Khanchit Khirisutchalual

Introduction

In May 2022, I wrote an article on SA about Taiwanese electric scooter company Gogoro (NASDAQ:GGR) in which I said that it looked undervalued, but competitors were starting to emerge and I had doubts the planned expansion in China would go smoothly.

I’m turning bullish as Gogoro’s market valuation has dropped by almost half since my first article and H1 2022 financial results were strong. Operating revenues rose by 27.9% to $185.2 million while adjusted EBITDA soared by 61.1% to $22.8 million. In addition, the company recently announced a $345 million syndicated loan which will help it strengthen its balance sheet. Let’s review.

Overview of the recent developments

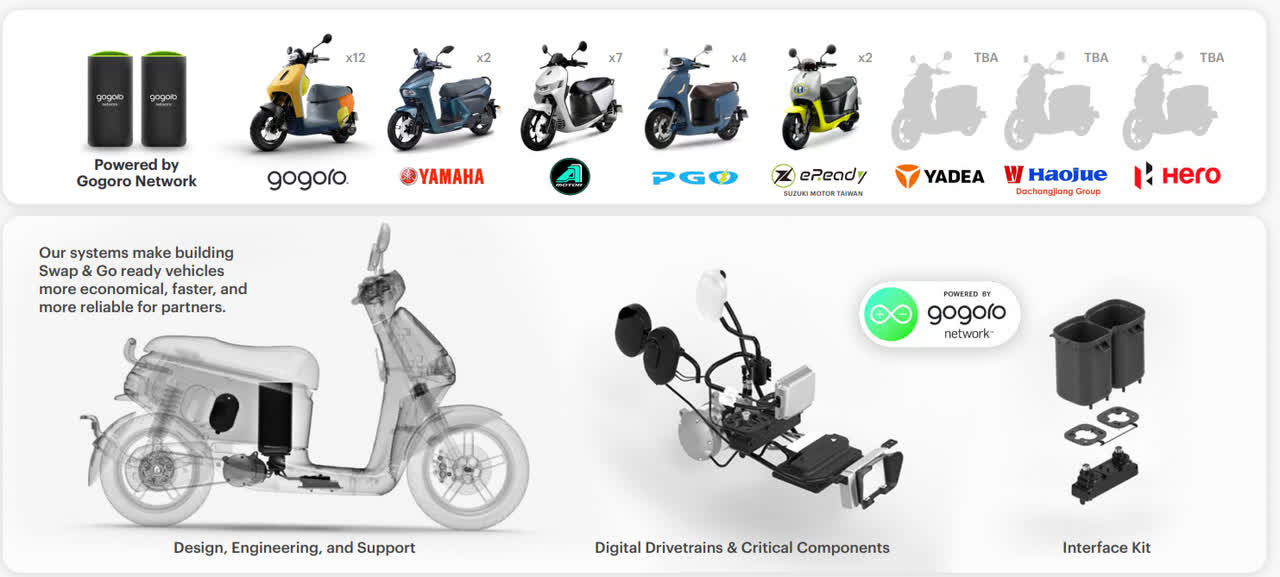

In case you haven’t read my previous article about Gogoro, here’s a short description of its business. The company was founded in 2011 and most of its revenues today come from the sale of electric scooters and battery packs in. It also has a network of more than 2,200 battery swapping stations that supports a total of 10 brands and hosts 340,000 daily battery swaps. This business operates under a subscription-based model.

Gogoro Gogoro

Most of the stations are located in Taiwan and in August 2022, Gogoro surpassed 500,000 monthly battery swapping subscribers on the island. This means that it has added about 50,000 new subscribers since the start of the year. The company has a 92% market share in Taiwan now and it seems that it’s almost unchallenged as this figure has been above 80% since 2017.

