Luis Alvarez/DigitalVision via Getty Images

Coffee. A cup of joe. A cup of mud. It is called many names. Around the globe, it is a beverage that people become obsessed with. Some people say that coffee renews their soul and that it is delightful and scrumptious. Others can’t even start their day without a cup of coffee in the morning. Many consider themselves coffee connoisseurs or coffee addicts, seeking that powerful hit that caffeine can provide!

Well, let me come clean to you, I am an addict.

But not coffee, oh no! I love the sound of coffee dripping into my pot as much as you do, but that is not my true addiction. I’m addicted to seeing dividends pour into my account. Some people are addicted to the sweetness of chocolate, others to the taste of coffee, but my guilty pleasure is dividends.

Every day, I open the “Dividend Tracker” built by the High Dividend Opportunities team to check when my next paycheck is. Knowing when I will get paid makes me happy and helps add pep to my step! A recurrent and stable income is essential for retirees and a dream for all investors, as it helps you plan ahead of time!

Lately, I have been buying what the market has been heavily selling. No, I am not buying the dips to sell in a couple of days. My strategy is to generate additional income. I cannot help but hit the buy button when I see solid companies and funds with great fundamentals at a big discount.

Today, I want to share two picks that I am buying for their strong future income, as well as knowing I’ll get paid by them in the coming days.

Pick #1: WPC – Yield 5.3%

W.P. Carey Inc. (WPC) is a “triple-net” REIT. This means that the tenant is responsible for most property-level costs. Insurance, regular maintenance, and taxes are all the responsibility of the tenant.

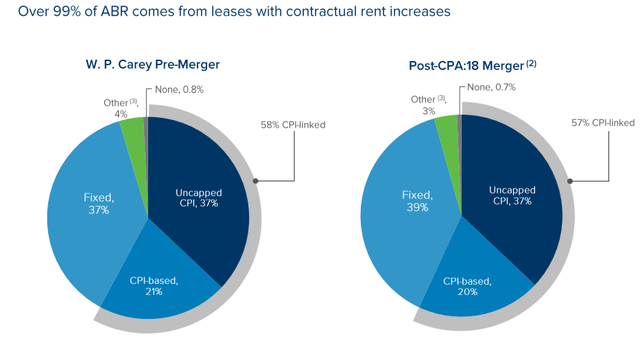

This is an ideal structure in an inflationary environment for the landlord. The expenses at the property level are also the ones that are most impacted by inflation. When it comes to the expense side, inflation isn’t significant to WPC. On the revenue side, WPC has 57% exposure to CPI-linked rent increases. A full 37% of those are “uncapped”, which means that rent will go up however much CPI rises. (Source: WPC Investor Presentation)

WPC Investor Presentation

Inflation increases revenues while having a minimal impact on expenses, making WPC very well positioned to benefit from inflation in the U.S. and in Europe where inflation is proving to be even more robust.

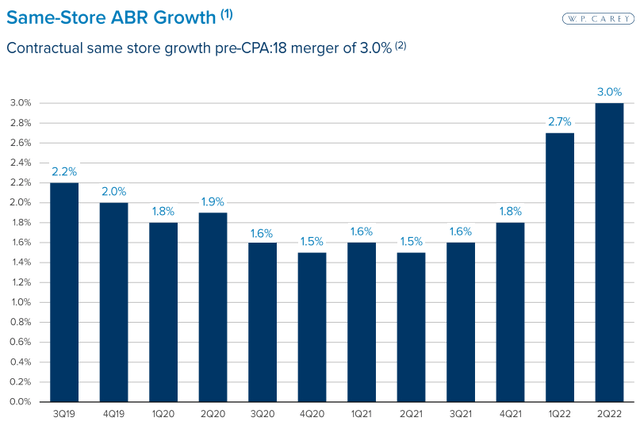

For many years, WPC’s same-store rent growth was only 1-2%. In Q2 2022, that is up to 3% and will grow even more next year as inflation continues surging.

WPC Investor Presentation

For over a decade, same-store rent growth has been anemic, making it only a small contributor to overall earnings growth. That is changing, with growth at 3%+, WPC will see solid growth even before investing in any new properties.

WPC has a fantastic dividend record, hiking every quarter for over 20 years. However, the size of those hikes has decreased in recent years due to slow rent growth. WPC is positioned to see even more aggressive dividend growth with rents rising faster. The next ex-div date is September 29th for $1.061.

When the market is bleeding red and selling “everything”, high-quality companies should be at the top of your shopping list. WPC has dipped below our “buy under”, I’m going to snag a few more shares before it goes back up!

Pick #2: ECC – Yield 17.2%

Eagle Point Credit Company (ECC) has a “problem” for a CEF, it made “too much” money and didn’t distribute enough of its taxable income. CEFs are required to distribute most of their taxable income. So ECC is solving this “problem” by paying investors an extra $0.25 supplemental dividend, in addition to their $0.14 regular monthly dividend in October.

Despite this, ECC is trading at a discount to its August NAV of $11.27-$11.37. What are investors so concerned about? One thing I often hear is investors are concerned about the quality of the loans. CLO equity positions are volatile because they are leveraged. The CLO equity is the first tranche to realize losses, so the big risk with CLO equity positions is if borrowers default on their loans. Of course, defaults will happen, that is the reality of lending, and some borrowers won’t pay back. The other reality is that if the yield received is high enough, it more than makes up for the defaults. So when we talk about ECC, the largest question we need to answer is “what is the default risk”.

