grandriver

Viper Energy Partners LP (NASDAQ:NASDAQ:VNOM) is one of the more interesting companies available in the market for income-focused energy investors. This is because the company acts almost like a resource streaming company, such as we might see in the precious metals space, although Viper Energy Partners operates in the traditional crude oil and natural gas space.

In short, the company purchases royalty interests in various crude oil and natural gas properties in the Permian Basin and then takes a percentage of the resources that are produced on the property. As might be expected, this makes the company a very good way to play energy prices and collect a very attractive yield at the same time. Indeed, the fact that the company’s partnership units are up 62.40% over the past twelve months helps to reinforce this conclusion.

Despite the dramatic increase that we have seen in the company’s units though, Viper Energy Partners still boasts a very attractive 10.31% yield at the current price. This should certainly be sufficient to reduce some of the annoyance that you would otherwise have when filling up your car or paying your heating bill.

As all of this sounds good, let us investigate and see if Viper Energy Partners could be a good choice for your portfolio.

About Viper Energy Partners

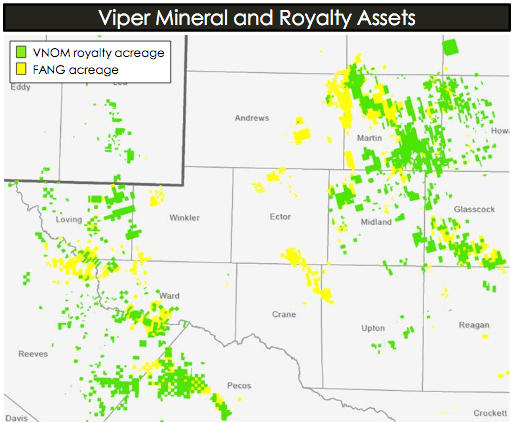

As stated in the introduction, Viper Energy Partners is one of the more interesting and unique master limited partnerships in the market today. The company was established by one of the dominant operators in the Permian Basin, Diamondback Energy (FANG), for the purpose of acquiring royalty interests in various crude oil and natural gas-rich properties located throughout the region. The company has enjoyed a reasonable amount of success at this, as the firm currently has 26,718 net acres upon which it collects a royalty interest:

Viper Energy Partners

The company’s royalty interests entitle it to a percentage of the resource production on the acreage, which of course provides it with a great deal of exposure to changes in energy prices. Thus, the unit price tends to rise when energy prices rise and decline when prices fall, just like we see with most of the producers in the space. However, Viper Energy Partners has a generally safer business model than the upstream companies. This is because Viper Energy Partners has essentially no exposure to changes in the cost of production. As I pointed out in a previous article, the price of steel and diesel have been increasing over the past year or two, and this has increased the cost involved in producing a barrel of oil compared to where they were a year ago. Viper Energy Partners was virtually unaffected by this, however. Indeed, one of the only factors that have a significant impact on the company’s financial performance is energy prices, which we all know have been reasonably positive lately.

As Viper Energy Partners was created by Diamondback Energy, we might expect that Diamondback Energy accounts for an outsized proportion of the drilling activity on the company’s acreage. However, Diamondback Energy is only responsible for about 55% of the production that is occurring on Viper Energy Partners’ acreage, which is a much lower percentage than might be expected. This is something that is quite nice to see, though. This is because it is generally not a good idea for any company to be too dependent on any other. After all, such a scenario could result in any problems present at the customer migrating through to the company that we are invested in. Fortunately, though, Viper Energy Partners seems to have enough diversity to reduce the risks of any serious problems. After all, about 45% of its revenue is coming from companies other than Diamondback Energy.

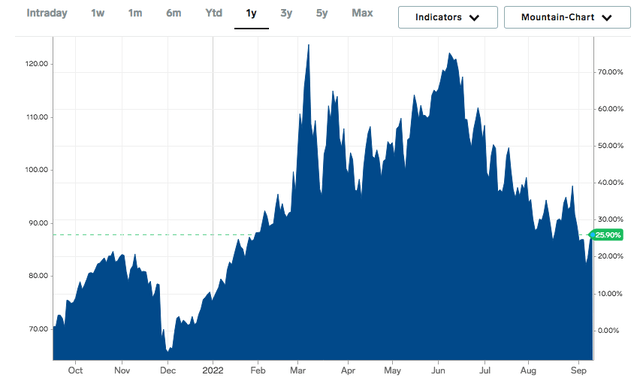

It is not exactly news to anyone reading this that energy prices have increased significantly over the past several months. As of the time of writing, West Texas Intermediate is up 25.90% over the past twelve months:

