enot-poloskun/E+ via Getty Images

Welcome to the March edition of the graphite miners news. March saw strong support by governments in the USA and Canada towards critical metals (including battery metals), with a new urgency to create local supply chains. March saw lots of good progress by the graphite juniors with several getting near to production.

Graphite price news

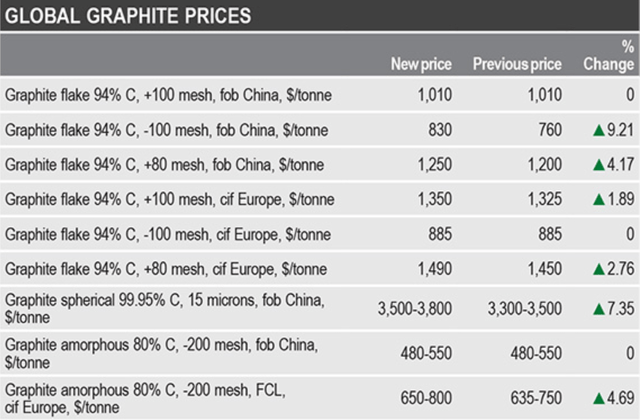

During the past 30 days the China graphite flake-194 EXW spot price was not updated by AsianMetal.com (up 9.85% the past 180 days, and up 28.28% over the past 360 days). Note that 94-97% is considered best suited for use in batteries; it is then upgraded to 99.9% purity to make “spherical” graphite used in Li-ion batteries. The spherical graphite 99.95% min EXW China price was up 7.67% the past 30 days.

Fastmarkets (see below) shows China graphite flake 94% (+100 mesh) prices were flat; however some other types were slightly higher, including spherical graphite up 7.35%.

Fastmarkets graphite prices the week ending March 17, 2022

In an April 25, 2021 report from Leading Edge Materials, they stated:

A recent price assessment produced by Benchmark Mineral Intelligence for the Company shows average pricing in 2020 for uncoated natural spherical graphite at around US$3,000 per tonne and for coated natural spherical graphite between US$7,000 per tonne (domestic China and non-EU) and US$12,000 per tonne (high-end applications), with an average price of around US9,500 per tonne for material used in cells for Western OEMs…..

A reminder of a 2016 Elon Musk quote:

Our cells should be called Nickel-Graphite, because primarily the cathode is nickel and the anode side is graphite with silicon oxide.

Graphite demand and supply forecast charts

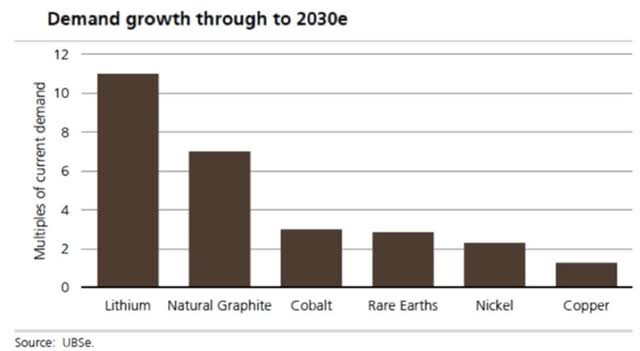

UBS’s EV metals demand forecast (from Nov. 2020)

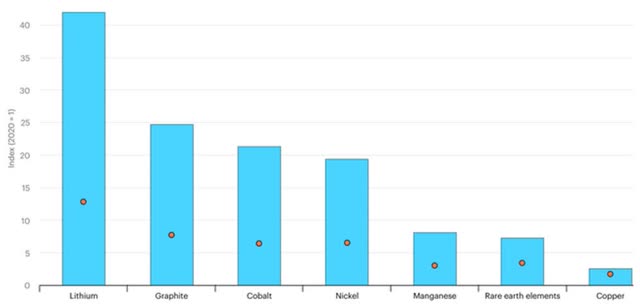

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

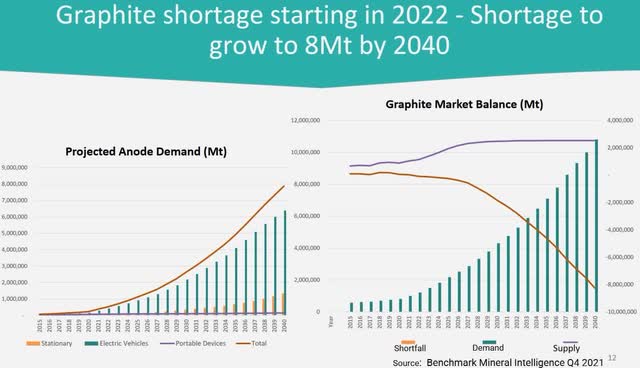

BMI forecasts graphite deficits to begin from 2022 as demand for graphite grows strongly

Graphite market news

On March 11, BNN Bloomberg reported: “Senators urge Biden to invoke Defense Act for battery materials.”

On March 12, Reuters reported:

CERAWEEK As EV demand rises, Biden officials warm to new mines… U.S. regulators are warming to approving new domestic sources of electric vehicle battery metals… Granholm told conference attendees she would work to streamline permitting for new sources of EV minerals, eliciting loud applause.

On March 13, NPR reported:

How a handful of metals could determine the future of the electric car industry… Companies are betting hundreds of billions of dollars on electric cars and trucks. To make them, they’ll need a lot of batteries. And that means they need a lot of minerals, like lithium, cobalt and nickel, to be dug up out of the earth. These minerals aren’t particularly rare, but production needs to scale up massively — at an unprecedented pace — to meet the auto industry’s ambitions… Beijing controls about three-quarters of the market for the minerals that are essential for batteries…. Demand for some mined products could scale up tenfold within a handful of years…

On March 15, Reuters reported:

Electric-car makers should rethink raw material supply chains -RBC… “Either way, the lesson for autos is to re-think value chains, especially as the industry moves to battery electric vehicles,” Spak wrote, noting the recent jump in nickel prices could translate to a $1,000-$2,000 increase in the cost of a battery pack for an electric-car maker. A variety of input prices, including for lithium, nickel, cobalt and copper, could move “a lot” in the next few years due to mismatches in demand and supply, he added.

On March 17, Fastmarkets reported: “Strong demand in China, tightening supply support graphite markets.”

Graphite miners news

Graphite producers

I have not covered the following graphite producers as they are not typically accessible to most Western investors. They include – Aoyu Graphite Group, BTR New Energy Materials, Qingdao Black Dragon, National de Grafite, Shanshan Technology, and LuiMao Graphite.

Note: Imerys Graphite and Carbon (OTC:IMYSF) and AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF) are also “diversified producers”, producing graphite. SGL Carbon (OTCPK:SGLFF) is a synthetic graphite producer and Novonix [ASX:NVX] (OTCQX:NVNXF) is commercializing their synthetic graphite product.

Syrah Resources Limited [ASX:SYR][GR:3S7]( OTCPK:SYAAF)(OTC:SRHYY)

Syrah Resources Limited owns the Balama graphite mine in Mozambique. Syrah is also working to become a vertically integrated producer of natural graphite Active Anode Material (“AAM”) at their Vidalia facility, Louisiana, USA.

On March 3, Syrah Resources announced:

Syrah announces completion of retail entitlement offer… approximately A$250 million (US$178 million). The proceeds of the Equity Raising will be used to: 1) fully fund remaining estimated installed capital costs for the Vidalia Initial Expansion, 2) fund estimated costs associated with Vidalia operations, expansion studies and product development in 2022, 3) pay the transaction costs of the Equity Raising and 4) fund Balama TSF expansion and sustaining capital costs, Balama working capital and for general corporate purposes.

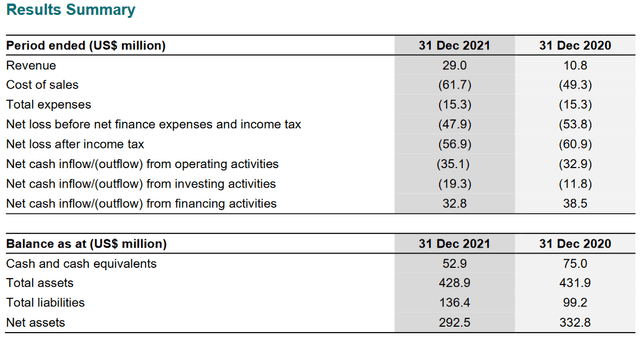

On March 24, Syrah Resources released their 31 December 2021 Annual Report 2021 and Full Year Results. 2021 Highlights:

- “Production at Balama restarted and increased subject to natural graphite market conditions and container shipping availability.

- Major new logistics option developed to commence break bulk shipments through Pemba port to help manage inventory positions and enable higher Balama production and sales.

- Advanced strategy to become a vertically integrated natural graphite Active Anode Material (“AAM”) supply alternative for USA and European customer market:

- On-specification natural graphite AAM produced from Syrah’s fully integrated AAM facility in Vidalia, Louisiana, USA Completed ~50% of detailed engineering on an initial expansion of Vidalia’s production capacity (“Vidalia Initial Expansion”).

- Executed offtake agreement with Tesla, Inc. Progressed commercial and technical engagement with multiple target AAM customers.

