ipopba

Syneos Health, Inc. (NASDAQ:SYNH) ended Q3 2022 reporting revenues almost 1% lower than the respective figure for Q3 2021. The results appeared to be below expectations. During the earnings call, Syneos’ CEO Michelle Keefe characterized the results as “frankly unacceptable.” Moreover, Syneos lowered its guidance for the second time during 2022 and placed the expected revenues figures for FY2022 between $5.3 billion and $5.36 billion. These developments scared investors and SYNH stock suffered a massive sell-off.

SYNH’s disappointing results can be attributed mainly to delays in net business awards and an unexpected decline in its overall clinical win rate among small to midsized biotechs. This customer segment has traditionally been a strength for the company. According to management, the root cause of the problem is Syneos’ significant growth during the last years. This development made the company’s operating model less agile and decreased the levels of leadership engagement. Both of these factors are critical in order to win repeat business in the SMID (small and mid caps) segment. Syneos’ management has recognized this structural issue and has already focused on initiatives to turn things around. But this effort won’t be easy due to the continued macro headwinds that put significant pressure on SMIDs. Moreover, the company’s significant amount of debt, a potential severe impact from large cancellations (almost 55% of its revenues come from large biopharma), and the stock’s high volatility pose serious risks for SYNH shareholders.

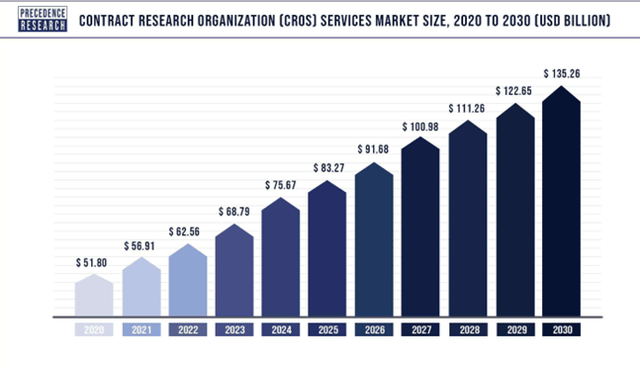

On the other hand, not everything looks gloomy at the moment for SYNH and its shareholders. The company merits a narrow moat in the global contract research organization (CRO) industry, which is expected to grow at a CAGR of 10.1% during the period between 2021 and 2030 and reach a market size of USD 135.26 billion by 2030. Moreover, the company remarkably improved its net income and FCF, and significantly decreased its SG&A expenses between Q3 2022 and Q3 2021 amid an inflationary economic environment. In addition, SYNH still has $350 million available for share repurchases under its current plan. Last but not least, its commercial solutions revenue growth was strong (8%) during the same period, primarily driven by the contribution of the Syneos One portfolio and higher reimbursable expenses.

Taking into account the aforementioned factors, we cannot identify at the moment any catalyst that could cause an important upward or downward movement in SYNH’s stock price. As such, we rate SYNH a hold.

Rapid Growth of the CRO Industry and Syneos’ Moat

As mentioned above, CRO stands for contract research organization, which is a company that provides research and clinical management services to biotechnology, pharmaceutical, and medical devices firms. According to Precedence Research, the CRO services market size is expected to reach $135.26 billion by 2030, growing at a CAGR of 10.1%. Several factors play a key role in fueling this growth. Among the most important ones is the rise of prevalence of chronic disorders and the increasing number of required and highly sophisticated clinical trials that are necessary for the development of novel medications and technologies. In addition, the rise of the availability of research funds due to governmental support for R&D and the expansion of healthcare expenditures also contribute to the explosive growth of the CRO industry.

In our opinion, SYNH merits a narrow moat in the industry mainly because it’s one of the few CROs that possesses the necessary global infrastructure to conduct large, complex, multinational late-stage trials and can secure contracts with large pharmaceutical companies. The company continues to make progress on the large pharma front, having landed its fifth strategic partnership this year. Syneos is also endowed with key intangible assets, including data from millions of patients around the globe and expertise in disease areas like oncology and neurology. These assets provide room for differentiation in the company and enforce high switching costs to its clients. The firm has also reported in previous years that its top 10 customers have worked with SYNH for an average of 18 years.

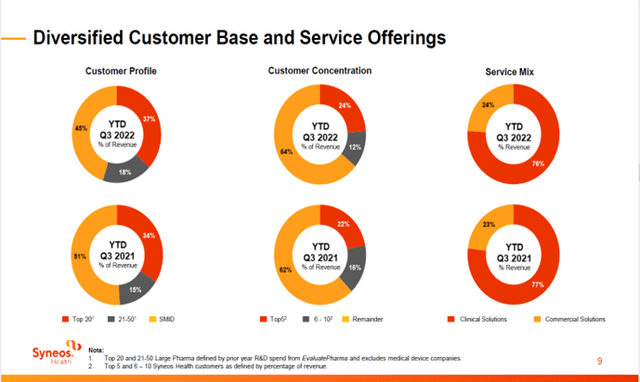

In addition, SYNH has a diversified client base and provides a full portfolio of solutions, offering remarkable flexibility to its clients. As we can see in the following diagram, the firm further diversified its customer base between Q3 2022 and Q3 2021 in terms of revenues attributed to different segments of its customers (Top 20, 20-50, SMID).

Syneos Q3 Earnings Release Presentation

Last but not least, Syneos has acquired three smaller specialized tech companies during the last two years in an effort to improve its competitive positioning in the industry. One of those is RxDataScience, which is a leading healthcare-focused data analytics and artificial intelligence company that focuses on providing insights-powered solutions across the whole product lifecycle. Another is StudyKIK, a clinical trial recruitment and retention company that has demonstrated exceptional capabilities in the acceleration of clinical trials. The third is Boco Digital Media, which will help Syneos deliver innovative solutions, high levels of quality, and exceptional services to its customers.

DCF Valuation

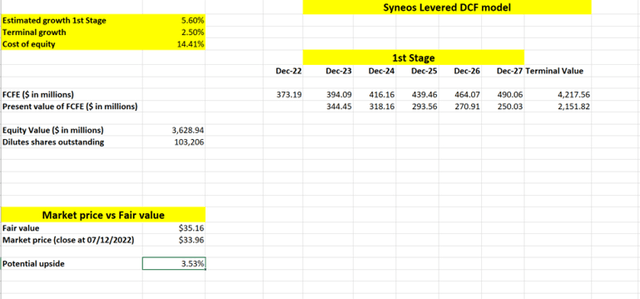

We used a levered DCF model to value Syneos due to its significant amount of debt and the fact that it doesn’t pay dividends. The relevant projected cash flow is free cash flow to equity (FCFE). Syneos’ FCFE (ttm) is currently $373.19 million. We are using a two-stage growth model. In the first stage we estimate the cash flows, taking into account a 5.6% growth rate, which is double Syneos’ revenue growth rate for FY2022 according to the company’s updated guidance. For the second stage, where we compute the terminal value, we use a growth rate of 2.5%. Each cash flow is being discounted using cost the of equity as the discount factor. We estimate Syneos’ cost of equity to be approximately 14.41%. In our calculations we take into account a risk-free rate of 3.6% (the 10-year Treasury Rate on Dec. 5, 2022), a beta of 1.69, and an average return of 10% for the market as measured by the historical performance of the S&P 500 index since the inception of its modern structure in 1957.

According to the results of our DCF model, the fair price of Syneos’ stock is $35.16. The company appears to be slightly undervalued by 3.53%. As such, we rate the stock a hold.

Risks

As explained above, Syneos Health faces a significant issue that’s structural in nature. Aside from that, potential investors should be well aware of certain risks when it comes to investing in the company.

To begin with, SYNH can be susceptible to remarkable impact from large cancellations in its clinical business segment. These can be caused mainly due to clinical failures or reprioritization on the part of its customers. On such occasions, it would be difficult for the firm to repurpose capacity that was previously allocated to that large trial. Such a development could lead to significant losses. Even though the company has a well-diversified client base, 55% of its revenues come from the largest 50 pharmaceutical corporations. Hence, this potential risk shouldn’t go unnoticed.

Moreover, as economic headwinds mount, SMIDs – which represent about 45% of Syneos’ revenues – are expected to face increasing economic difficulties due to a drop-off in market liquidity and uncertainty over profitability. According to macro analyst Alfonso Peccatiello’s estimates, the base case scenario seems to be a relatively serious recession starting around March/April 2023. In this case, we expect further punishment of SYNH stock by the markets.

As concerns regarding the economic outlook aren’t abating, Syneos’s net debt of $2.66 billion, from which around 45% is variable-rate, heightens its uncertainty level. Even though the company’s fast-growing EBIT (grew by 25% in the last year) covers its interest expenses by 6.6x and SYNH generated FCF amounting to 94% of its EBIT, the high amount of debt could affect the firm in other ways. Syneos could lose market share due to its debt if it isn’t able to pursue more acquisitions and evolve at its competitors’ pace.

Last but not least, SYNH stock price has high volatility. Over the past three months it was more volatile than 90% of U.S. stocks, typically moving up or down 16% per week. High volatility could result in reduced liquidity that, in turn, could cause a further decline in the company’s stock price.

Conclusion

Shares of Syneos Health suffered a massive sell-off in the past two months mainly due to issues with the key customer segment of SMIDs and macro headwinds. The management team has recognized the problem and has already taken steps to turn things around. Moreover, Syneos possesses a narrow moat in the global CRO industry, which experiences high growth. But any investment in the stock at the moment would entail significant risks due to the current economic outlook, idiosyncratic factors (risk of large cancellations/a high amount of debt), and the increased volatility of the stock. We believe that the headwinds are already priced in and we cannot identify any catalyst that could cause an important upward or downward movement in shares. According to our DCF model, Syneos is slightly undervalued by 3.53% and, as such, we rate it a hold.

Be the first to comment