General Summary of Analyst Day

AMD (NASDAQ:AMD) held its financial analyst day on Thursday, March 5. The company’s executives provided the analysts with a general idea of where the company is going:

- new financial model

- product roadmap

- RDNA vs. CDNA

AMD unveiled its new four-year financial model, gave analysts some more depth on the company’s future product roadmap, and did a deep dive on its new GPU architectures, RDNA and CDNA.

Lisa Su – CEO – Building The Best, 3:30-34:10

AMD kicked off its 2020 Financial Analyst Day with CEO Lisa Su taking the stage. First, Lisa started with the company’s overall focus long-term. Lisa shows analysts the company’s long-term strategy in all of its end markets: graphics, compute, and general solutions (pulling CPU and GPU together):

(Source: AMD)

Then she moves on to focus on where AMD is headed long term with its roadmap, process node, and chiplet designs.

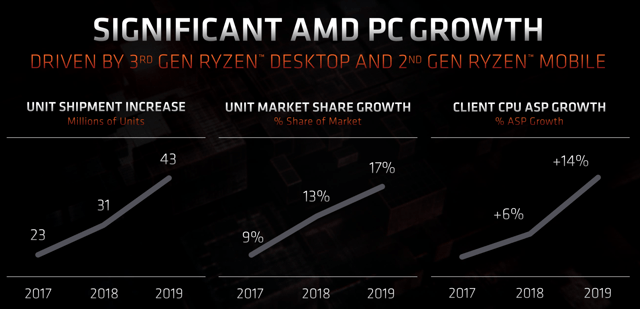

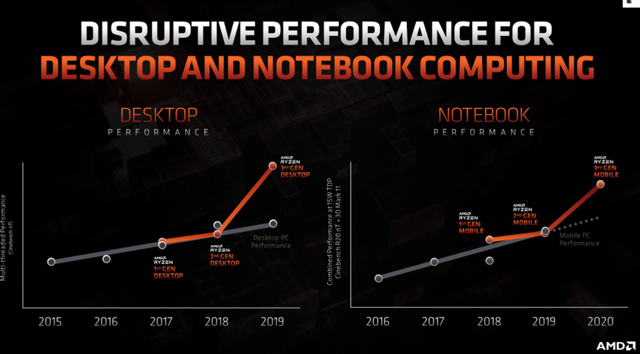

Starting with AMD’s CPU roadmap, Lisa pulls up a really interesting chart that demonstrates just how well AMD is doing in CPUs. With first and second generation Ryzen processors, AMD re-asserted itself as a competitive offering in the market, rather than the laughingstock it had been in years previous (think back to the Bulldozer architecture). Since then, AMD has become the leader at the high-end of the desktop and notebook markets. This is important, because being a high-end leader means higher ASPs, and higher gross margins.

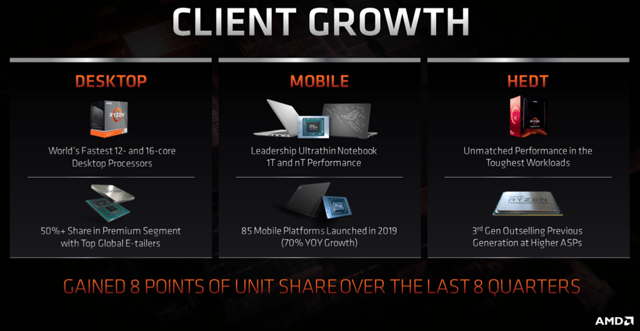

This explosive growth in performance is translating into solid expansion in AMD’s market share across notebook, desktop, and HEDT. This performance upgrade from AMD is real.

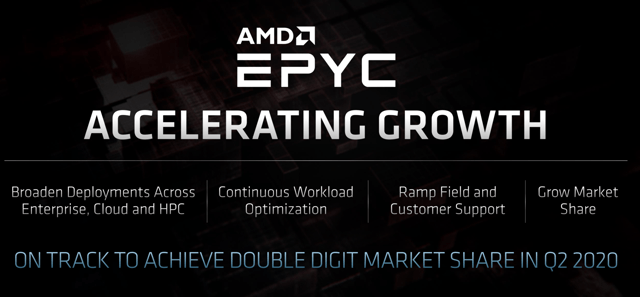

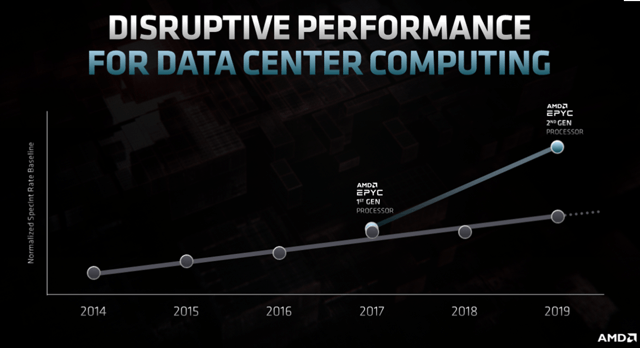

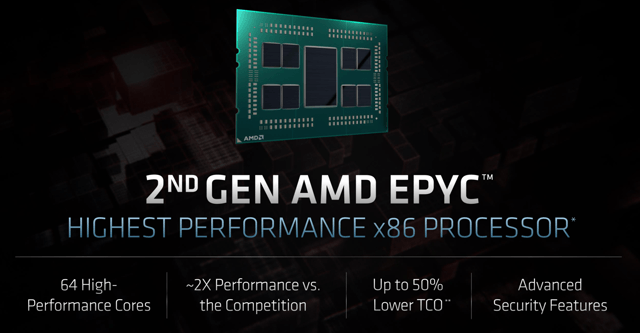

AMD is noticing a similar trend in the datacenter. EPYC was initially competitive, but EPYC 2, aka Rome has set the bar in terms of overall performance in the datacenter market.