- Final investment decision taken for the Vidalia Initial Expansion after year end.”

On March 25, Fastmarkets reported: “Syrah Resources’ flake sales jump in 2021 on strong demand.”

You can view the latest investor presentation here.

Ceylon Graphite [TSXV:CYL] [GR:CCY] (OTC:CYLYF)

Ceylon Graphite has ‘Vein graphite’ production out of one mine in Sri Lanka with 121 square kilometers of tenements.

On February 22, Ceylon Graphite announced: “Ceylon Graphite files NI 43-101 technical report for Karasnagala Graphite Project…”

On March 8, Ceylon Graphite announced:

Hoisting Graphite, battery advancement for OEMs are top priorities for Ceylon in 2022…..

On March 22, Ceylon Graphite announced: “Ceylon Graphite achieves breakthrough results with silicon enhanced anode graphite in full cell lithium-ion batteries.” Highlights include:

- “Ceylon Graphite’s unique natural vein graphite material enhanced with nano silicon additives has substantially outperformed industry standard synthetic graphite by more than 10%, We note CYL’s discharge capacity of 171 mAh/g, as compared to the industry standard of 153 mAh/g

- We believe that the impressive performance of our vein graphite material is due to the following: High crystallinity of vein graphite. High purity and further purification technology. CYL proprietary nano silicon graphene encapsulation coating and spherodizing technology.

- Ceylon Graphite continues to evaluate full cell performance at University College London in the UK.

- Ceylon has a mine-to-battery strategy that will maximize the value of our high-grade Sri Lankan vein graphite by transforming it into anode graphite for the rapidly growing lithium-ion battery market.”

Mineral Commodities Ltd. (“MRC”) [ASX:MRC]

Skaland Graphite is 90% owned by MRC. Skaland is the highest grade flake graphite operation in the world and largest producing mine in Europe; with immediate European graphite production of up to 10,000 tonnes per annum with regulatory approval to increase to 16,000. MRC plans to demerge its Norwegian graphite assets into a newly incorporated Norway company branded as Ascent Graphite.

On February 28, Mineral Commodities Ltd. announced: “2021 full year results summary.” Highlights include:

Skaland

- “Updated Resource at Skaland of 1.84 million tonnes at 23.6% Total Graphitic Carbon (“TGC”) (2020: 1.78 million tonnes at 22% TGC) for 434Kt of contained graphite, representing a 10.9% increase in contained graphite.

- Maiden ore reserve for Skaland of 0.64 million tonnes at 24.8% TGC containing 0.159 million tonnes of contained graphite.

- The Company completed down-dip mine development works to level -55m RL, which provides access to circa 3-5 years of ore production based on long term production at Skaland, which has been mined at circa 40Kt of ore annually to produce circa 10Kt of graphite.

- MRC secured the Hesten and Vardfjellet graphite prospects, located 15km from existing Skaland Graphite Operations and only 4km west of Bukken prospect.“

Financial

Total revenue of US$50.5 million. EBITDA of US$3.8 million. NL.AT of US$3.8 million. Cash balance US$4.3 million.

- “Company secured AU$10.6 million from a placement and fully underwritten rights issue.

- Earnings were below historical performance due to operating losses at Skaland impacted by an unplanned incident shutting the plant, various operational down times and higher operating costs at Tormin.”

On February 28, Mineral Commodities Ltd. announced: “Annual mineral resources and ore reserves statement.” Highlights include:

Graphite Projects – Australia and Norway

- “Total Group Mineral Resources of graphite contained 9.83 million tonnes at 14.3% TGC, containing 1.4 million tonnes of graphite.

- Total Group Ore Reserves of graphite contained 4.88 million tonnes at 14.3% Total Graphitic Carbon (“TGC “).”

Tirupati Graphite [LSE:TGR]

On February 24, Tirupati Graphite announced: “Agreement of exclusive UK distribution rights for flame retardant products.”

Graphite developers

Northern Graphite [TSXV:NGC][GR:ONG] (OTCQX:NGPHF) (potential to be a North American graphite producer very soon)

Northern Graphite has agreed to purchase from Imerys the Lac des Iles producing graphite mine in Quebec and the Okanjande graphite deposit/Okorusu processing plant in Namibia. They also own the Bissett Creek graphite project located 100km east of North Bay, Ontario, Canada and close to major roads and infrastructure. The Company has completed an NI 43-101 Bankable final Feasibility Study and received its major environmental permit.

