bjdlzx

(Note: This article appeared in the newsletter on July 28, 2022 and has been updated as needed. This is a Canadian company that reports in Canadian Dollars unless otherwise noted.)

Small companies like Yangarra Resources (OTCPK:YGRAF) often suffer from less-than-optimal exposure to the market. There are many small companies out there that receive little to no market attention except from small investors. For investors, the “name of the game” is to find one of these small companies that is executing exceptionally well and then hang on until the attraction of institutional attention drives the prices of the stock to a better valuation.

Yangarra Resources was one of the few companies that reported a profit in fiscal year 2020. Anything close to a profit was an exceptional performance because so many companies lost a lot of money in fiscal year 2020. That also meant this company did not have an impairment charge which was another accomplishment for the fiscal year.

Now that preliminary above average profitability indication has been followed with some industry leading profits in a considerably more friendly industry environment. Other indicators include the ability to repay the debt along with growing production. Returns to shareholders are not yet a priority as growth to a size that attracts institutional investors should be the first priority.

In the meantime, investors can invest in a company that is selling for less than two times annualized earnings. That low multiple should provide some downside protection even if oil prices decline as the market fears. The growing production with a very low breakeven point will provide further stock price downside protection. The low breakeven price of the wells means the company can grow production when many competitors cannot (while also generating decent cash flow).

Since the article was originally written, recession fears have climbed considerably. But a company that can report a profit in a challenging year like fiscal year 2020 is likely to breeze through the current challenge. This is that rare company that can repay debt to the satisfaction of the lender while growing production. That growth will likewise provide more downside protection.

(Canadian Dollars Unless Otherwise Noted)

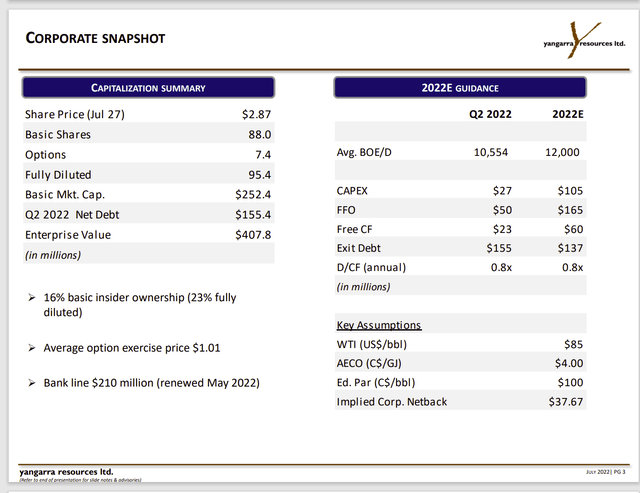

Yangarra Resources Corporate Snapshot (Yangarra Resources July 2022, Investor Presentation)

Notice that the debt level has declined to a far more comfortable level of the bank-line. A lot of the small companies that committed to a production model from the initial lease acquisition and drilling optimization model have a very tight ratio of actual debt to bank commitments. This is that rare company that can actually repay its debt without having to do “deals” involving stock to climb out of what was once considered a conservative level of debt before fiscal year 2020 changed the debt market ideas about conservative.

The other thing to note is that the assumptions are fairly conservative given the current price levels. That puts management in a position to continue to grow the company while reducing debt (probably) below guidance levels.

The company is not just growing production. But it is growing production at a fairly high level. A company this size can maintain that growth rate for some time. But an investor would never know that when looking at the key valuation ratios.

(Canadian Dollars Unless Otherwise Stated)

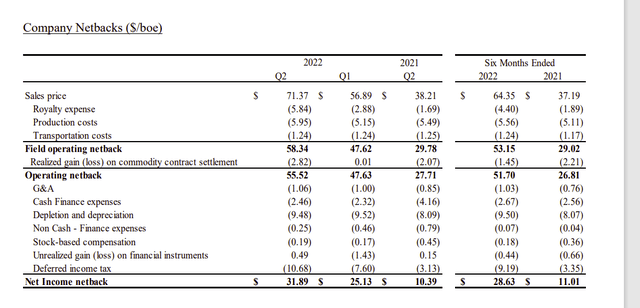

Yangarra Resources Operational Summary (Yangarra Resources July 2022, Corporate Presentation)

Some of the costs will vary with prices (like Royalty Costs). But the key to the company profitability is the very low Production Costs combined with the low Depreciation costs. The costs shown above are far more typical of a natural gas producer than a company like this that produces oil, natural gas, and liquids. The result is the extra value of the production stream when compared to a natural gas producer is heading straight to the bottom line (with a very large profit percentage of revenue as a result).