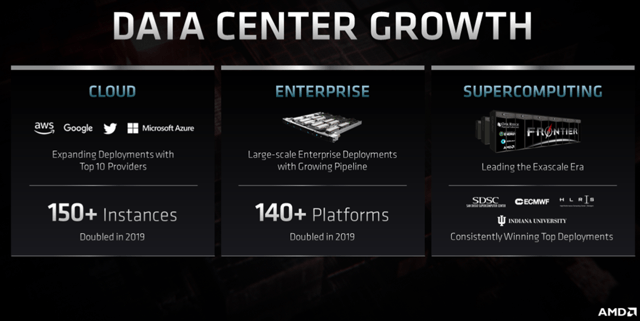

And it’s paying off:

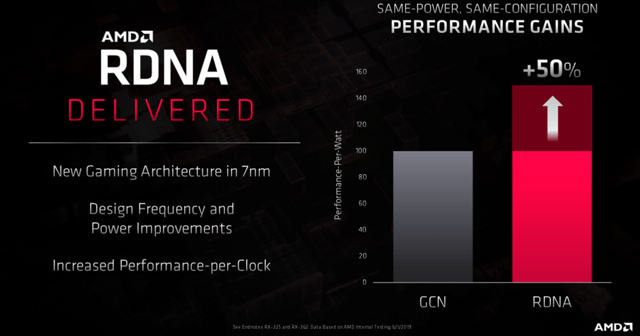

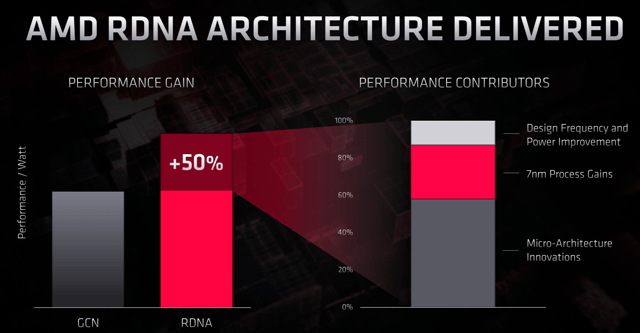

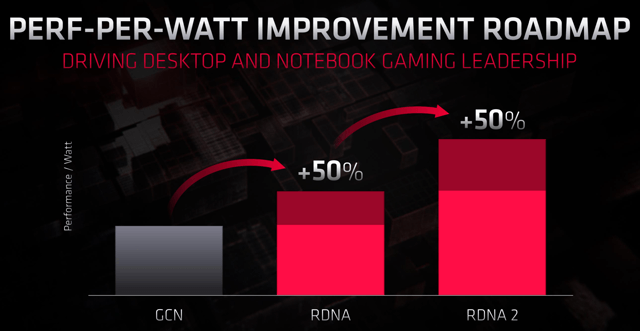

Then, Lisa began to talk about AMD’s graphics business. GPU is a big talking point at the event, and Dr. Su gives us a little taste of what’s to come. First off, AMD’s RDNA architecture has been much better performing than its previous GCN architecture.

(Source: AMD)

(Source: AMD)

So while AMD hasn’t quite bridged the performance gap with Nvidia (NASDAQ:NVDA), AMD is making in-house improvements that are bolstering clock speeds and overall performance.

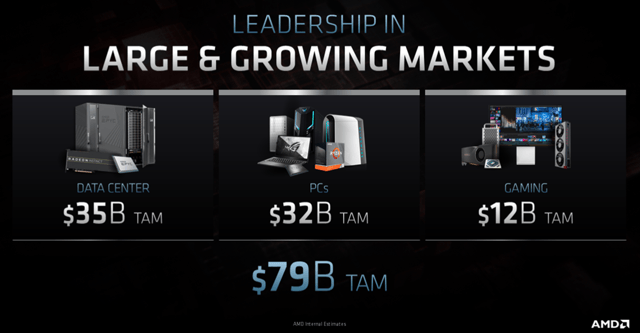

At around the 20-minute mark, Lisa transitions away from talking about AMD’s track record, and begins to talk about the future. Specifically, Lisa gives us an updated TAM (total addressable market) figure for gaming, PCs, and datacenter. Keep these numbers in mind when I am discussing my price target later on. These TAM numbers are 2023 numbers, not current day numbers.

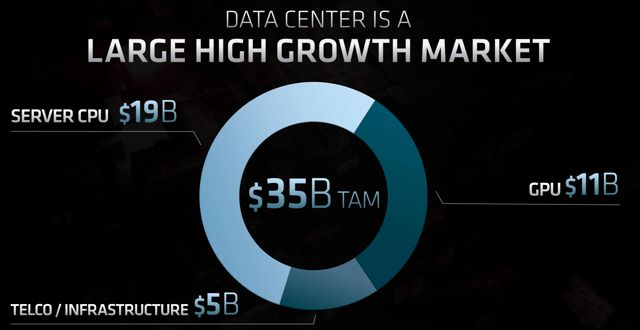

Dr. Su says that this datacenter market is a combination of CPU, GPU, and telco/infrastructure.

Then Dr. Su addresses AMD’s PC market, the second-largest market here. This includes DIY, pre-built desktops, and notebooks. Dr. Su mentions that this is not necessarily a growing market, but it is a large market. So growth from this business segment will likely be zero-sum, with AMD’s market share gains coming at Intel’s (NASDAQ:INTC) loss. Because the overall market is likely flat, this will likely make revenue and market share dynamics a little more challenging long term.

Dr. Su also says that gaming consists of both consoles and overall discrete graphics cards.

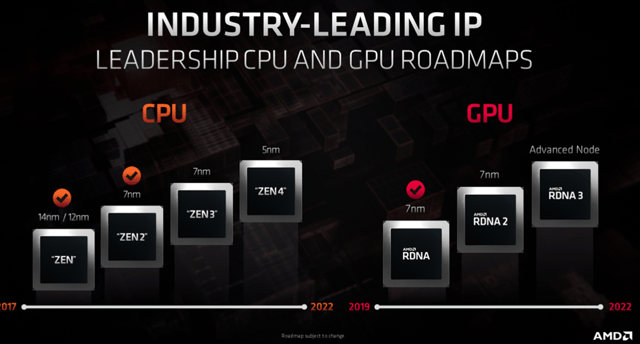

Then Lisa gives us a look at AMD’s product roadmap in both CPUs and GPUs.

