Chris Hondros/Getty Images News

Seeking Shelter

The weather outside is frightful, but at Goldman Sachs BDC (NYSE:GSBD) it’s delightful, since we have no place for cash to go, GSBD is the place to go.

It’s corny, I know, to take off an old Sinatra tune. Meantime, retail value investors can safely park their hoard of cash, in my opinion, collect a forward dividend yield (10.48%) that beats inflation, and rest easy weathering the financial storm. GSBD’s financial rating is stable. The share price is not volatile but slipped (-14.5%) over the past year. The shares have a BETA of 0.58, far below the market’s volatility. These factors make GSBD a potential opportunity for now. The DJIA is down 16.44% year-to-date. Seeking Alpha’s Quant “Hold” Rating leans promisingly to the “Buy” side. The Factor Grades are healthy, too:

Factor Grades

Source Seeking Alpha

A recent survey of managers at Bank of America Corporation (BAC) and their colleagues are frightfully bearish. Commentary about the survey being “extremely bearish” and “rate shock” coming scares the bejesus out of retail value investors. If “Fund managers are holding their highest levels of cash since the aftermath of September 11, 2001,” small investors are following suit. Inflation is gobbling savings at US banks that pay trifle returns on deposits and CDs.

The Company

GSBD invests in U S, developing, middle-size, private companies needing middle market and mezzanine financing to grow. GSBD holds secured debt of varying levels. Investments range between $25M and $75M each. At the end of March, the company reported earnings per share of $1.69, a net profit margin of 50.2%, and a debt-to-equity ratio of ~116%. Based on a price-to-earnings ratio, the stock is a fair value at 10.2xs compared to the capital markets industry average of +28xs.

On the downside, growth is sluggish. At $17.30 per share, we think the shares are a fair value. There are economic challenges facing the company. Management reported on May 5th that the total investment income for the quarter was $78.3M or 5.2% less Y/Y. We expect revenue in their investments to be down another couple of quarters but will not spin the share price into a dive. You can read in more detail about GSBD and get the buzz here.

There are positive signs of interest in GSBD. Hedge funds increased their holdings over the past year from a low of ~$333.1K in June ’21 to $482K ending May ’22. Quarterly earnings per share this year will be steady near to fifty cents. The second-quarter report is expected on August 3rd. The largest shareholder is the Goldman Sachs Group (GS) at 6.36% of the shares. By comparison, GS shares are -24.24% over the year and the GS dividend yield is currently less than 3%. The GS market cap is $94.2B while the GSBD market cap is $1.75B.

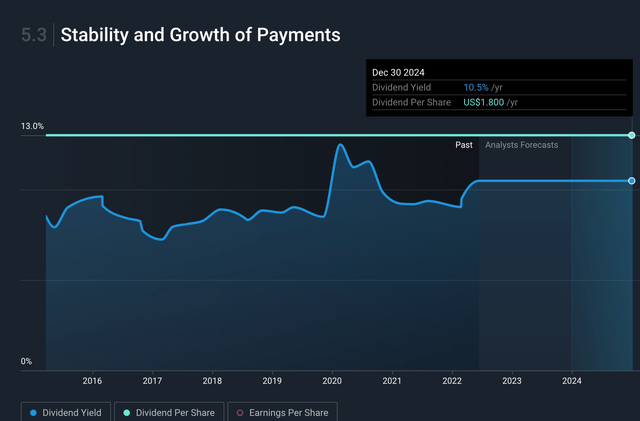

The dividend makes GSBD attractive. June 28th is the ex-dividend date. The payout ratio tops 72%. Except for February through August 2021 during the pandemic, GSBD has steadily paid a far better yield for years than the sector average of ~1.62%. GSBD’s dividend yield is in the top 25% of companies that any dividend.

Dividend Stability (Simply Wall Street)

Source Simply Wall Street

Investment Snapshot

GSBD invests in a lot of service companies. These include clinical research laboratories, security systems companies, many IT services and software developers, communications equipment firms, professional and financial services, and healthcare providers. It has holdings in building products suppliers like Senneca Holdings. They manufacture specialty doors and enclosures for commercial and industrial markets.

In anticipation of rising interest rates, GSBD management forecasts benefits to the company from investments in interest-earning assets.

Takeaway

We do not look at GSBD as an investment that will deliver much upside in the share price over the next 12 months. Potentially, the stock can move five or six percent into the low $18 range. We look at the stock as a safe investment. It is backed by a huge financial investment firm with which GSBD shares an investment platform. That gives GSBD staff a wider range of investment opportunities. Retail value investors can shelter cash and get an excellent return until the stock market turns.

Be the first to comment