On February 23, Northern Graphite announced:

Northern Graphite signs option to acquire Mousseau West Graphite Project. Northern Graphite Corporation is pleased to announce that it has entered into an agreement (the “Option Agreement”) that provides it with the option to acquire a 100% interest in the Mousseau West Graphite project (“Mousseau West” or the “Property”), subject to the owners retaining a 2% net smelter royalty (“NSR”). The Property is located approximately 80 kms, and in economic trucking distance, from the producing Lac–des–Iles (“LDI”) graphite mine in Quebec.

On March 2, Northern Graphite announced:

Northern Graphite financing update. Northern Graphite Corporation announces that it has received a 30 day extension from the TSX Venture Exchange (the “TSXV”) to close the final tranche of its private placement (the “Private Placement”) being conducted in connection with the Company’s previously announced acquisition of the producing Lac des Iles graphite mine in Quebec and the Okanjande graphite deposit/Okorusu processing plant in Namibia from subsidiaries of Imerys Group (“Imerys”) for approximately US$40 million (the “Transaction”). The final date for acceptance by the TSXV of the Private Placement has been extended to April 4, 2022 in order for the Company to finalize documentation associated with the debenture, royalty and streaming financings with the Sprott Group. It is anticipated that the Transaction, the final tranche of the Private Placement and the debenture/royalty/stream financings will close in mid–March, 2022…….

On March 9, Northern Graphite announced: “Northern Graphite plans to further reduce carbon footprint of Bissett Creek Project.”

You can view the latest investor presentation here and my recent Trend Investing article on Northern Graphite here.

Gratomic Inc. [TSXV:GRAT] [GR:CB82 ] (OTCQX:CBULF)

Gratomic’s Aukam Graphite Project is located in Namibia, Africa. The Project is undergoing ‘operational readiness‘. Gratomic is also collaborating with Forge Nano to develop a second facility for graphite micronization and spheronization.

On February 23, Gratomic Inc. announced:

Gratomic announces update on Capim Grosso Graphite Project drilling program in Brazil. Gratomic Inc. announces more preliminary findings from its 5,000-meter diamond drill program on the Capim Grosso graphite project located within the Bahia State of Brazil, to further delineate graphite mineralization on a recently completed two-fold trenching and sampling program (see Press Release Dated December 22nd, 2021 HERE). The Company has a 100% interest in the Capim Grosso graphite project (see Press Release dated December 8th, 2021 HERE). A total of 686.65 m has been drilled to date. The introduction of a second drilling rig, which is currently onsite, has expedited the drilling program.

On February 24, Gratomic Inc. announced:

Gratomic Inc. ranked among top performing mining companies by the TSX Venture 50TM for 2022.

On March 17, Gratomic Inc. announced:

Gratomic discloses update on its Operational Readiness [OR] plan for its Aukam Graphite Plant in Namibia.

Walkabout Resources Ltd [ASX:WKT]

On March 17, Walkabout Resources announced:

Interim financial report 31 December 2021. During the period under review the Company made significant progress in the construction and development of the Lindi Jumbo Graphite Mine. Following the obtaining of the US$20 million Debt Funding Facility with the CRDB Bank of Tanzania and company equity contributions in FY21 the Company executed in the first quarter of FY22 the material contracts with Yantai Jinpeng Mining and Machinery Co. Limited (Jinpeng) for the Engineering, Procurement and Construction of the Lindi Jumbo Graphite Process Plant as well as the agreement for the Bulk Earthworks and Civil Engineering works with TNR Engineering Ltd, a local Tanzanian contractor resulting in more than two-thirds of the project now contracted. TNR commenced site activities in August & Jinpeng commenced plant manufacture in mid-September…..

Black Rock Mining [ASX:BKT]

On March 16, Black Rock Mining announced: “Black Rock awards engineering design contract to CPC Engineering for Mahenge Graphite Mine.” Highlights include:

- “Black Rock awards Detailed Engineering Design contract to CPC Engineering.

- Contract includes detailed design of process plant and non-process infrastructure [NPI] for the Mahenge Graphite Mine and a FEED phase that will run in parallel with detailed design which aims to: Optimise the process plant design. Tender long lead equipment items. Provide updated CAPEX and OPEX for cost and schedule certainty. Support the finalisation of the debt finance process.

- An Integrated Project Management Team has been established focused on finalising detailed engineering to be construction ready in the coming months.

- Black Rock set to become a major producer of graphite for the clean energy supply chain.”

NextSource Materials Inc. [TSX:NEXT] [GR:1JW] (OTCQB:NSRCF)

NextSource Materials Inc. is a mine development company based in Toronto, Canada, that’s developing its 100%-owned, Feasibility-Stage Molo Graphite Project in Madagascar. The Company also has the Green Giant Vanadium Project on the same property. The Molo mine is fully-funded and scheduled to commission in March, 2022.

On February 28, NextSource Materials Inc. announced:

NextSource Materials announces Preliminary Economic Assessment for a mine expansion of 150,000 tonnes per annum of SuperFlake® graphite concentrate. The PEA considered an enhanced Phase 2 expansion consisting of a stand-alone processing plant with a production capacity of 150,000 tonnes per annum (“tpa”) of flake graphite concentrate over a 26-year life of mine (“LOM”). The PEA projects that the capital costs to construct 150,000 tpa of processing capacity would be US$155.8 million with a pre-tax NPV utilizing an 8% discount rate of US$929.6 million and a pre-tax IRR of 41.1%. The PEA assumed the Phase 2 processing plant will be built adjacent to the 17,000 tpa Phase 1 processing plant, currently under construction.

Investors can view the latest company presentation here. You can watch the company’s Senior Vice President Brent Nykoliation video interview here.

Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF) (formerly Bass Metals [ASX:BSM]

On March 8, Greenwing Resources Limited announced: “Graphmada Graphite Mining Complex exploration update.” Highlights include:

- “43 diamond drill holes for a total of 1,715 metres completed to date, representing a significant portion of the current diamond drilling program.

- Drilling has recorded significant intercepts of graphite mineralisation, up to 37.9m @ 6.6% Fixed Carbon [FC] including 4.9m @ 19.4% FC.

- The Company continues to drill and in particular expand the footprint of Ambatofafana.

- Current diamond drilling program designed to provide a Mineral Resource upgrade for Graphmada, supporting studies to undertake large scale mining and processing operations.

- Graphmada has previously produced concentrates to specifications and sold into all major global markets without penalty.“

Next Steps

- “Continue to drill and expand the footprint and depth of Ambatofafana.

- Continue analysis of drill samples to update the Mineral Resource Estimate for the Graphmada Mining Complex.

- Advance feasibility studies on large scale mining and processing.”

On March 14, Greenwing Resources Limited announced: “Half-year report for the period ended 31 December 2021.”

You can view the latest company presentation here.

Nouveau Monde Graphite [TSXV:NOU] (OTCQX:NMGRF) (NYSE:NMG)

Nouveau Monde Graphite own the Matawinie graphite project, located in the municipality of Saint-Michel-des-Saints, approximately 150 km north of Montreal, Canada.

On February 24, Nouveau Monde Graphite announced:

NMG releases its climate action plan – Continued carbon neutrality with successful transition to Net Zero.

On March 14, Nouveau Monde Graphite announced:

NMG opens office in New York and expands its U.S. and Canadian investor relations commitment ahead of NYSE Bell Ringing.

You can view the latest investor presentation here.

Westwater Resources (NYSE:WWR)

Westwater Resources Inc. is developing an advanced battery graphite business in Alabama. The Coosa Graphite Plant (2023 production start) plans to source natural graphite initially from non-China suppliers and then from the USA from 2028.

No news for the month.

You can view the latest investor presentation here.

Triton Minerals [ASX:TON][GR:1TG]

Triton Minerals Ltd. engages in the acquisition, exploration and development of areas that are highly prospective for gold, graphite and other minerals. The company was founded on March 28, 2006 and is headquartered in West Perth, Australia. Triton has two large graphite projects in Mozambique, not far from Syrah Resources Balama project.

On March 10, Triton Minerals announced: “Ancuabe Project Strategic Review & Desktop study completed scoping study to commence immediately on staged development plan.”

- “……Ancuabe Staged Development Strategic Plan – two stages: Stage 1 – development and construction of CPP for a small-scale processing plant, capable of producing flake graphite concentrate on a commercial basis, investigating a processing plant that will target processing 100 to 125k tpa of ore, producing 5 to 8 k tpa of graphite concentrate. Stage 2 – expansion to a large-scale operation as planned in the 2017 DFS1 incorporating value-add enhancements identified in Stage 1.

- Value Enhanced Products – investigate value-added adding opportunities through products and marketing, primarily for the lithium-ion battery and graphite foil applications, to build a vertically integrated business model to supply premium quality graphite products into a diverse range of premium markets.

- Funding – given the smaller scale of Stage 1, initial project funding requirements are lower, provides range of options such as BOOT arrangements, contractors and leasing which further reduces upfront direct funding requirements. The Company is receiving strong interest from Western debt providers.

- De-Risks the Project – staged approach reduces risk associated with execution, financing and technology for the larger follow-on expansion investment, as well as facilitating the development of end-user markets for its range of graphite products.

- Validates the Ancuabe Project as a Producing Mine – Ancuabe is regarded as one of the largest and highest-quality undeveloped graphite deposits globally and the Stage 1 CPP will provide proof of concept, confirms the quality of the orebody and concentrate product to the market.

- Use of Modular Plant – is a well-established and proven development methodology, used in other industry’s such as oil & gas and chemical industries, which is ideal for African developments and projects in today’s tight projects market, with potential to realise significant savings in both construction time and capital costs.

- Scoping Study and Stage Gate Approach – Triton is aiming to bring the CPP into production within 18 months or September Quarter 2023, will immediately commence a scoping study in March 2022. The use of Stage Gate approach which will allow for a rapid timeline to first production.”

You can view the latest investor presentation here, an excellent video here, and my article on Trend Investing here.

Magnis Energy Technologies Ltd. [ASX:MNS] (OTCPK:MNSEF)

Magnis is an Australian based company that has rapidly moved into battery technology and is planning to become one of the world’s largest manufacturers of lithium-ion battery cells. Magnis has a world class graphite deposit in Tanzania known as the Nachu Graphite Project.

On March 15, Magnis Energy Technologies Ltd. announced: “Financial report for the half-year ended | 31 Dec 2021.”

On March 18, Magnis Energy Technologies Ltd. announced: “New York lithium-ion battery plant update.” Highlights include:

- “New York battery plant status at the end of February – 63% complete.

- Fully automated production on track for late 1H 2022.

- Potential customer evaluation yields positive feedback.

- Safety – Zero incidents in February.”

Eagle Graphite [TSXV:EGA] (OTCPK:APMFF)

The Black Crystal Project is located in the Slocan Valley area of British Columbia, Canada, 35km West of the city of Nelson, and 70km North of the border to the USA. The quarry and plant areas are the project’s two main centers of activity.

No news for the month.

Mason Graphite [TSXV:LLG] [GR:M01] (OTCQX:MGPHF)

Mason Graphite is a Canadian graphite mining and processing company focused on the development of the Lac Guéret project located in northeastern Quebec, where the graphite grade is believed by management to be among the highest in the world. Mason Graphite also owns 66.67% of Black Swan Graphene.

No news for the month.

You can view the latest investor presentation here.

Talga Group [ASX:TLG] [GR:TGX] (OTCPK:TLGRF)

Talga Group is a technology minerals company enabling stronger, lighter and more functional materials for the multi-billion dollar global coatings, battery, construction and carbon composites markets using graphene and graphite. Talga 100% owned graphite deposits are in Sweden, proprietary process test facility is in Germany.

On February 24, Talga Group announced: “Talga produces Europe’s first battery anode during EVA plant commissioning.” Highlights include:

- “….More than 20 battery manufacturers and automotive customers engaged to receive Talnode®–C from the EVA production for large–scale EV battery qualification and procurement processes.

- EVA plant project executed on time and within budget with full commissioning expected to be completed late March 2022.”

On March 3, Talga Group announced: “Drill results to upgrade Europe’s largest graphite resource.” Highlights include:

- “Final results from Talga’s 2021 Vittangi drilling in Sweden return world–class grades, paving way to upgrade Europe’s largest natural graphite resource for Li–ion batteries.

- New deposit confirmed at Nunasvaara East with drill intercepts including: 51m @28.4% Cg (from 8m) NUN21028 incl. 12m @ 35.7% Cg.22m @28.4% Cg (from 31m) NUN21012 incl. 8m @ 39.4% Cg. 34m @ 26.1% Cg (from 40m) NUN21024 incl. 14m @ 28.2% Cg

- Niska South deposit extended at depth and along strike with intercepts including:24m @32.5% Cg(from111m) NIS21011incl.9m @36.6% Cg.26m @ 25.3% Cg(from 73m)NIS21005incl. 9m @ 31.2% Cg.22m @ 27.5% Cg(from 63m)NIS21010incl. 7m @ 37.4% Cg

- Revision of Vittangi JORC graphite resources underway, with drilling to re–commence immediately to continue growing feed stocks for battery customer road maps.”

On March 16, Talga Group announced: “Half year report 31 December 2021.”

You can view the latest investor presentation here.

SRG Mining Inc. [TSXV:SRG] [GR:18Y] [Formerly SRG Graphite Inc.]

SRG is focused on developing the Lola graphite deposit, which is located in the Republic of Guinea, West Africa. The Lola Graphite occurrence has a prospective surface outline of 3.22 km2 of continuous graphitic gneiss, one of the largest graphitic surface areas in the world. SRG owns 100% of the Lola Graphite Project.

On March 16, SRG Mining Inc. announced:

La Mancha to acquire a 19.9% stake in SRG for C$13 million. SRG to accelerate development of Lola Graphite Project and downstream processing strategy.

On March 21, SRG Mining Inc. announced:

La Mancha confirms completion of confirmatory due diligence and receipt of internal approvals necessary to complete its investment in SRG. The private placement now remains subject only to customary closing conditions, including TSX Venture Exchange approval, and is expected to close on or before March 31, 2022.

You can view the latest investor presentation here.

Leading Edge Materials [TSXV:LEM] (OTCQB:LEMIF)

Leading Edge Materials Corp. is a Canadian company focused on becoming a sustainable supplier of a range of critical materials. Leading Edge Materials’ flagship asset is the Woxna Graphite Project and processing plant in central Sweden. The company also owns the Norra Karr REE project, and the 51% of the Bihor Sud Nickel-Cobalt exploration stage project in Romania.

On March 24, Leading Edge Materials Corp. announced: “Leading Edge Materials reports quarterly results to January 31, 2022.”

Subsequent to January 31, 2022:

- “The Company initiated an internal review focused on the potential to restart production at the Company’s fully-owned Woxna graphite mine in Sweden.”

Investors can view the latest company presentation here.

Renascor Resources [ASX:RNU]

Renascor Resources Ltd. is an Australian exploration company, which focuses on the discovery and development of economically viable deposits containing uranium, gold, copper, and associated minerals. Its projects include graphite, copper, precious metals, and uranium.

On March 4, Renascor Resources announced: “S&P Dow Jones Indices announces March 2022 quarterly rebalance of the S&P/ASX Indices.”

On March 10, Renascor Resources announced: “Financial report – 31 December 2021.”

You can view the latest investor presentation here.

EcoGraf Limited [ASX:EGR] [FSE:FMK] (ECGFF)

On March 2, EcoGraf Limited announced:

Partnership with Vermeer to evaluate surface Miner at Epanko evaluation of new mining method to lower carbon emissions and enhance epanko’s sector leading esg credentials.

On March 10, EcoGraf Limited announced: “Interim financial report for the half year ended 31 December 2021.”

On March 16, EcoGraf Limited announced: “EcoGraf OTC shares approved for electronic trading in USA.”

You can view the latest investor presentation here.

Lomiko Metals Inc. [TSXV:LMR] (OTCQB:LMRMF)

Lomiko has two projects in Canada – La Loutre graphite Project (flagship) (100% interest) and the Bourier lithium Project (70% earn in interest).

On March 3, Lomiko Metals Inc. announced:

Lomiko announces corporate update and deepens its connection to Quebec Organizations and Research Centres…..

On March 22, Lomiko Metals Inc. announced:

Lomiko announces it is now UL ECOLOGO® certified for mineral exploration, validating mineral companies’ responsible business practices to the market, and demonstrating increased value to investors. Specifically, Lomiko has received UL 2723 ECOLOGO® Certification for Mineral Exploration Companies upon its successful completion of the final stage of the certification process….

Zentek Ltd. [TSXV:ZEN] (OTCPK:ZENYF) (formerly ZEN Graphene Solutions Ltd.)

On February 28, Zentek Ltd. announced:

Zentek provides corporate update. “With 2022 well underway, ZEN continues to progress on a number of fronts and is in an excellent financial position with cash of approximately $32 million and no debt. Industrial scale production of ZenGUARD™ will be an important next step in the continued commercialization of our IP developmental pipeline. We are pleased with the continued development of our rapid detection prototype in order to make application to Health Canada and other markets and we continue to make excellent progress on a number of other applications in our IP portfolio, including icephobic coatings” commented Greg Fenton, CEO.

On March 7, Zentek Ltd. announced:

Zentek receives approval for Nasdaq Listing…..under the symbol ZTEK. Zentek’s common stock will continue to trade on the TSX Venture Exchange [TSX-V] under the symbol ZEN….

On March 8, Zentek Ltd. announced: “Zentek provides update on rumours.”

On March 21, Zentek Ltd. announced: “Zentek to begin trading common stock on NASDAQ March 22, 2022.”

On March 24, Zentek Ltd. announced: “Zentek’s ZenGUARD™ patent application publishes.”

South Star Battery Metals [TSXV:STS] (OTCQB:STSBF)

South Star Battery Metals owns the Santa Cruz Graphite Project in Brazil with a Phase 1 commercial production target for Q4 2022. Plus the right to earn-in to up to 75% for the Graphite Project in Coosa County, Alabama.

On February 23, South Star Battery Metals announced:

South Star Battery Metals announces approval of all final exploration reports of Santa Cruz Mine by Brazilian Mining Authority and launch of product information bulletins for phase 1 operations….

