Justin Sullivan

Investment Thesis

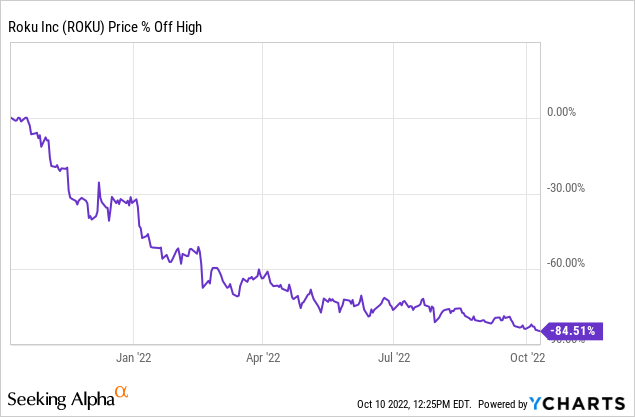

The transition from linear TV to streaming has been well under way for years, and it will continue to be a secular tailwind throughout the next decade. Despite Roku (NASDAQ:ROKU) being one of the driving forces behind this change, shares have plummeted over the past 12 months – currently sitting at an eye-watering 85% below their 52-week high.

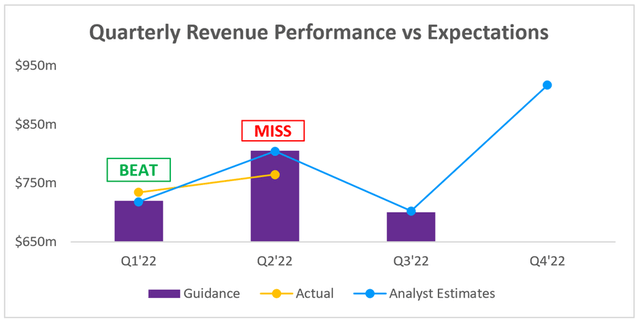

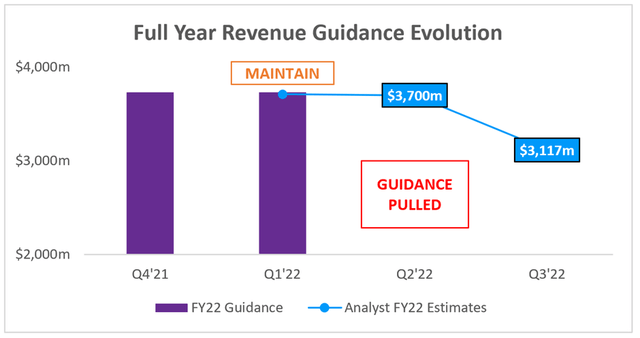

This certainly wasn’t helped by Roku’s Q2 earnings back in July, when management delivered an absolute stinker of a report. Full year revenue guidance was withdrawn, the revenue guidance for Q3 was 23% below analysts’ expectations, and shares of Roku tumbled 25% on the news.

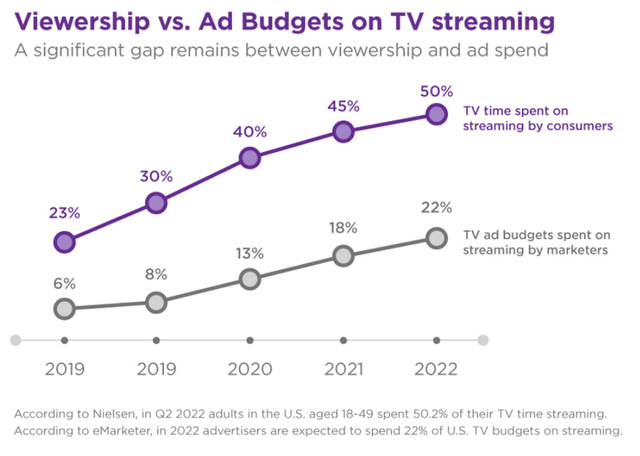

Let’s refocus on the business itself, and I’ll recall my investment thesis that was laid out in detail in a previous article. Being a leader in the streaming space, Roku has access to millions of eyeballs thanks to its reach in connected TV. This gives it the ability to benefit from advertising revenues through FAST channels, through banner adverts, as well as the ability to benefit from revenue share agreements with content streaming services. As more consumers switch to connected TVs, and advertising dollars make their way across from linear TV to streaming, Roku should continue to be a big beneficiary of this secular trend.

It’s clear, however, that Roku is struggling right now. If Q3 earnings do not provide enough proof that management have managed to get the business back under control, then my investment thesis could certainly be under threat.

With that in mind, what should investors be looking for in Roku’s Q3 results?

Latest Expectations

Roku is set to report its Q3 earnings on Wednesday, 2nd November, and there are several key items that investors should keep their eyes on.

Starting with the headline numbers, and analysts are expecting Q3 revenue of ~$702m, slightly ahead of management’s $700m guidance and representing YoY growth of just 3%. Given that analysts’ estimates were in excess of $900m for Q3 revenues prior to Roku’s updated guidance at Q2, it’s fair to say that almost any revenue number here will be a disappointment.

The good thing is that Roku’s shares are currently pricing in a lot of disappointment. Perhaps it is wishful thinking, but if management took an overly cautious approach back in July due to the uncertain macroeconomic environment, then there’s a chance that Q3 revenues greatly exceed both management’s guidance and analysts’ estimates – which would provide a much-needed boost for shareholders.

If we move onto full-year revenue guidance, analysts’ latest estimates are for ~$3.12B. Once again, this was a substantial drop from the $3.7B analysts had expected prior to Roku’s Q2 earnings. Right now analysts are doing a fair bit of guesswork when it comes to full year revenue, as Roku astoundingly pulled its full year guidance in its Q2 earnings release – ouch.

Quite frankly, all this does is highlight once again the carnage that Roku presented in its Q2 earnings. I’ve sat here thinking that surely it can’t get any worse going into Q3, but investing is a funny game.

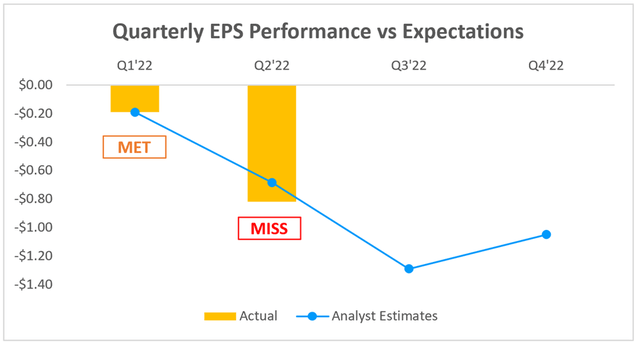

Moving down to the bottom line, and Roku doesn’t give guidance on EPS (and even if they did, it probably would’ve been pulled anyway). The company did miss analysts’ estimates in Q2, and analysts are now expecting Roku to see further, deeper losses throughout the year.

This is probably a good time to point out that Roku currently has a net cash position of just under ~$2B, meaning the company has more than enough in the bank to survive a difficult situation (such as this). Given that Roku still has a big opportunity ahead, it may well be able to thrive once it deals with this latest shock to the business – so the ability to survive is crucial, and I don’t think investors have anything to worry about on that front… at least, not yet.

Watch Out For Any Signs Of Hope

As I mentioned, Q2 earnings effectively shattered all hope and optimism surrounding Roku; the valuation has tanked, the stock has tanked, business performance tanked… sounds like the lack of optimism has got to me a bit.

So, what should investors look for in Q3? Honestly – absolutely anything positive.

This could well be a make-or-break quarter for Roku in terms of my personal investment thesis, so I’ll be keeping an eye out for any details that show Roku to be back on track. I’ve seen companies such as The Trade Desk (TTD) (which operates in the same industry as Roku) be successful in 2022 and not face the revenue turmoil that Roku has seen; clearly it is possible.

First and foremost, I’m going to be taking a look at the revenue figure. If it comes in below management’s $700m guidance, then I fear there may be something seriously wrong with this business. Yet if it exceeds this guidance, which I think Roku is more than capable of doing, then I’ll start to feel more confident in my long-term thesis.

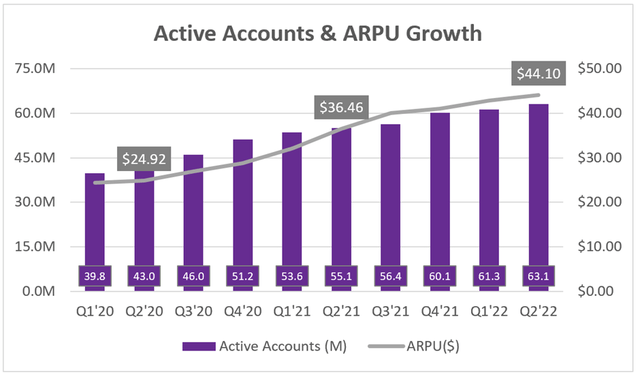

It’s also important to look at the number of active accounts and ARPU growth. These were actually some of the bright spots in Q2, as Roku managed to increase the number of active accounts and ARPU at a time where the likes of Netflix (NFLX) were hemorrhaging subscribers. I personally see Roku’s ability to continue adding more users as a sign that this side of the business remains strong, and could perhaps be a catalysts for a rapid return to growth.

