Ethan Miller

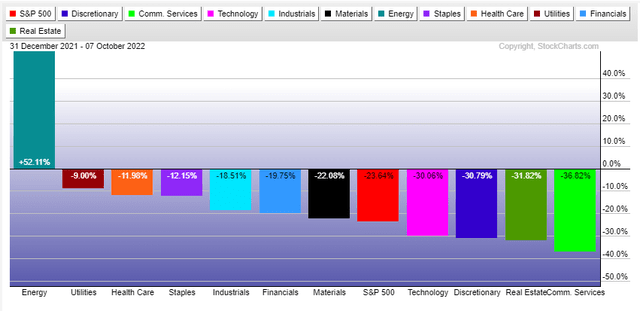

In an awful year for investors, the worst sector has consistently been Communication Services. The Select Sector SPDR Comm Services ETF (XLC) is down 37% in 2022 versus a 24% S&P 500 drop.

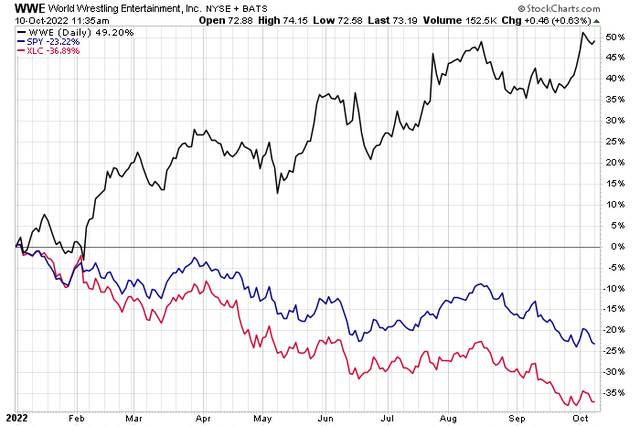

One sports entertainment company has weathered the storm with flying colors. Cue the intimidating walk-out music as WWE enters the ring with massive alpha year-to-date. But will the stock remain king of the investment ring?

2022 Sector Returns: Communication Services Pinned Down

WWE Bodyslams Its Sector And The Broad Market

According to CFRA Research, World Wrestling Entertainment, Inc. (NYSE:WWE), an integrated media and entertainment company, engages in the sports entertainment business in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. It operates through three segments: Media, Live Events, and Consumer Products.

There is uncertainty, but optimism, regarding how well the company transitions from being strongly controlled by Vince McMahon to the new team of executives. The stock generally rallied in the months after McMahon announced he would be stepping away. Also encouraging in the eyes of investors was that former superstar Paul ‘Triple H’ Levesque would be the sports entertainment firm’s chief content officer. Meanwhile, Frank Riddick will be president. Other upside risks include a key TV rights deal ahead of the current agreement’s 2025 expiration, according to analyst Peter Supino.

The Connecticut-based $5.4 billion market cap Entertainment industry company within the Communication Services sector trades at a high 28.0 trailing 12-month GAAP price-to-earnings ratio and pays a small 0.7% dividend yield, according to The Wall Street Journal.

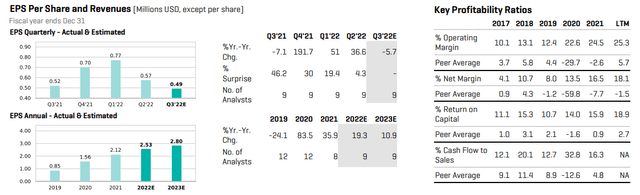

On valuation, earnings are seen as falling slightly in WWE’s fiscal third quarter, but per-share profit growth is positive for its 2022 and 2023, per CFRA. Moreover, the firm has a growing operating margin, well above its peer group’s average. Operating leverage has led to strong net profit margin growth. While Seeking Alpha gives WWE a poor valuation rating, a solid new TV rights deal and a good new leadership group should help boost profits in the coming years. Finally, perhaps the premium valuation exists in part due to possible takeover risks.

WWE: Earnings Outlook, Key Profitability Ratios

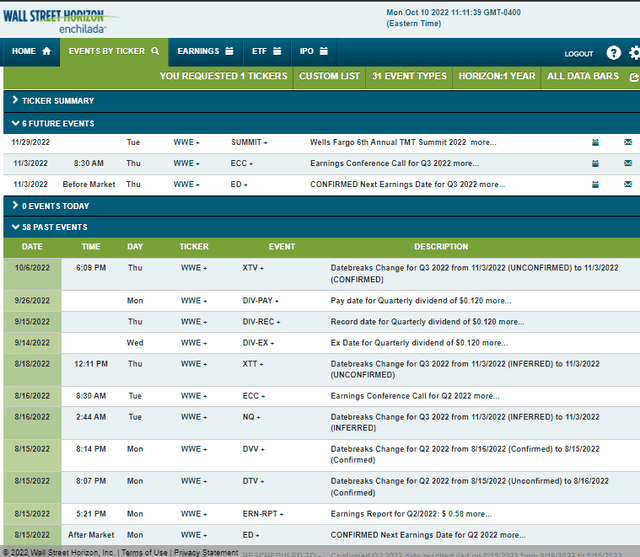

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 2022 earnings date of Thursday, Nov. 3 BMO with an earnings call immediately following the results being posted. You can listen live here. The action does not stop there, though. The firm’s management team is expected to speak at the Wells Fargo 6th Annual TMT Summit.

Corporate Event Calendar

The Technical Take

WWE is sharply outperforming both its sector and the broad market so far this year. And it has not come all in one knockout blow. Shares have steadily advanced despite major headlines both at the company level and with the macroeconomic picture. Technicians must like this absolute and relative momentum.

In terms of price levels, the current key spot is $75. The stock rallied big from under $60 in June to above $75 at its August high. The summer rally fizzled, as did the S&P 500’s, and WWE fell $10 to a low in early September before additional corporate management adds were announced. As the equity market notched fresh YTD lows, WWE was on the rise. I see support at $65, and if shares close above $75, that would portend a bullish measured move price objective to $85 based on a near-term cup and handle pattern.

WWE: Shares In A Solid Uptrend, Bullish Cup And Handle Near-Term

The Bottom Line

WWE’s valuation does not scream cheap, but decent growth prospects, a new leadership group, and impressive share price momentum in a tough tape make me bullish. Being long here makes sense, but the risk situation changes, should the stock break $65. Long-term investors less focused on the chart can be in WWE for the growth piece of their portfolio.

Be the first to comment