Michael M. Santiago

Thesis

Leading investment bank The Goldman Sachs Group, Inc. (NYSE:GS) has been battered by the equity bear market over the past year, following its highs in November 2021. Notwithstanding, none of it should be surprising as its investment banking (IB) unit came under significant pressure following the excesses in deal-making from the Fed-induced liquidity pump.

Therefore, as the Fed shuts down its liquidity pump and tightens financial conditions rapidly, IB’s growth momentum stuttered dramatically. It dragged down the bank’s revenue growth cadence, as its asset management (AM) arm also underperformed markedly.

Notwithstanding, we assessed that GS’s valuations have likely priced in these headwinds, even though we could be entering a recession. However, a worse-than-expected downturn could compress its valuation multiples further, de-risking the entry levels for GS.

Therefore, investors considering adding exposure should layer in over time. We believe its reward-to-risk profile is reasonable at the current levels.

As such, we rate GS as a Buy.

Goldman Sachs’ Strategists Turned More Pessimistic

While Goldman Sachs remains optimistic about US equities, the bank believes a potential recession cannot be ruled out in 2023. Furthermore, its equity market strategists posted a pretty pessimistic commentary on the S&P 500 (SPX) recently, suggesting a target of 3,600 by the end of 2022.

The bank reined in its market forecasts following the September FOMC meeting, as the Fed communicated an accelerated path to rate hikes. As a result, Goldman Sachs believes that the “rate complex has subsequently shifted dramatically,” suggesting that equity multiples should fall further. It articulated:

The higher interest-rate scenario in Goldman’s valuation model supports a price-earnings multiple of 15 times, compared with 18 times previously. “Our economists now forecast the FOMC will raise the policy rate by 75 basis points in November, 50 basis points in December, and 25 basis points in February for a peak funds rate of 4.5%-4.75%.” Goldman said the risks to its latest forecast are still skewed to the downside because of the rising odds of recession — a scenario that would reduce corporate earnings, widen the yield gap and push the US equity benchmark to a trough of 3,150. – Bloomberg

GS Valuation Multiples Likely Priced In A Recessionary Scenario

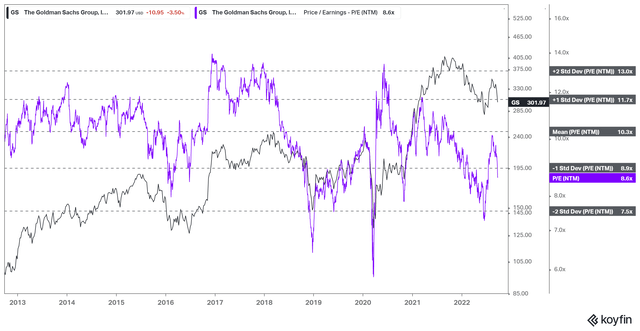

GS NTM normalized P/E valuation trend (koyfin)

As seen above, GS attempted to bottom out in June, as its NTM earnings multiple fell to the two standard deviation zone under its 10Y mean. Therefore, we postulate that the market has likely priced in a recession.

Notwithstanding, we believe it’s essential to recognize that unforeseen market volatility could still impact its valuations if the recession turns out worse than expected, as GS remains above its June lows.

Wharton School professor Jeremy Siegel suggested that the Fed’s accelerated tightening could have undesirable consequences, spurring a deeper than expected recession. He accentuated:

I think the Fed is just way too tight. They’re making exactly the same mistake on the other side that they made a year ago. If tightening actions from the Fed continue through 2023, you can [be] sure that there’s a major recession on the other side. – Insider

With that in mind, investors should be prepared for GS earnings multiple to compress further, with a target below the two standard deviation zone as a benchmark.

Therefore, investors should consider saving some ammunition to load up at less aggressive entry points if the market decides to take GS down further to de-risk its valuations.

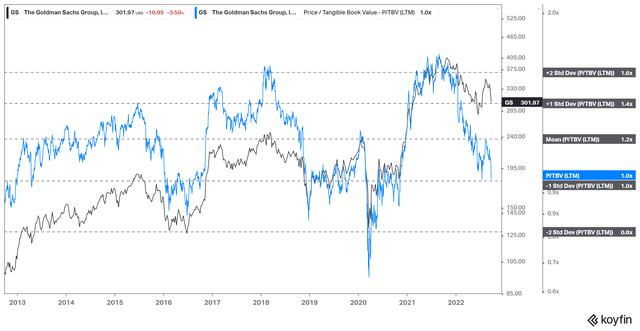

GS TTM P/TBV valuation trend (koyfin)

GS’s closely-watched TTM tangible book value (TBV) multiples unveiled similar observations from its earnings multiples. Its TTM TBV multiple of 0.99x is at the one standard deviation zone under its 10Y mean. We posit a major recession could see its TBV multiples compress further toward the two standard zone of 0.8x.

Therefore, we parsed that GS’s valuation multiples have factored in near-term headwinds but remain susceptible to further compression if the market anticipates a much harder landing for the economy.

