vdvornyk/iStock via Getty Images

The belly is an ungrateful wretch, it never remembers past favors, it always wants more tomorrow.”― Aleksandr I. Solzhenitsyn

Today, we take a look at a mid-cap name that comes up from time to time from Seeking Alpha followers. The company is in the hot RNA space and has several licensing with lucrative potential milestones. Like so many biotech stocks, the shares have faced tough sledding over the past year, although the stock is up over 25% since we first publish our research exclusively to Biotech Form members one month ago

That article has been updated and follows below.

Company Overview:

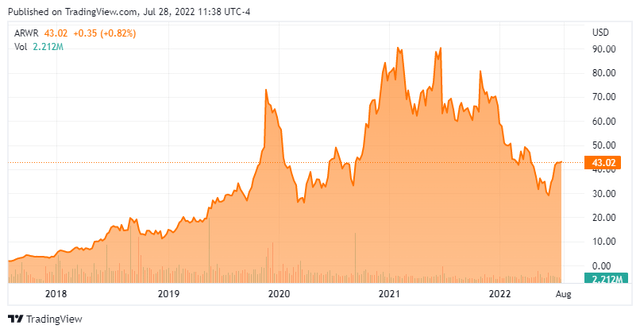

Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR) is a Pasadena, California-based clinical-stage biopharma concern focused on the development of therapies for hard-to-treat genetic diseases by silencing the offending gene. Although it has plans to use its RNA interference [RNAI] chemistries to target multiple disease types, the company’s eight clinical assets all target the liver. Arrowhead was formed as an incubator focused on nanoparticle technology in 2003 and went public via a reverse merger into failed multimedia and security concern InterActive Group on the OTC Bulletin Board in 2004, later listing on the NASDAQ that same year. It transitioned to its current raison d’etre when it purchased Roche’s (OTCQX:RHHBY, OTCQX:RHHBF) RNAi business in 2011. After achieving an all-time high of $93.66 in June 2021, shares of ARWR trade around $43.00 a share, equating to a market cap of approximately $4.7 billion.

