AvigatorPhotographer

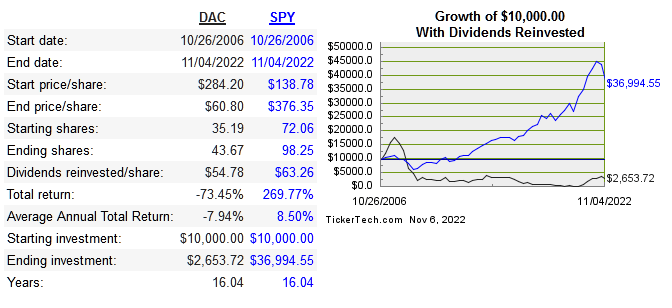

Danaos Corp. (NYSE:DAC) is a Greek shipping company that was founded in 1963 and went public in 2006. They have a fleet of 71 vessels, 45 of which are debt free. Below is the long term share performance:

dividend channel

This cyclical stock had underwhelming performance since IPO, but hit an inflection point during covid. Below are the return on capital metrics:

|

Company |

Revenue 10-Year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year Cagr |

FCF/Share 10-Year CAGR |

|

3.9% |

11.3% |

1.9% |

40.7% |

n/a |

|

|

5.7% |

9.6% |

3.9% |

-1.8% |

n/a |

|

|

7.6% |

11.9% |

3.8% |

8.5% |

n/a |

|

|

36% |

-0.8% |

-0.5% |

-7.8% |

-13.1% |

|

|

9.9% |

5% |

2% |

11.7% |

n/a |

|

|

14.3% |

2% |

1.1% |

2.9% |

-9.3% |

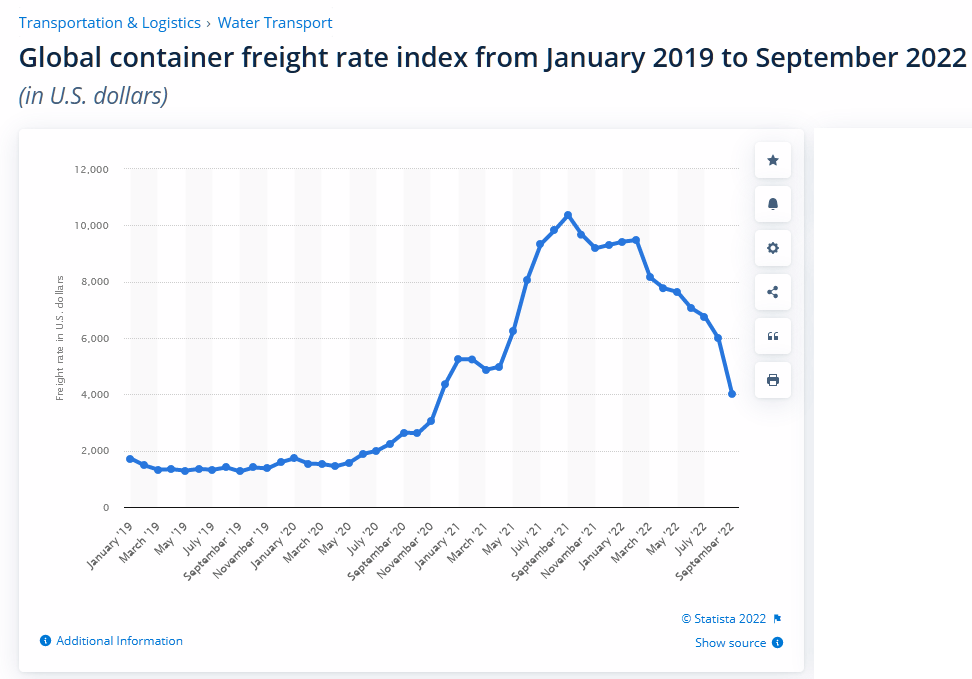

Freight rates have boomed since covid began and lately have settled back down a bit. The shares of most shipping companies followed these rates and saw a similar spike.

statista

Reinvestment isn’t too complicated in this industry, as it means acquiring more ships to add to the fleet. For example, last year the company acquired six secondhand ships for $260 mil USD.

