chonticha wat/iStock via Getty Images

By Steve Land, Research Analyst, Portfolio Manager, Franklin Equity Group

Many investors see gold as a sort of haven in times of turmoil, and prices have surged amid Russia’s invasion of Ukraine. Franklin Equity Group Portfolio Manager Steve Land outlines how his team approaches investing in the metals sector, and why smaller gold producers in particular look appealing.

Gold bullion – typically seen by many investors as a haven in times of international tensions – climbed above US$2,000 per troy ounce in March as investors sought hedges from inflation and political turmoil. On March 8, gold futures settled just above US$2,043 an ounce, not far from US$2,069 an ounce, the highest end-of-day price based on records dating back to January 1975.1 Gold has outperformed other perceived haven assets in February and March, including US Treasuries (as heightened inflation diminished the appeal of bonds), the Japanese yen and the Swiss franc.2

Western sanctions on Russia also prompted a pledge from the Russian Central Bank (RCB) to resume purchases of the precious metal that have been on pause for nearly two years. The RCB has historically purchased the gold produced in Russia as a way to add to government reserves, but it may see a benefit in shoring up existing supplies since gold is an asset not tied to any one country or financial system. Sanctions have also made it difficult for gold producers operating in Russia to sell their production globally, leaving the Russian government as a key buyer in order to keep those operations running.

Rising global inflation has been another factor supporting gold this year; in particular, US consumer prices have witnessed an accelerating uptrend in early 2022, sending the annual inflation rate to a four-decade high. Gold coin and bar demand has been strong over the last couple of years, which only seems to have been boosted by recent geopolitical events, as premiums above spot prices have increased in several markets, reflecting a shortage of available physical supply relative to the demand.

Three Key Value Creation Activities

Gold has been performing well, but we still see a number of potential drivers that could move the metal even higher. In our view, gold may benefit from additional bouts of elevated market volatility and lingering concerns over the coronavirus’s economic impact. The Russia-Ukraine war has added further uncertainty to the global economy. A classic feature of gold is its very low correlation with other asset classes, supporting increased interest in owning it as a portfolio diversification tool in volatile markets.3

As investors in gold-mining stocks, we look to gain exposure to three key value creation activities within the industry: (1) the discovery of new ounces of gold through exploration; (2) successful development of new mines; and (3) solid operation of mining assets with a focus on generating strong free cash flow.

Directional movements in gold are a key driver for short-term equity performance, but we feel it is also important to look longer term at industry dynamics. Gold has averaged more than US$1,750 an ounce over the past two years, and this price level provides a highly profitable backdrop for most gold producers.2 Higher by-product copper credits (copper ore is often found alongside gold in many parts of the world) have further supported strong cash generation in 2021 and early 2022 amid historically tight copper supply/demand balances worldwide, in many cases helping to offset some of the single-digit cost inflation currently being experienced by the broader mining industry.

Gold producers’ profit margins over the past two years have been sustainably stronger than we have seen in previous gold cycles. Unlike previous cycles, most gold companies aren’t chasing growth but have instead driven a much stronger focus on cost control and cash generation.

