GoodLifeStudio

VanEck Agribusiness ETF (NYSEARCA:MOO) is a passively-managed fund focusing on global equities with material exposure to the agribusiness theme encompassing agricultural chemicals and fertilizers, livestock, seeds, development and manufacturing of farm machinery, as well as trading activities, etc.

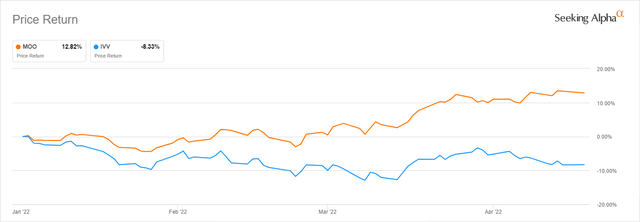

Amid persistent inflation, the theme has been in the limelight earlier this year, with the ETF delivering an almost 13% price return from January 3 to April 19.

Though it turned sharply lower afterward, erasing earlier gains, its price return of ~(11.2)% in 2022 to date still looks much better compared to the iShares Core S&P 500 ETF (IVV).

Truly so, a commodities-focused strategy can perform nicely compared to the bellwether funds during times of persistent inflation. But the issue with MOO is that the inflation factor is not the only one driving its returns. Other themes worth watching closely are capital scarcity and the prospect of a recession; there are also FX considerations not to miss. Combined, they can adversely impact its performance in the short term. In this regard, despite the fund having reasonable quality and comparatively adequate valuation, I prefer to remain on the sidelines this time.

The Investment Strategy: Looking Under The Hood

MOO’s investment strategy is based on the modified market-cap weighted MVIS Global Agribusiness Index, which is rebalanced quarterly, with an 8% cap applied.

To qualify for inclusion in the benchmark, a company must derive no less than half of its revenues from agribusiness, encompassing the following categories,

agri-chemicals, animal health and fertilisers, seeds and traits, from farm/irrigation equipment and farm machinery, aquaculture and fishing, livestock, cultivation and plantations (including grain, oil palms, sugar cane, tobacco leafs, grapevines etc.), plant-based meat and dairy alternatives, and trading of agricultural products.

Another remark is that the methodology is quite picky; for example, companies generating most of their sales from forestry are shown the red light, together with those that rely principally on selling packaged goods, biodiesel, and ethanol. More details on the eligibility rules and the benchmark construction process are available in the index guide document.

Speaking on why the agribusiness-centered strategy is nicely positioned for the long term, it merits mentioning that apart from its ability to reap benefits from elevated inflation, which at some point will certainly be tamed by scarcer capital (or a recession) and lose relevance, the agribusiness has a strong multi-decade bullish thesis undergirded by global population growth. For instance, the article in Nature Food from last year mentioned that the global food demand can “increase by 35% to 56% between 2010 and 2050.” Key industry players are perfectly aware of the tendency and its consequences. In the recent investor presentation, Bayer AG (OTCPK:BAYZF), one of MOO’s top holdings, mentioned that a growing population megatrend means 50% more food and feed would be required to meet the demand by 2050. This is a colossal figure, requiring a material rise in volumes, hence, technological advances to bolster productivity, hence, more sophisticated machinery (a theme MOO also has a footprint in), etc.

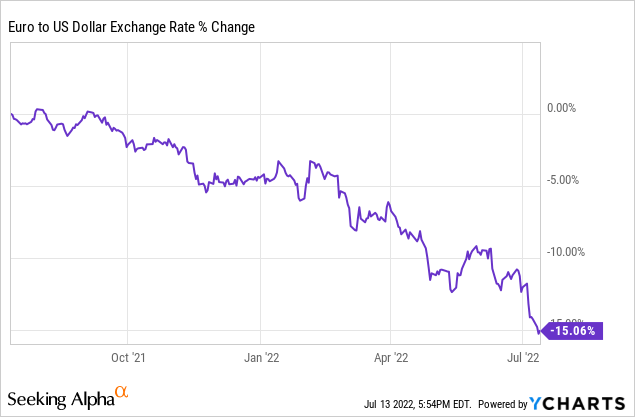

This ETF is more concentrated compared to its peer iShares MSCI Global Agriculture Producers ETF (VEGI), which tracks the MSCI ACWI Select Agriculture Producers Investable Market Index, with 53 holdings vs. VEGI’s 156. Both are rather U.S. heavy, with MOO having close to 54% of its net assets deployed to the country as of the end of June, compared to almost 55% in the case of VEGI as of July 12. This implies they do carry a meaningful FX risk, principally due to their exposure to the euro (for MOO, via its Germany, the Netherlands, and Denmark (quasi-exposure) holdings).

