SHansche

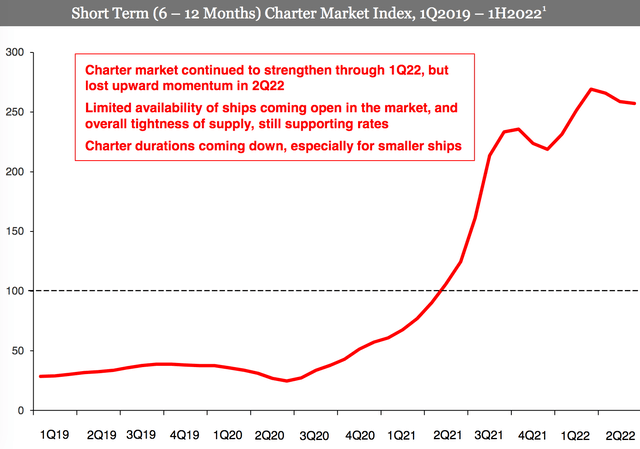

The cargo vessel industry’s shipping rates have been surging over the past two years due to supply chain logjams, port strikes, and China’s zero COVID policy, among other factors. Rates slowed down a bit in Q2 ’22, but still remained greatly elevated vs. pre-COVID rates:

GSL site

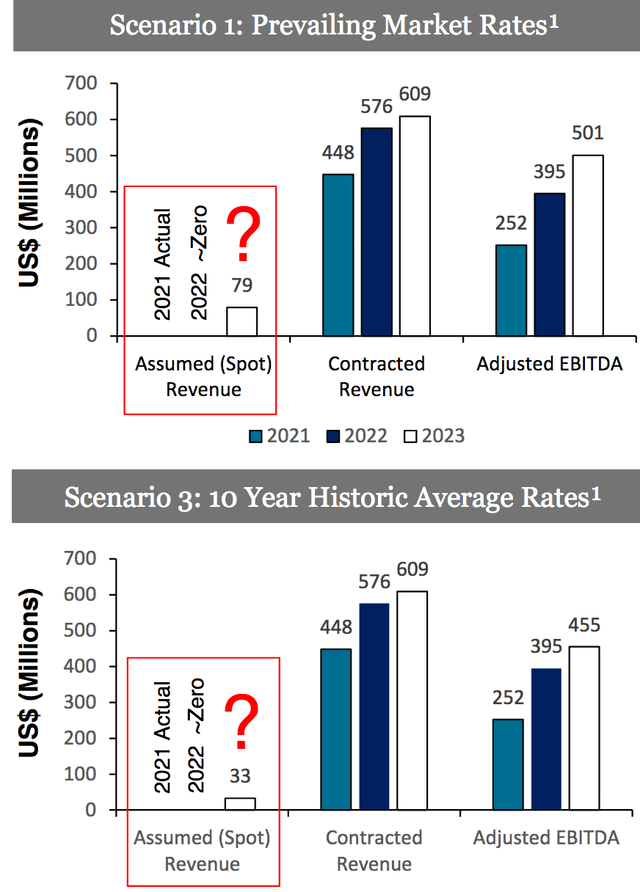

Shipowners, such as Global Ship Lease (NYSE:GSL), have been reaping the benefits, putting up huge topline and earnings growth numbers. In assessing future rechartering rates, GSL’s management provided various scenarios for rechartering rates moving forward.

Scenario 1 assumes that ships coming open in 2022 and 2023 are re-contracted at market rates prevailing for multi-year charters in July 2022, which shows EBITDA doubling to $501M in 2023, vs. $252M in 2021.