Below we see that the cash flows are more stable than net income alone:

|

Year |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Operating Profit |

282 |

292 |

262 |

285 |

2018 |

187 |

199 |

201 |

199 |

358 |

|

Free Cash Flow |

-209 |

142 |

153 |

271 |

257 |

177 |

156 |

199 |

95 |

72 |

|

Net Income |

-105 |

38 |

-4 |

117 |

(366) |

84 |

(33) |

131 |

154 |

1,053 |

Capital Allocation

Despite being a fairly cyclical industry, FCF has remained more consistent than earnings have as the table above shows. Share count gradually increased until peaking in 2020, and has been reduced by only 16% since then. Dividends were paid in 2007 and 2008, but were cut until being reinstated last year. Even though capital allocation typically becomes more important the bigger and more mature a company gets, I do think that increasing the fleet should still be a higher priority than returning capital to shareholders.

Risk

In terms of downside risk I see very little, especially at today’s price. More on the price in a bit, but the business fundamentals are intact barring a black swan disaster. Debt appears high when seeing the debt/equity ratio at 3.8, but long term debt was twice as high in 2013. They’ve been consistently paying down debt and I would rather see this effort continued for now rather than ramp up shareholder yield, which I often prefer.

Valuation

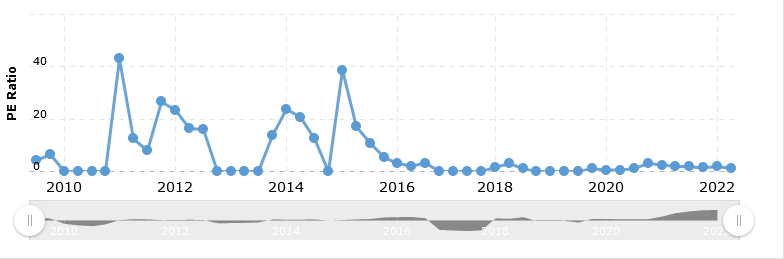

Shares are down about 40% from last year’s peak, but the stock often trades at a low P/E.

macrotrends

Below is comparison of price multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

DAC |

1.6 |

2.5 |

3.4 |

-0.5 |

4.9% |

|

SFL |

4.1 |

6.3 |

-7.2 |

1.4 |

8.8% |

|

CMRE |

2.8 |

4.3 |

50.6 |

0.7 |

4.6% |

|

GOGL |

2 |

3.6 |

3.7 |

0.9 |

27.8% |

|

GSL |

3 |

5.8 |

-6.4 |

0.8 |

8.4% |

|

NMM |

1.3 |

2.2 |

4.6 |

0.4 |

0.7% |

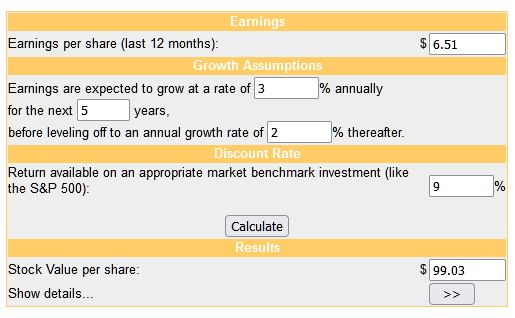

The net margins are distorted by the proceeds of the shares held in ZIM, and the company no longer holds a position. The EPS should be normalized since the gains from the ZIM shares gave a big boost to the net income and EPS. So I used 2020 EPS in the dcf model below:

money chimp

Conclusion

The price doesn’t reflect the sheer importance of a company like this in the world. There is very limited downside risk aside from a market collapse that drags down everything. The fundamentals are intact, management has a long term view, and the price is low. This is definitely not a low quality business, but I’m not convinced that investors can ever achieve more than dividend yield plus multiple expansion at some point.

There isn’t enough intrinsic value growth over time for me to consider this as a long term investment, in spite of the undervaluation today. The biggest risk right now is that multiples will stay low for a long time, with the dividend contributing to all or at least the majority of your return.

Be the first to comment