JuSun/iStock via Getty Images

Over most of the past year, Americans have found themselves increasingly in need of higher incomes. This is mostly because of the inflation that has been ravaging the economy. As this inflation has been largely centered in energy and food, which are necessities for daily life, this inflation has been particularly devastating among those of limited means and has forced many of them to take on second jobs or perform odd tasks to obtain extra money just to feed themselves. Fortunately, as investors, we have other options available to us that we can use to boost our incomes. One of the best of these methods is to invest in a closed-end fund that specializes in the generation of income. This is because these funds provide us with an easy way to obtain a diversified portfolio of assets that can usually provide a higher yield than any of the underlying assets possesses.

In this article, we will discuss the Guggenheim Strategic Opportunities Fund (NYSE:GOF), which is one such closed-end fund (“CEF”) that can be used for this purpose. I have discussed this fund before but that was more than a year ago, so obviously, a great many things have changed. This article will therefore focus specifically on those changes and provide an updated analysis of the fund’s finances.

About The Fund

According to the fund’s webpage, the Guggenheim Strategic Opportunities Fund has the stated objective of providing its investors with a high level of total return in the form of both current income and capital appreciation. As this is primarily a fixed-income fund, this seems like a rather strange objective. This is because fixed-income securities tend to be very limited in their potential for capital gains. After all, these securities do not participate in the growth and prosperity of the issuing company. We do not see a company increase the interest rate that it pays to its bondholders just because its profits went up, for example. As the amount of money paid to the holders of these securities is typically fixed, their price performance tends to be a function of interest rates. Basically, when interest rates increase, fixed-income security prices decline, and vice versa. This is because the yield of newly-issued securities will be at the prevailing interest rate so the price of existing securities adjusts so that they deliver a similar yield to maturity as a similar brand-new security. This is because investors will never buy a security with a lower yield than they can acquire elsewhere.

As a rule, interest rates cannot go below 0% because nobody will save or invest in such an environment. Thus, the potential upside from fixed-income securities is quite limited. A fund that focuses on investing in fixed-income securities like this one will therefore usually have an objective of providing its investors with a high current income. This is probably how we can expect the Guggenheim Strategic Opportunities Fund to deliver its return today, particularly since rising interest rates have made it incredibly difficult to produce capital gains from a fixed-income portfolio.

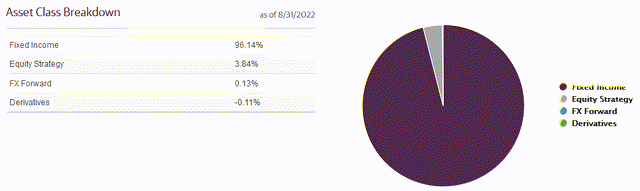

This fund is not exclusively a fixed-income fund, however. In fact, the Guggenheim Strategic Opportunities Fund holds about 3.84% of its assets in common stock:

These common stocks do provide the fund with some potential to generate capital gains. Of course, almost nothing apart from energy has delivered a positive return this year so it is unlikely that it gained very much from this aspect of its portfolio. In addition, 3.84% is such a small percentage of the portfolio that it hardly matters. This could be a sign that the fund’s management does not expect equities to stage a significant rally in the near term. When we consider that one of the biggest causes of the disappointing performance that the capital markets have delivered this year is the Federal Reserve’s switch to a policy of monetary tightening, this is a prescient decision. The current consensus is that the Federal Reserve will raise interest rates in December and raise them again to the 5% to 5.25% range in early 2023 before pausing to evaluate the conditions in the economy. There are some other predictions that this will not be nearly enough though and that the Federal Reserve will have to hike further. Either way, this is not likely to be very good for the stock market.

Unfortunately, the same applies to the fixed-income portion of the fund’s portfolio. As we have already discussed, the price of fixed-income securities tends to vary inversely with interest rates. Thus, the value of the securities that comprise the bulk of the fund’s portfolio will likely decline as the Federal Reserve continues to raise rates. With that said though, the amount that companies pay to their debtholders does not change if the companies’ profits go down. The point of the Federal Reserve’s policy is to push the economy into a recession so we can expect to see companies’ profits go down. We have already seen this as the rising cost of food and energy has forced many consumers to reduce their discretionary spending. The fact that the payments made to the holders of fixed-income securities do not change with the cash flow of the issuing company does mean that the fund’s income is unlikely to vary much in response to the Federal Reserve’s policy even if it does drag down its assets under management and share price.