Most importantly, investors should listen to any comments from CEO and Co-Founder Anthony Wood. As of April 2022, Wood owned about 13.1% of all shares in Roku – so if you’re a shareholder that’s been hit hard, believe me, the CEO has been hit harder, and he is likely feeling even more pain from this share price collapse.

This gives me a lot of faith in management’s desire to bring Roku back to growth, and deliver for shareholders once again. Whether Q3 proves to be a great or a terrible earnings report, I think any investor should pay a lot of attention to exactly what Wood has to say on the earnings call.

Valuation Appears Highly Attractive

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Roku is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

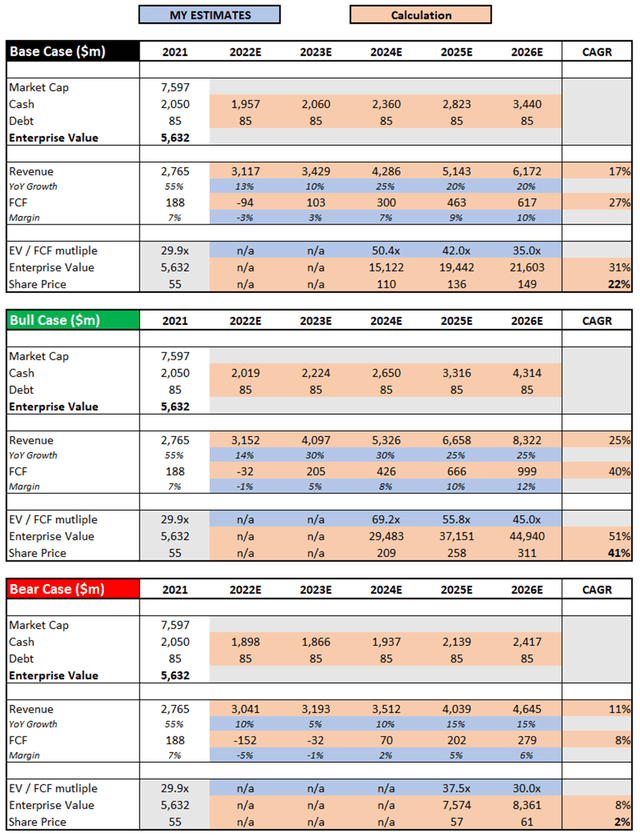

I have changed my valuation model slightly from my previous article, in order to give a better indication of the potential upside and downside in both the bull and the bear case scenario. My base case remains similar to the previous model, however I have chosen to be slightly more conservative in my latest iteration – no prizes for guessing why.

My bull case scenario assumes that the current struggles for Roku are just a blip along its path to long term success, and with multiple tailwinds at its back I can certainly see this being the case. It has so many eyeballs that it can monetize, and its software solution certainly can drive margins up over time. I’ve also used an appropriate FY26 EV / FCF multiple given its potential from that point onwards for revenue growth and margin expansion.

The bear case scenario effectively assumes the complete opposite; that this truly is a company in disarray, and any recovery for Roku will not be seen for a few years.

Put all that together, and I can see Roku shares achieving a CAGR through to 2026 of 2%, 22%, and 41% in my bear, base, and bull case scenarios. For me, what this demonstrates is that a lot of negativity is priced into Roku’s shares right now; in fact, Roku’s net cash position makes up ~26% of its current market capitalization (thanks Julian Lin)!

Bottom Line

I think it’s clear that valuation is not the issue for Roku right now (unlike 12 months ago); rather, it’s a question of whether or not the business can capitalize on the opportunity in front of it. Mr. Market is highly doubtful, and after a shocking Q2 earnings report investors have every right to assume the worst when it comes to Roku.

Yet I think the current risk / reward scenario is extremely attractive, considering the long-term potential that Roku has, the fact that it’s a leader in its industry, has secular tailwinds pushing it forward, has a pristine balance sheet, and has a Founder-CEO with skin-in-the-game.

Q3 earnings might end up being one step too far if it disappoints massively, but for now I think Roku remains an attractive investment and I reiterate my previous ‘Buy’ rating.

Be the first to comment