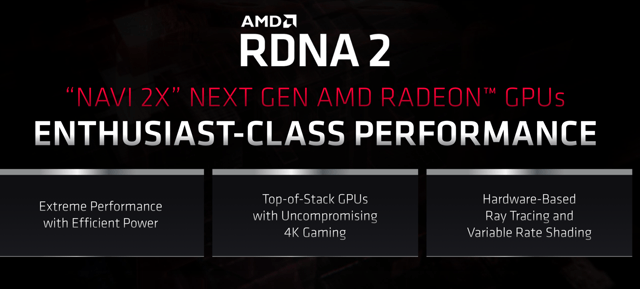

Judging by the timeline, it looks like RDNA 2 will debut sometime in late calendar 2020, around the same time as Xbox Series X and PlayStation 5 should begin sales. Later on, AMD says these consoles will use RDNA 2 architecture. This could also be the architecture that AMD launches its high-end “Big Navi” graphics card on. Right now, it appears as if AMD’s cards are only competitive with Nvidia’s mid-range cards, forfeiting the high ASP, high margin part of the market to Nvidia.

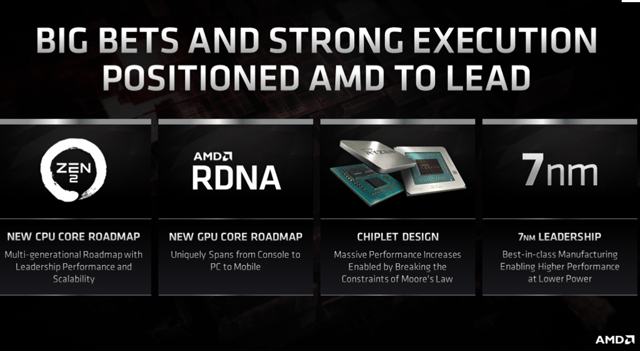

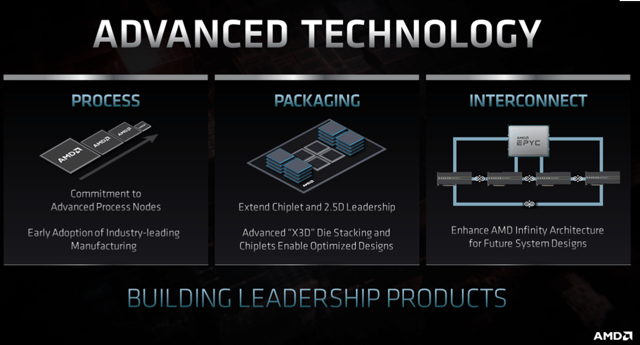

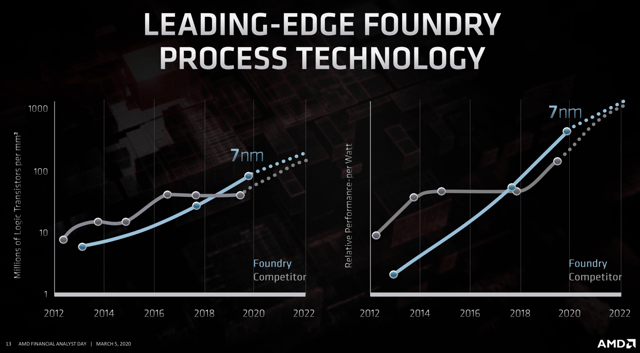

The focus then turns to advanced technologies, AMD’s way of improving performance in the future. Again, the relevant executives speak in more depth on this later in the analyst day. Dr. Su just gives us a general idea about what management is thinking here. AMD is committed to shrinking the node it manufactures on. On this slide, it also says “early adoption of industry-leading manufacturing.” Could this signal that AMD is an early adopter of the exciting EUV technology for semiconductor manufacturing? One can only speculate.

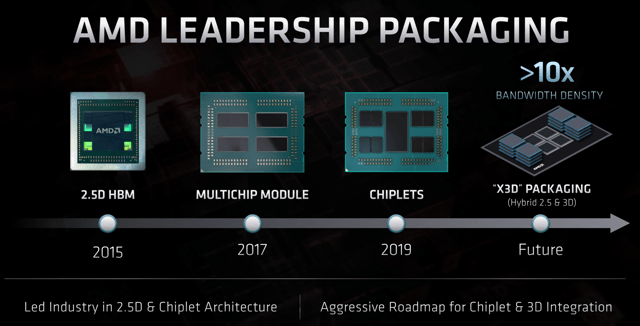

In addition, AMD is committed to extending development of its chiplet technology. Chiplets are an integral part of the future of x86 CPUs, and continued innovation could help grow performance. In addition, AMD is working on interconnect solutions, making it easier and more streamlined to integrate hardware together to make your system run.

