William_Potter/iStock via Getty Images

The Global X S&P 500 Covered Call ETF (NYSEARCA:XYLD) tracks the performance of the CBOE S&P 500 BuyWrite Index, which holds the S&P 500 and writes calls against it in order to earn the option premium. The fund holds the underlying stock positions and writes one-month, at-the-money call options on the Index. The ETF is for investors who are happy to miss out on potential upside in favor of generating regular income. Given how extreme valuations are, at the aggressive hawkish shift by the Fed, upside potential for the SPX seems limited anyway. Shifting into the XYLD now is likely to prove a good bet. While the ETF did not perform much better than the SPX during the COVID crash, the strategy employed has shown to outperform greatly during previous bear markets.

Historical Underperformance Is Reversing

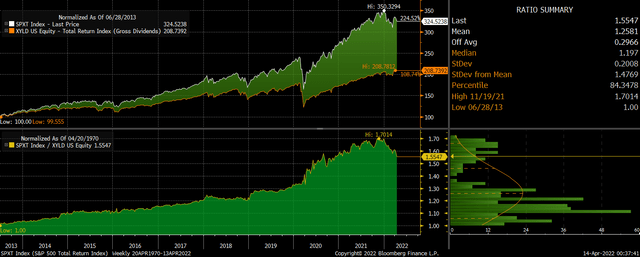

The XYLD has underperformed the SPX for the vast majority of the time since its inception in 2013. The reason being that the income generated from writing call options has not been offset by the losses on these calls that have resulted from the market rising. Since the start of 2022, however, despite the SPX being down around 7%, the XYLD is actually up marginally in total return terms. Furthermore, while the SPX has been flat since July 2021, the XYLD has risen over 8%.

XYLD Vs. SPX. Total Return Performance (Bloomberg)

These strong returns, resulting entirely from the income received from writing call options, are set to continue allowing the XYLD to outperform the SPX under most plausible market outcomes. With the SPX extremely overvalued from a historical perspective, upside potential is surely limited here. I argued in my most recent article on the SPX in late December that the most reliable valuation metrics put the market more than 3x its historical average, and the 4% decline since then has done virtually nothing to improve this. In fact, the outlook for the SPX has been further undermined by the increasingly hawkish Fed, whose main policy goal appears to have shifted from juicing the stock market to generate a positive wealth effect, to dampening the surge in inflation.

With upside for the SPX likely to be limited, the XYLD’s huge yield is likely to allow the ETF to post considerable outperformance. The XYLD now yields almost 10% versus the S&P 500’s paltry 1.4%. In order for the XYLD to underperform the SPX over the next year, the SPX would have to rise by over 8%. While this of course cannot be ruled out, the risk-reward trade-off looks particularly strong for the XYLD on a relative basis.

A Market Crash Would Hurt, But A Gradual Bear Market May Not

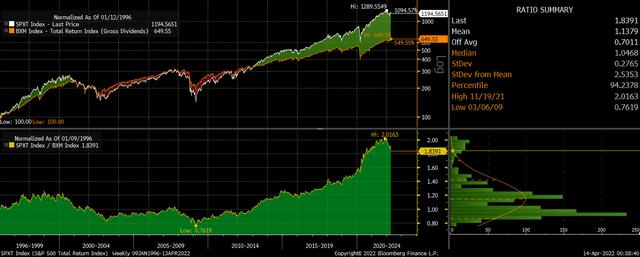

In the event of a market crash, the XYLD would certainly suffer. As we saw in the 2020 COVID crash, the ETF’s performance was barely distinguishable from that of the SPX. However, such occurrences are extremely rare. If we compare the performance of the XYLD’s underlying CBOE S&P 500 BuyWrite Index to the SPX during the 2007-2009 bear market, a much different picture emerges. As the chart shows, the BuyWrite index outperformed the SPX significantly over this 18-month period. While it still fell by 39%, this was far better than the SPX’s 55% rout.

CBOE S&P 500 BuyWrite Index Vs. SPX. Total Return Performance (Bloomberg)

If we go back to the 2000-2002 bear market, the BuyWrite index’ outperformance was equally noteworthy. While the SPX lost 46% from peak to trough, the BuyWrite index lost just 30%. Furthermore, it recovered its all-time highs by early 2004, while the SPX took until late 2006 to do so. In part this outperformance was driven by the elevated level of the VIX, which makes call writing more profitable. This is an added benefit of the XYLD; when markets decline, undermining the ETF’s core holdings, volatility also tends to rise, allowing higher income to partially offset the losses from on the equity holdings.

Summary

The XYLD is a solid option for U.S.-focused investors looking for high income and willing to forego some upside in the event of a resumption in the SPX bull market. Given how extreme valuations remain, and the increasingly hawkish Fed, upside for the SPX seems limited, suggesting that now is an opportune time for investors to shift out of the SPX and into the XYLD. The ETF is likely to perform very well in a sideways market, while the strategy it employs has a track record of strong outperformance during bear markets.

Be the first to comment