metamorworks/iStock via Getty Images

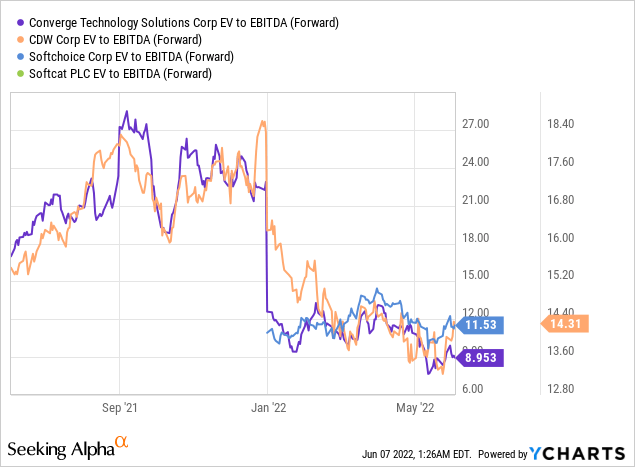

North American hybrid IT solutions provider Converge Technology Solutions (OTCQX:CTSDF) continues on its rapid growth path by consolidating yet another regional IT service provider through the c. $74 million TIG (Technology Integration Group) acquisition. While the below-par margin profile could result in a near-term dilutive outcome, Converge has plenty of room to layer on managed services and unlock cost synergies to get corporate margins in line over the medium to longer term. Looking ahead, Converge’s active M&A momentum should continue, backed by a strong balance sheet and liquidity position as well as an active M&A pipeline. At current levels, Converge shares are trading at a relatively discounted c. 9x EV/EBITDA – well below slower growth peers like CDW (CDW), Softchoice, and Softcat. As such, I remain upbeat on the shares, especially heading into the upcoming AGM, which could provide a timely catalyst.

A Closer Look at the TIG Acquisition

California-based TIG has a multi-decade track record of selling hardware and services to the following end markets – enterprises, government agencies, and educational institutions. Per TIG’s website, its government contracts are primarily focused on hardware (e.g., laptops, monitors, and networking equipment), while its partnerships span tech giants such as IBM (IBM), Microsoft (MSFT), Juniper (JNPR), and Apple (AAPL), among others.

Crucially, the end market focus aligns well with recent acquisitions PDS and REDNET AG as Converge further builds out its managed services. Specifically, TIG’s target verticals favor longer-term contracts with high renewal rates, implying higher customer retention and potentially even cross-selling over the long run. Relative to TIG’s gross sales of $423 million, the company generated a c. 4% adjusted EBITDA margin (or c. $15 million EBITDA) for fiscal 2021. This implies a purchase multiple of c. 6x trailing EV/EBITDA – at the upper-end of CTS’ typical acquisition price range of 4-6x EV/EBITDA.

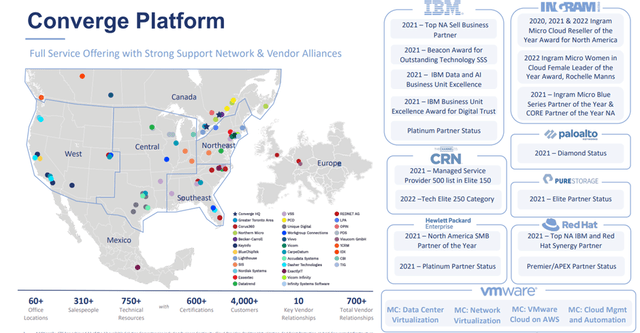

Strategically Complementing Converge’s Capabilities

Notably, TIG is the largest VAR (“value-added reseller”) acquisition by revenue to date by Converge and adds complementary exposure to the state and education end-markets along with similar vendor partnerships, which Converge can leverage across North America. The addition of TIG also enhances the company’s footprint within the US, especially in key cities like Los Angeles, Atlanta, and Philadelphia. Furthermore, TIG’s presence in Canada also adds to its potential product and service offerings to the Canadian government (mainly through Portage CyberTech at present).

