Chris Hondros

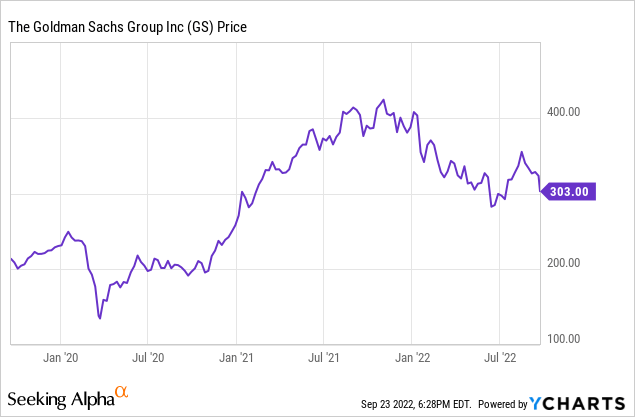

Investment banking giant Goldman Sachs (NYSE:GS) has had an eventful couple of years. The stock doubled not that long ago thanks to sharply improved profits in 2021. Since then, however, the stock has slipped back to near 52-week lows as the near-term profit outlook has dimmed amid a weakening economy:

There’s little doubt that Goldman Sachs will face a more challenging operating environment in coming quarters. However, my view is that traders are fretting the near-term swings too much. Instead, I’d urge investors to think about valuing Goldman Sachs based on its book value rather than quarterly earnings.

GS Stock: My Favorite Chart

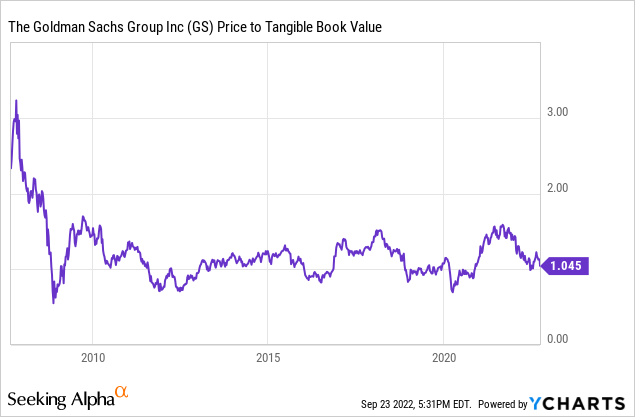

My preferred way to look at GS stock is through price-to-tangible book value (P/TBV). This measures a bank’s valuation compared to the net asset value of its balance sheet. Bank profitability is driven by its balance sheet and the level of income it can earn on those assets, so book value ends up being a key piece of a bank’s long-term value proposition.

Here is how GS’ ratio has evolved over time:

Prior to the financial crisis, Goldman Sachs used to trade at two and even three times tangible book value. This made sense as Goldman consistently and rapidly increased its tangible book value regardless of short-term economic conditions or earnings.

Subsequent to the 2008 financial crisis, however, GS stock plunged to a low 1s P/TBV ratio and has subsequently spent the last decade just plodding along right around 1.0x tangible book plus or minus a small range.

I was aggressively buying GS stock back in 2019 when shares were at the 1.0x P/TBV ratio, arguing that was much too cheap for such a high-quality bank with consistently strong profitability and operational metrics. At the time of my purchase, I hoped GS might rally toward 2x P/TBV in a better interest rate environment and with more positive sentiment for the banking sector.

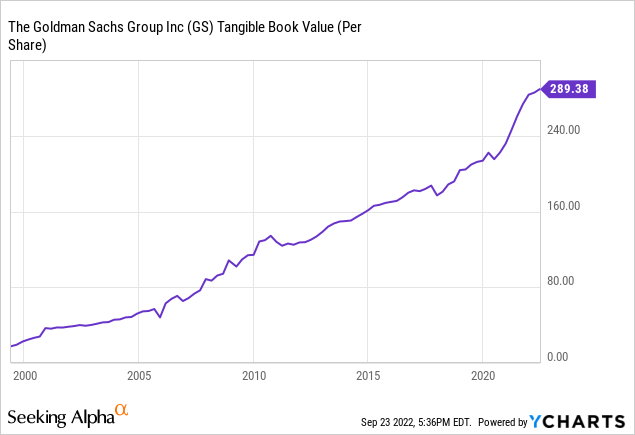

This was partially playing out; GS stock got up to a 50% premium to tangible book last year. Now, however, it’s right back to 1.0x once again. The investment has not been bad by any means, however. That’s because, regardless of what the economy is doing, GS stock continues to grow its tangible book value at a jaw-dropping clip:

In 2019, I was buying the stock around $200 with tangible book at $200. Now the valuation ratio is the same, but the stock price and book value have advanced to $300. Such is the way things go when owning a classic compounding operation such as thing one. Backing up a bit, I’d note that GS’ book value continued to rise steadily even in 2008 and 2009 when the rest of the financial sector was melting down. Goldman Sachs has a reputation for being the nation’s most shrewd investment bank and there’s a good reason why.

