Tashi-Delek

Those who can make people believe absurdities, can make people commit atrocities.”― Voltaire

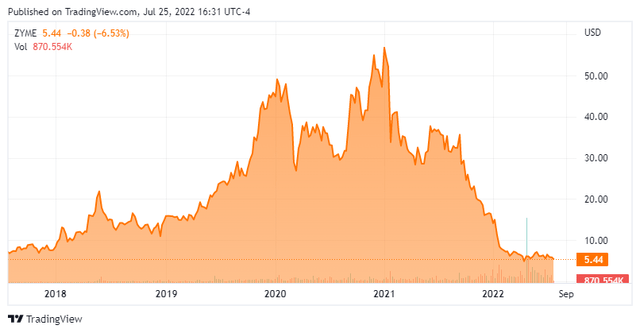

Today, we take our first look at Zymeworks (NYSE:ZYME). The stock has been in the news a lot recently and has taken its shareholders on an absolute roller coaster ride over the past few years.

Company Overview

Zymeworks Inc. is located in Vancouver, Canada. The company is a clinical-stage biopharmaceutical company focused on developing biotherapeutics for the treatment of cancer. The stock trades for around $5.50 a share and sports an approximate market capitalization of $340 million.

June Company Presentation

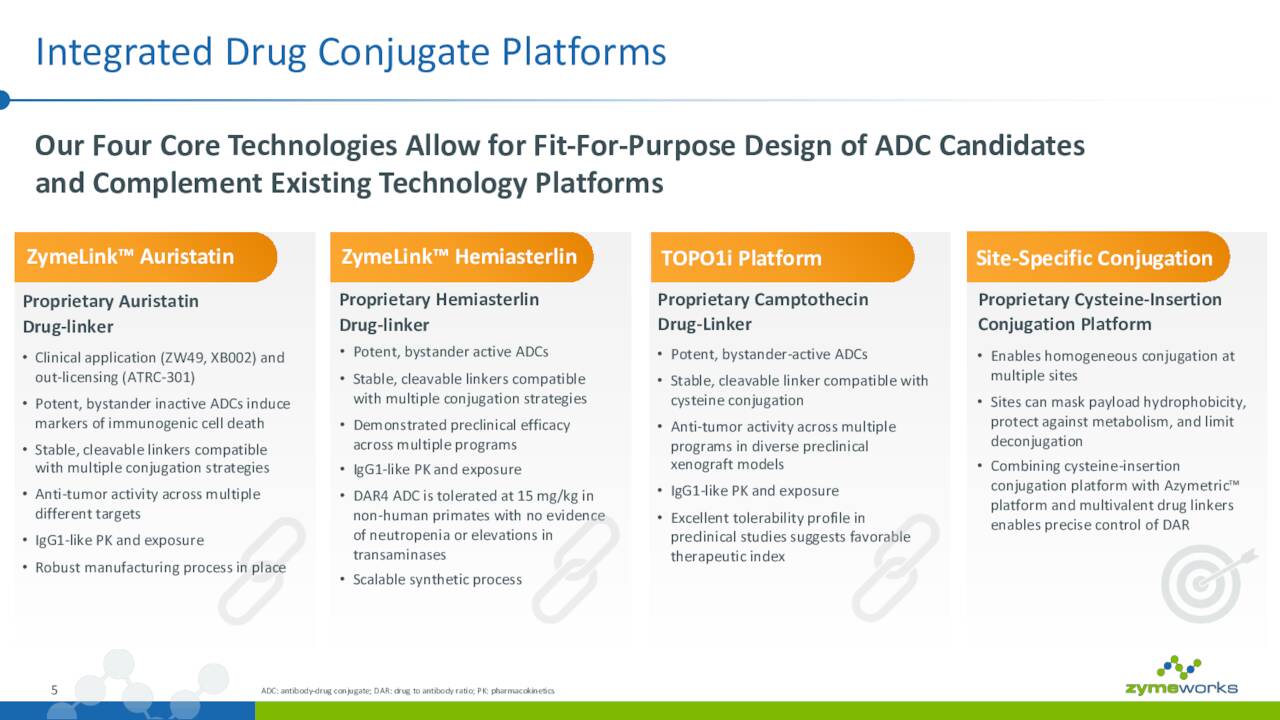

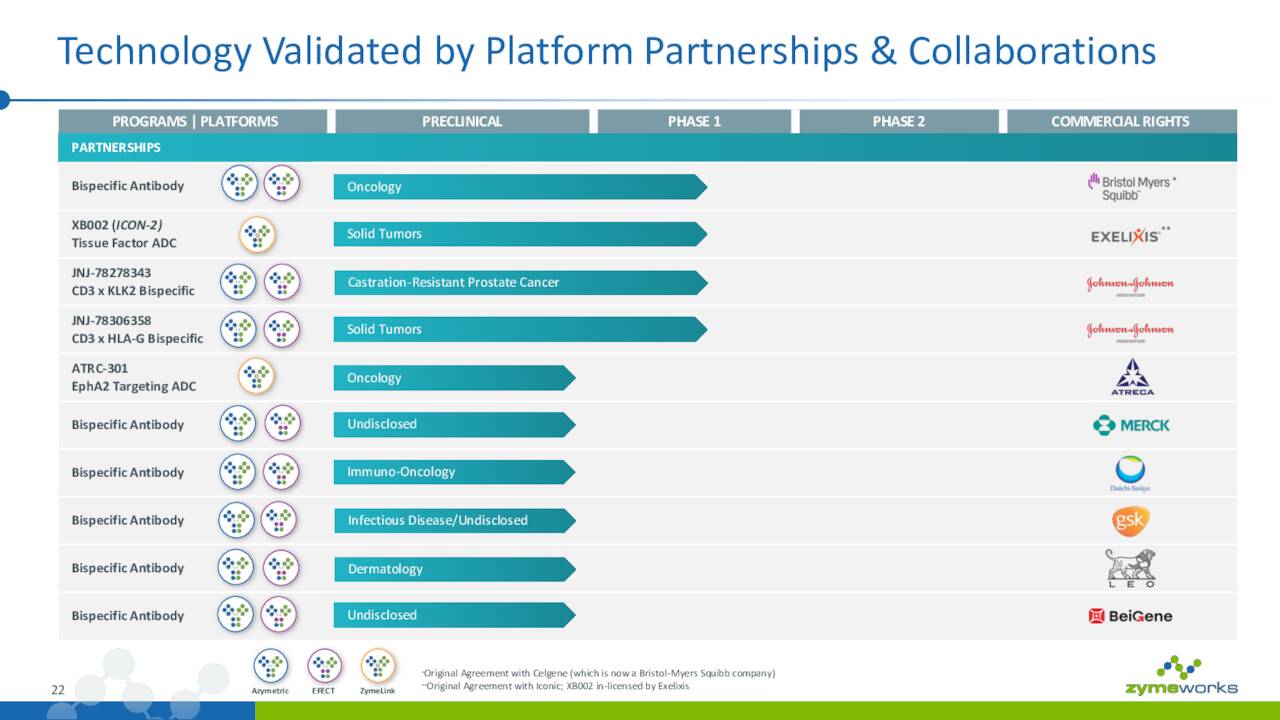

The company has several platforms, it is developing bispecific antibodies that can simultaneously bind to two antigens.

June Company Presentation

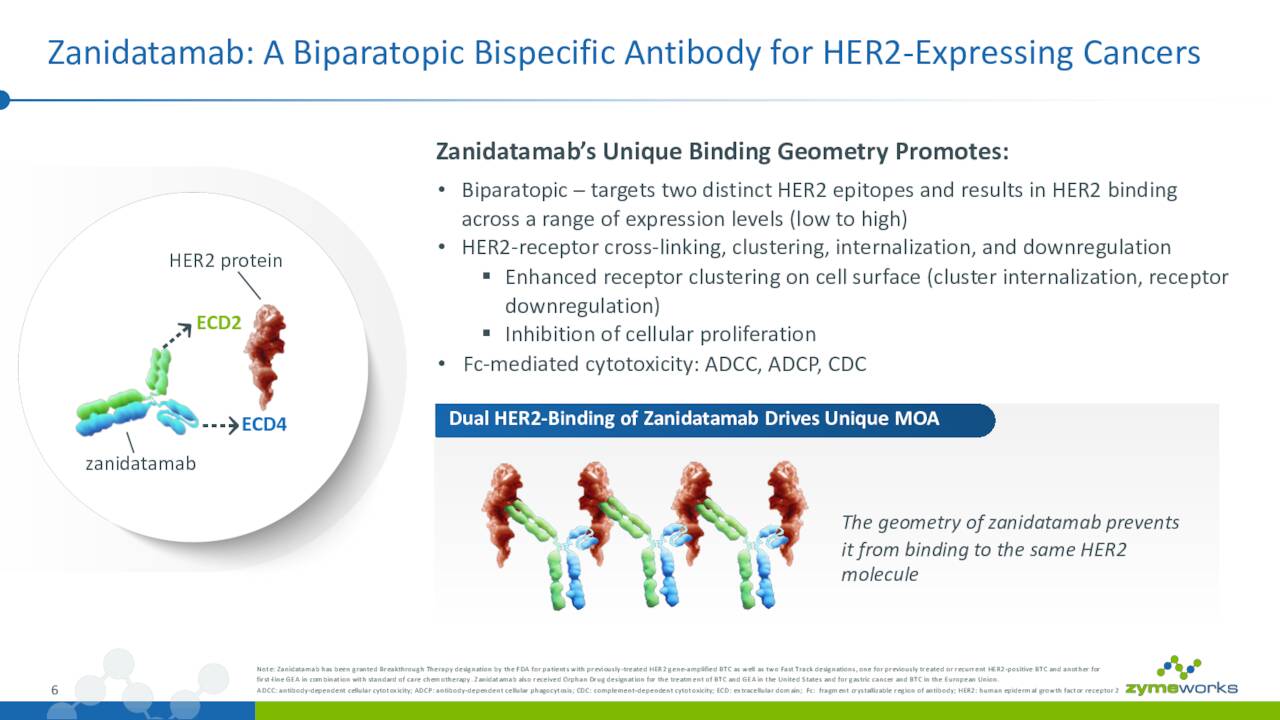

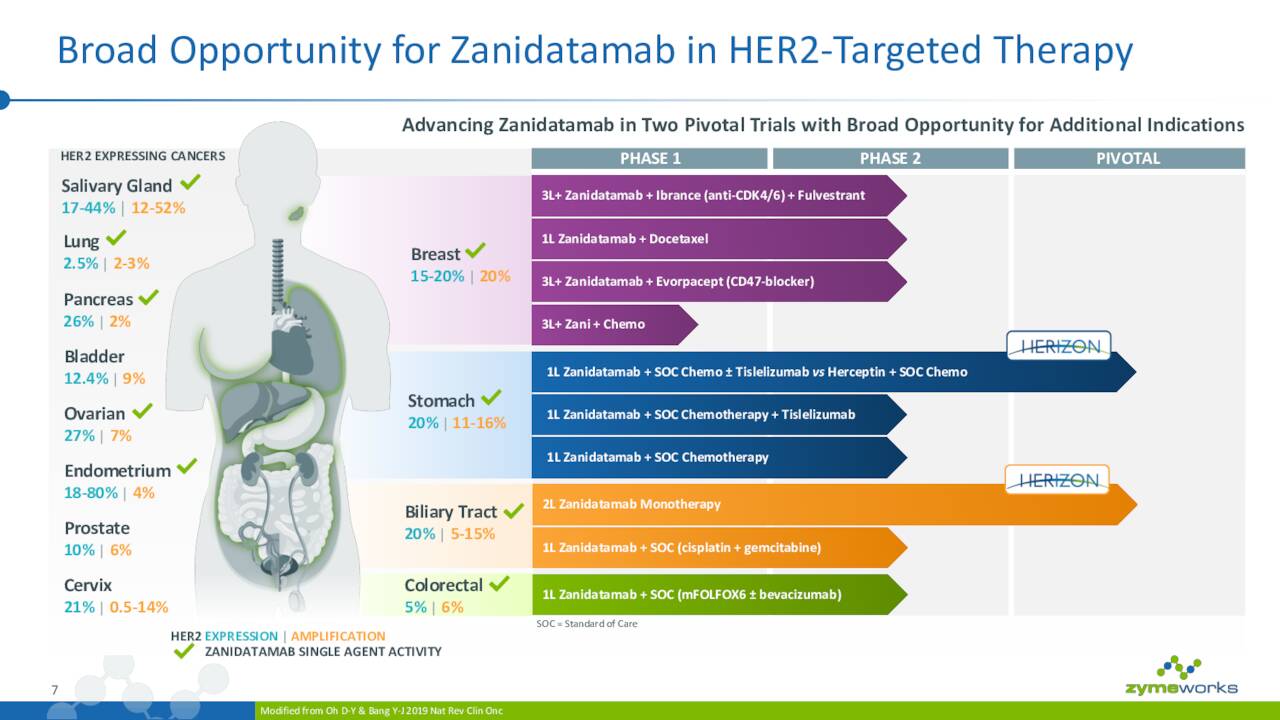

Zymeworks’ main asset is Zanidatamab which is targeting a variety of HER2-expressing cancers in combination with other drugs and also has a monotherapy.

June Company Presentation

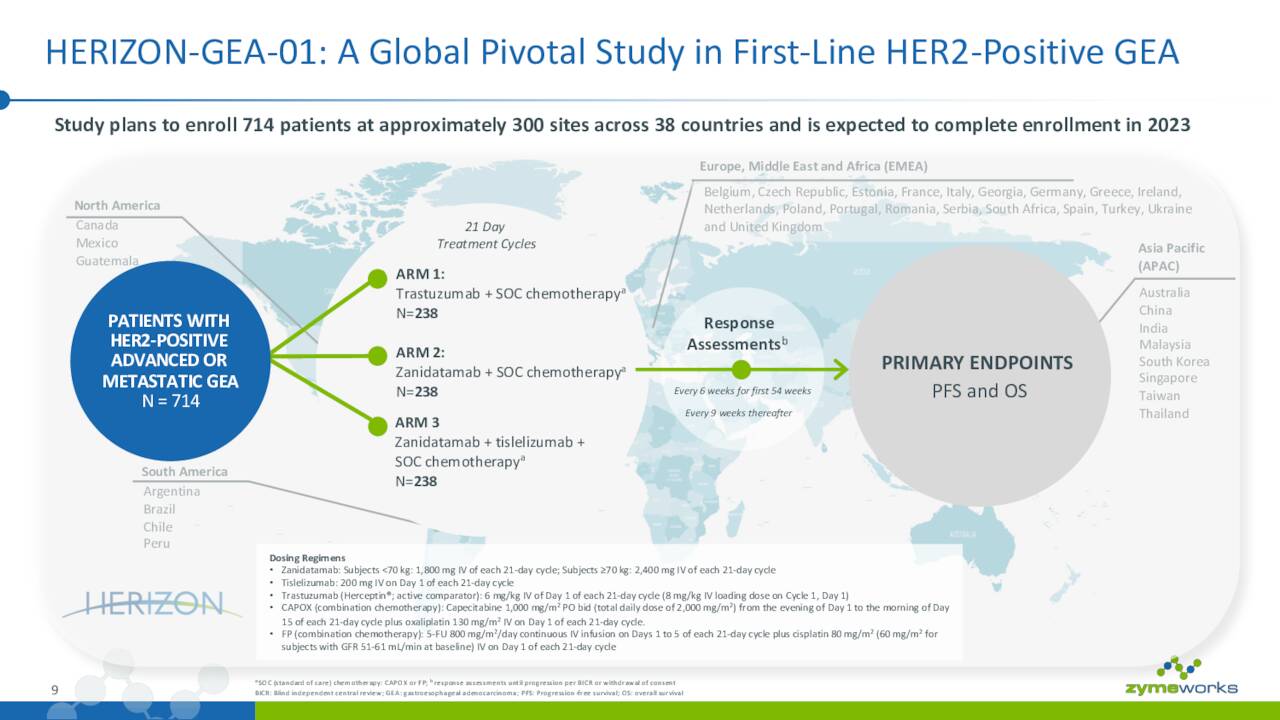

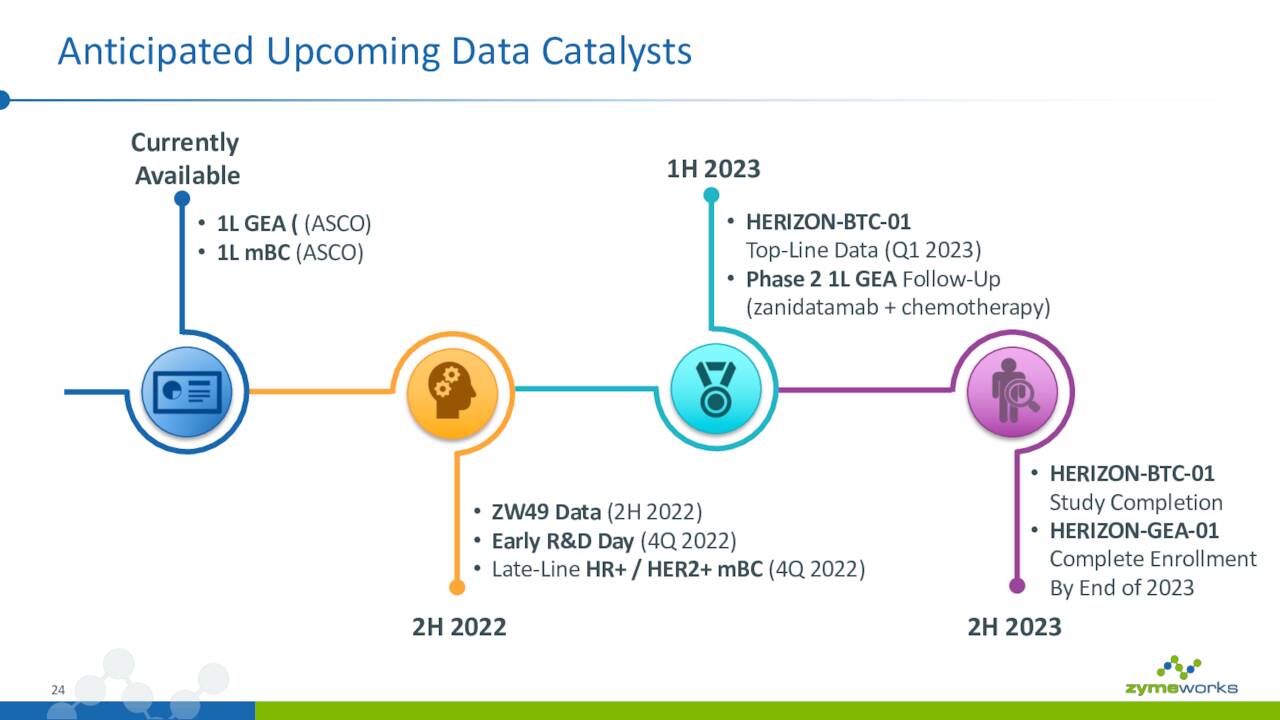

The company is currently recruiting over 700 patients with HER2-Positive advanced or metastatic Gastroesophageal adenocarcinoma or GEA in multiple sites across the globe for a pivotal study called HERIZON-GEA-01 which should have enrollment completed sometime in 2023.

June Company Presentation

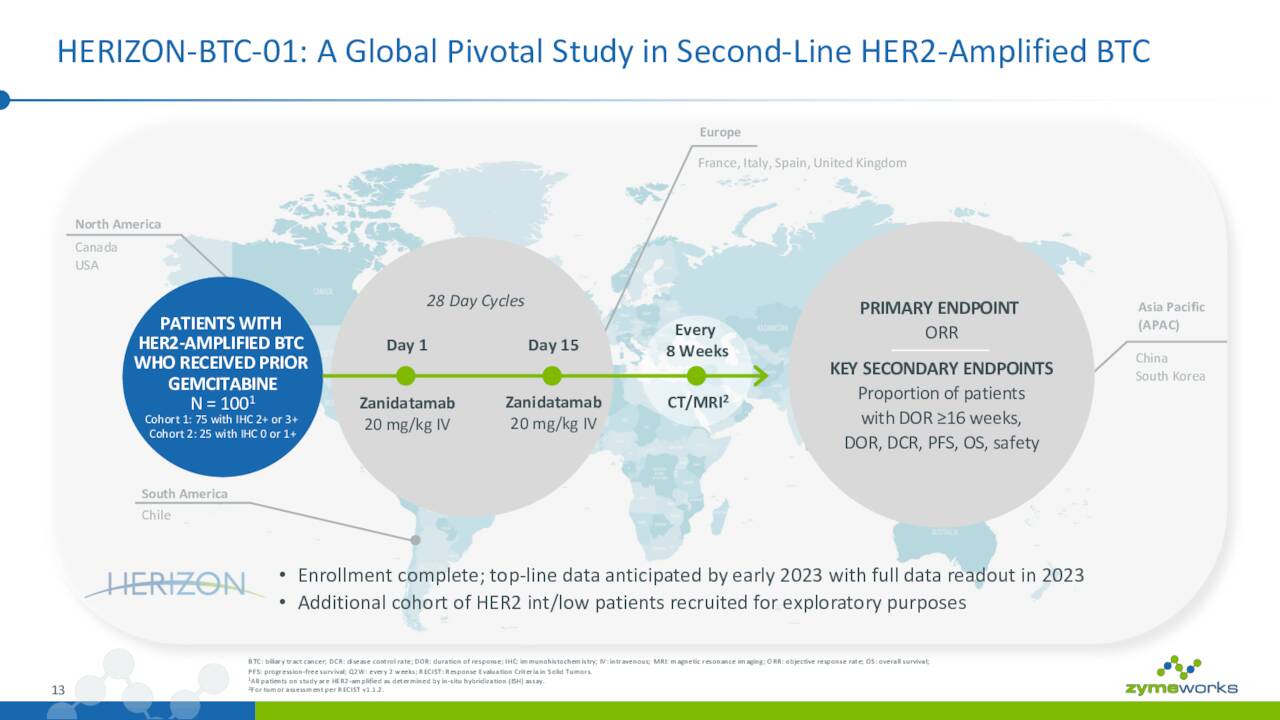

The company has already recruited all individuals for a pivotal study called HERIZON-BTC-01 using Zanidatamab as a monotherapy to treat second line HER2-Amplified BTC (Biliary Tract Cancer).

June Company Presentation

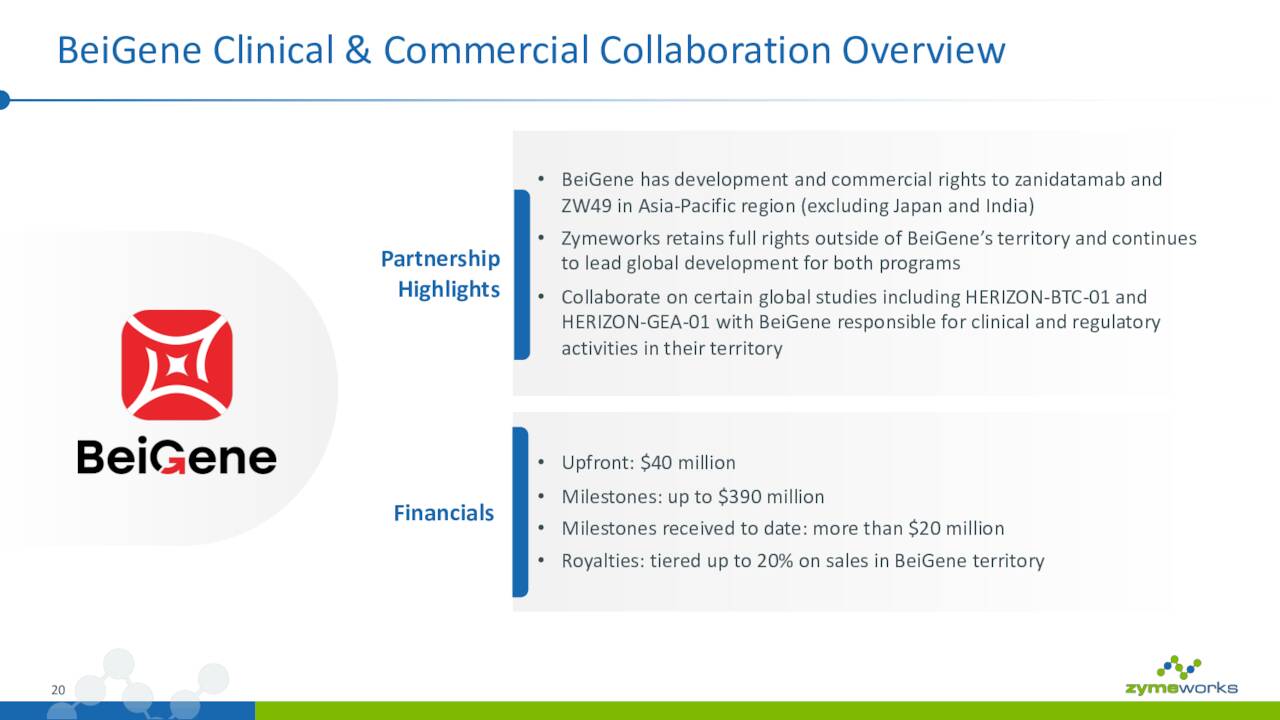

Top line data from this study should be out in the first quarter of 2023 and full results should be disclosed before the end of the first half of 2023. If successful, this could result in Zanidatamab being the first HER-2 targeted therapy approved for BTC. The company has a significant partnership with BeiGene (BGNE) in Asia-Pacific around these efforts.

June Company Presentation

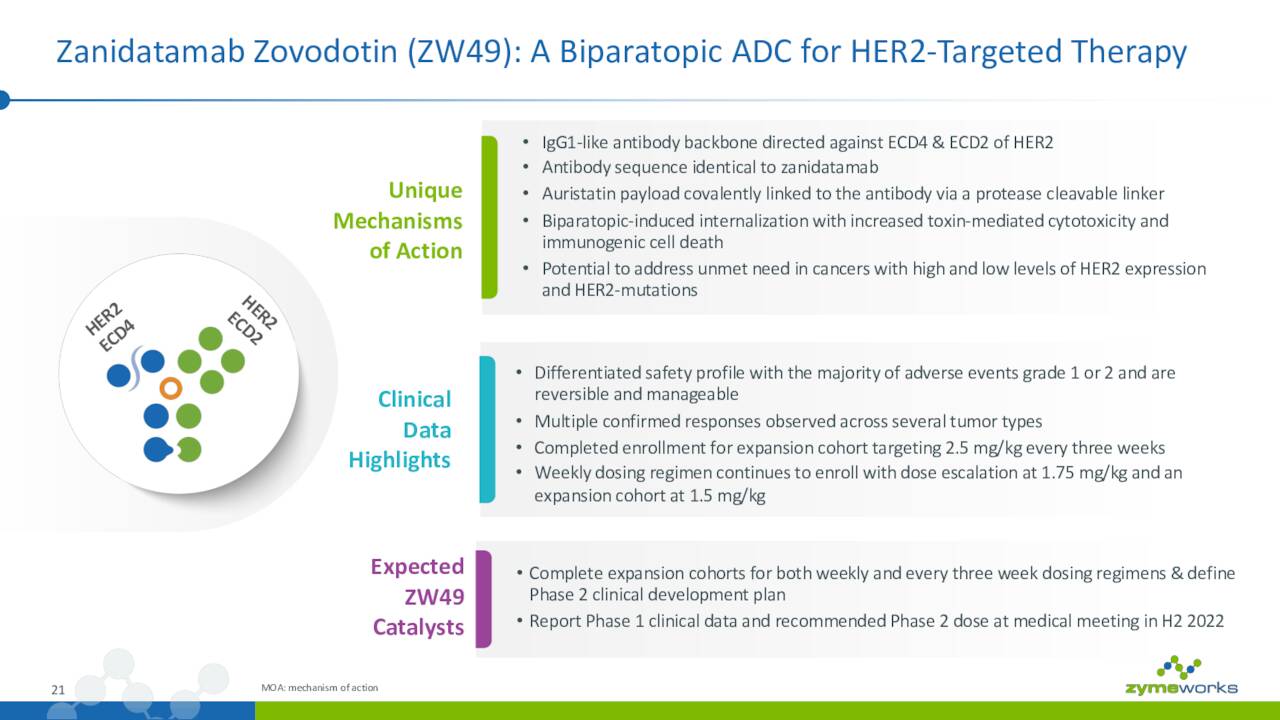

The company is also advancing ZW49 (below) and some Phase 2 data should be out before the close of 2022.

June Company Presentation

Recent Developments:

