Gold Price Talking Points

The price of gold struggles to extend the series of lower highs and lows from the previous week as the Federal Reserve delivers another emergency rate cut, and the precious metal may consolidate over the coming days as the global community of central banks stand ready to deploy unconventional tools to combat the coronavirus.

Gold Price Consolidates as RBNZ, FOMC Implement Emergency Rate Cut

The recent pullback in the price of gold appears to be sputtering as the Federal Open Market Committee (FOMC) implements a zero-interest rate policy (ZIRP), with the central bank planning to boost its holding of Treasury securities and mortgage-backed securities (MBS) in order to “support the smooth functioning of markets.”

The announcement comes after the Reserve Bank of New Zealand (RBNZ) delivers an emergency rate cut and reduces the official cash rate (OCR) by 75bp to a record-low of 0.25%, with Governor Adrian Orr and Co. indicating that a “Large Scale Asset Purchases of New Zealand Government bonds were the next best monetary tool available to the Committee.”

It remains to be seen if the efforts will cushion the world economy from the shock to the global supply chain, and it seems as though major central banks will deploy unconventional tools to combat the coronavirus amid the weakening outlook for growth.

With that said, the price of gold may continue to benefit from the low interest environment as market participants look for an alternative to fiat-currencies, and the broader outlook for bullion remains constructive as the reaction to the former-resistance zone around $1450 (38.2% retracement) to $1452 (100% expansion) helped to rule out the threat of a Head-and-Shoulders formation.

Recommended by David Song

Download the 1Q 2020 Forecast for Gold

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

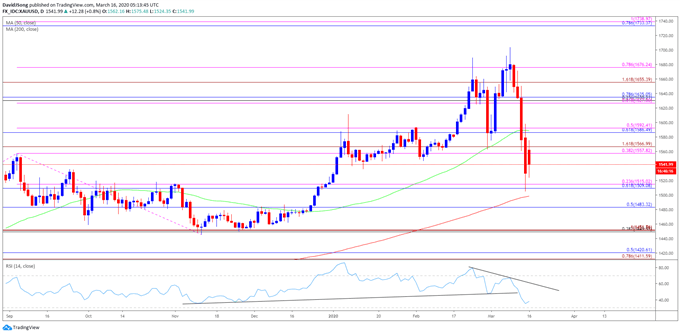

Gold Price Daily Chart

Source: Trading View

- The opening range for 2020 instilled a constructive outlook for the price of gold as the precious metal cleared the 2019 high ($1557), with the Relative Strength Index (RSI) pushing into overbought territory during the same period.

- A similar scenario materialized in February, with the price of gold marking the monthly low ($1548) during the first full week, while the RSI broke out of the bearish formation from earlier this year to push back into overbought territory.

- However, the price of gold has failed to maintain the monthly opening range for March after trading to a fresh yearly high ($1704), with the Relative Strength Index (RSI) signaling a potential change in gold price behavior as the oscillator deviates with price and snaps the upward trend carried over from last year.

- In turn, the price of gold may continue to consolidate over the coming days, but a break/close below the $1558 (38.2% expansion) to $1567 (161.8% expansion) region may open up the Fibonacci overlap around $1509 (61.8% retracement) to $1515 (23.6% expansion).

Recommended by David Song

Traits of Successful Traders

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment