AJ_Watt

When it comes to the world of REITs, asset types can vary significantly. And personally, one of the types of assets that I find most interesting are those dedicated to the self-storage space. They often require very little in the way of maintenance and, just by virtue of existing and holding products that other people own, generate attractive cash flows with little overhead. Most of the players in this market are rather large by comparison. But this doesn’t mean that there aren’t very small firms that are worth consideration. One that is particularly noteworthy and that is trading at a discount to its larger peers is Global Self Storage (NASDAQ:SELF). And given recent performance achieved by the company, I must say that shares still seem to be a ‘buy’ to me.

Performance Continues To Wow

Back in November of 2021, I wrote an article that looked upon Global Self Storage in a favorable light. In that article, I said that the company’s historical performance had been attractive. I was drawn in by its revenue growth over the prior years and I said that while shares of the company weren’t cheap, they were affordable. This was especially true when considering how the company was priced compared to similar firms. At the end of the day, these revelations led me to rate the enterprise a ‘buy’. Since then, the firm has outperformed even my own expectations. You see, when I rate a firm a ‘buy’, my general opinion is that the company is likely to outperform the broader market for the foreseeable future. But unless it is a ‘strong buy’ rating, I don’t expect it to beat the broader market by double-digit percentage points in the span of just a few months. But that is precisely what we have seen here with Global Self Storage, with shares generating a return for investors of 9.8% at a time when the broader market has fallen by 14.7%.

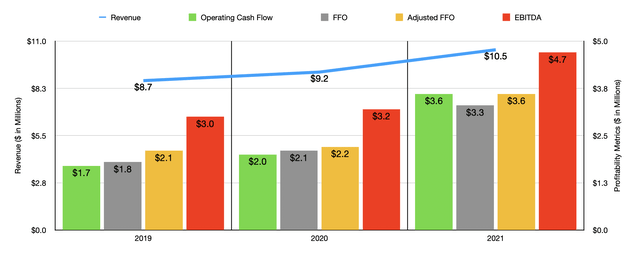

This strong performance seems to have been driven in large part by attractive fundamental performance generated by the firm. To start with, let’s touch on how the company finished off its 2021 fiscal year. When I last wrote about it, we only had data covering through the third quarter of that year. But today, we now know that revenue came in at $10.5 million for the year. That represents an increase of 14.2% over the $9.2 million generated just one year earlier. It also marks at least the fifth year in a row in which revenue increased for the enterprise. According to management, there were really two key drivers of this rise in sales. One big contributor was an increase in the rental rates the company charges its customers. And the other was the results of its revenue rate management program of raising existing tenant rates. However, the company also experienced a 13.2% rise in revenue associated with other store income, with that increase largely driven by increased insurance participation at both its wholly owned and managed properties.

This rise in revenue for the company also translated to stronger profitability. Operating cash flow went from roughly $2 million in 2020 to $3.6 million in 2021. In addition to benefiting from higher revenue, the company also saw a 1.9% decrease in operating costs, largely due to decreased depreciation and amortization and also because of a reduction insert in general and administrative expenses. While the depreciation and amortization would not have impacted operating cash flow, the other decreases certainly would have. This decrease in costs also helped to push other profitability metrics higher as well. FFO, or funds from operations, went from $2.1 million in 2020 to $3.4 million last year. On an adjusted basis, this metric went from $2.2 million to nearly $3.6 million. Meanwhile, EBITDA also increased, climbing from $3.2 million to $4.7 million.

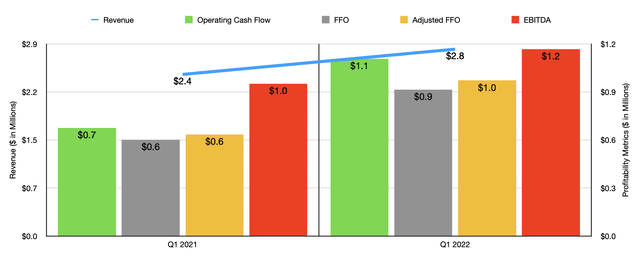

So far, the 2022 fiscal year also looks to be rather positive for the company. Revenue of $2.8 million in the first quarter of the year is higher than the $2.4 million generated the same time one year earlier. Profitability, meanwhile, has also been on the upswing, with operating cash flow rising from $675.8 million in the first quarter of 2021 to $1.1 billion the same time this year. FFO has gone from $602.1 million to $913.9 million, while the adjusted equivalent of this went from $633.8 million to $971.8 million. Meanwhile, EBITDA has gone from $951 million to just under $1.2 billion.

