BlackJack3D

In September last year, in my thesis entitled “One small step for Apple but a big leap for Globalstar”, I invoked a potential collaboration between the two companies for satellite-based communications. One year later, things materialized with Apple (AAPL) mentioning that it had integrated a satellite-based feature for contacting emergency services in its iPhone 14 in the event of a subscriber being unable to connect through the network of land-based mobile network operators.

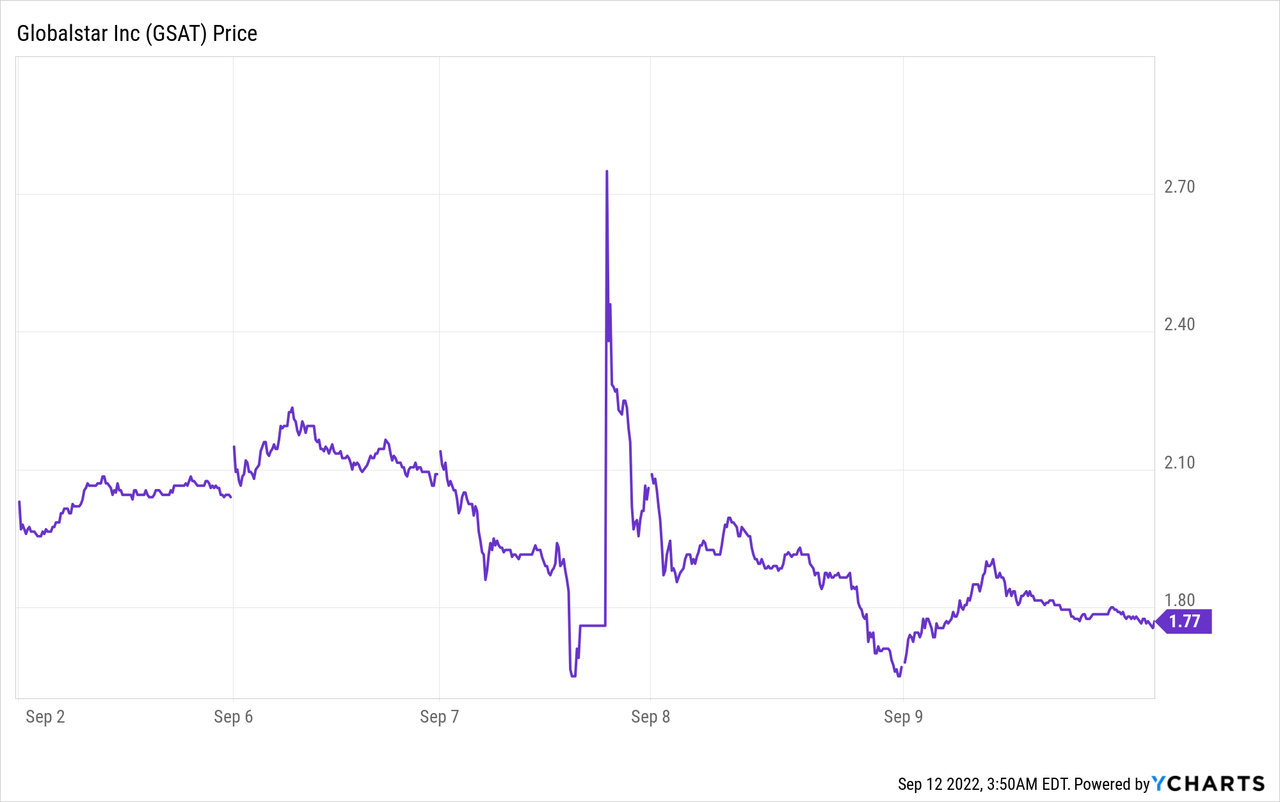

Now, Globalstar (NYSE:NYSE:GSAT) through an SEC filing dating September 7 confirmed that Apple was its partner. Subsequently, the stock surged by more than 40% to above $2.7 before dipping back to the $1.77 level as shown in the chart below.

Thus, it appears that the market may have overreacted before investors lost enthusiasm, and for those who have not been able to profit from that upside, I elaborate on a trading strategy using the momentum factor.