Approach

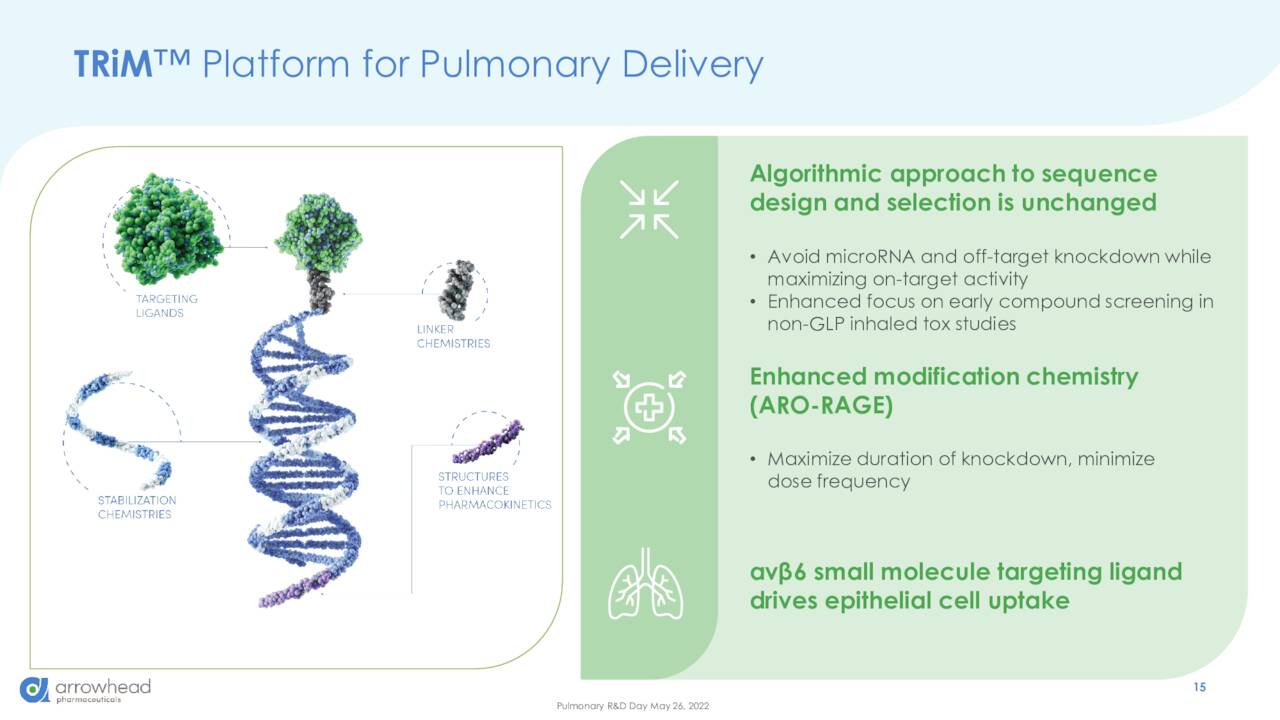

Arrowhead’s portfolio is centered on therapies that trigger RNAi mechanisms to inhibit the expression of a specific gene, thereby affecting the production of a specific attendant protein that plays a central role in a particular disease. Armed with a portfolio of RNA trigger structures and chemistries, its TRIM platform produces therapies that when introduced into a cell, pair with and degrade messenger RNAs, effectively halting the production of targeted proteins.

June Company Presentation

Pipeline

The company’s clinical pipeline includes five out-licensed assets and three wholly owned candidates, as well as two pulmonary programs that are about to enter the clinic. All require subcutaneous administration.

ARO-APOC3. The company’s lead wholly owned asset and first ever to enter a Phase 3 trial is ARO-APOC3, a subcutaneously injected RNAi therapy designed to reduce the production of apolipoprotein C-III (apoC-III), which is secreted by the liver and small intestines to regulates triglyceride [TG] metabolism. By inhibiting the hepatic production of apoC-III, Arrowhead hopes to reduce the synthesis of very low-density lipoproteins (LDLs) and enhance their (as well as TG-rich, ultra-low density lipoprotein chylomicron) clearance to regulate severe hypertriglyceridemia (sHTG) and familial chylomicronemia syndrome [FCS].

There are no FDA-approved remedies for sHTG or FCS. Omega-3 fatty acids safely lower fasting TG levels by 25%-30%, which is an excellent start. But in sHTG patients who have fasting TG levels of 880 mg/dl (normal is ~150 mg/dl), further assistance is necessary. Drug combinations of statins and fibrates are often prescribed but have safety and efficacy issues, leaving an unmet need and opportunity for Arrowhead’s ARO-APOC3.

It is currently undergoing investigation in one Phase 3 and two Phase 2b studies. The Phase 3 study (PALISADE) is evaluating the therapy in the treatment of FCS, an ultra-rare (1 to 2 in a million) genetic condition in which patients have extraordinarily high TG levels (like sHTG), leading to recurrent bouts of pancreatitis, which can be fatal. There are no FDA-approved therapies for FCS, although Ionis Pharmaceuticals (IONS) antisense oligonucleotide Waylivra (volanesoren), which targets the same apoC-III protein, is conditionally approved in the EU but was rejected by the FDA due to safety concerns in 2018. The two cohort, 72-patient, placebo-controlled PALISADE trial’s primary endpoint is change from baseline in TG between each ARO-APO3 dose (every three months) and pooled placebo at month 10. The study is expected to fully enroll by mid-2023 and complete in 2024. In a Phase 1/2 trial, ARO-APOC3 demonstrated an eye-popping 91% median reduction of TGs in four patients and was generally well-tolerated.

Although a small sample size, the decreases observed were similar to 26 patients in an earlier sHTG study where patients had similar TG levels but did not carry the genetic mutation consistent with FCS. That study led to APO-APOC3 being investigated in two placebo-controlled Phase 2b trials, involving the treatment of 300 patients with sHTG (SHASTA-2) and 320 patients with mixed dyslipidemia (MUIR). sHTG is a much more common (1 in 600) multifactorial disease, resulting from the accumulation of genetic TG raising variants together with modulating secondary factors, such as obesity. Mixed dyslipidemia is a lipoprotein metabolism disorder resulting in a buildup of LDLs and a reduction in ‘good’ high-density lipoproteins [HDLS]. Both studies aim to find the proper dosage for future pivotal trials with primary endpoints the percentage change from baseline in fasting TGs at week 24. Both studies are ~50% enrolled with full enrollment anticipated by YE22 and data sometime in 2023.

ARO-ANG3. Arrowhead’s other wholly owned cardio metabolic candidate is ARO-ANG3, an RNAi therapy designed to reduce production of angiopoietin-like protein 3 (ANGPTL3), a liver synthesized inhibitor of lipoprotein lipase and endothelial lipase. In prior studies, ANGPTL3 inhibition has demonstrated reductions in LDL and liver TG levels. ARO-ANG3 is undergoing evaluation in a 200-patient, placebo-controlled Phase 2b study (ARCHES-2) for the treatment of mixed dyslipidemia with primary endpoint percentage change from baseline in fasting TGs at week 24. The study is scheduled to complete in 4Q22 with top line data expected in 1H23.