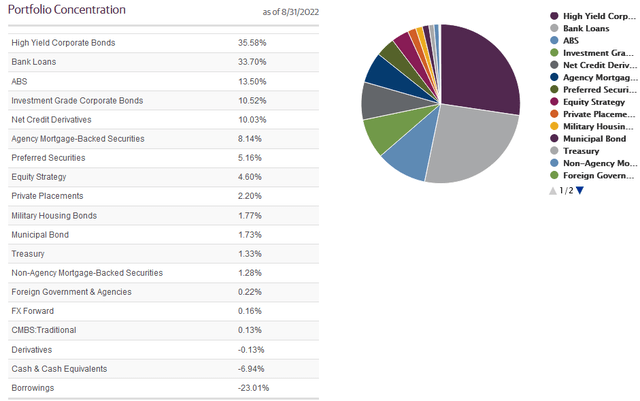

As I pointed out in my previous article on the Guggenheim Strategic Opportunities Fund, the fund’s asset base consists very heavily of high-yield bonds and bank loans. This is still the case, as we can see here:

We can see that 35.58% of the portfolio is invested in high-yield corporate bonds and another 33.70% of the portfolio is invested in bank loans. As bank loans held by closed-end funds tend to be leveraged loans, which are only extended to those companies that already have a significant amount of debt, they have some of the same characteristics as high-yield corporate bonds. Notably, each of these two asset types has a higher default risk than the more commonly-seen investment-grade bonds. This is something that may concern those investors that are concerned about principal protection. However, bank loans are typically secured by some asset that the company owns, just like a mortgage is secured by a house. Thus, the risk of loss is significantly reduced because the bank can seize the asset and sell it off in the event of a default.

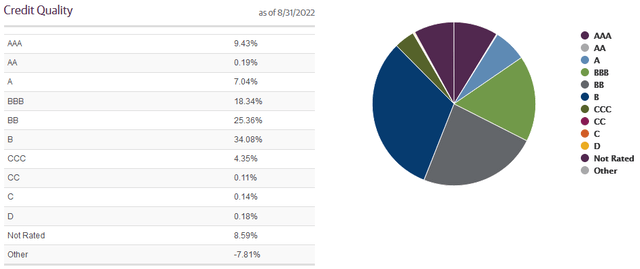

Naturally, none of this helps the fund with its risk of losses from defaults on the high-yield bonds in the portfolio. Fortunately, this may not be as big a problem as some may think. We can see this by looking at the credit ratings across the fund’s portfolio, which theoretically tell us the odds of any particular issuing defaulting on their bonds. Here are how the ratings break down:

Anything with a BBB rating or higher is considered to be investment-grade so we can clearly see that is only a relatively small proportion of the portfolio. However, approximately 59.44% of the portfolio consists of securities rated BB or B, which are the two highest ratings of below-investment-grade securities. According to the official bond rating scale, companies whose bonds have this rating have the sufficient financial strength to weather short-term economic disruptions but may be vulnerable to prolonged economic shocks. We have not had a prolonged economic shock in the United States since the Great Depression, so we can assume that such occurrences are fairly low risk. As most companies with these ratings should be able to handle short recessions and similar events, we can conclude that our risk of loss due to defaults here is relatively low.

Another strategy that the fund can use to reduce its risk of loss due to defaults is to include a large number of securities in its portfolio. This ensures that any default will only have a very small impact on the portfolio as a whole. The Guggenheim Strategic Opportunities Fund has 1,310 individual positions, which certainly qualifies as a large number of positions. If any one of these issuers defaults, it will not have a noticeable effect on the portfolio. The only real risk here would be if a substantial number of companies goes into default at once and in that case, the economy has bigger problems than just the shareholders of this fund losing some money. Overall, we can conclude that the fund’s portfolio is pretty safe despite consisting of a large number of junk bonds and similar securities.

Leverage

As mentioned earlier, closed-end funds are able to use certain strategies that allow them to boost their yields beyond that of any of the underlying assets. One of the strategies that are employed by this fund is the use of leverage. Basically, the fund is borrowing money and using those borrowed funds to purchase fixed-income securities. As long as the interest rate that the fund has to pay on the borrowed money is lower than the yield that it receives from the purchased securities, this strategy works pretty well to boost the overall yield of the portfolio. As the fund can borrow at institutional rates, which are lower than retail rates, this will usually be the case.

However, the use of debt is a double-edged sword because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much debt since that would expose us to too much risk. I do not generally like to see a fund’s leverage above a third as a percentage of its assets for this reason. The Guggenheim Strategic Opportunities Fund currently has a leverage of 24.99% though so it clearly abides by this restriction. This fund appears to be striking a reasonable balance between risk and reward.

