David Taljat

Note: This report was previously shared with members of Value Investor’s Edge on September 2, 2022.

Introduction: Clear Opportunity to Buy GSL

Global Ship Lease, Inc. (NYSE:GSL) is a containership lessor with a fleet composed of 65 vessels built between 2000 and 2015, with sizes ranging from 1,118 TEU to 11,040 TEU. The company was established in 2007 as a spin-off from CMA CGM, and became listed on August 15th, 2008. In 2018, after surviving over eight years of downturn, the company achieved a strategic merger with Poseidon Containers, which doubled the size of the company’s fleet. Throughout 2021, GSL conducted an additional three rafts of accretive acquisitions, which nearly doubled the fleet again.

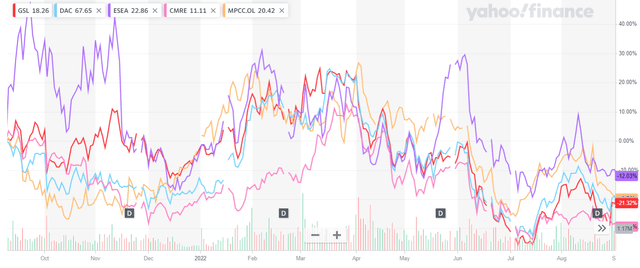

Containership lessors have posted mediocre share price performance over the past year despite very solid operational performance and strong additions to their charter backlog. GSL is trading at one of the largest discounts, with its entire enterprise value (both market cap and net debt) being handily covered by locked-in cash flows and scrap proceeds (i.e., even while assigning virtually $0 value to the fleet once vessels come off-charter).

Yahoo Finance

This is an unsustainably cheap valuation, and I believe GSL should trade at a substantially higher share pricing going forward. As the containership orderbook is delivered, older vessels coming off-charter will most likely head to the scrapyards, but modern tonnage should continue to find profitable employment. Liners clearly believe the same thing, as evidenced by the massive contract extension signed earlier this week, which fixed six vessels into 2028-2029.

Shareholder returns have taken a backseat versus debt reduction over the past year. Management has been clear they are comfortable with their current fleet positioning and will only continue to acquire assets if expected returns clear their thresholds (which seems unlikely in the near-term). Share repurchases should be prioritized in the current environment given the discount shares are trading at relative to locked-in cash flows.

Contract Renegotiations? Extremely Unlikely

A concern which has been widely voiced in the investment community is whether the contracts containership lessors have signed over the past couple of years will hold through once container freight rates come under pressure, since liners will strive to reduce costs. This is a valid consideration considering the “long containership lessors” thesis is based on these contracts, but this concern holds little ground. There have been very few contract renegotiations in the space over the past few decades, and most were conducted when certain liners either went bankrupt or were facing severe financial distress and ongoing restructuring during the 2010s.

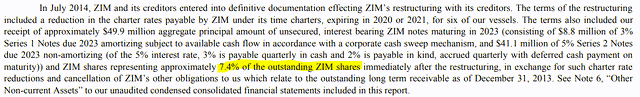

For example, ZIM Integrated Shipping Services Ltd. (ZIM) went bankrupt and completed a debt restructuring deal, which also involved shipowners such as Danaos Corporation (DAC) and Costamare Inc. (CMRE). However, in hindsight, this was possibly a blessing in disguise, considering DAC received $50M of unsecured notes and 7.4% of shares outstanding in exchange for reducing the charter hire on some vessels employed by ZIM. Ironically DAC ended up making back over 10x on this deal.

DAC’s Q3-20 6-K. (DAC’s Q3-20 6-K.)

Another example is HMM, which underwent a restructuring in 2016 and exchanged new equity and debt for a temporary charter rate reduction. In this case, all the owners either broke even or made a larger profit. The sole disastrous case was Hanjin’s bankruptcy in 2016, which was the largest liner bankruptcy in history. In this case, since Hanjin went completely bankrupt and all assets were liquidated, most owners received little compensation.

Except for Hanjin in 2016 (which had a horrendous balance sheet), contract restructuring has never been a major issue for containership owners, much less when liners have strong balance sheets.

Although a restructuring could be possible if liners went bankrupt or faced severe financial distress in the far future, these firms are currently in the best financial condition in history. For example, A.P. Møller – Mærsk A/S (OTCPK:AMKBY) finished Q2-22 with more current assets than total liabilities including debt, lease liabilities, other current liabilities, etc. (Maersk Q2 results).

Hapag-Lloyd Aktiengesellschaft (OTCPK:HPGLY, OTCPK:HLAGF) is in a very similar position, with a $10B+ cash balance as of Q2-22, and with current assets surpassing total liabilities (Hapag-Lloyd Q2 results). Finally, ZIM is also in a rock-solid financial position, although they have been extensively chartering-in tonnage, they would have a huge net cash position if we were to exclude lease liabilities (ZIM’s Q2 earnings).

It would be near-impossible for liners to attempt contract renegotiations after the windfall they have made throughout the pandemic, especially considering shipowners held their end of the bargain regarding below-market contracts when the charter market skyrocketed higher. Contract renegotiations are not impossible in extreme scenarios (e.g., a war over Taiwan), but this risk is extremely unlikely in most realistic scenarios. Additionally, should contract renegotiations happen (which as mentioned, is extremely unlikely), shipowners would be compensated with debt claims or equity in the newly restructured liner entities.

How Cheap is GSL?

Everyone has heard the argument that containership lessors are “cheap,” but what does that exactly mean? Let’s crunch the numbers. As of Q2-22 results, the company had a total contract backlog of $1.91B with an average length of 2.6 years. Given the latest contract additions ($393M in EBITDA, or an estimated $470M in revenues), we are looking at a total contract backlog of around $2.38B. Given the company’s cost structure, and assuming no new charters are signed (but no vessels are scrapped) going forward, the company is set to generate cumulative adjusted EBITDA of $1,243M through 2026, or operating cash flow of roughly $1.15B.

However, I believe this to be an extremely conservative estimate, considering GSL’s management will most likely scrap older vessels if they cannot find profitable employment. I can certainly be wrong, and that’s why I have also modeled an extreme bearish case if GSL kept operating all the vessels generating $0/day once they come off-charter.

Overall, the company has a total of eleven vessels coming off-charter through 2023-end:

- 2002-built 2,207 TEU Julie

- 2000-built 2,506 TEU Maira

- 2000-built 2,762 TEU Nikolas

- 2002-built 6,840 TEU GSL Christen

- 2015-built 9,115 Anthea Y

- 2008-built 1,118 GSL Amstel

- 2014-built 2,546 TEU GSL Maren

- 2006-built 2,741 TEU GSL Elizabeth

- 2006-built 2,824 TEU GSL Lalo

- 2013-built 3,404 TEU GSL Melina

- 2014-built 3,421 TEU GSL Alice

If these vessels are chartered out at $20k for two years, $20k for two years, $21k for two years, $35k for three years, $40k for five years, $15k for two years, $22k for two years, $22k for two years, $22k for two years, $25k for two years, and $25k for two years respectively, EBITDA generation through 2026 increases to $1.56B, whereas OCF also increases to approximately $1.47B.

Everyone has differing estimates on how the market will develop going forward, and those can be adjusted up and down. However, keep in mind any charter signings going forward directly accrete to FCF generation under this methodology, since all costs are already accounted for.

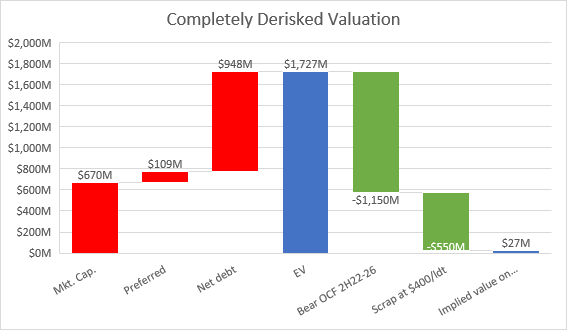

As of quarter end, the company had a total debt position of $1.1B, plus around $109M in preferred stock, and around $670M in common equity value, for an enterprise value (“EV”) of $1,879M. If we use a net debt estimate (including all liabilities), EV is closer to $1,727M.

Additionally, scrap value currently amounts to an estimated $800M (at $400/LDT it would be worth closer to $550M), which exemplifies how cheap GSL currently is: the company is trading well below its locked-in cash flows until 2026 plus scrap value of the fleet! Some may argue that current scrap pricing is on the higher side (and I tend to agree), but this should be more than offset by the wildly bearish assumption that vessels will earn a TCE of $0/day until 2026.

In the image below we can how GSL’s EV compares to stress-test OCF generation in the 2H22-2026 period plus scrap proceeds of the fleet at $400/ldt (which already implies a hefty discount from current scrap prices); the market is valuing GSL’s fleet at $27M post 2026! Furthermore, OCF will almost assuredly come above the stated $1,150M, since that is based on GSL keeping all vessels coming off-charter at $0/day (which seems extremely unlikely).

Author’s own elaboration

We have built a charter discount model for VIE subscribers, which allows investors to calculate the discount to be applied on prevailing asset values with scrap age, scrap price, and EBITDA discount assumptions. This is especially relevant considering unadjusted NAV for GSL is estimated at $4B+, or $109.6/sh. However, and as mentioned before, this number needs to be adjusted for the charters already in place (i.e., vessels with charters at lower rates cannot participate in the current bonanza, and asset values therefore need to be adjusted).

If we look at expected earnings, the company is still trading at a wild valuation (below forward expected earnings for both 2023 and 2024). I currently expect the company to report adjusted EPS of ~$9.70/sh and ~$10/sh in 2023 and 2024 respectively, whereas both 2025 and 2026 should also easily remain in profitable territory. The “stated assumptions” estimates are based on GSL securing the charters stated before on the vessels coming open prior to 2023-end, and on the options on the “GSL Tripoli,” “GSL Kithira,” “GSL Tinos,” and GSL “Syros” being exercised (3-year options at $17,250/day). Additionally, it also assumes all vessels older than 20 years when coming off-charter to be demolished on the spot (given weaker market conditions), with corresponding adjustments to operating and depreciation expenses, whereas vessels younger will be re-chartered at $10k/day.

| EPS estimates | 2H-22 | 2023 | 2024 | 2025 | 2026 |

| Extreme stress test | $ 3.95 | $ 8.60 | $ 7.24 | $ 1.97 | $ -0.19 |

| Stated assumptions | $ 3.95 | $ 9.51 | $ 10.12 | $ 7.67 | $ 5.82 |

Overall, GSL is trading at an absurd valuation. The company is trading (on an enterprise value basis) below the sum of locked-in operating cash flow and scrap value of the fleet. Furthermore, there is a lot of embedded optionality considering the company owns several assets built after 2010, which should be able to secure profitable employment for many years to come once they conclude their current charters.

Previous Fleet Growth Deals

GSL had aggressively pursued fleet expansion during 2021. In February 2021, the company announced the agreement to acquire seven 6,000 TEU Post-Panamax containerships with an average age of 20 years for an aggregate purchase price of $116M. The vessels were owned by Maersk, which most likely decided to dispose of them given their vintage.

The deal was extremely attractive; the vessels were all employed under contracts set to generate a cumulative $95M in EBITDA, plus two one-year extension options, which if exercised, would increase cumulative EBITDA to $126M. The acquisition was financed with the offering of 5.4M shares at $13/sh (which at the time was a premium to NAV).

Considering the vessels have a scrap valuation of $71M at $400/ldt, the project is expected to generate an IRR of around 26.6% during the 3.1-year average firm contract period assuming no extension options are exercised. This is quite an attractive locked-in return, but there is additional upside if the extension options were exercised (the IRR would have been a tad lower, but nominal returns higher).

On June 9th 2021, GSL announced a second raft of acquisitions, disclosing it had agreed to acquire 12 containerships from Borealis Finance LLC with an average size of “approximately 3,000 TEU and a weighted average age of 11 years for an aggregate purchase price of $233.9M.” The locked-in EBITDA on these contracts was lower relative to the purchase price, but the vessels were set to come open throughout late-2021, 2022, and early-2023, allowing GSL to re-charter them if strong market conditions persisted. This was more of a “speculative bet,” but given subsequent market strength it has already paid-off.

As of quarter-end (and after three quarters of OCF generation), the vessels had an estimated revenue backlog of slightly below $330M, which essentially means the transaction is now fully de-risked. Additionally, six of these vessels are coming open in the coming year (three in Q1-23, one in Q2-23, and two in Q3-23), and given prevailing conditions, they are likely to be re-chartered at decent rates. If they are employed at rates ranging from $15k to $25k for two years, the revenue backlog would increase to closer to $425M. Furthermore, the acquired vessels have a combined scrap valuation of $59.2M at $400/LDT, further providing downside protection.

On June 16th, 2021, a final raft of acquisitions was announced, with GSL disclosing it had agreed to acquire four 5,470 TEU Panamaxes with an average age of 11 years for an aggregate purchase price of $148M. Considering the vessels were chartered to Maersk for a firm period of three years each set to generate total cumulative EBITDA of $124.4M, the acquisition was largely de-risked, especially considering the vessels have a scrap valuation of $35.7M at $400/LDT.

