courtneyk

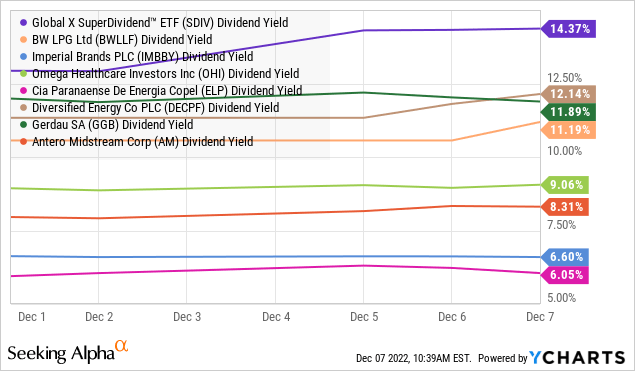

The Global X SuperDividend ETF (NYSEARCA:SDIV) takes an extreme approach to a high-yield strategy by simply investing across 100 of the highest dividend-paying stocks globally. The attraction here is a double-digit dividend yield currently above 12% through a monthly distribution that represents a targeted exposure to a unique market segment.

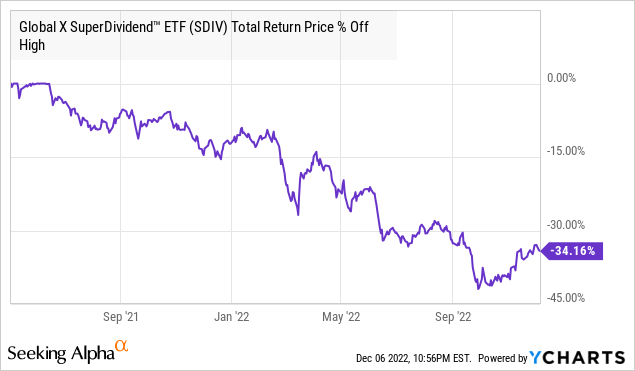

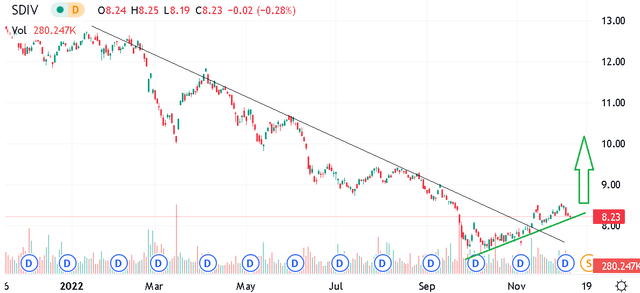

That being said, SDIV’s performance has been challenged over the past year amid several macro headwinds including the impact of a stronger Dollar on international stock holdings and the strategy’s sensitivity to rising interest rates. Indeed, the fund is down more than 30% over the past year amid the broader market volatility.

Still, we’re taking a more positive outlook following the deep correction considering several reasons to expect a rebound into 2023. Signs indicate the Dollar is trending lower while interest rates have also stabilized in recent months. Next, while the fund’s position in Chinese stocks was a drag last year, developments in the country have set up a more positive momentum. Overall, we see value in SDIV which can work in the context of a diversified portfolio to both add diversification and increase income.

What is the SDIV ETF?

SDIV technically tracks the “Solactive Global SuperDividend Index” which features several screening criteria and inclusion rules that ultimately decides the composition of the fund.

Through an annual review, the top 100 companies with the highest dividend yields are included that are listed on a major regulated exchange with a market cap of at least $500 million. The selection methodology considers companies with a dividend yield above 6% and less than 20% for potential inclusion. There is also a process to screen for any pending dividend cuts or looming suspension.