On March 24, South Star Battery Metals announced:

South Star Battery Metals announces Letter of Intent to enter into binding 5-year Offtake Agreement with Graphex Group Limited. South Star Battery Metals Corp. is pleased to announce that it has entered into a Letter of Intent (“LOI”) with Graphex Group Limited (“Graphex”) for up to 50,000 tonnes of natural flake graphite concentrate over a period of five years for the Santa Cruz Graphite Project in Brazil and the Ceylon Graphite Project in Alabama (“Projects”). The parties have agreed in the LOI to negotiate a binding offtake agreement (“Offtake Agreement”) within 60 days of signing the LOI. The LOI was signed on March 22, 2022 and terms and conditions of the agreement are confidential.

Sovereign Metals [ASX:SVM] [GR:SVM][LSE:SVML]

Sovereign Metals Ltd. is an exploration company, which engages in the explorations of graphite, copper and gold resources. It operates through the Queensland, Australia and Malawi geographical segments. Sovereign Metals has world’s biggest graphite saprolith resource of 65m tonnes at 7.1% TGC at their Maligunde project in Malawi.

On March 15, Sovereign Metals announced: “Interim financial report for the half year ended 31 December 2021.”

You can view the latest investor presentation here.

Other graphite juniors

Armadale Capital [AIM:ACP], BlackEarth Minerals [ASX:BEM], Black Rock Mining [ASX:BKT], DNI Metals [CSE:DNI] (OTCPK:DMNKF), Eagle Graphite [TSXV:EGA] [GR:NJGP] (OTC:APMFF), Electric Royalties [TSXV:ELEC], Focus Graphite [TSXV:FMS][GR:FKC] (OTCQB:FCSMF), Graphite One Inc. [TSXV:GPH] [GR:2JC] (OTCQX:GPHOF), Green Battery Minerals Inc. [TSXV:GEM] (OTCQB:GBMIF), Metals Australia [ASX:MLS], New Energy Metals Corp. [ASX:NXE], Volt Resources [ASX:VRC] [GR:R8L].

Synthetic Graphite companies

- Graphex Group [HK:6128] (OTCQX:GRFXY)

- Novonix Ltd [ASX:NVX](OTCQX:NVNXF)

- SGL Carbon [ETR:SGL]

Graphene companies

- Archer Materials [ASX:AXE]

- Elcora Advanced Materials Corp. [TSXV:ERA](OTCPK:ECORF)

- First Graphene [ASX:FGR] (OTCQB:FGPHF)

- Graphene Manufacturing Group Ltd [TSXV:GMG]

- NanoXplore Inc. [TSXV:GRA] (OTCQX:NNXPF)

- Strategic Elements Ltd [ASX:SOR]

- Zentek Ltd. [TSXV:ZEN] (OTCPK:ZENYF)

Conclusion

March saw flake graphite prices generally flat the past month; however spherical graphite prices rose strongly.

Highlights for the month were:

- As EV demand rises, Biden officials warm to new mines.

- Senators urge Biden to invoke Defense Act for battery materials.

- A handful of EV metals could determine the future of the car industry.

- Electric-car makers should rethink raw material supply chains -RBC.

- Strong demand in China, tightening supply support graphite markets.

- Syrah Resources announces completion of retail entitlement offer of approximately A$250 million (US$178 million).

- Ceylon Graphite achieves breakthrough results with silicon enhanced anode graphite.

- Northern Graphite signs option to acquire Mousseau West Graphite Project.

- Gratomic gives an update on its Operational Readiness plan for its Aukam Graphite Plant in Namibia.

- Walkabout Resources reports significant progress in the construction and development of the Lindi Jumbo Graphite Mine in Tanzania.

- NextSource Materials PEA for 150,000tpa mine expansion resulted in a Pre-tax NPV8% of US$929.6m and a pre-tax IRR of 41.1%. Initial CapEx US$155.8m.

- Triton Minerals to begin scoping study to commence immediately on staged development plan, lower initial CapEX modular approach.

- Magnis Energy Technologies – New York battery plant status at the end of February 63% complete.

- Talga Group produces Europe’s first battery anode during EVA plant commissioning, Vittangi drilling results – 51m @28.4% Cg (from 8m).

- La Mancha to acquire a 19.9% stake in SRG Mining for C$13 million.

- Leading Edge Materials internal review focused on the potential to restart production at their fully-owned Woxna graphite mine in Sweden.

- Zentek to begin trading on NASDAQ March 22, 2022, ticker “ZTEK”.

- South Star Battery Metals announces Letter of Intent to enter into binding 5-year Offtake Agreement with Graphex Group Limited.

As usual all comments are welcome.

Be the first to comment