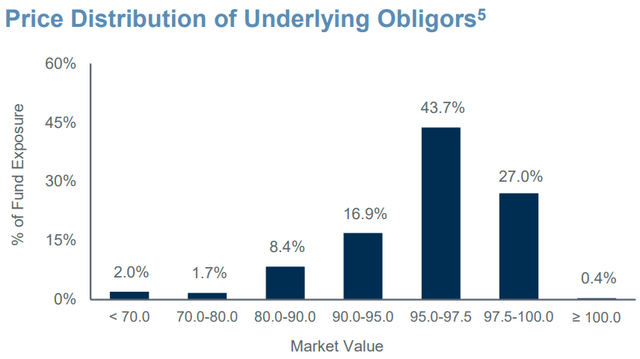

Is ECC exposed to “especially risky” loans? With such a high yield, that is what many assume. Yet when we look at the loans in ECC’s portfolio, they trade at an average price of $94.13. In this environment, that is about average.

ECC FactSheet

In fact, ECC’s exposure to loans under $80, a line that is typically used as a “rule of thumb” for identifying whether the market believes it is at risk of being distressed, is under 4%. These are not “low-quality” loans. These are very average leveraged loans. Prices have declined because the price of all debt has declined. We can see this if we compare it to ECC’s portfolio in Q4 2019.

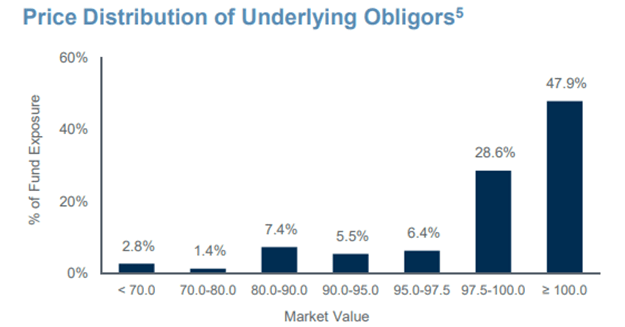

Eagle Point December 2019 Monthly Update

The “average” price for loans was higher at $96.49, but there was a greater risk with 4.2% of loans trading below $80. And this is a portfolio that went through COVID-19 with few defaults and had a full recovery.

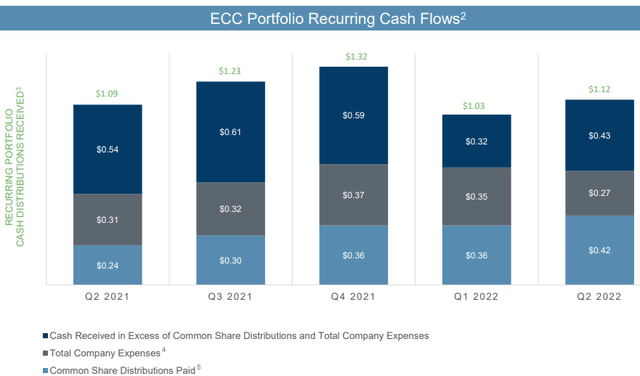

ECC is producing an immense amount of cash flow relative to NAV, with $1.12 in recurring cash flow last quarter. The $0.42 dividend was easily covered with plenty of excesses.

Q2 Update

What is ECC doing with that other $0.43 in extra cash flow that wasn’t paid out in dividends? Reinvesting in new CLO equity positions. ECC has been a net buyer of assets. Who benefits from low prices? Buyers!

This is why we don’t panic when ECC’s book value declines. This is not an indication of some great risk. It is primarily loans trading in the $90s because interest rates are rising and credit spreads are high. This means existing loans are cheaper. For ECC, that just means they might have the same “problem” they had before – their earnings might be “too high” and they will have to pay out more dividends.

Don’t worry, I’m happy to take those excess dividends off their hands!

ECC pays monthly – the next ex-div date is October 7th for $0.14 + a special distribution of $0.25, for a total of $0.39.

Dreamstime

Conclusion

Today we’ve looked at two good coffee picks. With ECC, we get monthly income. Something to enjoy every month, as steady as my morning coffee. With WPC, we get quarterly income, which continues to grow and climb over time. The next dividend hike is coming next quarter!

Retirement should be a time to relax and enjoy life. For many, kicking the day off with a cup of coffee is the starting point of a great day. Perhaps they’ll watch a beautiful sunrise while sipping their cup of coffee and plan out their day.

With reliable income from monthly and quarterly payers, you can plan out your life without wondering, “How will I afford this?”. Your answer is coming soon in the form of another dividend deposit.

Don’t trade this volatile market, as it could ruin your day by making you angry or, even worse, make you lose your hard-earned money.

Focus on financial freedom and gather cheap and solid dividend picks such as WPC and ECC to enjoy a happy and stress-free retirement! That way, every morning when you brew your cup of coffee, that dripping sound of freshly brewed goodness takes your mind back to those amazing dividends pouring into your account!

You can do it. I believe in you.

Oh, and save me a cup!

Be the first to comment