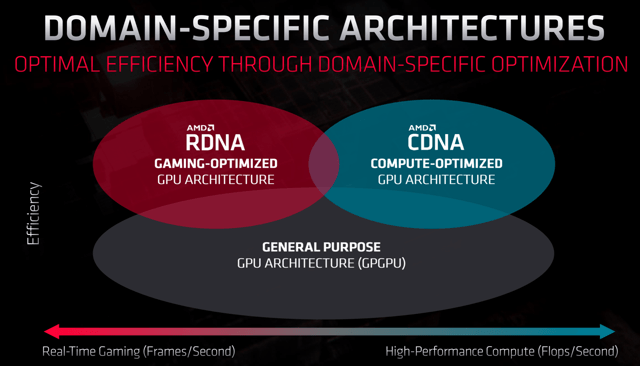

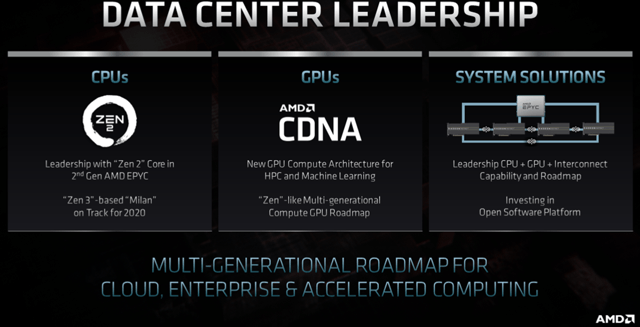

AMD then updates investors with its datacenter roadmap. This is extremely important, as datacenter is likely the big long-term growth driver for AMD going forward. AMD’s Zen 2 products for datacenter, aka EPYC Rome have now differentiated themselves as the performance leaders in the datacenter. AMD will launch its Zen 3 server platform sometime later this year, and plans to continue to lead the datacenter market going forward. On top of AMD’s plans in the CPU market, AMD has designed a whole new architecture for GPU compute. In the past, AMD has shared the underlying architecture between its discrete graphics cards, and its datacenter specific products. However, in order to optimize the architecture specific for machine learning/deep learning tasks, AMD has designed a new ground-up architecture, CDNA. Expect GPUs built on CDNA to be higher performance than GPUs built on the previous “shared” GCN architecture. Again, management goes into more specifics later on.

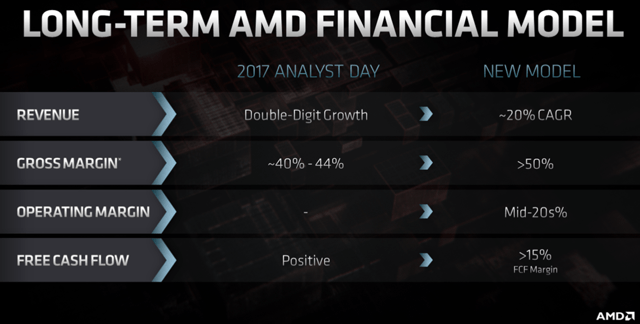

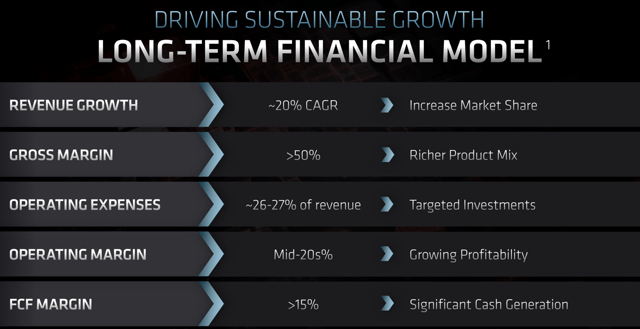

And finally, after all of this roadmap talk, Dr. Su finally gives us what many were looking for: AMD’s new long-term financial model.

Basically, AMD is implying a reaccelerating top-line growth story. In addition, this model shows strong gross margin expansion. This is likely due to AMD expanding into higher performance, higher ASP products. While this isn’t as high as Nvidia and Intel’s 60%+ margin levels, this is still strong considering AMD’s weak history. In addition, management is targeting a doubling in operating margin to the mid-20% area, and to be significantly cash-generative in years ahead.

Mark Papermaster – CTO – Future of High Performance – 34:53 – 1:05:06

The majority of the beginning of Mark’s presentation is focused on technological investments AMD made years ago that are coming to fruition now. This includes AMD’s investment in expanding its 7nm technology, as all of AMD’s platforms now have 7nm-based products.

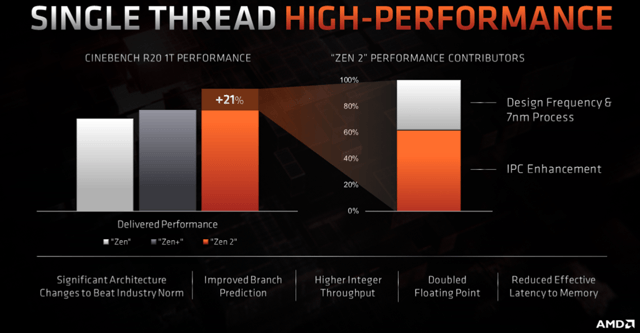

Immediately afterwards, Papermaster pivoted to focus on AMD’s ever-improving single thread performance. This has been a common critique of AMD processors over the years. Single core and single thread speeds have been a key marketing point for Intel, and rightly so. But now, AMD is taking on Intel effectively in this benchmark, with single thread performance improving drastically as AMD launches new generations of CPUs. In addition, it appears as if the performance upgrades in AMD processors has accelerated from Zen+ to Zen 2 versus Zen to Zen+.

(Source: AMD)

(Source: AMD)

AMD also plans on launching Zen 3 later this year. I would expect this to be a more incremental improvement versus Zen 2. Kind of like how Zen+ was an incremental improvement over Zen. This is mostly because we aren’t getting any kind of generation-to-generation node improvements.

Here is the juiciest slide in the presentation. For years now, AMD’s manufacturing partners, whether it be GlobalFoundries or TSMC (NYSE:TSM), have been lagging behind Intel’s process technology. It now appears, however, that TSMC’s process technology has not only closed the gap against Intel, but is now in the lead.

Next, Papermaster talks about AMD’s improving X3D connectivity architecture that will combine the positives of HBM 2.5D and the company’s chiplet approach that has been implemented in previous Zen 2-based processors.

This is yet another area where AMD can improve the performance of its CPUs relative to Intel. This basically sums up the entirety of Mark Papermaster’s presentation.

David Wang – SVP Engineering, Radeon Technologies – Driving GPU Leadership – 1:05:00 – 1:23:00

Mr. Wang starts off the presentation focused on AMD’s strategy when it comes to GPUs.