I start by providing some important clarification in a fascinating, but an often over-hyped area of technology.

Satellite-based Communications

First, this is not about providing 5G or even 4G anywhere on the earth as being attempted by AST SpaceMobile (ASTS) with its Blue Walker3 satellites, the first of which was put into orbit a few days back. Instead, the Apple-Globalstar partnership seems more similar to the one recently brokered between Elon Musk’s SpaceX (SPACE) and T-Mobile (TMUS) where the objective will be to allow for text-based messaging which necessitates a much lower bandwidth of 2-4 Mbits compared to 100 Mbits for the 5th generation cellular mobile network.

Looking deeper into Elon Musk’s venture, the aim is to use Starlink’s Leo (low earth orbit) satellite constellation to allow subscribers on T-Mobile’s network to make emergency calls or text messages in order to inform rescue services where they are stranded.

Now, such a service already exists but is only available through the specialized satellite phones (as in the picture below) of service providers like Globalstar, Inmarsat, Iridium (IRDM), or Thuraya together with a subscription service that varies from $375 to $1,295 annually plus additional fees and voice call charges depending on the chosen plans.

Global Star products showing the touch SOS button (investors.globalstar.com)

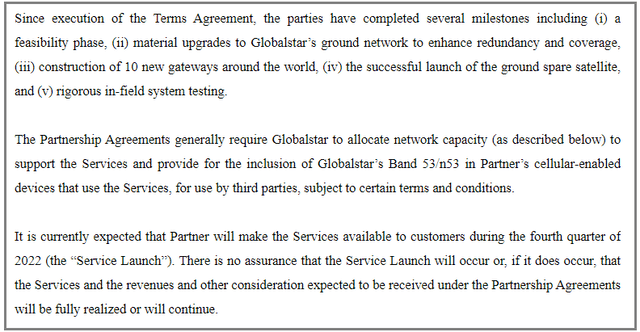

Thus, both partnerships aim to democratize access to the niche satellite-telephone markets so that calls can be effected directly from someone’s phone. However, Globalstar seems to be at a more advanced stage as it has already conducted a feasibility study, and field tests as well as some upgrades to its ground network, with the service to be launched later this year.

On the other hand, for T-Mobile, testing has to be done using the 1.9 GHz frequency spectrum and SpaceX’s Falcon 9 rockets will have to be slightly altered to accommodate satellites equipped with longer phased-array antennae than those currently used by Starlink for its wireless internet service.

Positioning Within the Telco Ecosystem

As for the iPhones, they have to be equipped with Globalstar’s band 53. Now, for cellular devices to communicate, they are equipped with modems, which for Apple have traditionally been Qualcomm’s (QCOM) 5G X60. The newer generation X65 should include band 53 for the latest iPhone 14.

Interestingly, the idea seemed originally to add global 5G band support for n53 using the X65 chip, but, the fact that the announcement is restricted to emergency services and not 5G may point to a moderation in the initial intent. It is a more realistic one too when you think of the challenges for a phone signal to be received by an antenna located about 500 miles away while the satellite is traveling at 17 thousand miles an hour.

SEC filings with respect to the Apple partnership (www.seekingalpha.com)

At the same time, it shows that Apple’s venture into satellite communications is not intended to replace or compete with the terrestrial antennas of mobile network operators like AT&T (T) and Verizon (VZ) whose tower and radio antenna infrastructure are essential for 5G availability. Instead, the Globalstar network will extend coverage in remote locations where subscribers cannot obtain a 4G or even a 3G signal.

Now, this emphasis on emergency services also deserves to be highlighted in light of regulations. With Apple being a big tech, there will surely be regulatory scrutiny into the venture as is often the case with telecommunication providers when they pass on charges to consumers, especially those who are economically disadvantaged. Now, satellite-based emergency services can become crucial in order to save lives, especially when ground-based infrastructure has been disabled following floods or fires and are more “acceptable” to regulators.

In this respect, the service launch is expected for the fourth quarter of this year and Apple intends to provide the “Emergency SOS” feature free for at least the first two years initially in the United States and Canada. In this respect, Globalstar acts as a wholesaler to the tech giant.