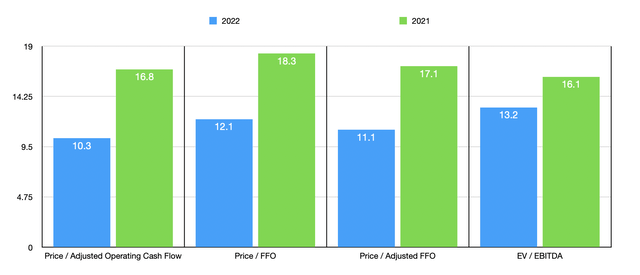

We don’t really know what to expect for the rest of the fiscal year. But if we annualize results experienced so far for the first quarter, we should anticipate operating cash flow of nearly $6 million. FFO should be $5.1 million, while the adjusted figure for this should be $5.5 million. Meanwhile, EBITDA should come in somewhere around $5.7 million for the year. Taking these figures, it doesn’t become difficult to value the company. For instance, on a forward basis, the firm is trading at a price to operating cash flow multiple of 10.3x. This compares to the 16.8 multiple that we get if we use the 2021 results. The price to FFO multiple should drop from 18.3 using last year’s results to 12.1x for this year. On an adjusted basis, this multiple should drop from 17.1x to 11.1x. And when it comes to the EV to EBITDA approach, the multiple should decline from 16.1x to 13.2x. As part of this analysis, I also compared the company to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 17.5x to a high of 24.2x. And when it comes to the EV to EBITDA approach, the range was from 20.3x to 24.1x. In both scenarios, Global Self Storage was the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Global Self Storage | 16.8x | 16.1x |

| Public Storage (PSA) | 21.2x | 22.8x |

| Extra Space Storage (EXR) | 24.2x | 23.1x |

| CubeSmart (CUBE) | 19.1x | 22.5x |

| Life Storage (LSI) | 20.2x | 24.1x |

| National Storage Affiliates Trust (NSA) | 17.5x | 20.3x |

Economic Musings

Given recent economic conditions, investors are well within their sensibilities to ask what the impact of things like a recession, inflation, and rising interest rates, might have on a company like Global Self Storage. Obviously, every company is different and everything ultimately depends on the severity of any adverse economic events. But for the most part, investors in the self-storage space should find themselves sleeping soundly at night. I say this because there is ample evidence to support the view that this particular industry will fare quite well if current turbulence continues.

Consider the impact that a recession might have on the self-storage space. Back in 2008, when it looked as though the world was falling apart, this industry actually still managed to achieve growth of 5% year over year. While this may seem unlikely, it’s quite logical when you understand why people use self-storage to begin with. Often, it is utilized when people are, for whatever reason, forced to move from one area to another and need some place to park their goods. What better time for that kind of activity than during a recession? And it’s unlikely that the goods in question will instead be thrown away because, while definitely affordable, self-storage is expensive enough that people generally wouldn’t use it for items that can be easily disposed of and replaced later. So if people are going to be forced to move around and change their living conditions, self-storage should see demand increase if anything during difficult times.

When it comes to inflation, the picture is a little less certain. It is possible that inflationary pressures could impact the space in two different ways. The first way would be through decreased demand for self-storage space because income must be utilized for more important things. However, as I mentioned already, self-storage is usually quite affordable for consumers, and it almost always relies on having hundreds of clients per location, so even if some clients do roll off of the roster, the loss of income should be marginal. On the other side, you also have the risk of increased costs. This is a more realistic concern. But given that the nature of the self-storage space involves much of the investment being made in the physical real estate in which the activity takes place, and the fixed nature of that real estate is immune from cost increases, any rise in expenses, such as labor costs, should account for only a small portion of the company’s income statement.

And finally, there is the question of rising interest rates. Companies with high amounts of debt, particularly of variable debt, could be subjected to rising interest expense. Fortunately for investors and Global Self Storage, this is not a concern. Substantially all of the company’s debt today is in the form of a note payable that is locked in at a fixed rate of 4.192% per annum. And that note does not come due until 2036. If interest rates are still high at that time and if the company has not been able to use its excess cash flow to pay down this debt in advance, then investors will have bigger things to worry about than interest expense.

Takeaway

At this moment in time, I do believe that there is still some nice upside potential on the table for Global Self Storage. This is not to say, of course, that the company is without its risks. As a smaller player, it is more susceptible to market volatility, and it is less likely to be able to withstand the loss of customers and to handle difficult market conditions. But in general, the self-storage market is incredibly resilient and given how shares are priced relative to similar firms, it looks as though its size disadvantage is already comfortably priced in. In all, these findings have led me to retain my ‘buy’ rating on the company for now.

Be the first to comment