ARO-ANG3 is also undergoing assessment in an open-label Phase 2 trial (GATEWAY) in the treatment of up to 16 subjects with homozygous familial hypercholesterolemia.

Olpasiran. The company’s other cardiometabolic asset is olpasiran, an RNAi treatment designed to reduce apolipoprotein A production, which has been linked to increased cardiovascular disease risk, independent of cholesterol and LDL levels. It was out-licensed to Amgen (AMGN) in 2016 for a total upfront consideration of $56.5 million, consisting of an equity investment of $21.5 million and cash of $35 million. Currently undergoing a Phase 2 dose finding study in patients with elevated apolipoprotein [A], olpasiran could generate milestone payments to Arrowhead totaling $400 million, as well as low double-digit royalties.

ARO-AAT. The company’s other clinical stage assets not only target the liver, but also liver diseases. All of these programs except one are out-licensed with its ARO-AAT program, a co-development venture with Takeda Pharmaceutical (TAK). Under the terms of the 2020 agreement, both entities will advance the treatment for liver disease associated with alpha-1 antitrypsin deficiency (AATD) and co-commercialize (if approved) in the U.S. under a 50/50 profit share. Takeda will assume the development lead beyond Phase 2 studies and have an exclusive international license, with Arrowhead eligible to receive royalties of 20% to 25%. Arrowhead received $300 million upfront and is eligible to receive potential milestones totaling $740 million.

An interim readout of a Phase 2 trial (AROAAT2002) in November 2021 conveyed that ARO-AAT reduced serum and liver Z-AAT and globule burden in all patients and normalized liver enzymes. The mutant ‘Z’ form of AAT occurs in over 95% of patients with AATD, a disease that causes significant injury to the liver and lungs with a prevalence of ~1 in 4,000 Americans. The only available cure is liver transplant. ARO-AAT is also being evaluated in a 40-patient placebo-controlled Phase 2 trial (SEQUOIA) that should readout in 4Q22 with primary endpoint percentage change from baseline in serum Z-AAT. This candidate has been granted Orphan Drug, Fast Track, and Breakthrough Therapy designations by the FDA, as well as an Orphan designation from the EMA. There exists a remote chance that if the biopsy data from SEQUOIA is overwhelmingly positive, the need for a pivotal trial may be unnecessary.

JNJ-3989. Another Arrowhead out-licensed hepatic asset in Phase 2 development is JNJ-3989 (formerly known as APO-HBV), a RNAi therapy for the treatment of chronic hepatitis B that is being advanced through the clinic by Johnson & Johnson (JNJ). In return, the company received $250 million upfront ($75 million in the form of equity investment) and has earned $73 million in milestones to date. Arrowhead is eligible to receive an additional $1.6 billion in milestones and mid-teen royalties.

JNJ-75220795. Also part of the 2018 accord, J&J selected three additional targets for further development, of which it is going forward on one: Phase 1 NASH therapy JNJ-75220795, which could eventually generate $600 million in milestones and low-teen royalties for Arrowhead.

ARO-HSD. The company also recently inked an out-licensing deal with GSK (GSK) for its RNAi non-alcoholic steatohepatitis [NASH] therapy ARO-HSD after 9 of 18 patients demonstrated liver fat reductions of 4-41% in a Phase 1 study. Under the terms of the November 2021 agreement, Arrowhead received $120 million upfront and is eligible for potential milestones of $910 million, as well as mid-teens to twenty percent royalties. GSK is expected to enter ARO-HSD into a Phase 2 study by YE22.

ARO-C3. The company’s final clinical-stage, liver-related program is wholly owned ARO-C3, which is undergoing Phase 1/2 evaluation in the reduction of complement component 3 as a potential therapy for various complement mediated diseases.

