Elena Bionysheva-Abramova/iStock via Getty Images

Introduction

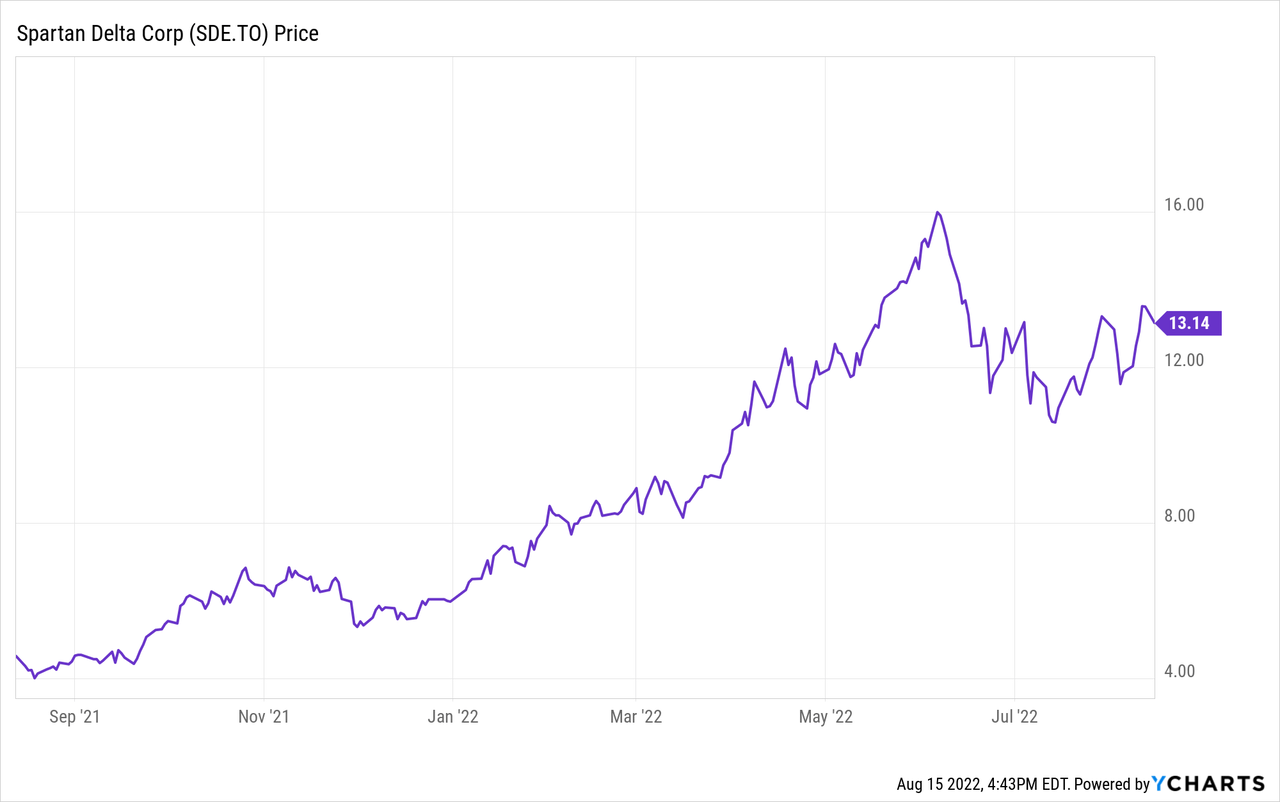

I have been following Spartan Delta (OTCPK:DALXF) (TSX:SDE:CA) since the company was created. In a June 2020 article, I called the company a ‘once-in-a-decade opportunity’ and Spartan definitely didn’t disappoint. Thanks to a series of well-timed acquisitions and helped by a very high natural gas price, Spartan’s financial performance has exceeded my expectations. Unfortunately, most oil and gas players don’t get the recognition they deserve yet and Spartan Delta is for instance trading at just 4 times the annualized H1 net income.

Spartan Delta has its primary listing in Canada, where it’s trading on the Toronto Stock Exchange with SDE as its ticker symbol. The average daily volume in Canada is quite good with 700,000 shares representing about C$9M in monetary value. As Spartan Delta reports its financial results in Canadian dollar, I will use the CAD as the base currency throughout this article, unless indicated otherwise.

Record natural gas prices result in a record performance (despite hedges)

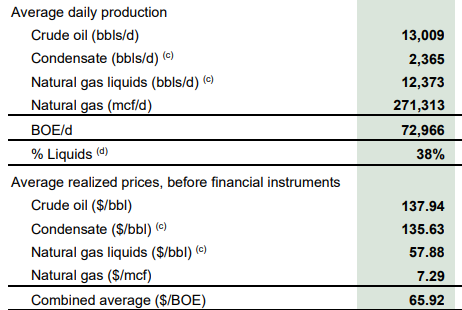

In the second quarter of this year, Spartan Delta produced a total of just under 73,000 barrels of oil equivalent. About 38% consisted of liquids (mainly crude oil and NGLs while the 2,365 barrels of condensate per day represented about 3% of the oil-equivalent production rate). And thanks to the very high commodity prices, Spartan Delta did well (despite the hedges).

Spartan Delta Investor Relations

The total revenue from the sale of oil and gas was just under C$440M and after paying the relevant royalties, the sales revenue was just around C$380M. As you can see in the image below, the total amount of losses related to the hedge book remained pretty low in the most recent quarter.

Spartan Delta Investor Relations

The total operating expenses came in at just under C$146M and almost one-third of all operating expenses were related to the (non-cash) depreciation and depletion expenses. With a pre-tax income of C$235M and a net income of C$182M, I am not complaining at all. The Q2 EPS came in at C$1.17 while the net income per share jumped to C$1.58/share in the first semester (this result does include a hedging loss of almost C$0.50 per share).

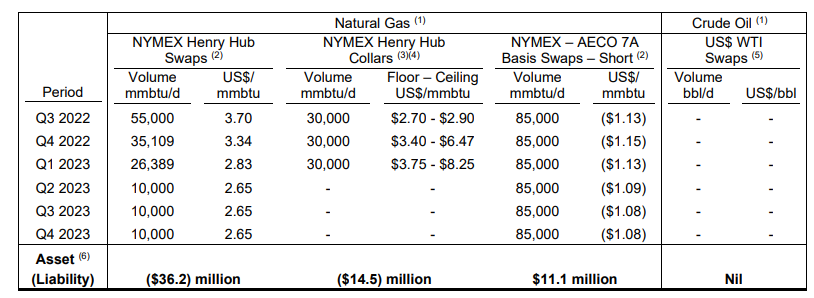

A very, very strong set of results from Spartan Delta which seems to take advantage of the high natural gas prices despite having locked in some hedges in February of this year which – in hindsight – was an unfortunate moment. I’m just surprised that if the company was happy to hedge a portion of its output at (see below), it didn’t enter into additional hedges. If Spartan was fine hedging 55,000 mmbtu/day at US$3.70 for Q3, I personally would not have objected to the company for instance adding to its Q2 2023 hedge book. Even if it would hedge just 20,000 mmbtu/day, the total amount of hedged gas would still be just over half the volumes hedged (using a sap, excluding the collars) while the Henry Hub price for delivery in Q2 2023 averages US$5.29 which is almost exactly twice the price Spartan Delta was happy to lock in just a few months ago.