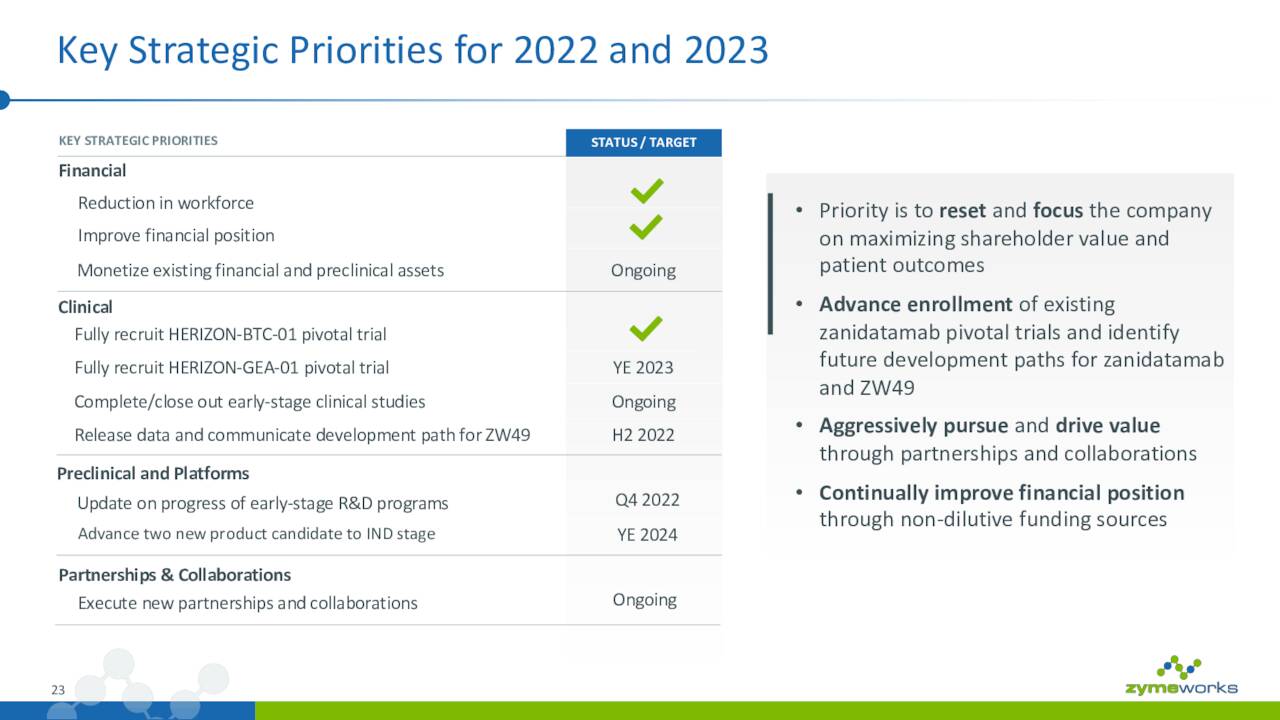

It has been an eventful 2022 for the company to say the least. The company began the year by installing a new CEO. It also nixed half of its leadership team and a quarter of its workforce. It added a new Chief Scientific Officer late last month. The new leader has a history of selling companies to larger players as a recent article pointed out.

Sure enough, in late April All Blue Falcons made a $773 million all-cash non-binding offer for Zymeworks. The firm rejected the offer a few weeks later stating the offer ‘substantially undervalues the company‘ and also ‘lacks information regarding potential sources of funding or any details on their ability to consummate such a transaction‘. In June Zymeworks adopted a shareholder rights plan that makes a takeover less likely, at least until it expires in June of next year.

Analyst Commentary & Balance Sheet

Bears like this stock as nearly one out of four shares are currently held short. Analyst firms are more sanguine on the company’s prospects. Since early May, seven analyst firms including Citigroup and Stifel Nicolaus have reissued or upgraded to Buy or Outperform ratings. Price targets proffered ranged from $14 to $40 a share. Both Barclays ($7 price target) and JPMorgan ($14 price target) have reiterated Hold ratings on the stock.

The company had $1.9 million in revenue in the first quarter as it posted a net loss of $72.6 million for the quarter. Currently, all of Zymeworks’ revenues come from non-recurring upfront fees, expansion payments or milestone payments from collaboration and license agreements. As such, they are ‘lumpy‘. The company ended the first quarter with approximately $300 million worth of cash and marketable securities on its balance sheet. Management has stated it is well funded through the first half of 2023. The company last did a $100 million capital raise in late January of this year via a secondary offering. There has been little insider activity in the stock so far in 2022.

Verdict

There are several positives around the stock including recent acquisition interest. The cash on the balance sheet also is nearly equal to the stock’s current market cap and generally, analyst firms are positive on it. On the downside, the company has a large quarterly burn rate and will have to go back to the markets to raise additional funding if it is now bought out over the next few quarters. The large amount of short interest in the shares are also a ‘red flag‘.

June Company Presentation

The company seems to be moving in a more focused direction under the new CEO. That said, Zymeworks is still quite some time away from any potential commercialization.

June Company Presentation

A buyout is now unlikely it would appear, and the company is going to have to have at least one significant capital raise (outside signing a new major partnership) in a challenging funding environment before any products hit the market. A new partnership is hardly outside the realm of possibilities to extend the company’s cash runway given how many collaborations and partnerships it has already put together around its platforms/candidates. Given all of this, ZYME probably only should be a small ‘watch item‘ holding for aggressive investors at this point in time.

June Company Presentation

Slay your demon and another will only take its place. Tame your demon and you will have a companion for life.”― Anthony T. Hincks

Be the first to comment