Additionally, the charters on the vessels came with options for an additional three years at $17,250/day (which would imply EBITDA generation of around $3.15M per vessel per annum, or $37.8M in total). This acquisition was structured similarly to the first deal; downside was fully covered by the fixed charter and the scrap value of the vessels, whereas there was additional upside if the extension options were exercised.

Overall, GSL has conducted three different sets of acquisitions (while also pursuing an opportunistic disposal when pricing was deemed attractive). These transactions have been characterized by substantial downside protection while providing upside optionality if market conditions remained strong. The acquisition from Borealis Maritime was a tad more speculative, but it has paid off given the charters management has already secured on the vessels, whereas if we make some assumptions on the vessels coming open in the next year, returns are outstanding.

Capital Allocation Priorities

As mentioned in the prior chapter, GSL aggressively scooped up tonnage when attractive opportunities were available last year. Although returns on the acquired assets were strong, I would have rather seen more repurchases when trading at a substantial discount to NAV.

When a company trades at a discount to NAV, the market is offering management the possibility to realize outstanding IRRs by acquiring their own shares. For instance, asset values tend to be based on 6-8% unlevered returns, which with leverage can lead to mid-teens returns on equity. Therefore, when a company is trading at a substantial discount to NAV, share repurchases should be prioritized: management has the possibility to acquire their own ships at 12-16% unlevered returns and 20%-30% returns on equity!

NAV is not static (and share repurchases can end up being a waste of capital if asset values plummet), but if a management team is considering growing the fleet, first they should make sure they are not trading at a huge discount to NAV. The per share value accretion is simply unparalleled relative to direct vessel acquisitions, especially at today’s valuations!

In September 2021, GSL’s management repurchased 522k shares at an average price of $19.17/sh, whereas in April-22, they repurchased an additional 185k shares at an average price of $26.66/sh. Although no repurchases have been disclosed since then, the attractiveness of pursuing those has only increased with recent share price declines. Some argue for share repurchases to “stabilize share pricing” or to increase it, but that should never be the aim of a share repurchase program; the aim should always be to create value on a per share basis; GSL has an opening to create unprecedented value by repurchasing shares in today’s market well below 50% adjusted NAV.

No one knows exactly how the containership market will end up faring going forward, but containership leasing rates will obviously trend lower as newbuilds are delivered. However, with the opportunity to repurchase shares well below locked-in free cash flow and scrap value, management should be aggressively repurchasing shares given the embedded upside optionality!

It is true that GSL’s free cash flow will not increase substantially until later this year considering management initially prioritized balance sheet repair, but I expect (and strongly encourage) management to pursue aggressive share repurchases going forward.

GSL’s dividend yield is around 8.1%, and I would not be surprised if it is increased either later this year or, most likely, in early-2023. However, share repurchases are the most optimal capital allocation given the massive discount to NAV. I also expect GSL will continue to aggressively repay debt, in-line with their recently updated amortizations schedule.

Conclusion

GSL’s current common equity valuation is absurdly low, trading below its locked-in cash flows until 2026 plus the scrap value of the fleet. This makes the company a very attractive risk-reward play considering containership lessors have historically traded at substantial premiums to NAV (whereas GSL is now trading below 0.50x NAV).

Even under the most extreme stress test, GSL trades at less than expected earnings from 2H-22 through 2026 ($21.57/sh). However, under more normalized assumptions, earnings could equate to closer to $37/sh! It remains to be seen how the market will end up faring, but GSL provides ample downside protection.

Going forward, containership leasing rates will come under pressure as the orderbook is delivered, but liners have shown their willingness to continue acquiring and chartering-in tonnage at very attractive terms (both regarding TCEs and chartering periods), especially for modern tonnage. Older vessels coming off-charter in 2024 and 2025 will almost assuredly head to the scrapyards, but this will also partially help offset the delivery of newbuilds.

I have personally been cautious on containerships over the past year given my expectations of deteriorating sentiment in the sector (when rates are sky-high, they can only head lower), but at current valuations, the risk reward is just too enticing, making me a buyer at current prices. Charter renegotiations have historically been a non-event, only happening when liners were in bankruptcy, whereas they are currently in the best financial health in modern history.

If GSL and its peers were trading its vessels in the spot market, the risk-reward would be totally different, but the long-term contracts these companies have secured provide an asymmetrical risk-reward with substantial upside optionality with a ton of downside protection.

Be the first to comment