Spartan Delta Investor Relations

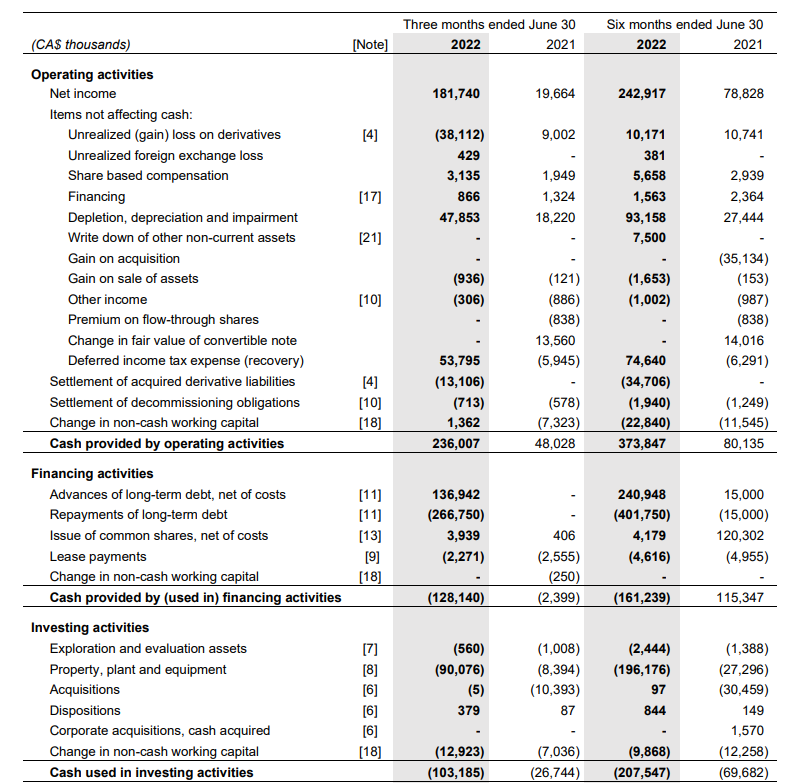

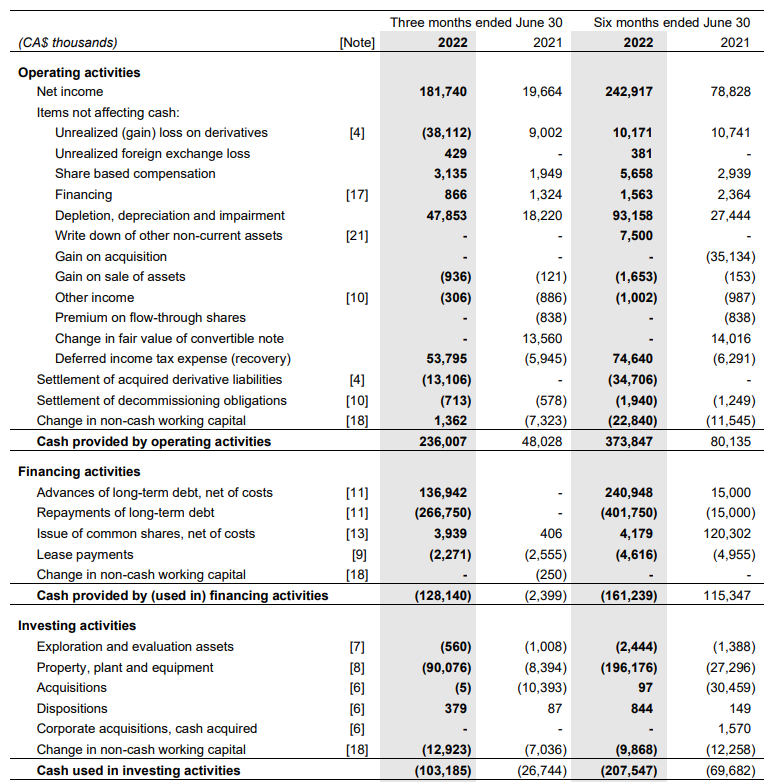

During Q2, Spartan Delta generated about C$236M in operating cash flow. This includes a C$13M cash outflow related to the settlement of derivative liabilities but it also deducts a C$38M deduction related to unrealized gains on the hedge book. The C$2.5M total hedge impact in the income statement was the so-called ‘net’ impact, which consisted of about C$40M in realized losses and about C$38M in unrealized gains. If I would add back the C$38M in unrealized gains but subsequently deduct the C$54M in taxes owed but not paid, the adjusted operating cash flow was C$218M. While Spartan Delta still has tax assets on the balance sheet, these are going down pretty fast. That’s not necessarily a bad problem to have as it means the company is very profitable and while no taxes were due [yet], I wanted to calculate the more ‘normalized’ cash flows to avoid suddenly being hit by a tax bill next year and base my conclusions on the wrong numbers.