The most interesting subject here is AMD’s domain-specific architecture. This leads right into AMD’s announcement of its CDNA architecture. AMD is optimizing its architecture for the task at hand. For RDNA, the hardware is optimized around delivering the best frame rate possible for gamers. The other side, CDNA is designed for the most FLOPS/second (computational power). This distinction is important, as AMD used to share the architecture between compute and gaming GPUs, the GCN architecture. Creating a task-specific architecture for AMD’s GPU solutions allows AMD to customize products for specific tasks, and remove features for other tasks that slow down performance.

(Source: AMD)

(Source: AMD)

As we can see, moving away from the cookie-cutter GCN architecture and moving towards a gaming-optimized architecture like RDNA have proven to increase the performance of AMD’s GPUs.

The bulk of AMD’s performance improvement comes from these micr-architecture innovations and hardware optimization.

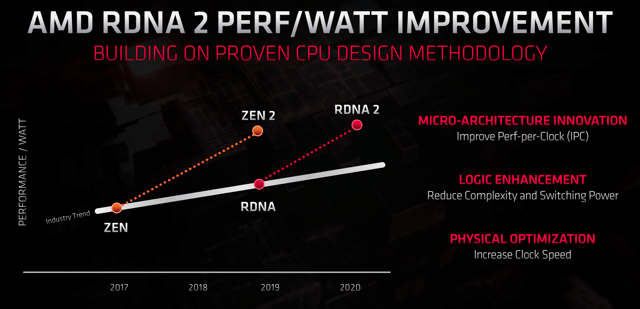

As exciting as RDNA has been for gamers, AMD has even more in the works on the 7nm node, with AMD’s RDNA 2 architecture. Notably, RDNA 2 will support ray tracing, a key differentiating factor that has led to Nvidia’s dominance in the high-end GPU market since the launch of Nvidia’s RTX lineup. As a matter of fact, AMD sees extremely strong performance growth from RDNA to RDNA 2, similar to Zen to Zen 2’s growth.

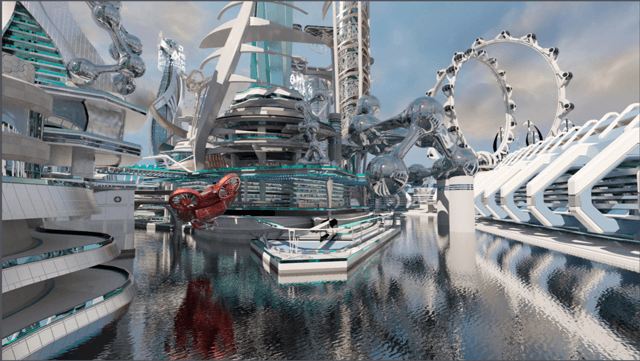

If this is true, then AMD might now be finally competitive with Nvidia’s offerings. That being said, Nvidia is yet to release its RTX 30 Series Ampere lineup. That release could blow AMD’s RDNA 2 out of the water. And considering that Nvidia has been the GPU king for years, catching up will be no easy task. Here is an example of ray-tracing on RDNA 2:

In addition, RDNA 2 will be the main graphics platform for the new-generation gaming consoles. The focus of the presentation then moves to CDNA.

David describes AMD’s new approach to datacenter GPU compute. Again, it is branching off the GCN architecture to CDNA in its next-generation offerings. CDNA is broken out a little more when AMD talks about datacenter later in the presentation.

Rick Bergman – EVP Computing & Graphics Business Group – Driving Growth Across PCs and Gaming – 1:23:25-1:46:57

The first important thing to look at here is AMD’s market share, unit, and ASP trend.

(Source: AMD)

(Source: AMD)

AMD has seen significant progress in units, market share, and now, an accelerating ASP trend as AMD moves into the high end of the market.

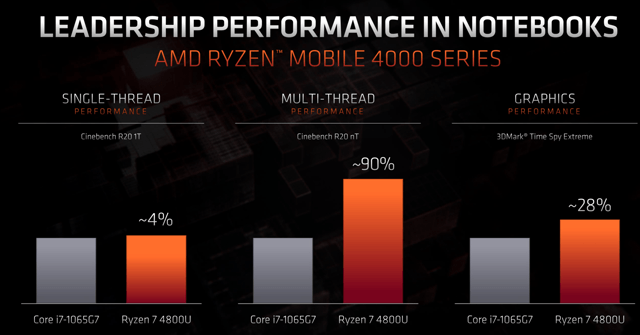

Next, we get a pretty interesting comment from Rick on notebooks. He says, referring to the $32 billion PC TAM, that 64% of TAM is notebook-related. And AMD is beginning to deliver high-performance, quality notebook products with its Ryzen 4000 mobile series of processors.

Just like desktop before it, AMD is now establishing itself as the leader in single-thread performance. As you can see, AMD absolutely dominates the combination in multi-thread tasks and graphics, but conquering single-thread asserts AMD’s dominance in the notebook market.

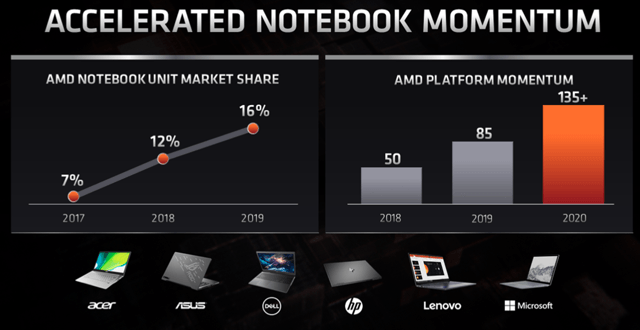

Here are AMD’s notebook figures, before Ryzen Mobile 4000 series. AMD has been on a trajectory of expanding sales and market share in notebooks, before its watershed 3rd Gen Ryzen.

Again keep in mind that these market share numbers are trending higher before this Ryzen 4000 series. While AMD added 35 platforms in 2019, it is looking to add an additional 50+ in 2020.

Mr. Bergman speaks a little about the commercial side of things, and transitions to talking about graphics.