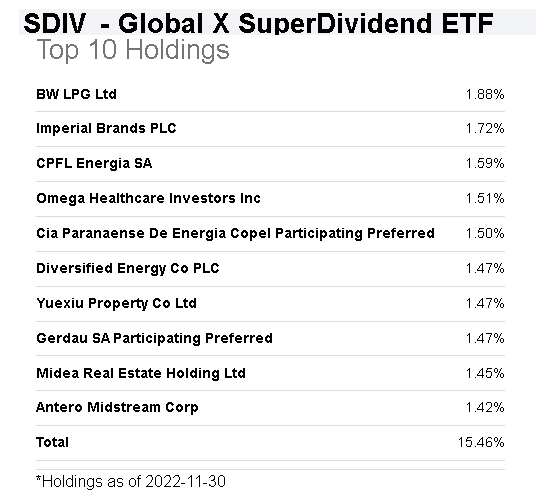

An important point here is that the underlying index features an equal-weighted methodology that is further adjusted based on liquidity measures during a quarterly rebalancing. The largest holding in the fund has a 2% weighting which means no single stock dominates the composition.

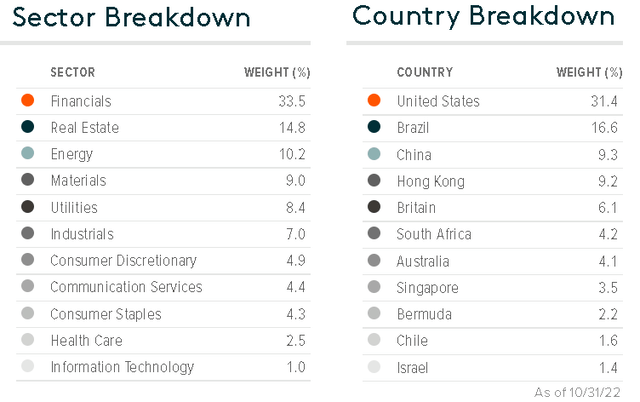

Naturally, the breakdown of the fund has a tilt towards sectors that typically offer generous shareholder payouts between financials representing 34% of the fund, followed by real estate at 15%. Notably, this group does not include business-development companies ((BDCs)) or limited partnership structures. Energy and materials sector companies are also well represented at 10% and 9% of the weighting, respectively.

By Country, U.S. stocks have the largest position at 31% of the fund followed by emerging markets between China and Hong Kong holdings together representing 19%. Down the list, SDIV has important positions in Brazil stocks at 17% and other commodity exporters like South African and Australian companies each with a 4% weighting.

Taking a look at some of the top holdings, the largest current position is in local shares of Singapore-based shipping company BW LPG Ltd (OTCPK:BWLLF) with a 1.9% weighting. There is also U.K.-based tobacco stock Imperial Brands PLC (OTCQX:IMBBY), along with Brazilian utilities CPFL Energia SA (OTC:CPFEY) and Cia Paranaense De Energia Copel (ELP).

The takeaway here is an otherwise good diversification across different types of companies that most investors likely currently do not own. In many cases, only thinly traded over-the-counter shares are available for trading in the U.S. which adds to SDIV’s allure as a global fund.

Seeking Alpha

More importantly, what all the holdings have in common is their high-yield profile which contributes to the fund’s monthly payout. The energy and materials sector has been supported by record earnings for many companies this year with Antero Midstream Corp (AM) with its 8% yield as one example. Brazilian steel maker Gerdau SA (GGB) also yields an impressive 12%.

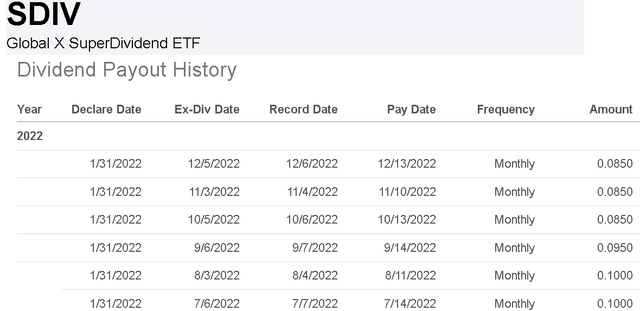

The current monthly distribution of $0.085 implies a forward yield of 12.4%. Notably, this amount has been reduced from $0.10 at the start of the year based on market conditions. Assuming the equity market performance remains stable or improves from here, we expect this distribution to be sustainable for the foreseeable future.