Scenario 3 assumes that the ships are re-contracted at 10-year historic average rate, which implies that EBITDA would rise to $455M in 2023, up 80% vs. 2021, and 15% vs. 2022:

GSL site

Company Profile:

Global Ship Lease, Inc. owns and charters containerships of various sizes under fixed-rate charters to container shipping companies. As of March 10, 2022, it owned 65 mid-sized and smaller containerships with an aggregate capacity of 342,348 twenty-foot equivalent units. The company was founded in 2007 and is based in London, the United Kingdom. (GSL site)

Earnings:

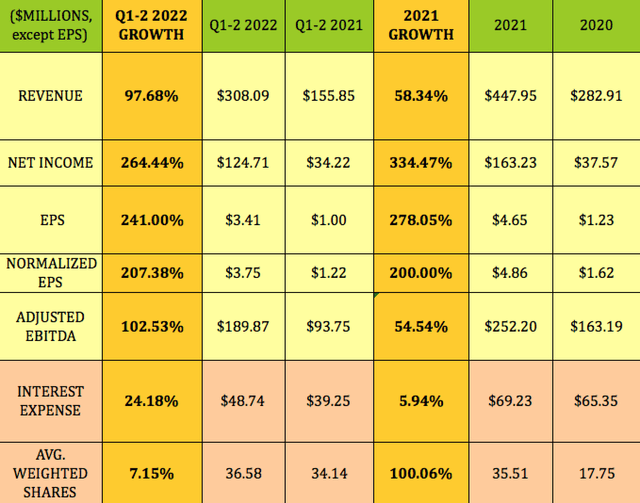

GSL made a major move in 2021, acquiring 23 vessels, which caused Revenue and Adjusted EBITDA to ~double in the first half of 2022. Net income, EPS, and normalized EPS were all up by more than 200%.

This continued the rapid growth pace of 2021, when revenue rose by 58%, adjusted EBITDA grew 54%, net income surged by 334%, and EPS rose by 278%.

You’d expect this type of growth from a recent startup, but not from a company that was founded 15 years ago.

Hidden Dividend Stocks Plus

In Q2 ’22, GSL had operating revenue of $154.5 million, almost double revenue of $82.9 million for Q1 ’21. Net income available to common shareholders was $54.5M, up 81% vs. Q2 ’21, while EPS was $1.50, up 180%.

Fleet:

Between Jan. 1 and Aug. 3, 2022, management contracted ~$435.5M of additional revenues for its fleet, including five forward fixtures of charters of four to five years duration each, one prompt fixture of just over three years, and three charter extension options of 12 months. These charters were renewed in a rising market, locking in increased forward cash flows even before accretive impact of 2021 acquisitions.

GSL’s fleet had an average remaining charter length of 2.6 years, with $1.91B in contracted revenues. It has no exposure to the charter market in 2022, with 91% of fleet ownership days in 2023 covered.

Dividends:

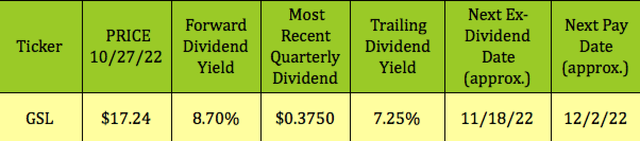

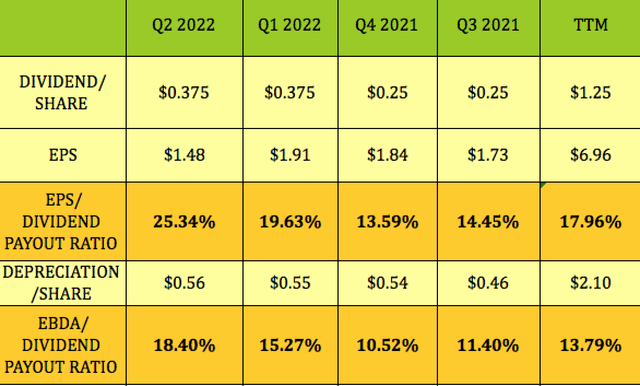

Management increased the dividend by 50% in Q2 to $0.375/share. At its 10/27/22 intraday price of $17.24, GSL yields 8.70%. It should go ex-dividend on ~11/18/22, with a ~12/2/22 pay date.

Hidden Dividend Stocks Plus

Dividend coverage has been very strong, with low dividend payout ratios ranging from 13.59% to 25.34%, and averaging 17.96% over the past four quarters, based upon EPS, which includes quite a lot of non-cash depreciation and amortization.

Stripping out those non-cash D&A expenses shows an average dividend payout ratio of 13.79% over the past 12 months.

Hidden Dividend Stocks Plus

GSL also has a preferred B series with an 8.75% rate dividend, which was selling at ~$25.09 on 10/27/22.

