Chimpinski/iStock via Getty Images

Introduction

The Global X NASDAQ 100 Covered Call ETF (NASDAQ:QYLD) seeks to generate income by selling covered calls on NASDAQ stocks. The ETF aims to track the CBOE NASDAQ-100 Buy/Write Index. Income investors are likely attracted to the fund’s distributions that come as a result of selling covered out-of-the-money calls expiring in a few weeks. The fund last paid out a monthly distribution of $0.21 per share. This would be good for a $2.52 annual distribution or a yield of around 12% as of the time of writing. The fund charges a moderate expense ratio of 0.60%.

Portfolio Construction & Holdings

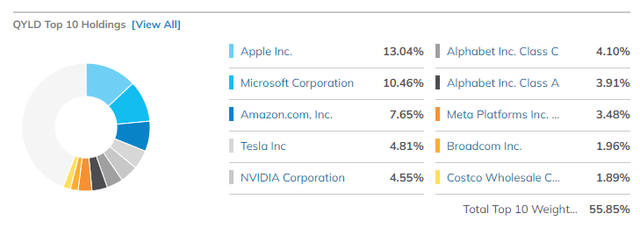

It should come as no surprise that QYLD holds all the mega-cap tech names given it’s a NASDAQ 100 ETF. The top 10 holdings represent 56% of the total holdings of this ETF, so it’s quite concentrated.

QYLD Top 10 Holdings (ETF.com)

The largest holding is Apple (AAPL), followed by Microsoft (MSFT) and Amazon (AMZN). Big tech covers the next few holdings, with a slightly surprising Costco holding in tenth place at a 1.89% weighting.

Of course, these are the stocks the ETF will be selling covered calls on. These are all very liquid names, and thus, the ETF’s managers should have no problem selling even very large covered call positions on these holdings.

Why Cap Your Upside?

When one sells a covered call, they’re effectively capping their upside on a stock up to the time of expiration of the call, while collecting a premium immediately in exchange. The amount of the premium collected depends on how much volatility is being priced into the options. Investors can track the S&P Volatility Index (VIX) to get an idea of how much volatility is currently being priced in. The higher VIX is, the more premium options sellers will collect on calls.

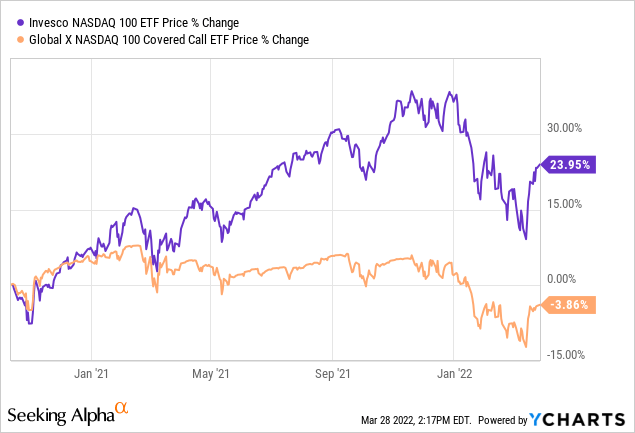

QYLD retains downside exposure by holding shares of stock, but caps the upside by selling calls against this stock. Collecting a premium can be nice, and can provide a bit of income along the way, but in a bull market it is likely that an ETF like QYLD would severely underperform as the underlying stock would constantly be at risk of being called away once the covered call goes in the money. That said, in a bear market, QYLD would be able to buffer the downside with gains produced from covered calls expiring out of the money, meaning the fund keeps the entire premium collected for selling the call.

Indeed, one can see that QYLD has underperformed just holding the Invesco NASDAQ 100 ETF (QQQM) during the bull market over the last few years. This is especially apparent from May 2021 to January 2022, when QYLD struggled to get back to its highs, but QQQM kept on chugging higher.

QYLD holds the stocks in the portfolio long, and as such retains most of the downside of a regular Nasdaq ETF (buffered only by the premiums collected), but caps the upside with covered calls. The premiums collected will only provide a minimal amount of buffer against larger corrections.

Conclusion

While there may be spots in some portfolios for an ETF like QYLD, I would encourage many investors interested in selling calls to avoid QYLD’s fee and learn how to trade such a strategy themselves. It’s more complex than setting and forgetting an ETF, but provides the individual investor with a tremendously greater amount of flexibility. Upcoming stock splits on Alphabet (GOOG) and Amazon will make this strategy far more feasible for individual investors on the top Nasdaq stocks as well. Even if an investor doesn’t want to dabble in individual stocks, simply selling covered calls on ETFs like QQQ or QQQM provides greater flexibility.

Ultimately I would avoid making QYLD a main holding in most portfolios. This may be especially important for investors that are taxed at greater rates on distributions than capital gains. QYLD would be best held in a tax-advantaged account. The income distributions are nice for those that need it, but ultimately capital gains are still better. And if the downside risk is similar, I’ll take an ETF with capital gains over distributions any day.

Be the first to comment