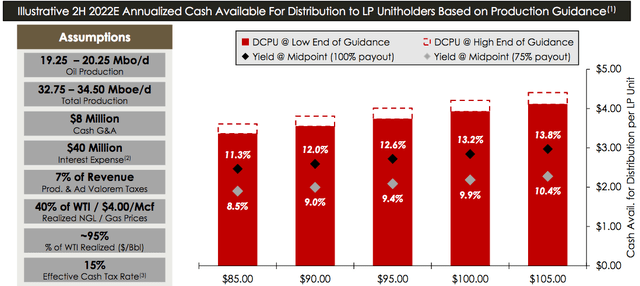

This has been allowing Viper Energy Partners to generate copious amounts of cash flow, which is the biggest reason why the company has been increasing its distribution over the past few quarters. Indeed, if West Texas Intermediate crude oil were to go to $95 per barrel, the partnership would be generating a distributable cash flow of $3.75 per common unit. Assuming that it distributes all of its cash flow, that would give it an 11.92% yield at the current price:

This makes Viper Energy Partners one of the best vehicles to use to hedge your exposure to energy prices as a consumer. With that said, some readers may point out that energy prices have retreated a bit lately so it is no longer as critical to hedge exposure to energy prices as it was earlier in the year. However, even at $85 per barrel West Texas Intermediate crude oil, Viper Energy Partners is going to be able to boast one of the highest yields in the market. In addition, there are some signs that the pullback in energy prices over the past few weeks is merely a respite from a long-term inflationary trend as the fundamentals point to rising prices going forward. We will discuss this in more detail later in this article.

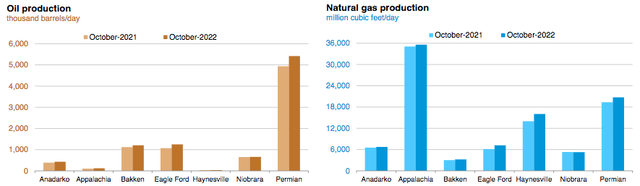

Viper Energy Partners is able to benefit from more than simply rising energy prices, however. As I have pointed out in a few past articles, energy companies in the Permian Basin have been boosting their production of crude oil and natural gas in aggregate. The United States Energy Information Administration shows this quite clearly in the most recent drilling productivity report:

U.S. Energy Information Administration

Diamondback Energy itself has stated that it is not particularly interested in growing its production, but as we have already seen, 45% of the production occurring on Viper Energy Partners’ royalty interests is being performed by other firms. Viper Energy Partners has thus benefited from this production growth, as there was an average of 33,560 barrels of oil equivalents per day produced on average on the company’s acreage during the second quarter of 2022. This was an all-time high for the partnership, which naturally had a positive impact on Viper Energy Partners’ cash flows. After all, the higher production meant that Viper Energy Partners had more products to sell, which boosts revenues and cash flows, all else being equal. The combination of high energy prices and record production resulted in Viper Energy Partners reporting its highest distributable cash flow ever during the second quarter:

Viper Energy Partners expects this trend to continue. Based on drilling plans produced by the various companies operating on its royalty interests, the company expects to realize an average of 32,750 to 34,500 barrels of oil equivalents per day in the second half of 2022, which is a bit higher than it had in the first half of the year. This should result in the company generating higher cash flows during the second half of the year than it did in the first unless oil prices decline substantially. That is, to put it mildly, highly unlikely. Thus, we could very easily see the company raise its distribution over the next few quarters, which increases the appeal of making an investment today.

Fundamentals Of Crude Oil And Natural Gas

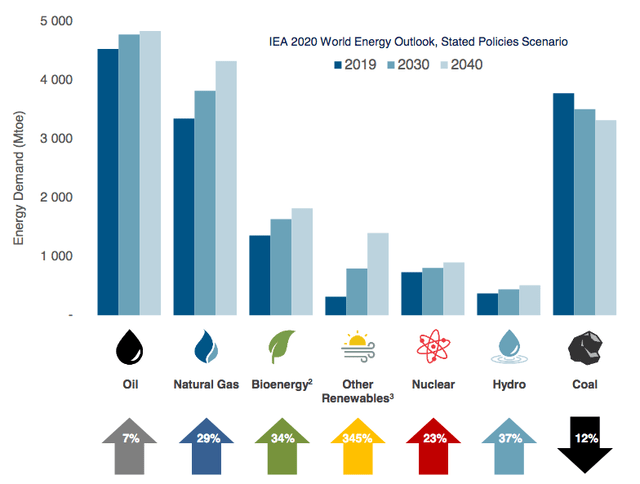

As we have seen throughout this article, Viper Energy Partners benefits significantly whenever energy prices, and to a lesser extent production, increase. Fortunately, that is likely to be the case due to the basic laws of economics. In particular, the demand for both crude oil and natural gas is likely to increase much more than the supply of these resources going forward. This may seem strange as the media keeps telling us that the demand for fossil fuels will go away in the near future as the “green economy” takes hold and electricity generated by renewables replaces fossil fuels for most tasks in our lives. However, according to the International Energy Agency, the global demand for crude oil will increase by 7% and the global demand for natural gas will increase by 29% over the next few decades:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

Perhaps surprisingly, the natural gas demand growth is being driven by concerns about climate change. As everyone reading this is certainly well aware, these concerns have led governments all over the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. The most popular strategy that is being used to accomplish this is to encourage utilities to replace their old coal-fired power plants and replace them with renewables. However, renewables have one very big problem, which is their lack of reliability. After all, solar power does not work when the sun is not shining and wind power does not work when the air is still. In order to overcome these problems, utilities will frequently supplement renewables with natural gas-driven turbines. This is because natural gas burns much cleaner than any other fossil fuel and is still reliable enough to ensure the functionality that we expect from a modern electric grid. This is why natural gas is often called a “transitional fuel” since it provides a way to reduce carbon emissions and ensure the proper functioning of modern society until renewables can do the task on their own.

