Diego Thomazini/iStock via Getty Images

Investment Thesis

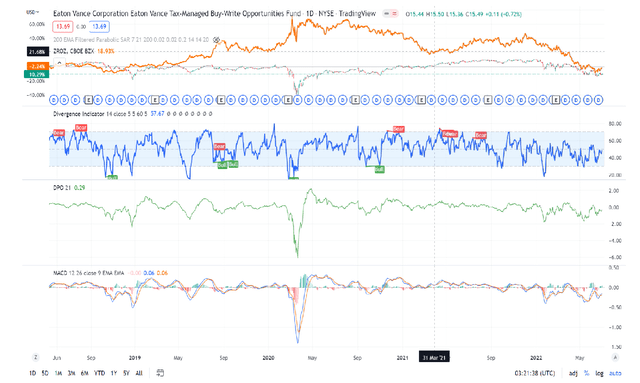

In the wake of rising rates and equity volatility, investors have been left searching for answers how to invest their money safely. I have identified the Eaton Vance Tax-Managed Buy-Write Opportunities Fund (NYSE:ETV) as a potential option for income investors. It offers a steady monthly distribution, tax benefits, and equity participation. The caveat is that it is essentially an S&P 500 covered call fund and you must be prepared for the associated volatility of investing in an all-equity fund.

Fund Overview

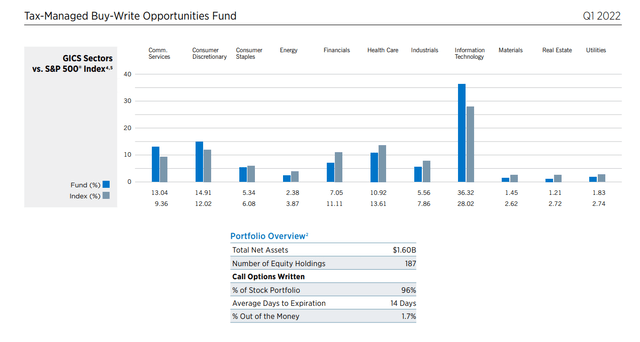

As you can see from the above image, ETV’s holdings are close to that of the S&P 500 (SPY). What really separates it from it from SPY is that this fund is designed to generate a high current income by writing calls that are just out the of the money. While that does put a cap on capital growth during bull runs, the idea is to blend growth and income.

Sustainability of Distribution

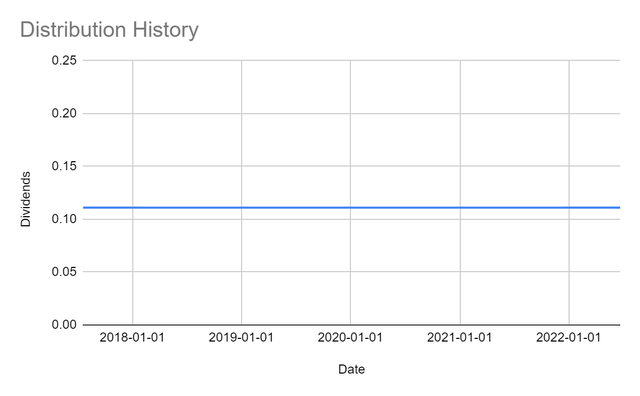

ETV has been the gold standard of reliability when it has come to the monthly distribution. Through various economic cycles, it has remained constant. When assessing an income investment, that should be one key driver of making a decision. Notwithstanding the high rate of inflation that we all face today, ETV does offer a nice 9.71% current yield. That arguably can be enough to compensate you for the risk of investing in equities as well as loss of purchasing power.

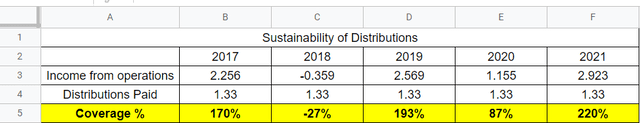

Furthermore, there is a lot more to like when you break down and analyze the fund’s financial statements. The stable distributions are not a mere dummy yield as is unfortunately common these days. Each year with the exception of one has delivered plenty of profit to cover the distribution.

It should be noted, however, that when you branch out the Income From Operations, the lion’s share comes from capital gains as opposed to income covered call premiums. This means that they have relied on capital appreciation.

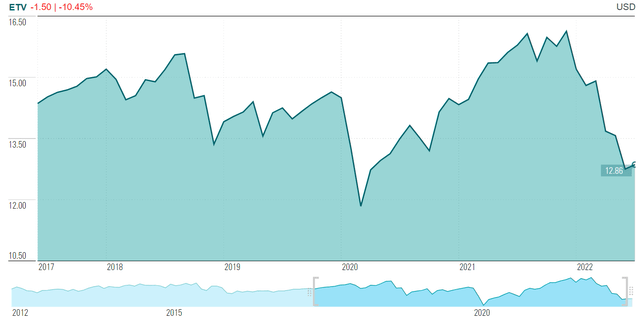

Which leads me to my next point. Relying on capital gains is fine in a bull market, but it does little to protect your downside risk when the market is falling. Indeed, you can see from the above image the aggressive drawdowns you would have faced if you invested in ETV.

How To Achieve An Acceptable Total Return

While some may scoff at the idea, I’m a big proponent of diversification and rebalancing. Indeed, I think the historical data speaks for itself when you consider the negative correlation between ETV and certain asset classes like treasury bonds. The idea is to book your profits and in treasuries during times of equity drawdowns and use the proceeds to buy more ETV while it’s cheap. With the benefit of hindsight, you can clearly see what the results would have been.

I would be remiss to not mention, however, that long duration treasuries do little to protect your downside when short-term rates are rising. Performance of this portfolio was indeed dismal during the Taper Tantrum and 2022 YTD.

Conclusion

All things considered, I can recommend ETV to prospective income investors if they are prepared to diversify with long duration treasuries. The fund will deliver a high yield reliably but the key is to protect your principal investment. There is no method of completely eliminating risk, please do your own due diligence.

Be the first to comment