Goldman Sachs’ Estimates Suggest A Recovery In 2023

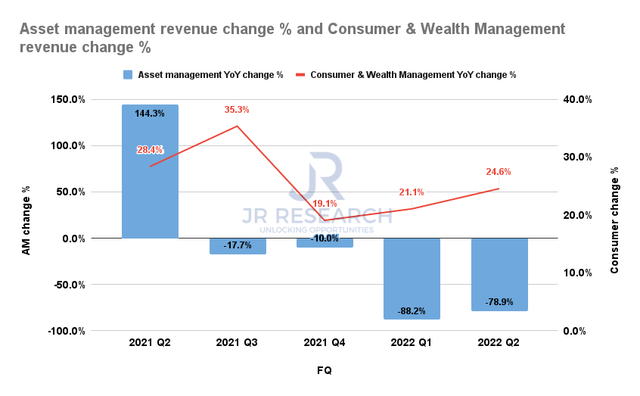

Goldman Sachs revenue by segment change % (S&P Cap IQ)

As seen above, its consumer and wealth management segment performed well in Q2, as revenue grew by 25% YoY, up from Q1’s 21%. However, that segment is unlikely to lift Goldman’s profitability in the near term, as the bank remains in investment mode. CEO David Solomon articulated:

I’d highlight that we’ve been building a business from scratch here. It certainly takes investment. And we’ve been pretty clear that we have a long-term strategy to create a leading digital platform in the consumer banking business. On a year-to-date basis, the vast majority of the investment relates to building credit reserves as we grow the business. And just a reminder, CECL requires [a] very, very significant upfront reserve build. So we continue to feel good about the progress we’re making, and we expect this business to generate accretive returns [for] Goldman Sachs over time. (Goldman Sachs FQ2’22 earnings call)

Therefore, we urge investors to continue paying attention to its IB and global market business to determine the trajectory of its recovery momentum, with AM’s momentum expected to remain tepid.

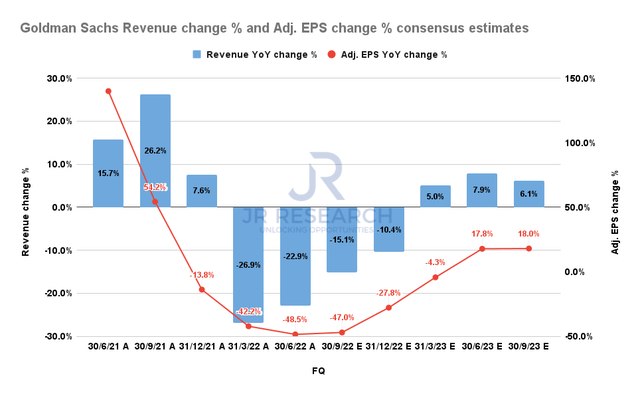

Goldman Sachs Revenue change % and Adjusted EPS change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) indicate that its Q1/Q2 performance could be its nadir. Therefore, if Goldman could execute well through the coming recession, it could continue its recovery cadence, supporting its valuation based on its recent June bottom.

We believe the estimates are credible, as we explained that the market has factored in a recessionary scenario for GS.

Is GS Stock A Buy, Sell, Or Hold?

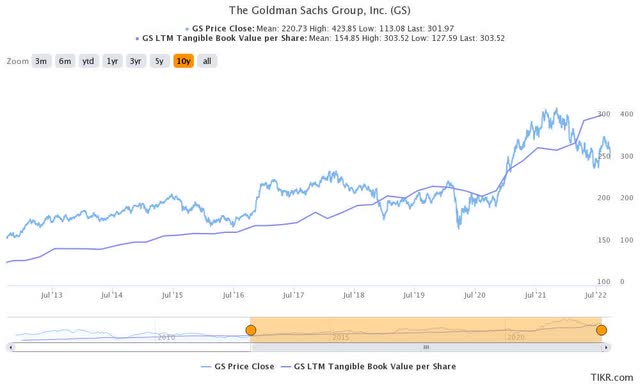

GS TTM TBV & price trend (TIKR)

Despite the pessimism in the market, GS’s closely-watched TTM TBV has continued to increase, corroborating the bank’s robust value creation capabilities even amid tough headwinds.

While its earnings volatility has certainly impacted its stock, investors should consider its TBV vs. price trend as a potential long-term bottoming process for GS. Therefore, we believe the opportunity for long-term investors to add more positions is appropriate.

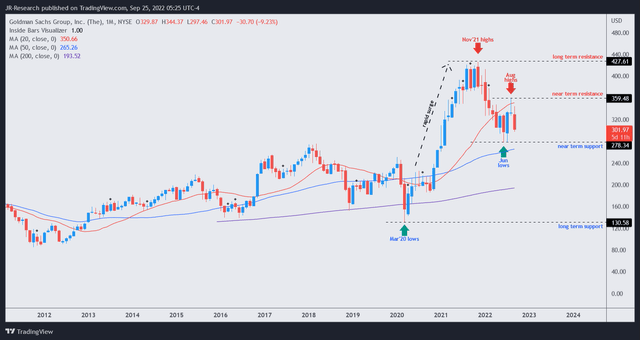

GS price chart (weekly) (TradingView)

We also gleaned that GS’s price action is constructive, as it has fallen to its 50-month moving average (blue line) at its June lows. That dynamic support level has underpinned GS’s long-term uptrend over time, attracting robust buying support.

Therefore, we believe the recent pullback from its August highs is a solid opportunity for long-term investors to add exposure. Notwithstanding, investors should size their allocation appropriately and keep ammunition to add at even more attractive levels if the market decides to de-risk its valuations further.

We rate GS as a Buy.

Be the first to comment