The case for forward crude oil demand growth may be harder to understand. After all, most of us live in nations in which the government is actively attempting to reduce the consumption of crude oil. However, it is a very different story in the numerous emerging nations around the world. These countries are expected to see tremendous demand growth over the projection period, which will have the effect of lifting the citizens of those nations out of poverty and putting them firmly into the middle class. These newly middle-class people will naturally begin to desire a lifestyle that is closer to that of their counterparts in the developed nations than they have now. This will result in the growing consumption of energy, including energy derived from crude oil. As the populations of these nations vastly exceed the populations of the developed nations, the rising demand for crude oil from the developing world will more than offset the stagnant-to-declining demand in the Western nations.

It is, however, somewhat unlikely that the production of crude oil and natural gas will grow sufficiently to meet this demand growth. One major reason for this is that the energy industry has been underinvesting in production and midstream capacity since the 2015 bear market. This is why the offshore drilling industry never recovered from that event. According to Moody’s, the energy industry must immediately increase upstream spending by $542 billion (about 54%) in order to avoid a supply shock. It is highly unlikely that the energy industry will actually do this. After all, it is under attack from both politicians and environmental activists that are attempting to get it to improve the sustainability of its operations. In addition, investors in energy companies are demanding better returns since the industry has been one of the worst-performing sectors over the past decade. These two factors point to demand growth significantly exceeding supply growth of hydrocarbons going forward, which the laws of economics tell us should result in higher prices. As we have already seen, Viper Energy Partners is a beneficiary of high energy prices. Thus, this dynamic strengthens our thesis for investing in the company.

Distribution Analysis

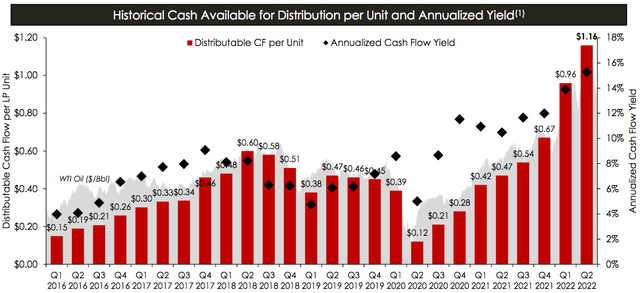

One of the biggest reasons for investing in Viper Energy Partners is the high distribution yield that the company tends to possess. Indeed, as of the time of writing, Viper Energy Partners yields 10.31%, which is substantially above the 1.46% yield of the S&P 500 index (SPY). As might be expected, Viper Energy Partners’ distribution has varied over time, which is mostly a function of energy prices:

The fact that the company’s distribution tends to vary with time will likely reduce the appeal of this company in the eyes of someone that is looking for a safe and steady source of income that they can just forget about. This company should not be thought of in that way. Rather, it acts as a hedge against energy prices, which are a major expense for many households. This is because the company will end up sending its investors more money when prices are high. Thus, it is something of a hedge against a person’s exposure as a consumer.

As is always the case though, it is critical that we ensure that the company can actually afford the distribution that it pays out. The usual way that we do this is by looking at its distributable cash flow, which is a non-GAAP measure that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available to be distributed to the limited partners. During the second quarter of 2022, Viper Energy Partners reported a distributable cash flow of $87.982 million, which works out to $1.16 per common unit. The company only paid out $0.81 per unit, however, which gives it a distribution coverage ratio of 1.43x. This is lower than most of the companies that we recommend here at Energy Profits in Dividends, but it is reasonable.

With that said, Viper Energy Partners does not advertise itself as boasting a sustainable distribution as the distribution varies with energy prices. It should certainly be able to maintain its distribution at the current level as long as energy prices remain at or above today’s levels, however.

Conclusion

In conclusion, Viper Energy Partners is a somewhat unique partnership in the energy space. This uniqueness is something that can work to the benefit of investors, however. The company’s business model provides a natural hedge against the impact of high energy prices that we all face in our regular lives and it may deserve a place in your portfolio because of that. The company should not really be thought of as an “income” investment but rather as a way to take the edge off of inflation since high energy prices tend to cause that event. Overall, the company is recommended for that reason, although the 10.31% current yield is certainly appealing in its own right!

Be the first to comment