bjdlzx

(This article was in the newsletter July 29, 2022 and has been updated as needed.)

One thing stood out when Baytex Energy (OTCPK:BTEGF) reported the second quarter reports. Just about every company in the industry is making good money right now and many have a goal to lower debt while eventually returning something to shareholders. But this company mentioned that the ultimate debt goal is important because they want that debt ratio at 1.0 when the price of oil is at WTI $40. Hopefully shareholders will take notice.

In the current market, just about every company has a good debt ratio. There will likely be more than a few that allow costs to rise because “we are making money. Aren’t we?”. It is almost as if showing a profit is “good enough”. This actually happened when oil prices shot up in the 1990’s and really stayed fairly high until about 2015. It took a recession in 2008 to briefly bring oil prices down.

The danger again is that the currently strong market will last long enough for many managements to not worry about costs as they had in the past. But by announcing that debt goal, management is telling shareholders they remember the industry is cyclical and the next downturn is unpredictable. Therefore, debt and by inference costs, are still pretty important. It is just one small indication for shareholders to tell which managements will be tightly controlling profits so that any downturn will not be as threatening as it is to the average crowd that settles for “good enough”.

Increasing Profitability

But this management is not only maintaining costs. It is actually decreasing those costs in a significant way.

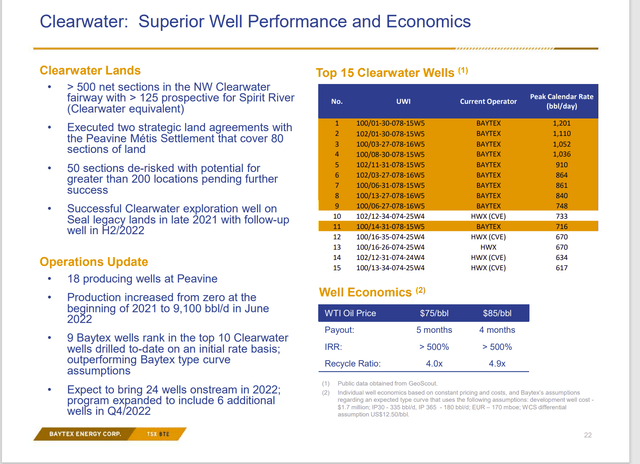

Baytex Energy Clearwater Performance Summary (Baytex Energy September 2022, Investor Presentation)

Management found a heavy oil play with considerably lower costs than the legacy acreage that is currently producing much of the heavy oil. The result is that this new play successfully competes for an outsized share of company capital expenditures.

Management is also working on improving a very profitable situation. As shown above, the company currently has some better than expected well production. That is very likely to continue into the future.

The expanding production at Clearwater will come at the expense of production growth at the other heavy oil options. As this growth continues, it will drop the average production cost of the corporation because the breakeven here appears to be at least C$10 per barrel lower. As the well production improves, that gap will widen.

This is an important consideration now that fears of a recession have grown. Nothing helps performance in a downturn better than lower costs when compared to the competition. This company now has significant production in two of the lowest cost basins in North America (Clearwater and Eagle Ford). Better yet, the production mix exposed to those lower costs is growing.

Production Growth

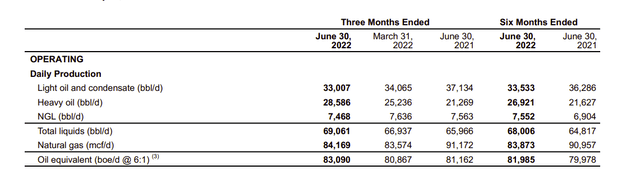

It should be expected that all the production growth will be in heavy oil as is shown below:

Baytex Energy Second Quarter, 2022, Production Comparison (Baytex Energy Second Quarter 2022, Earnings Press Release)

Ironically, the legacy heavy oil production had the highest costs (and hence the highest breakeven point) in the company portfolio. The Clearwater production does have lower costs. But those lower costs are still higher than some of the light oil prospects. The Eagle Ford leases likely have the lowest costs in the portfolio.

As the product mix changes with more heavy oil production, the corporate average cost could rise because the Clearwater costs are higher than the light oil production. But the cost improvement over the legacy acreage will allow for profitability improvement.

Profitability Improvement Source

The Clearwater heavy oil project has lower drilling costs. This will lower depreciation.

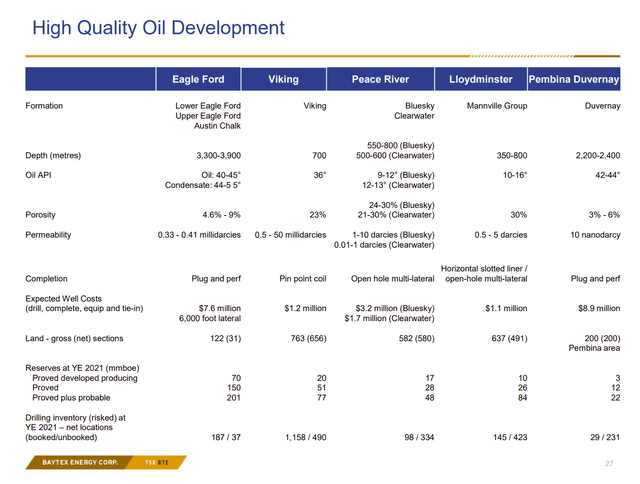

Baytex Energy Key Basin Performance Characteristics (Baytex Energy September 2022, Investor Presentation)

Notice that the Clearwater well costs only slightly more than half of the cost of a legacy (Bluesky) well. Yet the well flows initially far more oil as was shown previously. Clearwater is basically an emerging play. Therefore, optimization is likely to proceed at a pace in excess of established production. No guarantees of course.

All management has to do is replace higher cost legacy production with lower cost production (achieved from the higher production volume combined with lower well costs) to improve corporate profitability. That gives this company a significant edge over much of the industry.

Most of the industry relies upon technology advances to improve costs. A play like Clearwater that can materially change corporate profitability is very rare. Production is likely to rapidly grow from a very low base production because of that profitability.

The only risk with heavy oil is that during a cyclical downturn, the gap between premium light oil and discounted heavy oil can widen. In this case, the extremely low cost of the heavy oil production will mitigate that issue to some extent. It makes the shut-in of wells to lower the loss of cash flow less of a necessity.

It also points to why management chose the final debt number. Heavy oil profits are very volatile. Therefore, a fairly low debt level is indicated.

Prioritizing Production

The Eagle Ford is a light oil project that has similar profitability characteristics. But the Viking light oil is probably needed to assure cash flow during any cyclical downturn. The Viking Light oil project appears to have higher costs. But light oil receives better pricing than does heavy oil. Therefore, light oil often provides the necessary cash flow when commodity prices are weak (and discounts for heavy oil likely widen).

That probably gives both the Eagle Ford and the Viking projects a high priority in the capital budget. What is unusual is the very high priority of the Clearwater play because heavy oil production is not usually this profitable. Heavy Oil rarely breaks even at low WTI prices because it is a discounted product while WTI prices are for light oil.

The Future

This company will increase profitability when compared to many in the industry because it will likely benefit from the low-cost Clearwater project and technology advances. Many competitors will only benefit from technology advances. That means that profitability will increase even if production does not grow.

But management is now forecasting some slow production growth as well. Investors can expect profitability to improve at an above average rate for the industry thanks to Clearwater. That puts this stock in the position of earning above average returns for the foreseeable future.

Normally, large companies do not grow production quickly because the logistics of fast growth are daunting for a large company with a sizable production starting point. In this case, Baytex has some very profitable production that should increase profits at a faster rate for a few years than one would normally expect given the company production growth guidance. That profit growth should translate into a common stock price that outperforms many competitors in the industry.

Be the first to comment