shaunl

Investment Thesis

The shipping industry exploded during the post COVID period, with charter rates screaming higher as demand for goods outstripped supply.

Although we note hesitation in the market which could bring charter rates down, GSL is in the perfect position to take advantage of the current rates and lock in long-term contracts.

The business is reasonably financed and generates strong cash flows. Based on our rough estimation, we believe the business has guaranteed EBITDA in excess of its market cap.

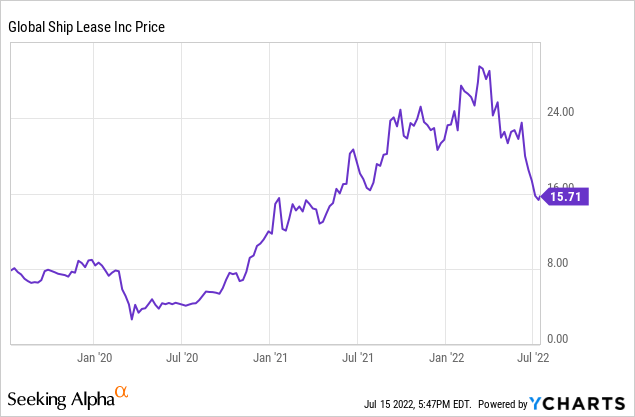

The share price has dropped quite aggressively in recent months, with markets seemingly overlooking the fact it has a hefty contract book and so we believe now is a great time to begin scaling into the stock.

Company Description

Global Ship Lease (NYSE:GSL) is a global shipping business which owns and operates container ships. It is headquartered in London but is listed on the NYSE. The company’s 65 ship fleet is predominately made up of small-to-medium sized container ships, ranging from 1,118 to 11,040 TEU (TEU stands for twenty-foot equivalent unit, which is 1 of the containers pictured above).

GSL has a few listed securities, the ordinary shares (GSL), preferred shares (GSL.PB) and a bond (NYSE:GSLD).

Firstly, we should establish what GSL actually does. In the shipping industry you have 2 types of companies, containership owners and liners. Liners are responsible for sourcing the cargo, loading, transporting and discharging the containers. Containership owners on the other hand merely own the ships, they are responsible for maintenance, crewing and technical operations. Containership owners lease these ships to liners on long or short-term charters.

The shipping industry has had an eventful few years. In 2020, COVID-19 caused a complete standstill in much of the shipping industry. This continued for many months as with varying levels of lockdowns globally, demand for goods was just not there. Unsurprisingly, during this time, the number of new-build ships and ship orders were at record lows. Things very quickly reversed, with pent up demand exploding when restrictions were lifted. Global supply chains could not respond and we saw many cases of containership backlogs.

GSL’s shares during this time performed poorly and then extremely well, growing from a COVID-19 low of $3 to $29.

Macroeconomic conditions

Macroeconomic conditions drive the health of the shipping industry. The reason for this is simple: the demand for ships is correlated with the demand for goods. The demand for goods is one of the driving forces of macroeconomic conditions.

Inflation

Inflation in isolation has been quite good for shipping companies. It has allowed liners to increase shipping fares, while controlling expenses. This is coupled with the boom in demand, which has left liners in a position of strength in negotiation. Both ZIM Integrated (ZIM) and Maersk (OTCPK:AMKAF) saw margins improve in the LTM by at least 400 bps.

Over time however, this cannot continue. Inflation is causing a cost-of-living crisis and so prices can only go up so much before people forgo all but essential spending. This has created much of the uncertainty in global markets, with fears that demand will soon completely cease.

As a lessor, GSL benefits from the upside, while having downside protection. The reason for this is that due to the demand for shipping, GSL can negotiate long contracts at favorable charter rates with the liners. Therefore, being locked in means that if prices were to cool or decline, this would not reflect negatively against GSL. In a sense, they have locked in a degree of future revenue today. The only risk is the liquidity of the counter parties to meet payments. Given that they are, and have been, making large profits, one would expect them to be flush with cash.

Interest rates

Rising interest rates are not good for lessors. Lessors need to finance their ships and usually take loans against the vessels to finance the build. This can push many into financial distress, especially when markets turn but GSL once again may navigate this nicely. The business refinanced its core debt to an average interest rate of c.5%, this is well below the US inflation rate of 8.3% and means a rate lower than it had previously (L+7%). Importantly, the business hedged its floating rate and so is not exposed to any increase in interest rates.

GDP Growth

Slowing growth is a major headwind heading towards the shipping industry. Inflation and interest rates increasing will reduce demand, with central bankers tasked with riding the fine line between cooling and depressing an economy. The question for prospective investors is how long will this last. With ships chartered for an average of 3-5 years, GSL could realistically see out any (extended) recessionary period. In theory, this could mean back-to-back charters at above historic average rates.

China

A factor which is more significant than may initially seem is the congested ports in China. Due to China’s zero COVID policy, it has seen many regional lockdowns in recent weeks. This has caused disruption to China’s supply line, as the country is one of the most significant importers and exporters to the world. As of May-22, it was estimated that 25% of the world’s container vessels were waiting in China. This is good news for GSL as even with the economy weakening, the supply of available vessels is artificially reduced.

Shipping Industry

The shipping industry is part of the wider market of ship building. Shipyards only have finite capacity globally and so will look to build those ships that are the most lucrative. Currently, the order book for container ships is at an all time high, with only LNG carriers higher (Russian invasion likely a contributor to this). This reflects the cyclical nature of shipping. When things are good, ships are built, this then drives down charter rates due to oversupply and so reduces the number of ships being built. This is thus bearish news in the medium term as once these ships come online, the new equilibrium charter rate will be lower. Given the level of building that we are seeing, we could see an extended bear market in the containership industry in several years.

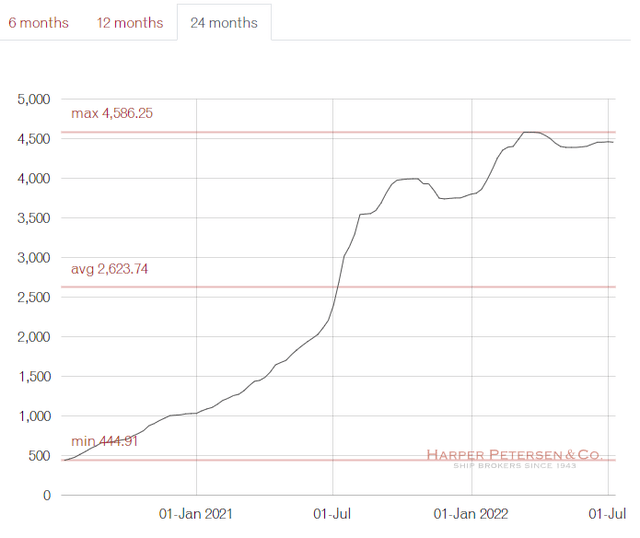

There are two useful data sources to look at when considering the health of the freight industry. Firstly, the Harpex. This “reflects the worldwide price development on the charter market for container ships”.

What we have seen is an extended plateau of the index a month or so into the year. This aligns with the heightened economic uncertainty of recent months. What is also interesting is the development of the index since 2020, we must remember that GSL is locking in rates at current levels.

Secondly, there is FBX. It provides the market rates for 40 containers.

We note here that prices have begun to fall post Q1. We have yet to see whether this will stabilize or continue to fall.

There is certainly evidence to suggest that we have seen the peak of charter rates, which will now begin to fall. The question is how quickly and for what period of time. We note that 26% of GSL’s current fleet will see their firm employment cease by Q4 2023. This mitigates GSL’s risk to a certain extent but we must continue to monitor this. If we think realistically, rates will continue to fall but if GSL can focus on locking in rates well above the historic average, then the business is certainly in a great position going forward.

GSL’s financials

GSL’s financial performance has been nothing short of fantastic. The business has grown revenue by 2.1x for the 3 months to Mar-22, with net income up c.17x. GSL’s current utilization is 94.7% as a result of regulatory dry-docking, regardless it is the highest figure since 2018.

The large jump in revenues is driven almost wholly by greater charter rates, with utilization only marginally higher. Expenses have increased due to the economic climate, with average cost per ownership days increasing 7.5%. With inflation where it is, our belief is that this will continue to creep up, and so we may see a slight contraction in margins even before falling charter rates begin to impact GSL.

With a cyclical business like this, the quality of the balance sheet is incredibly important. The business has c. $90M in cash, with a current debt position of $210M and long-term debt position of $850M. Although this might look slightly worrying, the business is actually very healthy. Deferred income sits at $118M, restricted cash sits at c. $130M and most importantly of all, the business has contracts in place which means its 2022 income is wholly certain. Analysts estimate that GSL’s free cash flow will land around $291M. Therefore, the business is in a comfortable position to clear the remaining short-term debt and reward shareholders, with the remaining debt maturing in 2024.

Looking forward, it is difficult to bet against GSL’s financials. They have $1.5BN-$2BN in revenue locked in. Assuming an EBITDA margin of 60% (1.5% haircut on Q1-22), we get c. $1BN in EBITDA. With a market cap of $561BN, investors have a large margin of safety. This is where we see a real mispricing, markets seem to be assuming these companies materially care about a fall in charter rates in the short term. As long as they can stay liquid, which GSL should do comfortably, and the liners stay solvent, which they should now that they are flush with cash, the money will roll in.

Valuation

With charters locked in, we have reliable insight into the forward market of GSL. It is currently trading at 1.64x its NTM FCF, which is around its historic average (Source: Tikr Terminal). GSL’s stock price is now approaching its fair value, with its dividend yield sitting at c.7.4%. As we have established, this should be serviceable with the current contracts in place.

Final Thoughts

Not all stocks need to be a “buy and hold forever” investment. GSL is one such example of a short-term investment which can be quite lucrative. With inflation where it is, investors are increasingly looking for somewhere to park their money, and GSL’s dividend yield provides that. Given the business’s excellent contract book, there likely won’t be any surprises for investors and it allows us to take advantage of the post COVID charter rates, without paying the inflated share price. Even if charter rates fall, they are unlikely to fall so aggressively that the new contracts signed going forward will cause a large adverse impact on the EBITDA. This also gives us downside protection with the cash flows contractually locked in. When taken alongside an extreme scenario where the ships are scrapped at the end of their current contract (for c.$400-$500/ton), the shareholder value is greater than GSL’s current market cap.

This investment is far from risk free however. The share price of shipping companies (especially of this size) can be extremely volatile. EGLE‘s share price fell c.18% in a week at the beginning of July and I have yet to see why.

We rate GSL a buy.

Be the first to comment