Thinking aloud, Apple’s role as a device manufacturer is evolving to a service provider, and the strategy to provide services for free is somewhat similar to T-Mobile which also intends not to charge for satellite connectivity for some service plans. This brings us to the financial part.

The Financials

According to the SEC filing, Globalstar’s total revenues for 2023 which includes proceeds from the partnership agreement will be between $185 million and $230 million. The midpoint would constitute a 66% gain over 2021’s $124.3 million and depends partly on the attainment of certain performance targets. Noteworthily, these revenues include sales from its incumbent Duplex, SPOT, and IoT businesses.

Talking profitability, EBITDA margins should reach 55% (table below), compared to 30% currently.

SEC filings with respect to the Apple partnership (www.seekingalpha.com)

Going into details, Apple will finance 95% of the Capex incurred by Globalstar for deeper North American coverage and expansion of its satellite constellation to the rest of the world. However, this payment will be made over the course of the “useful life of a satellite” which can last up to 15 years. This implies that in the meantime, the satellite company will most likely have to look for a loan to finance the construction and launch of the satellites, as it is equipped with only $13 million of cash.

In order to obtain an idea of the amount to be invested, I take into account that earlier in February, Globalstar signed a contract with MDA (Macdonald, Dettwiler and Associates) to buy 17 satellites for $327 million. Optionally, it can buy 9 additional satellites for $11.4 million each, which totals $102.6 million. Together, this comes to $429.6 million (327+102.5). Now, add to this the cost of launching satellites, and you approach the figure of $450 million, which according to an unconfirmed source is the amount that Apple will be paying to Globalstar.

Therefore, the satellite play will have to contract an additional debt of about around $450 million, which would add to its existing $360.6 million. However, taking into consideration that the satellites should be delivered by 2025 since the service has to be operational by 2026, means that Globalstar does not need to contract the full debt amount this year. Continuing on a positive note, some of the costs related to the borrowings will be borne by Apple itself.

Valuations and Key Takeaways

Now, with an enterprise value of $3.53 billion and a partnership with America’s most valued company, Globalstar should not find it too hard to raise additional debt capital. For this purpose, it has mandated Goldman Sachs (GS) and the financing plan should be ready by Q4. Additionally, as per the partnership agreement, Apple can purchase up to 2.64% of Globalstar’s outstanding common stock at a pre-established price of $1.01 per share. This amounts to the tech giant taking a tiny stake in the satellite company.

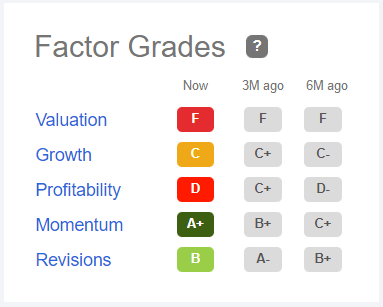

Consequently, after the Apple deal which enables it to generate revenues and profits, namely by optimizing its existing 48 satellites while at the same time expanding its fleet, Globalstar makes for a valuable investment. However, it is way overvalued relative to the IT sector median with a valuation grade of “F” as shown in the table below. Moreover, its forward price to sales multiple of 23.64x exceeds the sector median by more than 1700% which may not make it appealing to value investors.

Factor Grades (www.seekingalpha.com)

However, this is a stock which scores a momentum grade of A+ signifying that it could surge back to above the $2 level, possibly after a successful launch, by one of the Rocket Lab’s (RKLB) launchers, as this satellite launcher was named by Globalstar’s CEO back in March. Other news connected with the service launch could also trigger an upside. In the meantime, in the absence of news, the stock should retrench to $1.56, or its 50-day MMA level, constituting an opportunity to buy.

Furthermore, the fact that Apple did not announce the name of the satellite provider could imply that it is open to a competitor. This led to news that Elon Musk is in talks with the tech giant for the potential use of SpaceX’s Starlink satellite constellation. However, subscribing to Starlink means hooking a dish antenna to your home in order to obtain a WiFi signal on your smartphone or laptop, not the sort of remote connectivity you would expect outdoors.

Finally, remote emergency services are only possible if there is the right hardware in your iPhone, namely the chipset. In this respect, Globalstar seems well ahead.

Be the first to comment