Tailwinds:

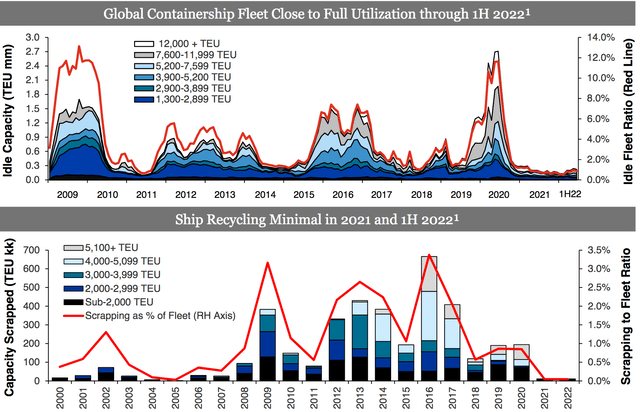

The strong demand for vessels pushed the global fleet to nearly full utilization through Q1-2 ’22. (The red line represents the idle fleet ratio.) Scrapping of older vessels was also at a minimum, due to the strong demand:

GSL site

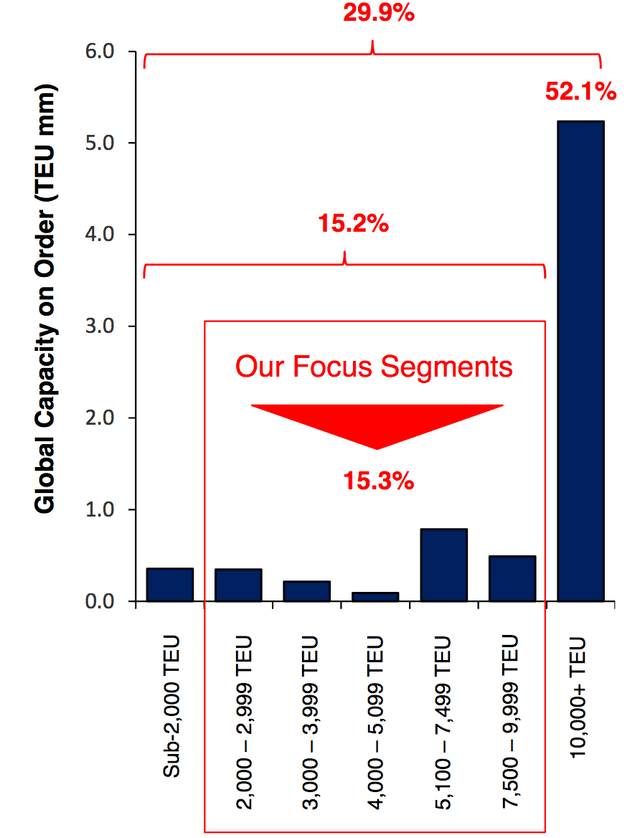

The global order book is skewed toward larger vessels, with an order book to fleet ratio of 52.3%. However, in GSL’s arena of smaller ships under 10,000 TEU, the order book to fleet ratio is only 15.2%.

GSL site

Another tailwind for GSL is that new EXI/CCI requirements will also force vessels to move slower, which means that more vessels will be needed to carry the same tonnage.

Profitability and Leverage:

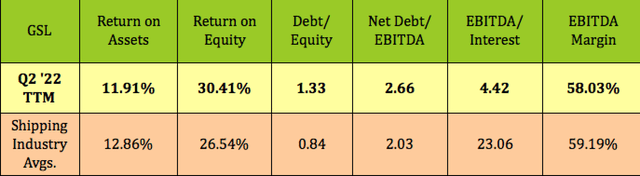

GSL’s trailing ROE is above average for the shipping industry, while its ROA is slightly lower, as is its EBITDA margin. While you may have thought that, due to the high costs of owning vessels, the broad shipping industry would be debt heavy, that’s not the case.

The average Debt/Equity is .84X, and the average net debt/EBITDA is ~2x. GSL’s leverage is above both of those figures, but not by a huge amount. Its interest coverage is reasonable, at 4.42X, while the industry average is much higher, at 23X.