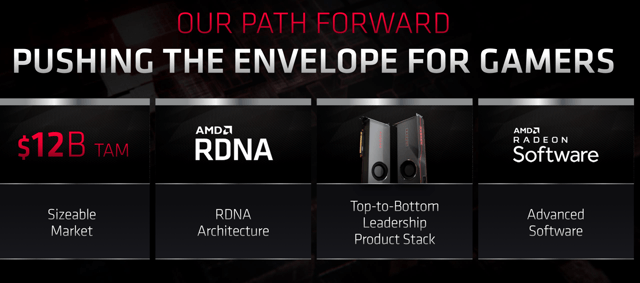

AMD’s RDNA architecture will allow AMD to deliver product solutions at the top and bottom of the product stack, in the high and low ends of the market. This will allow AMD to capitalize on the $12 billion gaming TAM. However, AMD has a solid platform for 1080p and 1440p solutions, competitive with Nvidia’s performance offerings. But 4K gaming has been Nvidia’s arena. AMD’s RDNA 2 plans to change some of that. RDNA 2 will be the architecture AMD implements in its high performance offerings.

AMD is well-positioned in PCs and gaming over the coming years.

Forrest Norrod – SVP Data Center & Embedded Business Group – Data Center Leadership – 2:08:16-2:39:46

Forrest starts his presentation with a look at the market. As Lisa mentioned earlier, AMD’s datacenter TAM estimate is $35 billion, of which is $19 billion in CPU, $11 billion in GPU, and $5 billion in telco/infrastructure equipment. Since AMD doesn’t really play in telco, this TAM should be closer to $30 billion.

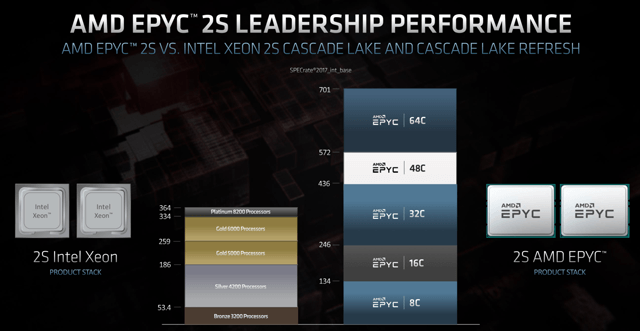

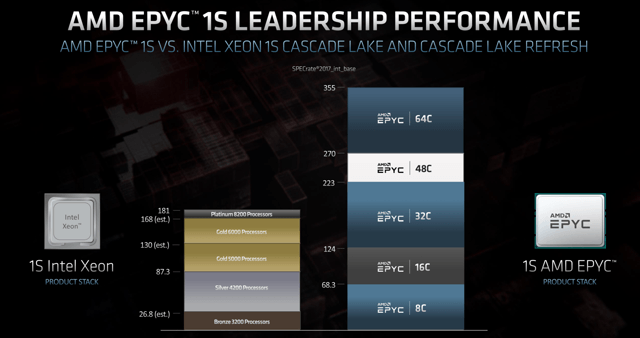

Forrest then goes on to establish that AMD’s EPYC server processor is the highest performing server x86 processor, ever. This has enabled a great decline in total cost of ownership on the data center side.

Here, AMD proves it:

AMD now has a single socket and dual socket lead on Intel’s current Cascade Lake and Cascade Lake Refresh processors, and a big one at that.

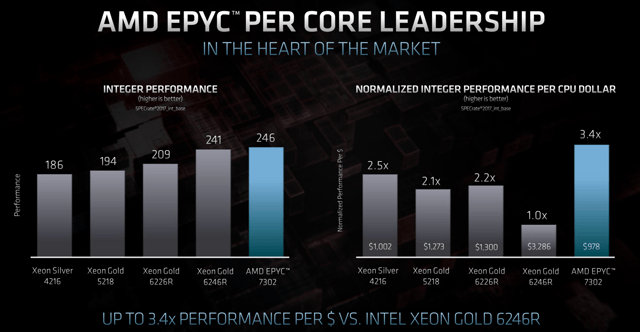

And not only does AMD have the highest performance processor on the market, it also has the best chip on the market on a price/performance basis. It isn’t even close to be quite honest.

Now you can understand why AMD is such a disruptive force in the server market. Not only does it have high-performance offerings, those higher-performance offerings are “cheap” on price/performance basis. So, no wonder AMD anticipates double-digit market share in server CPUs by Q2.

(Source: AMD)

(Source: AMD)

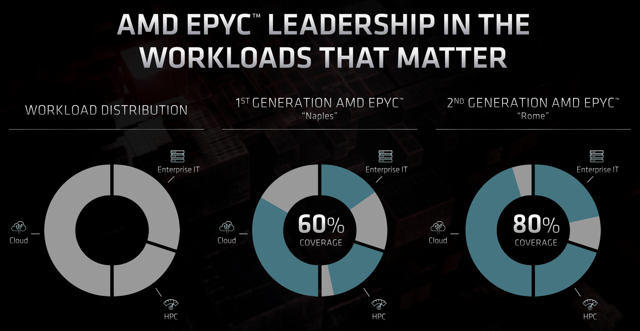

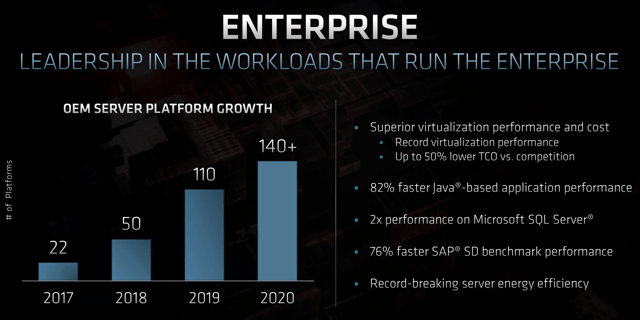

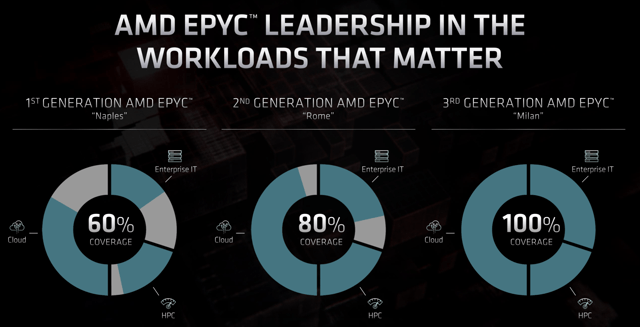

AMD with each iteration of EPYC server processors has been getting better and better in terms of leadership in different server workloads.

As AMD’s coverage of these workloads increases, so has the number of total OEM server platforms.

AMD is also doing quite well in the high performance computing segment of the datacenter business. The company continues to see solid expansion and cut new deals with supercomputers, most recently El Capitan. The sheer number of supercomputing contracts that AMD has won, including the recent El Capitan victory, shows AMD is pulling in the high end performance market.

Then, finally, we see what AMD is looking at when it comes to this telco/infrastructure opportunity that $5 billion worth of the TAM. In a partnership with Nokia, AMD demonstrated more than double the performance of competitive CPUs in 5G.

Now, AMD looks to the future, 3rd Gen AMD EPYC, also known as Milan. Milan is set to launch later this year. In addition, AMD Milan should be capable of operating on all workloads, and improvement from Rome that should drive continued market share gains.

Expansion of workload coverage will enable greater use cases for AMD high performance chips, and should mean greater deployment. Milan will be the second consecutive generation of AMD’s 7nm based server technology, so it will not get a boost related to an upgraded process node. That being said, performance and use cases should improve, enabling market share expansion.

Forrest then moves to datacenter GPUs. The gist of his presentation surrounded AMD’s ability to develop AMD EPYC CPUs and CDNA based GPUs for optimized performance. As AMD releases products for its CDNA architecture, I can see the company grabbing share from Nvidia in the datacenter market.

Devinder Kumar – CFO – Sustainable Growth – 2:40:06-2:53:33

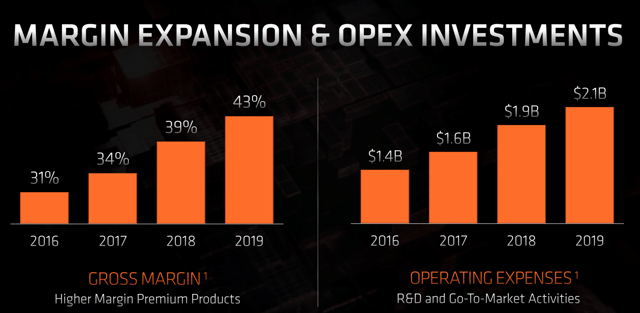

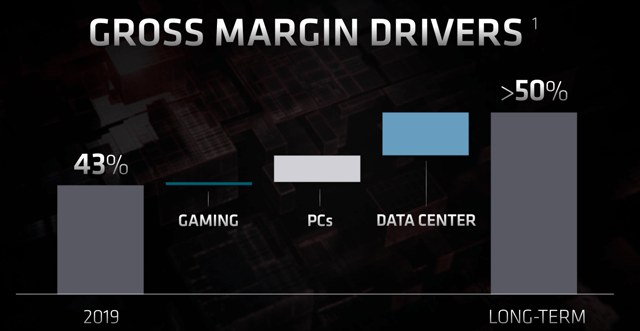

First off, we get a chart showing AMD’s margin trend.

(Source: AMD)

(Source: AMD)

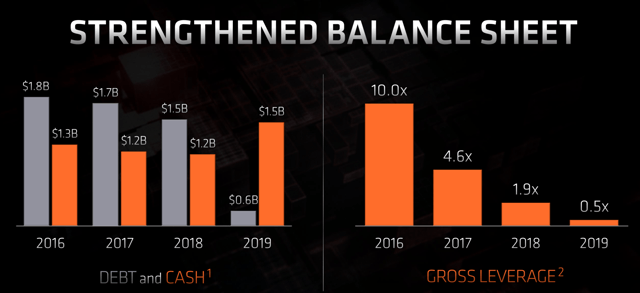

In the last four years, AMD has seen gross margins scale by a grand total of 12%, while OpEx maintains a fairly steady ramp-up. If you extrapolate this gross margin trend over the last couple of years to the next three years, then gross margins could hit 55%. In addition to strong margin trends over the last few years, AMD has completely de-risked the balance sheet.

2019 was the first year that AMD moved to a net cash positive position, a strength that allows the company to devote financial resources to growing the business, rather than paying down obligations.

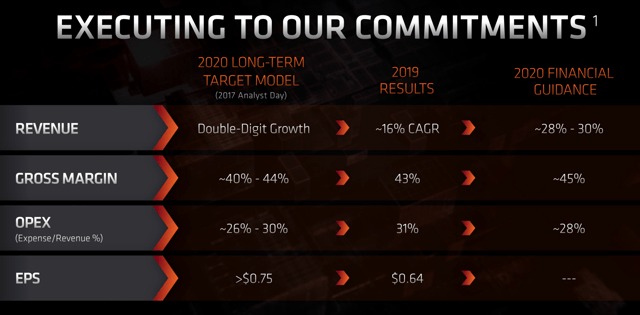

The next important thing to consider with regards to the valuation of AMD (more on that later), is understanding how AMD executed against its old three-year model.

In certain aspects of this model, AMD exceeded expectations in FY’19, and will definitely exceed this model in FY’20. Keep that in mind when we analyze AMD’s valuation later on.

Here is AMD’s full long-term financial model:

This implies an acceleration in revenue growth. This acceleration will likely be delivered by strong datacenter revenue. In addition, AMD is anticipating strong cash generation longer term, while reining in cost-growth. Opex should consist of R&D and go-to-market strategies that will boost revenue long term.