Distribution Analysis

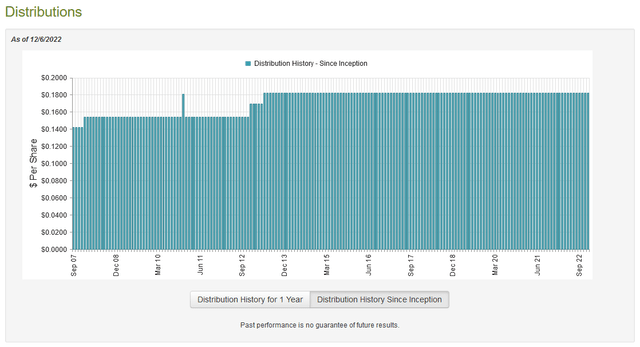

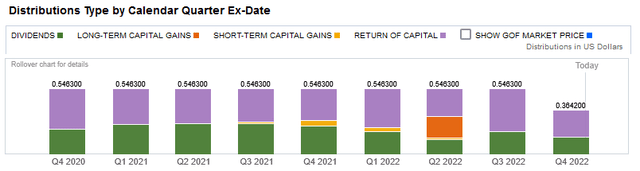

As already mentioned, one of the ways that the Guggenheim Strategic Opportunities Fund seeks to achieve its objective is by providing investors with a high level of current income. It does this by investing in a leveraged portfolio of high-yield bonds so we can assume that the fund likely has a very high yield itself. This is certainly the case as the fund currently pays out a monthly distribution of $0.1821 per share ($2.1852 per share annually), which gives it a 13.39% yield at the current price. The fund has been extremely consistent about its distribution over the years as it has increased it three times and has never cut:

This is one of the best track records that we have seen any fixed-income fund possess. It is something that will undoubtedly appeal to any investor that is seeking a consistent source of income to use to pay their bills or otherwise finance their lifestyles. Unfortunately, a significant percentage of the fund’s distributions in recent quarters has been classified as a return of capital:

This can be concerning because a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. However, there are other things that could cause a distribution to be classified as a return of capital, such as the distribution of unrealized capital gains. However, as was already mentioned, capital gains are very hard to come by for a fixed-income fund given today’s environment of monetary tightening. Thus, we want to investigate the fund’s finances to determine exactly how it is financing these distributions in order to figure out how sustainable they are likely to be.

Unfortunately, we do not have a particularly recent report to consult for that purpose. The fund’s most recent financial report corresponds to the full-year period ending May 31, 2022. As such, this report will provide us with no particular insight into the fund’s performance over the past several months. However, the Federal Reserve started raising rates in March so at least we will be able to see the early effects of the policy change on the fund’s portfolio. During the full-year period, the fund received a total of $75,544,745 in interest and another $10,033,761 in dividends from the assets in its portfolio. This gives it a total income of $85,578,506 during the reporting period. The fund paid its expenses out of this amount, leaving it with $61,747,184 available for the shareholders. This was nowhere close to enough to cover the $174,976,235 that the fund actually paid out to its investors during the period. This is certainly concerning at first glance.

However, the fund can obtain money from other sources that can be used to cover the distribution. The most important of these is capital gains. Unsurprisingly, the fund failed at this endeavor during the year. It did manage to realize net gains of $50,862,539 but this was more than offset by net unrealized losses of $239,758,554 during the period. Overall, the fund failed to cover its distributions through income and capital gains, which explains the return of capital distributions. With that said, the fund did sell $252,476,733 worth of new shares of its own stock during the period. This brought in enough money to cover the distribution but I do not like to see a fund relying on bringing in new money from investors just to pay its distributions. So far, this does appear to be a one-time event as the fund did manage to cover its distributions solely from income and capital gains in the previous year. We want to keep an eye on this situation though and make sure that the fund switches back to a more sustainable way to pay its distributions going forward.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Guggenheim Strategic Opportunities Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market cap of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of the fund when we can buy them at a price that is less than the net asset value. That is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. This is unfortunately not the case right now. As of December 6, 2022 (the most recent date for which funds are currently available), the Guggenheim Strategic Opportunities Fund had a net asset value of $12.97 per share but its shares currently trade for $16.37 per share. This gives the shares a 26.21% premium to the net asset value. This is one of the highest premiums of any closed-end funds, although it is very much in line with the 26.26% premium that the shares have had on average over the past month. It is quite possible that the shares will fall back down to earth at some point and as such, it is rather risky to purchase shares of the fund at this price.

Conclusion

In conclusion, the Guggenheim Strategic Opportunities Fund is one of the most popular fixed-income funds in the market due to its high yield and consistent payout. There is a lot to like here as the portfolio is quite well diversified and should be relatively safe from default risk despite being heavily invested in below-investment-grade debt. The biggest concern here is that the fund failed to cover its distribution using its income and capital gains during the most recent period. Despite the general attractiveness of the fund’s portfolio though, the price right now is far too high to justify a purchase today. It would be best to wait until GOF starts trading at a level close to its net asset value before buying in.

Be the first to comment