The compelling strategic benefits should drive an accretive outcome in the long run, helping to offset the c. 6x EV/EBITDA multiple paid. On the revenue front, TIG’s diversified contracts should offset some of the seasonality that Converge experiences throughout the year, while margins should benefit from vendor rebates and cost synergies. If successful, TIG’s margins should inch toward the 6% mark in the short term (mainly due to the 2%pts from cost synergies), consistent with the current corporate margin structure. As this also implies an undemanding sub-5x post-synergy EBITDA multiple, Converge should benefit from an accretive outcome. Looking ahead, revenue synergies from extending managed services (e.g., education capabilities at Rednet) to bolster the services business should drive margins even higher over the medium to longer term.

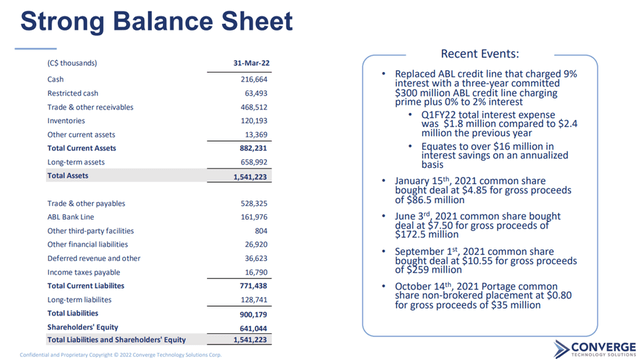

Retaining Balance Sheet Flexibility

Considering Converge held c. $280 million of cash (including restricted cash) as of its most recent quarter, the balance sheet remains in great shape. Even after accounting for the restricted cash set aside for the CBI acquisition (closed at the beginning of Q2′ 22) as well as Interdynamix and TIG, Converge would still have a pro forma cash balance of c. $86 million. Note that this ignores its cash generation potential and any working capital changes post-quarter, which would likely drive down the pro forma net debt position (c. $40 million or 0.3x leverage). Furthermore, the scale added in the past year also grants management the option of utilizing an upsized $300 million asset-backed lending facility – akin to the approved increase following the REDNET acquisition. As my base case is for over $90 million in free cash flow for the rest of the year, I see plenty of room for more acquisitions ahead without the need to lever up aggressively.

Towards a More Shareholder-Friendly Capital Allocation Strategy

Once the TIG transaction is closed, Converge will have completed over 80% of its target to acquire $1 billion in gross revenue for the year. Interestingly, most of the acquisitions have focused on North America, with Converge adding c. $600 million in North American revenue. And with plenty of dry powder left on the balance sheet, there should be more M&A to come for the rest of the year. Key focus areas include managed services, where recurring revenue was c. $106 million in Q1 ’22 (vs. the $200 million post-2022 target), as well as Europe, where acquired revenue remains well short of the €400 million target.

More broadly, I think Converge is approaching an inflection point – having completed a series of financings in the past two years, the company is well-capitalized and could even opt to return excess capital at some point (note $250-$300 million of capital is currently earmarked for M&A). While it is likely still too early to call for it, a capital return strategy would potentially introduce a new income-oriented base to the shareholder register. Looking ahead, the June AGM will be worth monitoring closely for longer-term plans and targets on the shareholder return front.

Final Take

On balance, the TIG acquisition represents a significant addition to the CTS group of companies, contributing a robust client base and the potential to realize significant synergies down the line. While TIG will be dilutive to Converge’s overall margin profile near-term (TIG generates below-par c. 4% EBITDA margins), Converge has plenty of levers to unlock expansion, including by layering on managed services and streamlining costs to expand margins over the medium to longer term. Furthermore, Converge’s healthy liquidity position, and active acquisition pipeline should ensure continued M&A momentum ahead. Shares currently trade at a relative discount to slower growth peers in North America and Europe, keeping me bullish.

Be the first to comment