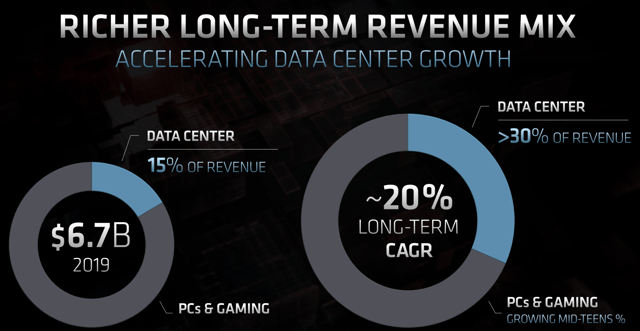

Now, here is the (potentially) most important slide in the entire presentation:

In 2019, 15% of total revenue came from datacenter, $1.005 billion. AMD is saying the rest of this revenue, PC and gaming, should grow at a CAGR of mid-teens long term. This means that AMD’s $5.695 billion/year PC and gaming revenue should grow to a size of $9.96 billion exiting 2023. Using AMD’s new guide, this builds out to 70% of total revenue. Assuming 30% of total revenue is datacenter, then AMD is anticipating 2023 datacenter revenues of $4.269 billion. Using that $35 billion TAM figure, this implies AMD anticipates market share of ~12.2% long term. Considering AMD anticipates double-digit server CPU market share by Q2 of this year, I believe AMD is being conservative here. In addition, if we are to take AMD’s PC and gaming TAM at face value, then AMD is implying that by 2023, its combined market share will only be ~22.6%. This could prove conservative if AMD sees positive trends with next-generation RDNA architectures, strong console sales, and increased desktop/notebook adoption amongst different OEMs.

AMD also believes that the strongest driver of gross margins long term will be AMD’s datacenter segment. So not only will datacenter drive revenue growth, it should also drive gross margins expansion longer term.

AMD also says that the long-term non-GAAP tax rate should be ~15%.

Q&A Session

To start the Q&A session, Lisa Su gives us somewhat of an update on the coronavirus impact on both supply and demand. On the supply side, things were a little bit rocky, considering much of the supply chain is concentrated in China, Taiwan, and Malaysia. That being said, she also noted that AMD should be nearing supply chain normalization later this month. With regards to demand, AMD has felt an impact in consumer products particularly in offline retail outlets, but international demand excluding China has been in line with its internal expectations. The company also saw greater-than-expected demand for infrastructure in China so far in the quarter.

The first question of the Q&A has to do with AMD breaking out its datacenter segment in a little bit more depth. The interesting point here is that Devinder Kumar says the overall server CPU market is roughly flat, and that the growth in overall datacenter will be driven by GPUs.

The second question has to do with market share. Lisa responds basically by saying that she anticipates the current product portfolio and future product roadmap to yield strong growth in market share back to prior levels and beyond. Keep in mind, AMD’s prior high market share in datacenter was ~26% in 2006.

There are quite a few more questions, and if you want to watch the webcast click here. But overall, these first two are the most important to me.

Valuation

This is where we turn fundamental narrative into a stock price. To gauge a revenue estimate, I am going to apply a market share number to a TAM number. Let’s start with the PC CPU segment.

AMD said this a ~$32 billion TAM. AMD says it has ~17% market share in the overall CPU market. If we look three years out, considering AMD’s continued robust innovation and its greater plethora of notebook offerings, I can easily see AMD hitting a solid 30% market share. Notebook will likely be the primary driver of growth, but desktop and HEDT performance will also drive market share higher. This implies $9.6 billion in PC CPU-related revenue. This is almost as much as the $10 billion PC and gaming combined guidance.

AMD’s gaming unit should be strong this year and maybe next year, driven by SoC strength related to Xbox Series X and PlayStation 5 consoles. I really believe the Street is underappreciating consoles. Xbox Series X could be a big hit in particular, launching with Halo Infinite, a title that is rumored to have a $500 million budget. The combination of Xbox and Halo was a key driver of the Xbox’s initial success, and this tactic could drive significant unit volumes. Longer-term, AMD’s main driver of the gaming business is the discrete GPU market. As AMD rolls out high-performance Navi (i.e., RDNA 2), the company could see market share grabs from Nvidia. I wouldn’t get too excited about gaming, as Nvidia remains the technological leader. Overall, I can see AMD stabilizing market share at around 25% of the TAM. On a ~$12 billion TAM, this implies revenues of $3 billion.

Now on to the juicy segment, datacenter. I’m going to break this down into CPU, GPU, and telco revenues. CPU is a ~$19 billion TAM. If it hits 10% in Q2 (it guided double-digit market share), then over the next three years I can see AMD’s market share in servers scaling closer to 25%. This means we see server CPU revenues of $4.75 billion. Factor in 15% market share in the $11 billion server GPU TAM, and we see another $1.65 billion in datacenter related revenue. 10% share in telco gets me to $500 million in additional revenue. Putting it all together, datacenter revenues should total $6.9 billion.

This brings me to an overall revenue figure of $19.5 billion by 2023.

Using a 51% gross margin estimate and assuming 26% of revenue falls to operating expenses, I get to operating income of $4.875 billion. Considering the non-GAAP tax rate of 15%, net income comes out at $4.144 billion. On 1.17 billion shares, this is an EPS number of $3.54/share. So let’s put a multiple on this number. By 2023, AMD will likely be in a slower growth phase as market share gains will be topping out. Considering this, I’m willing to put 20X on AMD’s 2023 numbers. That gets us to a share price of $70.80 in 2023. Discounting this back by 10%/year, we get to a present value of $51.61/share. Hence my $52 price target.

Conclusion

AMD is getting hammered right now, alongside the overall market. When investors shake out the COVID-19 fear and the actual numbers start to come out, confidence will increase, and the investment community will likely reward AMD shares.

TIPRANKS: Buy.

Disclosure: I am/we are long AMD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice. I am not a financial advisor. Please do not interpret this as financial advice. Do your own due diligence before initiating positions in any of the securities mentioned.

Be the first to comment