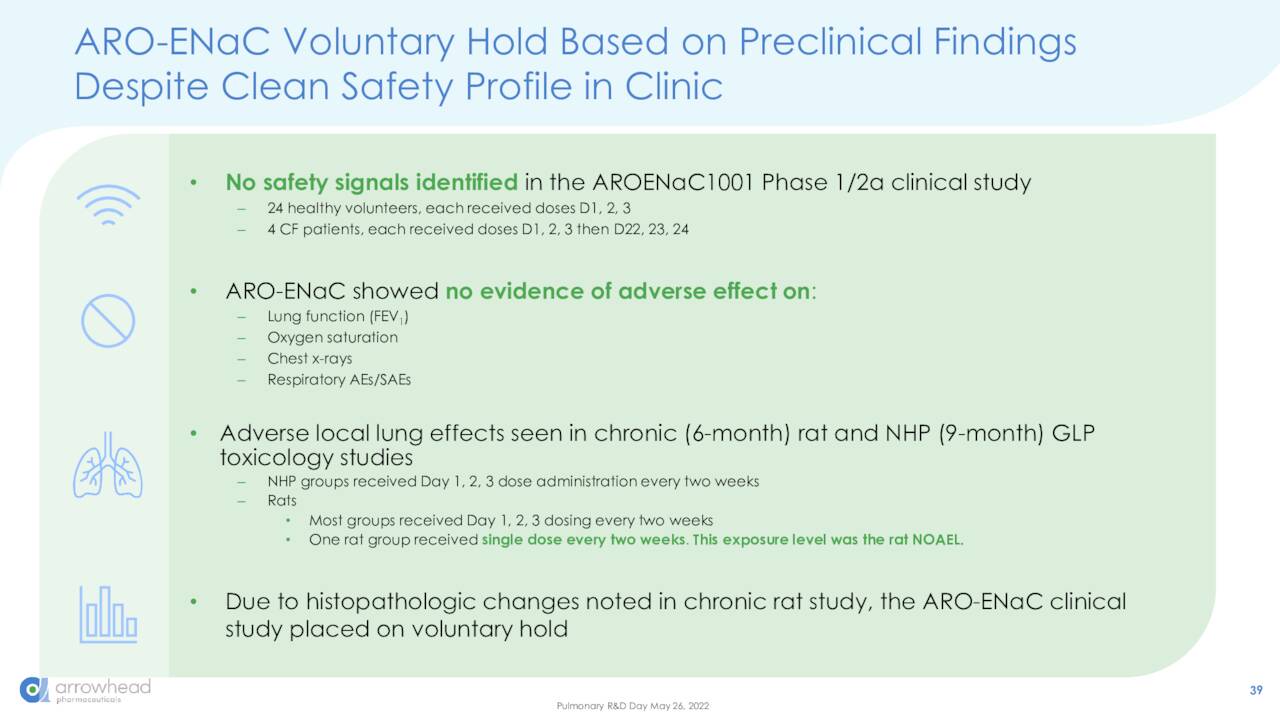

Program Halts

Part of the reason for Arrowhead’s revaluation was the termination of its Phase 1/2 trial investigating its RNAi cystic fibrosis therapy AROENaC1001, after an ongoing preclinical study discovered unexpected signals of lung inflammation in rats in July 2021. That said, the company should be entering the clinic shortly with two more pulmonary assets: ARO-RAGE for asthma; and ARO-MUC5AC for muco-obstructive lung disease. Dosing began in both of these trials earlier this month. Management also decided to abandon clinical development of ARO-HIF2 for the treatment of renal cell carcinoma after Phase 1 study, owing to the competitive landscape.

June Company Presentation

Balance Sheet & Analyst Commentary:

Arrowhead’s approach of out-licensing most of its mid-stage clinical assets has filled its coffers with non-dilutive capital, leaving it with cash and investments of $603.5 million as of March 31, 2022. Assuming no more out-licensing deals or milestone payments, the company has enough liquidity to get it to the autumn 2023. Arrowhead also has an untapped $250 million ATM facility.

With a promising approach to disease treatment somewhat validated by its multiple out-licensing deals, the company enjoys mainly positive support from Street. Since May, seven analyst firms including Goldman Sachs and RBC Capital have reissued Buy ratings on ARWR. Price targets proffered range from $60 to $110 a share. SVB Securities recently maintained its Hold rating and $35 price target on the equity. Just less than 5% of the overall float is currently held short.

Verdict:

After approaching a market cap of $10 billion one year ago, shares of ARWR have retreated 53%. In addition to program discontinuations and the general bloodbath in biotech, Arrowhead is suffering from not getting anything to market. Its chief RNAi competitor, Alnylam (ALNY) also entered the RNAi space in 2011 and has five commercialized therapies – mostly through collaborations. Alnylam has only lost ~15% of its market cap since Arrowhead set its all-time high in June 2021. And with its closest-to-commercial asset (ARO-APOC3) not scheduled to readout its pivotal trial until 2024, the wait continues.

However, with $4.25 billion in potential milestones, multiple liver and cardiometabolic shots on goal with a high chance of success, an approach that has been validated by its partnerships, Alnylam’s commercial success, and Novo Nordisk’s (NVO) purchase of RNAi concern Dicerna, the pullback in the shares represents a decent entry point for a small “watch item” position for now. After the next capital raise, the stock may merit a larger holding provided adequate progression of its pipeline. This name would make a solid covered call candidate if the liquidity in the options against the equity was better.

That’s what comes of hungering for something; you forget to check if it’s rotten before you gobble it down“― Holly Black

Be the first to comment