphabet’s balance sheet is very strong. It has enough cash to keep acquiring small companies with cash and do its share repurchases.

Some shareholders would probably prefer a faster reduction of the cash pile, but again, I don’t expect this to happen. The net cash position is a luxury and enables Alphabet to jump onto possible opportunities during tough times.

Valuation

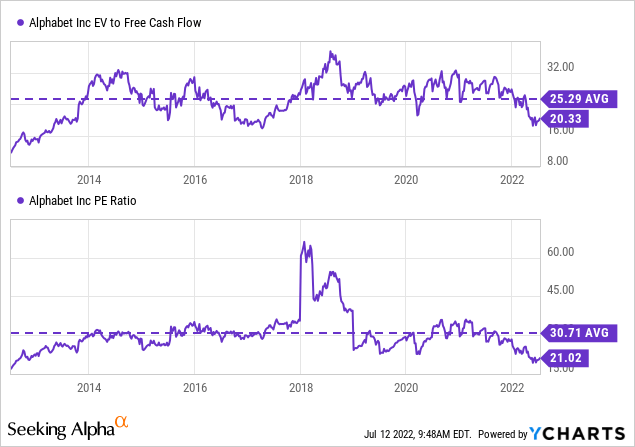

One of my key arguments at the start is the valuation of Alphabet. Like many stocks and major indices, Alphabet sold off since the beginning of the year. I believe the fear is overdone and creates a value opportunity, but the difference could (always) increase.

Alphabet now trades 20% below its average EV/FCF over the past ten years. I prefer this metric as it corrects for debt/cash, and FCF is what can be used for shareholders. The average PE ratio is also slightly deformed due to a drop in earnings in 2018.

Risks

The biggest risk for Alphabet is that none of the moonshots work out. That would lead to slower growth and will ultimately affect the valuations investors are willing to pay for it. It has a good approach to moonshots with a lot of responsibility on the daughter companies.

There are obvious near-term risks due to a slowing economy. Alphabet is very exposed to the cyclical nature of the economy with its ads. So far, it mitigated the cycle very well due to its continuous fast expansion throughout the cycle. Cloud services should help in that regard as well as I expect a more stable business return from that business line.

Conclusion

Alphabet looks too cheap in comparison to its past valuation. The buybacks should offer some downside protection. The stock split on July 15 could inspire more investor appetite, but I wouldn’t count on it immediately.

The long-term story for Alphabet is easy: it’s a dominant company with healthy margins and strong shareholder returns. This will stand throughout the cycle and periods of undervaluation are an opportunity to add shares or to become a shareholder. It’s tough to tell how long the undervaluation will last. It’s cheap enough for me to add.

Be the first to comment