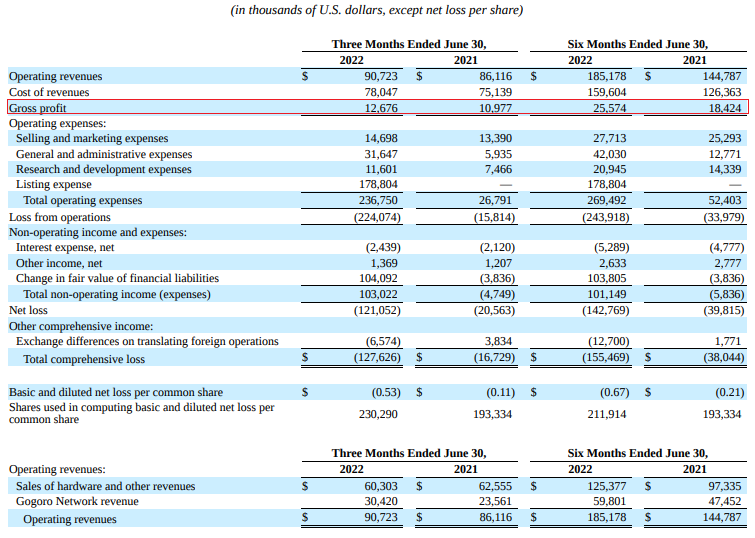

Turning our attention to the financial performance of Gogoro, H1 2022 results looked good as revenues continued to grow rapidly despite a weaker New Taiwan dollar and a challenging market environment due to COVID-19 lockdowns that led to a drop in retail foot traffic and scooter sales. Sales of Gogoro vehicles grew by 3.5% in the first half of the year while high retention rates boosted subscriber growth in the battery swapping business. Thanks to economies of scale, the gross profit margin grew from 12.7% to 13.8%. Yet, the income statement shows a $155.5 million net loss due to $178.8 million listing expenses connected with its SPAC deal in April.

Gogoro

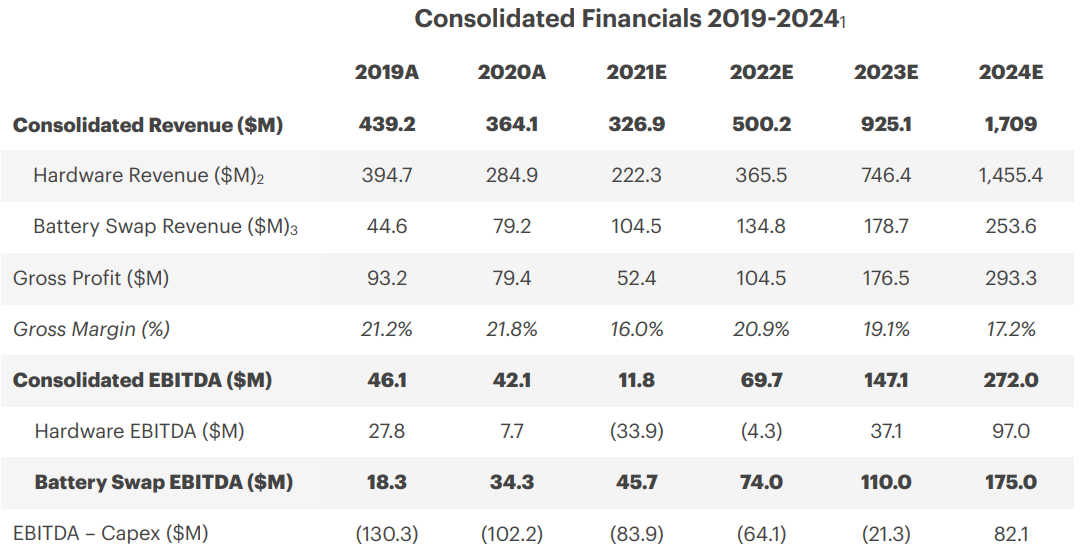

At the time of its listing, Gogoro was expecting to surpass $500 million in revenues in 2022 and its EBITDA for the year was forecast to reach $69.7 million. However, the lockdowns in Taiwan led the company to trim its revenue guidance for the full year to $380 million to $410 million, with Q3 sales accounting for about a quarter of that amount.

Gogoro

In my view, the revised guidance seems too conservative considering Taiwan has just announced that its significantly relaxing COVID-19 measures as mandatory COVID-19 quarantines for arrivals will be scrapped from October 13. In addition, PCR tests for arrivals are also ending and the island is resuming visa-free entry for citizens of all countries that previously had that status. This should significantly boost tourist flows in Q4.

Turning our attention to the expansion in China, the company had a total of 202 battery swap stations across the cities of Hangzhou, Wuxi, and Kunming as of June. COVID-related lockdowns there have led to a slow pace of battery swap station openings and almost all of Gogoro’s revenues still come from Taiwan. The company said during its Q2 2022 earnings call that it’s likely to delay the further expansion of its network to additional cities in the second half of the year. It added that uncertainties will likely extend into next year so I think that EBITDA could surpass CAPEX in 2023, which is a year earlier than initially expected.

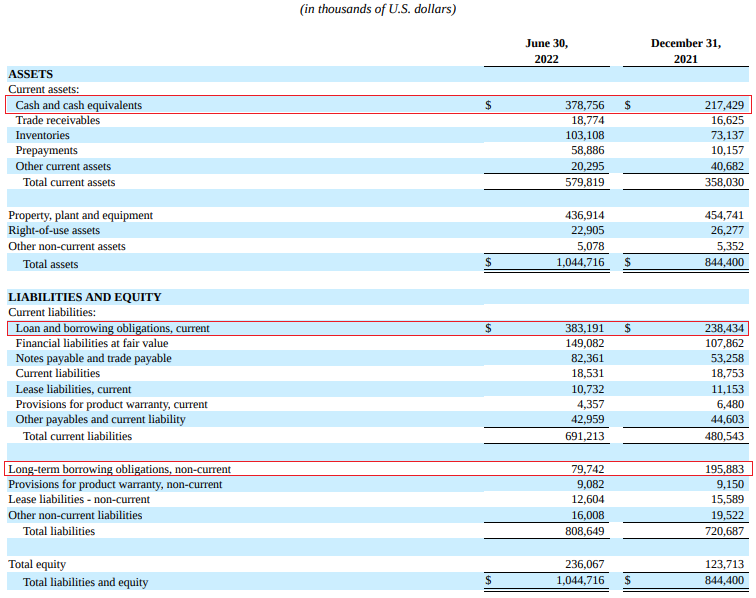

Turning our attention to the balance sheet, the situation looked good at the end of June as net debt stood at just $84 million. Gogoro had $378.8 million in cash at the end of Q2 and this amount could be higher at the end of September as the company just secured a $345 million five-year credit facility, which has a two-year extension option.

Gogoro

Overall, I think that Gogoro posted good H1 2022 financial results despite difficult macroeconomic conditions and I like the economies of scale here. The expansion of the business in China has been delayed but the company has a dominant position in Taiwan and a growing subscriber base. Also, the revised 2022 guidance seems conservative. In my view, adjusted EBITDA is likely to surpass $40 million this year. This would put the forward EV/EBITDA here at about 25x. It looks high at first glance, but you have to take into account that the company is growing fast, and these figures reflect only the Taiwan market. Sure, EBITDA targets have now been pushed back but Gogoro is trading at less than 4x EV/EBITDA based on the original 2024 forecasts. In my view, the 2024 EBITDA figures could be reached by 2026 unless there is a significant global recession.

Looking at the risks to the bull case, I think there are three major ones. First, a new COVID-19 wave could lead to more lockdowns across the world and thus put pressure on Gogoro’s operations in Taiwan as well as further delay its expansion plans in China and India. Second, rising tensions between China and Taiwan could create regulatory pressure for Gogoro in the future. Third, the company could be overestimating its chances to replicate its success in Taiwan across other countries.

Investor takeaway

Gogoro’s revenues and margins are continuing to grow despite a challenging market environment due to COVID-related restrictions and I expect the situation to improve in the coming months as Taiwan is ending its quarantines for travelers in October.

The company has just refinanced its debt and it seems EBITDA could surpass CAPEX earlier than expected due to delays in expansion abroad. Gogoro is much cheaper today than it was in May, and I think it would be undervalued even if it faces hiccups in China or India. I rate this stock as a speculative buy.

Be the first to comment