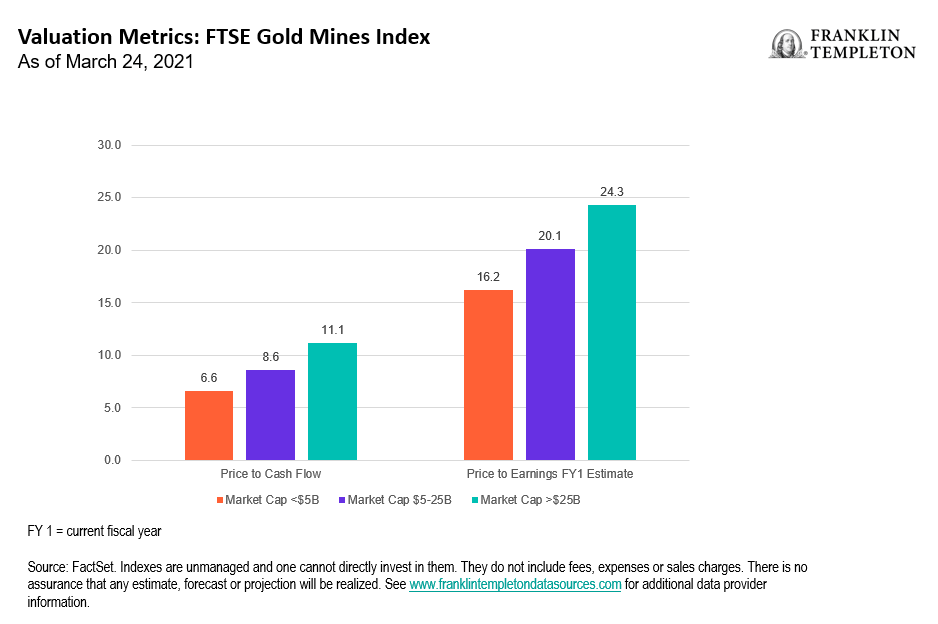

The current cycle has also been somewhat unique in that much of the new money entering the gold market has favored physical gold exchange-traded funds. Accordingly, where gold equities had historically led the cycle up, in the last few years, we have seen more of a market where rising gold prices have pulled gold stocks higher. As a result, although the correlations remain high, the valuation multiples have remained fairly depressed, with price-to-cash flow multiples often declining as gold prices moved higher – especially among the mid-tier producers.

Although we believe gold mining companies as a whole are running better businesses than they have at any point since the world came off of the gold standard in 1971, many of them are trading at very low multiples compared to their historical levels in up gold cycles and look inexpensive relative to the general market as well. We might expect this type of trading from highly cyclical businesses when investors feel prices will move lower over the medium term, yet this does not seem consistent with a market in which investors are net buyers of physical gold (where the only way to profit is for prices to move higher).

Most gold producers generate significant cash flow at current prices and have real free cash flow to return to investors, even after reinvesting in their businesses. We think this creates an interesting opportunity for anyone who believes gold can hold around current prices levels, or move higher, as we believe many stocks are currently discounting gold prices well below spot.

Previous upcycles in gold usually came with expanding equity valuation multiples that reflected a view that gold prices would move even higher in the future, leaving significant downside potential if they didn’t. Although we expect that gold equities will remain volatile, we believe the downside risk is mitigated by the current lower valuations and stronger balance sheets, and gold equites should outperform physical gold in a flat-to-higher price environment.

Many of the smaller gold producers – companies typically still in the exploration and development phase of building a new gold mine – trade at significantly lower equity valuations than their producing peers, according to our analysis. The development-stage companies have the opportunity to advance their projects and grow their assets, which often results in expanding multiples over time as their projects move into production.

There is also an underlying theme that many of the established, large-capitalization gold miners have not reinvested enough in their current operations to organically sustain their existing production bases. As a result, acquiring smaller companies is likely to be an efficient way to replace depleted gold reserves and add some production growth to help differentiate themselves from their competitors. As a result, we currently favor pre-production gold companies, with a view that these stocks may still benefit from higher gold prices while offering what we believe to be better opportunities to unlock value for shareholders independent of movements in the gold price.

Although we continue to see notable economic improvements in the United States and many other countries, the global economy is still under extreme stress after two years of pandemic-induced lockdowns and restrictions, and we think the path to a full global recovery is unlikely to be smooth in all parts of the world. The Russia-Ukraine war further complicates the path to recovery. In this environment, we believe inflation will feature prominently in many countries as governments may look to deflate their way out of the additional debt they had been forced to take on since the pandemic began. This may drive regional demand for gold as it is considered a proven alternative to holding paper money in inflationary environments.

What Are The Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The precious metals sector involves fluctuations in the price of gold and other precious metals and increased susceptibility to adverse economic and regulatory developments affecting the sector. In times of stable economic growth, traditional equity and debt investments could offer greater appreciation potential and the prices of gold and other precious metals may be adversely affected.

Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity. Smaller and newer companies can be particularly sensitive to changing economic conditions. Their growth prospects are less certain than those of larger, more established companies, and they can be volatile. A non-diversified portfolio involves the risk of greater price fluctuation than a more diversified one.

1. Source: Bloomberg, LP.

2. Source: Bloomberg, LP, as of March 24, 2022.

3. Diversification does not guarantee profit or protect against the risk of loss.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment