Oat_Phawat/iStock via Getty Images

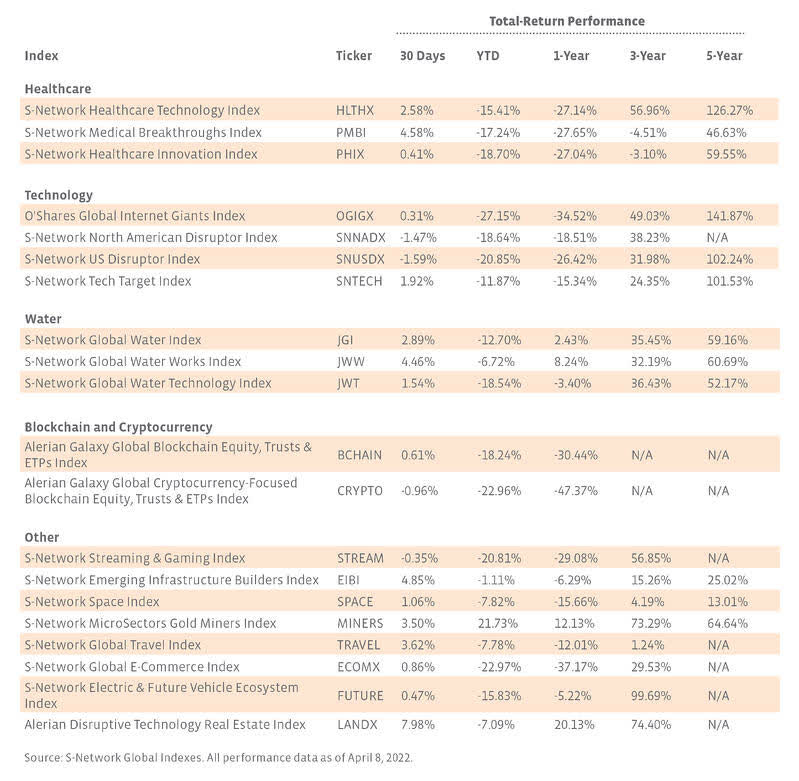

With U.S. inflation rising to record highs and geopolitical unrest causing volatility in the global markets, investors have been looking more closely at investing in gold, which has been outperforming broad equity markets. YTD, the S&P 500 Index (SPX) has fallen 5.5% as of April 8, 2022, while gold prices have risen 6.5% YTD. Gold mining equities – as measured by the S-Network MicroSectors Gold Miners Index (MINERS) – rose an even higher 21.7% YTD. As mentioned in an earlier note, the gold mining industry is leveraged to gold prices, so gold mining companies often outperform gold when gold prices rise and underperform when gold prices fall. As most investors understand the benefits of investing in gold as a commodity (e.g., inflation hedge, safe haven investment), this note explores some recent shifts in gold mining industry fundamentals which may potentially benefit gold miners in the long term even if gold prices retreat.

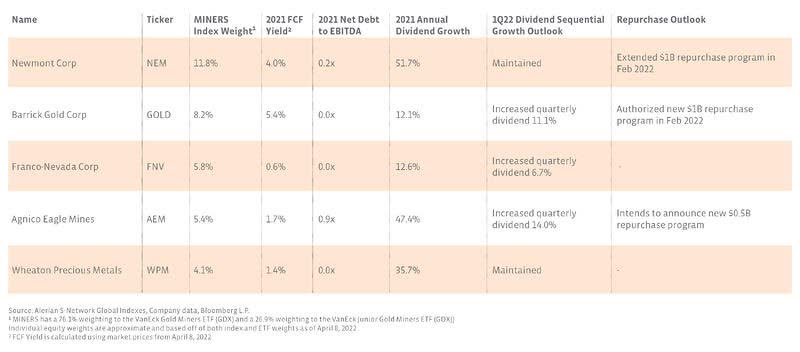

Higher gold prices have contributed to solid margins and more free cash flow generation relative to recent years. With higher cash flows, gold mining companies have been able to clean up balance sheets, increase dividends, initiate share repurchases, and better position themselves for future gold price volatility. After using excess cash reserves to reduce debt, three out of five of the largest gold miners – Barrick Gold Corp. (GOLD), Franco-Nevada Corp. (FNV), and Wheaton Precious Metals (WPM) – all have net cash balances as of the end of 2021. With less debt and more cash, gold mining companies are focusing on returning value to shareholders through higher dividends and share repurchases. For example, Newmont (NEM) had increased its annual dividend by over 50% in 2021 and is among the top 10% of dividend payers in the S&P 500 (by dividend yield). Looking forward to 1Q22, GOLD, FNV, and Agnico Eagle Mines (AEM) have announced quarterly sequential dividend increases of 11.1%, 6.7%, and 14.0%, respectively. Though less common, several companies have recently announced repurchase programs. NEM extended its $1 billion buyback program though 2022 after returning over $525 million in share repurchases in 2021. GOLD recently authorized a new $1 billion share buyback program in February 2022, and AEM also stated in its last quarterly earnings release that it intends to announce a $500 million share repurchase plan. See the table below for more details on the largest-capitalization gold mining stocks.

Bottom Line

Gold mining companies are enjoying benefits from higher gold prices this year, but a shift toward cleaner balance sheets and greater free cash flow generation has helped the industry increase shareholder value and potentially protect margins should gold prices retreat in the future.

The S-Network MicroSectors Gold Miners Index (MINERS) is the underlying index for the MicroSectors Gold Miners 3x Leveraged ETN (GDXU) and MicroSectors Gold Miners -3x Inverse Leveraged ETN (GDXD).

Disclosure: © Alerian 2021. All rights reserved. This material is reproduced with the prior consent of Alerian. It is provided as general information only and should not be taken as investment advice. Employees of Alerian are prohibited from owning individual MLPs. For more information on Alerian and to see our full disclaimer, visit Disclaimers | Alerian

Be the first to comment