Adriana Romanova

Thesis

Leading dry bulk players have come under significant pressure over the past two months as the market turned its attention to worsening macroeconomic headwinds and falling commodity prices.

Golden Ocean Group (NASDAQ:GOGL) stock has also been battered, as it collapsed more than 40% from its June highs to its July lows. However, the pace and extent of the sell-off have also created a sustained bottom that we believe GOGL should hold resiliently.

Furthermore, Golden Ocean telegraphed in its Q1 commentary that the company should see a marked improvement in H2 after a record 2021 performance.

Our internal valuation analysis indicates that GOGL’s valuation is reasonable, coupled with its attractive dividend yield. Our price action analysis suggests that GOGL is likely at a medium-term bottom and has been gathering buying momentum to resume its upward cadence.

Accordingly, we rate GOGL as a Buy.

The Battering In GOGL Is Justified

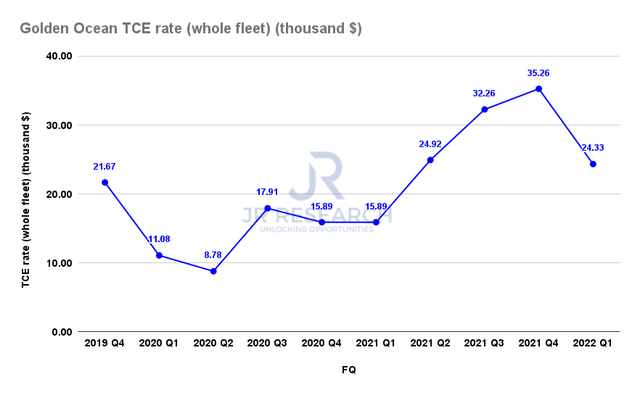

Golden Ocean TCE rates (Company filings)

Global freight rates have collapsed since notching their highs in 2021. As a result, Golden Ocean also saw its whole fleet TCE rates fall markedly in Q1 to $24.33, down from $35.26 in Q4’21.

However, the company also reminded investors in its Q1 earnings commentary in May 2022 that it expects better performance in Q2 and H2’22, with freight rates expected to remain robust. Management articulated:

The Company’s estimated TCE rates for the second quarter of 2022 are $28,300 per day for 78% of available days for Capesize vessels and $27,500 per day for 77% of available days for Panamax vessels. The Company has continued to opportunistically secure charter coverage at highly profitable rates. For the third quarter of 2022, the Company has secured 15% of total days at an average rate of $38,200 per day for Capesize vessels and 33% of total days for Panamax vessels at an average rate of $34,900 per day. (Golden Ocean FQ1’22 earnings commentary)

Notwithstanding, the market reaction in June demonstrated that the market was concerned that the dry bulk leaders, including Golden Ocean, may underperform. The market has turned its focus on the worsening macroeconomic environment, spurring further demand destruction. Also, falling commodity prices in Q2 have impacted market sentiments further.

In addition, Bloomberg reported in mid-July that the supply chain imbalance had eased further, potentially putting further pressure on shipping demand. Citi emphasized:

Pressures in the global goods sectors, which have been a central driver of inflation, may finally be easing. The bad news is that this looks to be occurring on the back of a slowing in the global consumer’s demand for goods, especially discretionary goods, and thus may also signal rising recession risks. – Bloomberg

Accordingly, we believe the market has de-risked GOGL in June to account for these challenges. As a result, investors need to pay attention to management’s commentary in its Q2 earnings call on August 31 for any potential revision to its guidance.

But GOGL’s Valuation Is Attractive Again

| Stock | GOGL |

| Current market cap | $2.17B |

| Blended hurdle rate [CAGR], including dividends | 11% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 13% |

| Assumed TTM FCF margin in CQ4’26 | 40% |

| Implied TTM revenue by CQ4’26 | $620M |

GOGL reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a market-perform hurdle rate of 11% (including dividends) to model whether GOGL can perform in line with the market at its current valuation.

We also used relatively reasonable parameters (below the Street’s consensus) to assume an appropriate margin of safety. We believe GOGL’s robust free cash flow profitability should undergird its ability to continue its strong dividend policy through CQ4’26, underpinning its valuation.

As a result, we are confident that GOGL should be able to outperform the market at the current levels.

GOGL’s Price Action Is Constructive

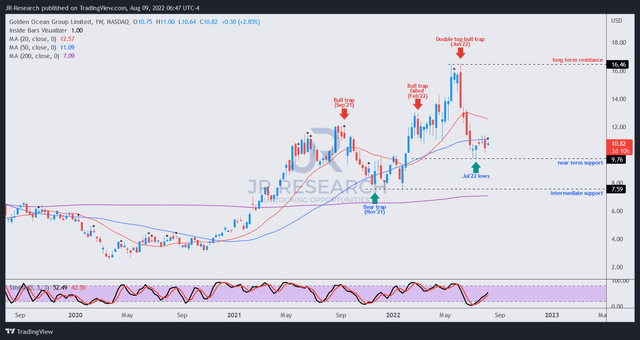

GOGL price chart (weekly) (TradingView)

As seen above, GOGL formed its medium-term bottom in July after falling 40% from its June highs. We are also confident that its near-term support seems robust, which should help drive buying momentum.

We also noted that GOGL remains in the buy zone, allowing investors to add more positions at the current level.

Is GOGL Stock A Buy, Sell, Or Hold?

We rate GOGL as a Buy.

We noted that GOGL’s steep sell-off in June has likely de-risked the expectations for its upcoming Q2 earnings release. Our valuation analysis indicates that GOGL is attractive at the current levels. Coupled with constructive price action, we urge investors to use the buy zone to add more positions.

Be the first to comment