Hidden Dividend Stocks Plus

Debt:

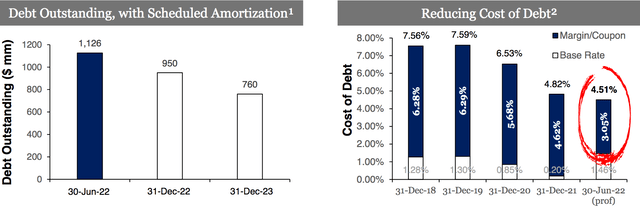

Management has had a busy refinancing year so far in 2022:

It redeemed GSL’s 2024 Notes of $89M in aggregate principal amount in July 2022, and also partially redeemed $28.5M principal amount of GSL’s 2024 Notes in April ’22.

In June 2022, a GSL wholly-owned subsidiary closed the private placement of $350M of privately rated investment grade 5.69% Senior Secured Notes due 2027.

In January 2022, amended its existing $268M Syndicated Senior Secured Credit Facility with an outstanding balance of $213.2 million, to extend the maturity date from September 2024 to December 2026, at an unchanged rate of LIBOR + 3.00%.

GSL’s corporate family credit ratings were improved by Moody’s, from B1 / Stable to B1 / Positive, and by S&P Global, from BB- / Stable to BB / Stable in July and August 2022.

GSL’s debt is projected to decrease by ~15%, to $950M by 12/31/22; and to decrease an additional 20% by 12/31/23. The cost of this debt has decreased dramatically since 2019, dropping from 7.59% to 4.5%:

GSL site

Valuations:

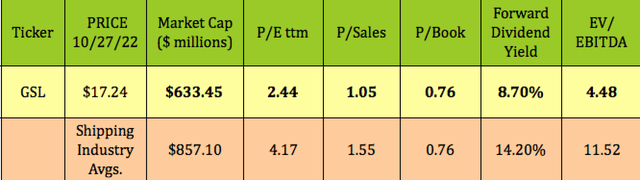

GSL looks undervalued on a P/E basis, at 2.44X vs. the 4.17X industry average. Its 4.48X EV/EBITDA valuation is much lower than the 11.52X industry average, while its P/Sales is also lower than average.

Hidden Dividend Stocks Plus

Analysts’ Targets:

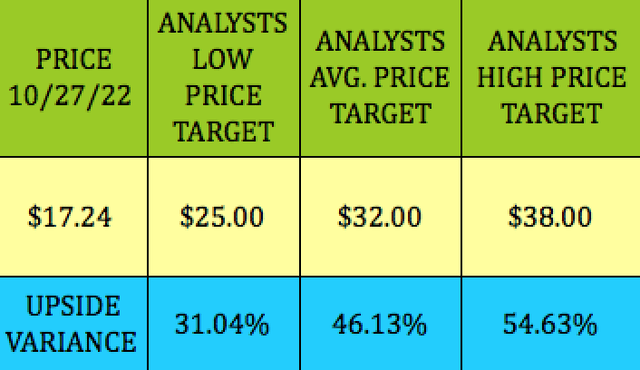

At its 10/27/22 intraday price of $17.24, GSL was far below analysts’ price targets – 31% below the $25.00 lowest target, and 46% below the average price target.

Hidden Dividend Stocks Plus

Performance:

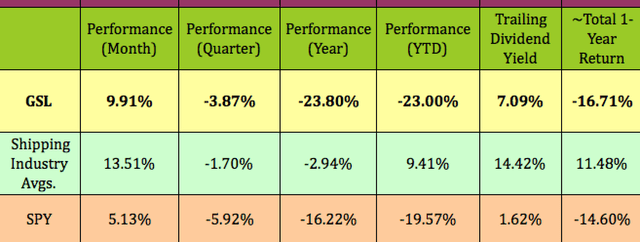

While GSL has outperformed the market over the past month and quarter, it has lagged the S&P and the shipping industry over the past year, year to date, and has also lagged them on a total return basis over the past year.

Hidden Dividend Stocks Plus

Parting Thoughts:

We rate GSL a speculative buy based upon its improving debt leverage, strong earnings, and attractive well-covered dividend yield. It’s speculative, because of the volatility of the shipping industry, and the many questions facing the global economy at present.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment