kevinjeon00/E+ via Getty Images

Brixmor (NYSE:BRX) shares have performed well thus far in 2022. While the stock has declined 15% year-to-date, Brixmor has meaningfully outperformed the broader REIT universe which has seen a decline of ~30% as measured by the Vanguard REIT Index/ETF (VNQ). Brixmor has benefitted from its multiyear transformation whereby it has shed underperforming shopping centers and completed value accretive redevelopments. Performance has been further bolstered by strong tenant demand for space in its grocery anchored shopping centers which has driven increases in rent and same store NOI.

Despite economic turmoil, I believe the outlook for Brixmor remains favorable given its impressive tenant roster, solid balance sheet, and the ability to continue creating value via redevelopment in addition to the favorable leasing environment. That said, as I will discuss below, the share price largely reflects these characteristics.

Overview

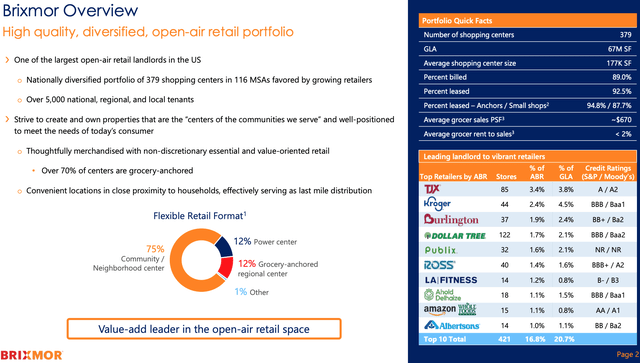

Brixmor owns 379 shopping centers which average 177k square feet, more than 70% of which are grocery anchored. The company boasts a tenant roster which includes many proven winners in retail including TJX Companies, Kroger, Burlington, Publix and Dollar Tree among others.

Overview (Brixmor Investor Presentation)

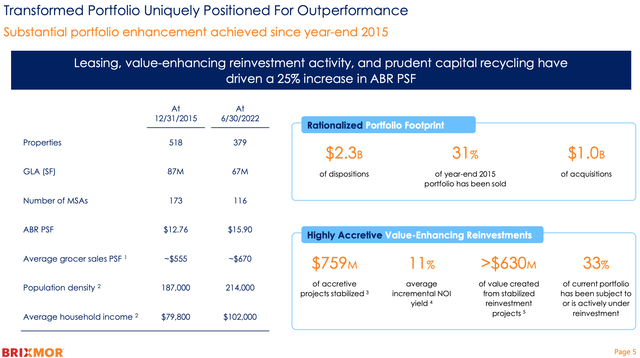

Brixmor has undergone a significant transformation over the past seven years under the current management team led by CEO James Taylor, whereby it has divested ~140 (27% of total) underperforming shopping centers. The shopping centers Brixmor has sold off typically operated in less attractive markets which were either oversupplied, had less population density, or had negative demographic characteristics (i.e. declining population, less affluent residents).

Portfolio Transformation (Brixmor Investor Presentation)

As shown above, the culling of the bottom quintile of its portfolio, has left Brixmor with a portfolio of centers in high density areas serving more affluent customers with greater purchasing power (27% increase in average household income). Further, Brixmor has re-invested some of the proceeds from asset sales to re-develop many of its remaining properties. In doing so, the company has not only earned attractive (11% incremental yield) returns on investment, but also increased the relevance of its shopping centers by bringing in more successful new tenants.

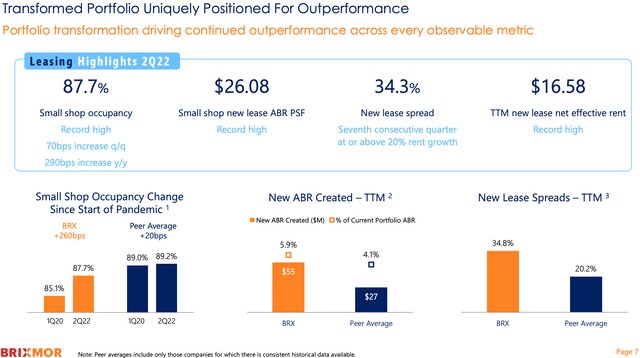

Shopping centers are a collaborative ecosystem whereby tenants benefit from the success of other tenants who drive additional traffic to the center and create an uplift in sales for all tenants within the shopping center. Importantly, this gives Brixmor an ability to increase overall occupancy and drive rents higher as shown below.

Portfolio Metrics (Brixmor Investor Presentation)

Retail Leasing Environment Tailwinds

The environment for retail leasing remains very strong – after several years where retailers closed more stores than they opened, 2021-22 has seen a reversal of this trend with a dramatic increase in openings. This is driving increases in occupancy (all major shopping center operators are now mid 90s leased vs. low 90s pre-COVID) and driving increased rental spreads which will positively impact NOI going forward.

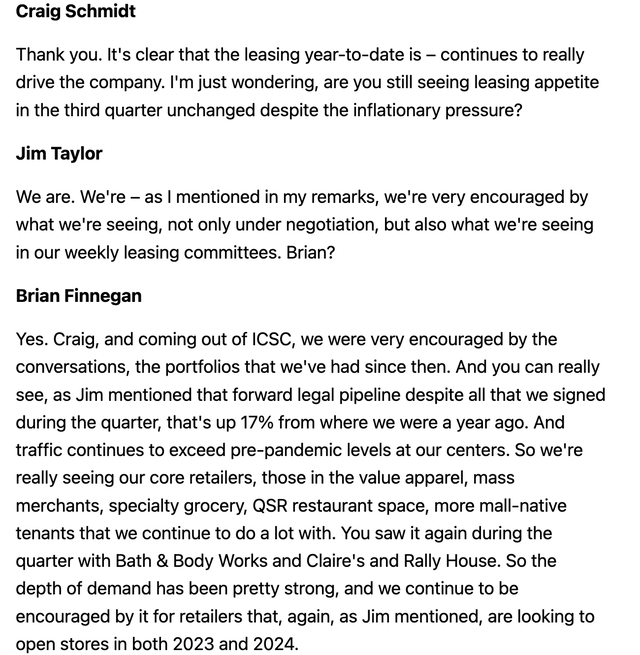

Here is some recent commentary from Brixmor management:

2Q22 Brixmor Management Commentary (SA Transcript)

Similarly, on its 2Q conference call, Kimco (KIM) management noted strong demand for its space:

Kimco 2Q22 Management Commentary (SA Transcripts)

The strong leasing environment has shown up in increased occupancy numbers for Brixmor. As we sit today, the overall portfolio is nearly 94% leased (up from 91-92% pre-pandemic) with small shop occupancy (small shops have the highest rent per square foot in shopping centers) at a multi-year high (nearly 88%).

Valuation & Conclusion

I expect 2023 should show 5-6% total NOI growth comprised of a ~3% same store NOI increase (driven by rent increases and occupancy) as well as continued gains from re-development properties coming online. As we sit today, Brixmor trades at roughly a 7.8% cap rate as shown below:

|

Share Price |

21.5 |

A |

|

Shares outstanding |

300 |

B |

|

Market Cap |

6450 |

C=A*B |

|

Net Debt |

5078 |

D |

|

Total Cap |

11528 |

E=C+D |

|

2023 Estimated NOI |

900 |

F |

|

Implied Cap Rate |

7.8% |

G=F/E |

Ultimately I think the fair cap rate for these types of assets is somewhere around 6.5-7% which implies 20-25% upside in BRX shares.

Brixmor has proven to be a successful operator of shopping centers and is a REIT I would be happy to own at the right price. While Brixmor shares are modestly undervalued by my calculations, I believe there to be greater opportunities in the REIT universe, some of which I have recently written up here on Seeking Alpha. At this time I hold no position in Brixmor shares, but would be a buyer below $18 per share which would be a 30% discount to my estimate of intrinsic value (as a value, I always look to buy in at a hefty discount, typically 30% or more).

RISKS

1. A sharper economic downturn could lead retailers to curb expansion plans. A severe downturn could lead to retailer bankruptcies and store closures.

2. Continued interest rate increases may lead to further near-term declines in REIT prices.

Be the first to comment