The EUR’s historic weakness likely resulted from investor expectations for the Fed’s aggressive steps amid red-hot inflation.

That said, the issue is that investors who have been betting on MOO as a U.S. inflation beneficiary (which is completely rational) have probably overlooked the fact that its NAV has been simultaneously adversely impacted by the FX headwinds (e.g., weakness of the euro, yen, a few EM currencies, etc.) spawned by the exact same factor.

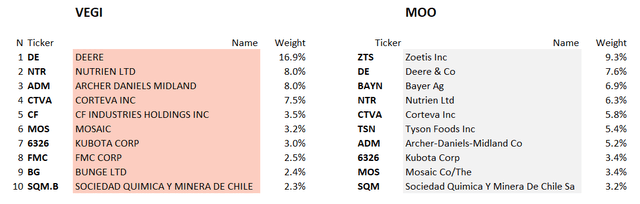

The table below compares MOO’s and VEGI’s ten major holdings:

Created by the author using data from the funds

MOO’s largest investment is Zoetis (ZTS), with a 9.3% weight, a heavyweight name in the animal health medicines and vaccines market.

Deere (DE), an industrial player with a vast portfolio encompassing production and precision agriculture, small agriculture and turf, and construction and forestry equipment, is in second place, with a 7.6% weight.

Frankfurt-quoted Bayer (OTCPK:BAYZF), a healthcare sector behemoth operating via Pharmaceuticals, Consumer Health, and Crop Science (46% contribution to the top line in FY2021) segments is the last in the top trio with ~6.9% allocated to it.

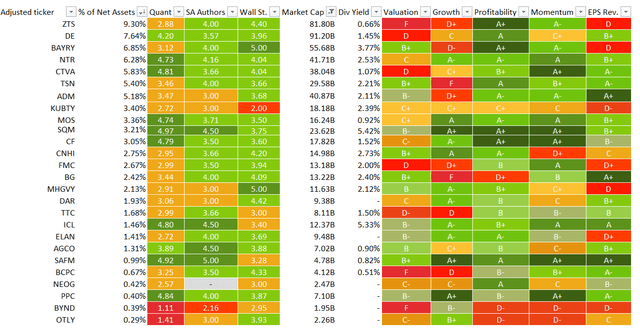

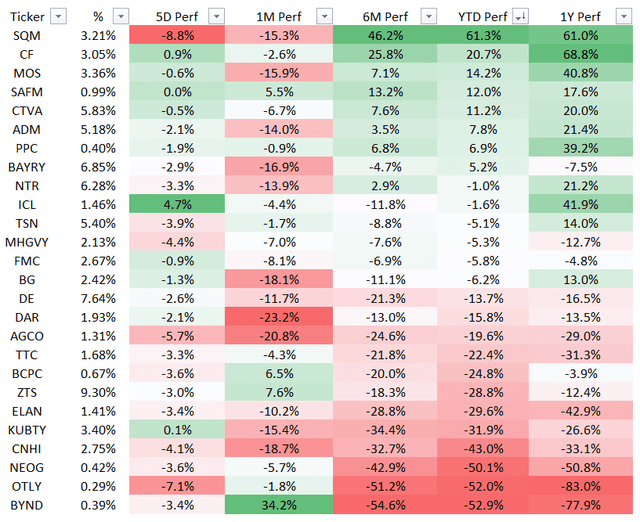

Around 80% of the MOO holdings have a Quant rating (I have adjusted a few tickers replacing them with ADRs this time, Bayer included). After analyzing this set, I can conclude that the portfolio has mostly adequate quality characteristics; valuation is far from perfect, but intolerably overstretched multiples are not a substantial concern either.

Created by the author using data from Seeking Alpha and the fund

It does hold a few stocks valued speculatively, with three companies having an F Valuation rating, namely ZTS, Beyond Meat (BYND), and Balchem (BCPC). BYND is also EBITDA and cash flow negative. Of course, their expensiveness poses obvious risks; however, we also see that around 33.5% of the holdings sport value characteristics, which should make them less sensitive to the bearish trends should the market creep lower. Besides, the median EV/EBITDA for the MOO holdings with a QR is 10.44x (excluding BYND and Oatly Group (OTLY), which also has issues with coverage of operating expenses), a fairly reasonable level.

Meanwhile, a few rapidly growing companies can be spotted, together accounting for ~27.7%. Those that face revenue, profits, and cash flows stagnation or are growing rather anemically are also present, with a greater weight of almost 35%.

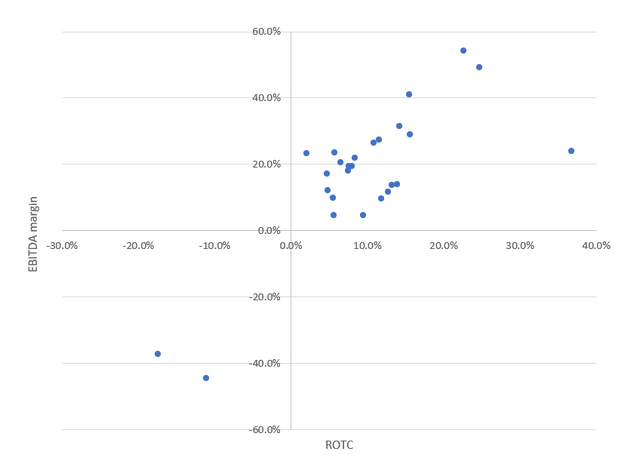

Turning to quality, this large/mid-cap mix scores nicely against a set of indicators, from a few margins to cash flows and returns on capital. Around 74% earned a Profitability grade of B- or better. Three cash flow-negative companies did percolate into the mix, namely BYND, OTLY, and Bunge (BG). However, they account for marginally above 3%, thus the impact on MOO performance should they drift lower will be minor. To bring a bit more color, the chart below compiles the EBITDA margins and Returns on Total Capital for 80% of the holdings. Overall, they are rather strong, except for BYND and OTLY.

Created by the author using data from Seeking Alpha and the fund

Returns: Turned Lower After Racy Start To 2022, More Softness Possible

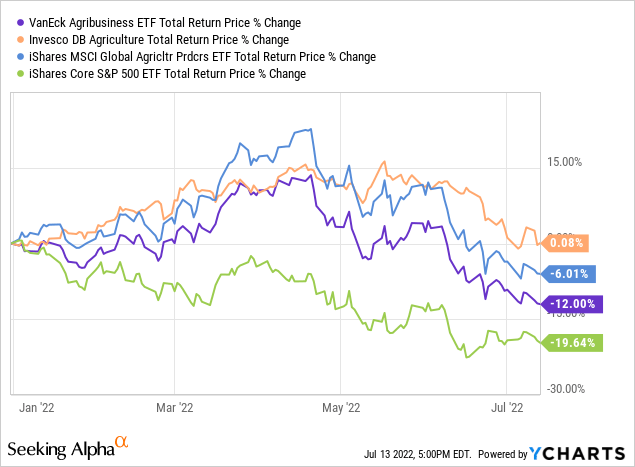

MOO has had a stellar start to 2022, propelled by the inflation narrative. However, as I said above, the rally totally lost steam in April, with the fund’s price now in the red, though with YTD return being better compared to IVV. VEGI was also not immune. Strong early 2022 returns of the Invesco DB Agriculture ETF (DBA) have also been erased.

Looking under the hood, in the 26 stock list I analyzed above, only 8 names have delivered positive returns this year, while 12 (~31% weight), DE and ZTS included, are down in double digits. Avian flu arguably contributed to ZTS’s lackluster performance, while for asset-heavy businesses like DE, it was more likely the capital scarcity (higher interest rates) issue.

A few tickers were adjusted. (Created by the author using data from Seeking Alpha and the fund)

Final Thoughts

Acknowledging that agribusiness-centered strategies can benefit from persistent inflation, I should warn against ignoring the capital scarcity and recession risks. We see that the market has already been pricing in a great deal of economic softness since spring, with the fund now in the red, despite food inflation not losing relevance across the globe. In this environment, MOO’s price may still drift lower.

Speaking about the FX risk, though the U.S. dollar rally looks a bit overdone, with the EUR/USD rate hovering around historic lows, the prospect of further pressure on EM and DM currencies is not to be ignored. This is especially important for the Canadian dollar should the oil price decline on recession fears.

Also, MOO’s expense ratio of 52 bps is slightly elevated, which is a downside for long-term investors. VEGI is marginally cheaper, with a 39 bps ER.

In sum, I am of the opinion that a Buy rating is excessive at this point, with a meaningful risk of the fund failing to live up to bulls’ expectations. Owing to great uncertainty, a Hold rating looks justified.

Be the first to comment