It’s worth mentioning that the fund sponsor Global X has recently announced a reverse stock split for SDIV and other ETFs in the group effective after the market close on December 19th. The 3-to-1 reverse stock split will increase the price per share of the fund with a proportionate decrease in the number of shares outstanding. The effort here is simply to adjust the trading price of the fund from the current level under $9 to a higher nominal amount. The value of the NAV will not be impacted, while the per shares distribution amount would reflect the adjustment going forward.

SDIV Outlook 2023

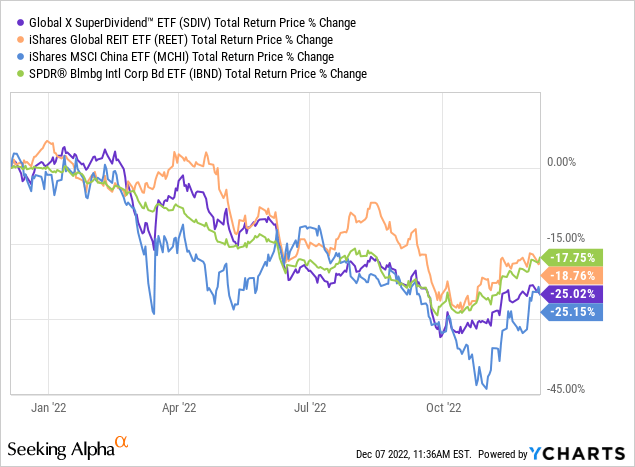

We already touched on the poor performance of SDIV this year with several factors at play. From a high-level perspective, the global theme of monetary tightening across Central Banks worldwide evident by rising interest rates means that high-yield stocks become relatively less attractive on a risk-adjusted basis. The stronger Dollar has also hit international stocks that generate the bulk of their sales and earnings in foreign currencies.

The real estate sector, in particular, to which SDIV has a large exposure is historically sensitive to higher interest rates and has underperformed this year amid the slowing in property prices worldwide. There is also SDIV’s weighting in China and Hong Kong companies that have faced specific local market dynamics between lingering Covid disruptions in the region as well as investor risk aversion eyeing regulatory uncertainties.

These impacts are evident through benchmarks like the iShares Global REIT ETF (REET) down 19% year-to-date, along with the iShares MSCI China ETF (MCHI) losing more than 25% of its value. Rising interest rates have translated to a global rout in bonds with the SPDR Bloomberg International Corporate Bond ETF (IBND) off 18%. The point here is to place SDIV’s performance in perspective as not necessarily a “bad” fund but simply correlated to global trends.

On the other hand, there have been some encouraging developments that could suggest either the cycle low is in, or the downside is limited from the current level following what has already been a deep selloff.

First, signs indicate inflation is cooling off worldwide which could provide some flexibility for Central Banks to ease off the pace of rate hikes. This is a good turn of events compared to conditions at the start of the year where scenarios including a hyperinflation disaster were discussed as a possibility.

Interest rates pulling back from their highs provide some support for high-yield stocks, evident by the rally in SDIV off its lows in early October. The Dollar has responded by breaking down from a long-running uptrend with the weakness acting as a tailwind for foreign stocks.

Finally, the headlines out of China have also been more positive considering reports the country is easing its “Covid-zero” policies. The result is positive for local market conditions in a broader re-opening theme that also has implications for global trade and other emerging markets. There has also been some improving regulatory clarity with the U.S. and China agreeing to enhance auditing rules and accounting transparency. The setup here is good for investor sentiment across SDIV positions in Asia-Pac holdings.

SDIV Price Forecast

The current level provides investors with an opportunity to lock in an attractive yield with an upside to the share price from what are still depressed levels. The bullish case for SDIV is simply that the macro picture evolves better than expected, accompanied by a recovery of investor sentiment to high-beta international securities. We see SDIV trending higher over the next several months as our base case.

On the other hand, the white elephant in the room comes down to what are still major risks worth watching. The concern is that the potential for a deepening recession in 2023 defined by a surge in global unemployment and a decline in trade activity could open the door for another leg lower in global stocks. The situation in Russia-Ukraine is also volatile. Headlines out of China and the trading action in the Dollar remain key monitoring points.

Be the first to comment