Spartan Delta Investor Relations

The total capex during the quarter was approximately C$90M, resulting in a free cash flow result of C$128M, which works out to approximately C$0.76/share. In the first half of the year, which is based on a C$6.07 natural gas price and an oil price of approximately US$100/barrel, the operating cash flow (excluding hedging losses and including all taxes as if they were payable) was in excess of C$307M.

The balance sheet is getting stronger much faster than anticipated

As Spartan Delta plans to increase its capex spending in the second half of this year (see later), it was able to aggressively reduce its net debt. During the first semester, it repaid about C$160M in debt and ended the quarter with just C$220M in net debt (excluding the (low amount of) lease liabilities).

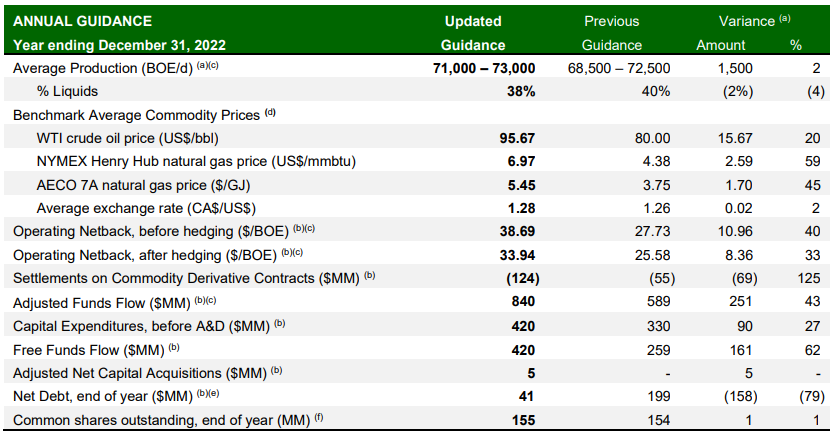

The company has now also updated its guidance for 2022 thanks to the strong production results and high commodity prices. The net capex budget has been increased by about C$90M, of which half is required to address inflation and the other half will help the company to hit the ground running in 2023.

The company also narrowed down its production guidance for this year as the mid-point now comes in at 72,000 barrels of oil equivalent per day, up from 70,500 barrels of oil-equivalent per day. The Adjusted Funds Flow result has been hiked by about 43% to C$840M but readers are warned this is using a Henry Hub and AECO natural gas price of almost US$7 and C$5.45, respectively. That’s 59% and 45% higher than the prices used in the previous guidance. This means the 43% AFF guidance increase is correlated to the commodity prices (which obviously shouldn’t come as a surprise).

Spartan Delta Investor Relations

With a total capex of C$420M, the free cash flow is still anticipated to come in at C$420M which means the net debt level at the end of this year will come in close to zero, much faster than I had anticipated.

Investment thesis

Seeing the very strong expectations for the second half of this year and the additional production growth in 2023, one should wonder ‘what’s next?’. The company will be net debt free in Q1 2023 and will likely generate hundreds of millions in free cash flow, even at a lower natural gas price. Spartan currently doesn’t pay a dividend and isn’t buying back stock. Perhaps that could be an option. But as Spartan Delta now has a reputation of being a ‘serial’ acquirer after completing a few very accretive transactions in the past two years, I wouldn’t be surprised if M&A would be high on its list.

I have a long position in Spartan Delta, and although I’m up about 400% on this position, I am not reducing the size of my stake just yet (I had already sold some shares last year to recoup my original investment). Looking at the prices for the AECO futures, the average price for the September to December months is approximately C$6.46. If Spartan Delta would indeed be able to generate these prices, it is entirely possible its full-year guidance may still be too conservative as it is based on a full-year average price of just C$5.45 for AECO-based natural gas.

Be the first to comment