The hedging activities have been a relatively small part of company operations because production costs are so low. The result is that this company often achieves a net selling price that is far closer to the actual commodity price than is the case for many companies I follow. Earnings of course are much more volatile. But then again, the company reported earnings in fiscal year 2020 when much of the industry lost a lot of money. Therefore, the extra risk of more exposure to volatile commodity prices is made up by the low production costs.

(Canadian Dollars Unless Otherwise Stated)

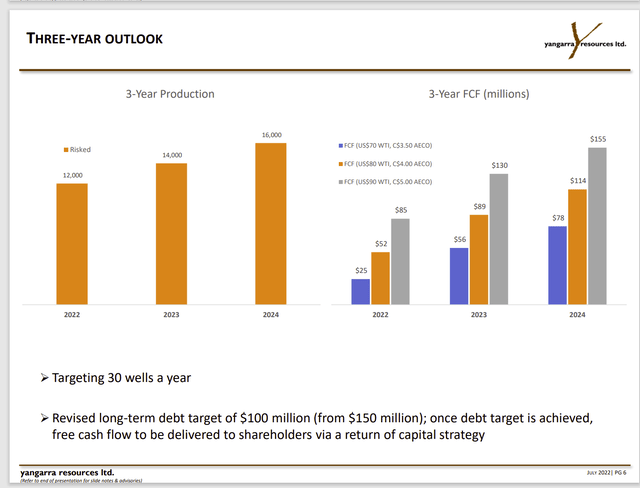

Yangarra Resources Three Year Cash Flow Outlook (Yangarra Resources July 2022, Corporate Presentation)

The one worry I constantly see is that “prices are going to decline”. A slide like this should help investors to see that if the company makes the C$85 million cash flow estimated when WTI averages $90, then even if WTI slides to $70 million, the free cash flow is practically right back there within about two years.

That assumption does not take into account continuing technology improvements that keep lowering costs (which would increase cash flow) and increasing well productivity (which also increases cash flow). Chances are very good that as long as technology continues to improve that 2024 free cash flow projection will prove to be conservative.

In the meantime, this is one company that is rapidly growing production at a time when many others can only repair the company balance sheet while maintaining production. That production growth when combined with the continuing advance of industry technology provides considerable downside protection.

The market concerns about the debt will likely fade as the pace of debt payment continues at an accelerated rate. There were a lot of debt market fears about industry debt at the beginning of this fiscal year. It is likely that the debt market will be a little less conservative as fiscal year 2020 fades. But that also depends upon economic management that can easily prevent the disasters of both fiscal years 2008 and 2020 in the future. Another year like either of those two years would result in a far more conservative debt market that is very counterproductive to growing companies.

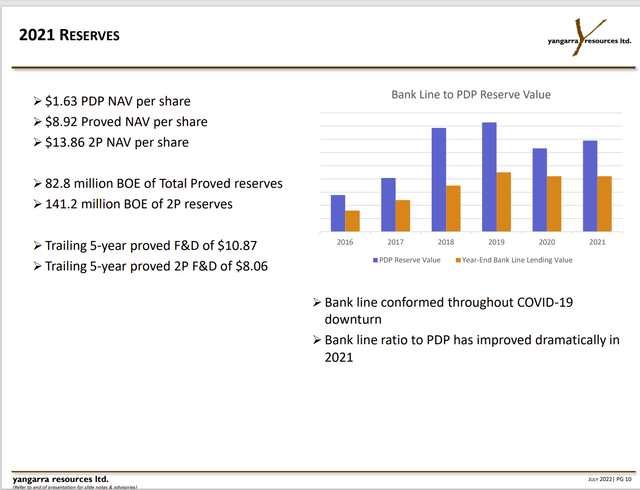

Yangarra Resources Reserve Value Per Share (Yangarra Resources July 2022, Investor Presentation)

In the meantime, there is a generous amount of (likely) highly profitable reserves behind each of the outstanding shares. The above average cash flow makes these reserves a far more viable proposition than is the case where the cash flow is really insufficient for the production level. The active drilling program will likely revise this slide upwards as the year continues.

Note that management announced a fair number of wells beginning at the end of the second quarter and the beginning of the third quarter. That likely means the lull in activity caused by the Canadian Spring Breakup is over. There appears to be a lot of production coming online in time for the important heating season (this company produces a fair amount of natural gas). Therefore, the next two quarters are likely to report significant sequential improvement over the current quarter because of the new wells that begin production in the second half of the fiscal year.

It is always hard to tell when a small company like this will attract that necessary institutional attention that leads to a higher valuation. But for those who are patient buy and hold investors, the current price is likely to provide a rewarding entry level for a long-term investor. Management experience clearly showed when the company reported a profit in fiscal year 2020. That experience continues to show given the very low breakeven price of the wells.

Be the first to comment