Rising Book Value, Dividend & Multiple Expansion

Even if Goldman Sachs’ stock price merely tracked its tangible book value, it’d be a tremendous investment, as its tangible book is up from less than $40/share at the turn of the century to $290 today.

But there’s more to it than just the steady increase in its balance sheet. For one thing, the company offers a reasonable dividend. Following aggressive hikes in recent years, GS stock now pays out $10/share in annual dividends which works out to a solid 3.2% yield following the sell-off in the stock price. Throw in a starting 3% dividend yield on top of nearly double-digit annualized TBV growth, and things are cooking.

Then there’s the multiple. As pointed out, in recent years, GS stock has tended to hug the 1.0x P/TBV level. However, it did hit 1.5x in 2021 and consistently was above 2x prior to the financial crisis. A 1.5x T/PBV would put the stock at nearly $450 today, and a 2x multiple would lift it to $579.

I’m not the only one thinking GS stock is worth more than $400 per share. Morningstar’s Michael Wong just raised his price target for GS stock up to $438 per share in July of this year. Wong shares my thinking, writing:

“We think the firm should trade at 1.5 to 1.6 times tangible book value.”

Wong attributes this higher valuation multiple to the bank’s larger and more profitable investment management operation, a growing revenue stream from the consumer business, and improved expense control among other factors.

Goldman Sachs’ Profitability

The issue with measuring the too-big-to-fail banks on short-term earnings is that there are a ton of moving parts that make up the calculations. You have things like loan loss reserves, mark-to-market accounting, and so on which can greatly influence profitability over a three month over even yearlong period.

Goldman Sachs currently looks exceptionally profitable on a trailing basis, and a lot of people have made bull theses for the stock based on its single-digit P/E ratio. They aren’t wrong, exactly, but the thinking is incomplete.

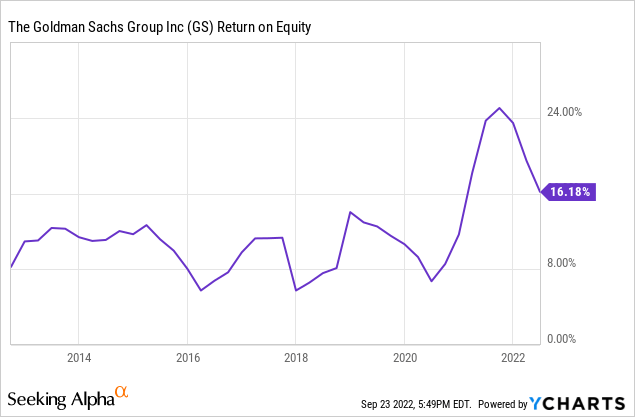

To zoom out, let’s consider Goldman’s return on equity “ROE” over the past decade:

ROE is a bank’s profitability on its book value assets — essentially how much profit it can wring out of every dollar of equity it is putting to work. Over time, a bank’s returns are driven by how much capital it is using and how profitable it can deploy said capital. As we’ve seen above, Goldman Sachs has grown its book value incredibly quickly. Now let’s look at the return on equity side.

Over the past decade, ROE has been very stable, almost always being in the 8-12% range. This is pretty good for a large U.S. bank in a low interest rate environment. An 8% ROE would be considered fairly average, and a 12% reading is quite good though not best in class by any means.

Since 2020, however, Goldman’s ROE blasted off to stratospheric levels. This explains the massive earnings and very low P/E ratio. Goldman was suddenly able to get as much as twice as much return out of every dollar it was putting to work.

This period of excess earnings appears to be winding down, however. The torrid pace of activity in investment banking areas such as IPOs and M&A is slowing down. Asset management fees fall as markets decline in value. More deals go bad, leading to banks taking losses in the course of doing business. Now Goldman is reportedly laying off workers as it hunkers down for a less prosperous business environment.

But, this is all normal cyclical stuff. Short-term profits go up and they recede. The difference here is institutional. Goldman has superior risk management and capital allocation, and thus is able to avoid losses and even continue making money during dismal market conditions such as 2008.

While earnings and ROE go up and down from time to time, the bank’s tangible book value has steadily climbed in virtually all market conditions. And with P/TBV back at a trough level, downside is limited from the current entry point. Meanwhile, it’s not at all hard to imagine a big pick-up in sentiment for the banking sector and GS stock in particular as soon as the Fed pivots and capital starts flowing a little more freely.

I expect Goldman will be able to normalize its ROE at or above 12% once we enter a more normal set of economic conditions and this should support a significantly higher valuation than we’re at today.

Long story short, I expect GS stock to top its prior all-time high of $426 per share over the next 12-24 months. And, thanks to its recent dividend increases, Goldman is now a surprisingly strong income option as well with a healthy 3.2% yield on offer today.

Be the first to comment