Martin Barraud/iStock via Getty Images

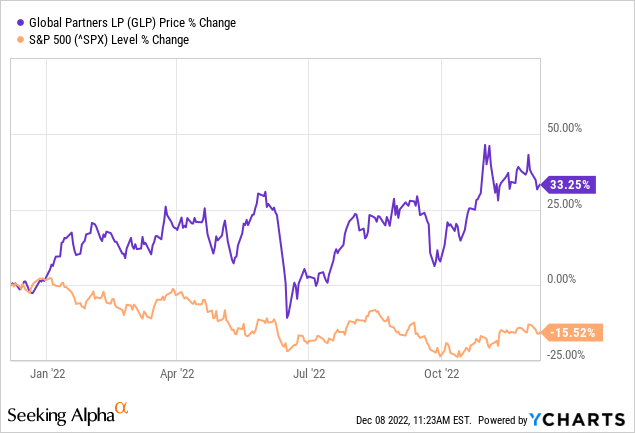

Global Partners (NYSE:GLP) owns 21 terminals and operates the largest terminal network in New England and New York. In addition, the company owns 1,600-plus retail stations across the Northeastern and Mid-Atlantic U.S. and fills 1 million tanks per day. GLP is an MLP that declared a Q3 distribution of $0.625/unit. On an annual basis, the $2.50/unit distribution equates to 8.2% yield given the stock’s current $30.58 price. Meantime, the stock is up 33% over the past year, significantly outperforming the S&P500 (see below). As a result, I find GLP attractive for income-oriented investors who don’t mind dealing with a Schedule K-1 instead of a Form-1099 at tax time.

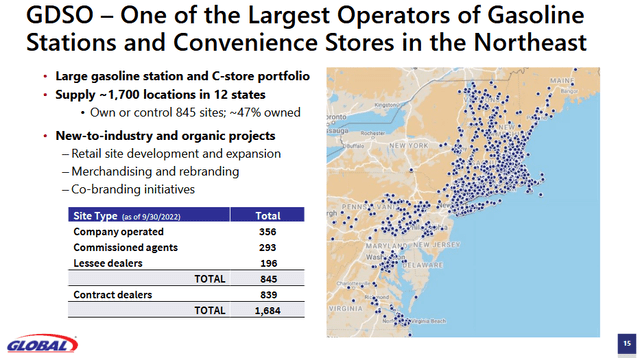

The slide below taken from the recent Q3 presentation gives investors a high level view of GLP’s operations, which includes 8.9 million barrels of storage capacity:

GLP

Earnings

GLP announced its Q3 results in the first week of November and it was a very strong report. GAAP EPS was $3.12/unit while revenue of $4.63 billion (+39.5% Y/Y) was a whopping $520 million beat. Other Q3 highlights:

- Q3 net income of $111.4 million compared with net income of $33.6 million last year.

- Q3 EBITDA of $168.2 compared with $79.4 million in the same period of 2021.

- Q3 Distributable cash flow (“DCF”) was $128.0 million compared with $49.7 million in Q3 of last year.

Eric Slifka, GLP’s President and CEO, commented on the quarter:

During the third quarter we expanded our GDSO footprint in the mid-Atlantic with the acquisition of Tidewater Convenience, a transaction that included 15 retail fuel and convenience store locations in Virginia. At the end of the quarter, our GDSO portfolio totaled 1,684 sites, including 356 company-operated locations. Our portfolio of company-operated locations has grown more than 20 percent year over year. The M&A pipeline remains very active across all areas of our business, and we continue to evaluate potential opportunities that align with our strategic growth objectives.”

Author’s Note: GDSO stands for “Gasoline Distribution Station Operations”

The quarter was primarily driven by favorable market conditions for gasoline and distillates and increased volumes due to acquisitions (see Seeking Alpha contributor Value Quest’s article GLP: 9.88% Yield And Acquisition of Tidewater Convenience).

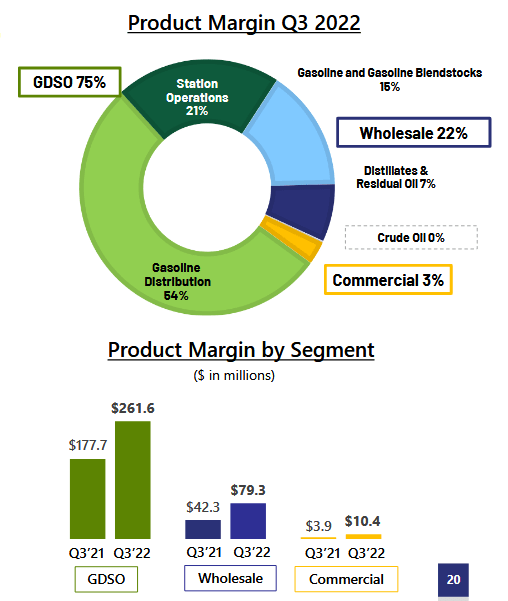

The graphic below, taken from the previously reference Q3 presentation, shows the MLP’s product margin across segments – which is dominated by its GDSO and Wholesale operations:

GLP

Going Forward

The Tidewater purchase referenced earlier included 15 gas stations and convenience store locations in Southeast Virginia. GLP also recently bought 23 convenience stores from Miller’s – including 21 company-operated sites with fuel supply agreements at 34 locations – primarily in Virginia. Both of these deals will make for easier year-over-year comparisons for GLP over the next few quarters.

The slide below shows GLP’s current GDSO footprint:

GLP

Note that GLP sells gasoline under major brands such as Mobil, Shell, BP, CITCO, and Gulf.

Recently, GLP completed the sale of its Revere, Mass., terminal on Boston Harbor for $150 million. That deal contained a lease-back agreement that enables GLP to continue operations at the terminal.

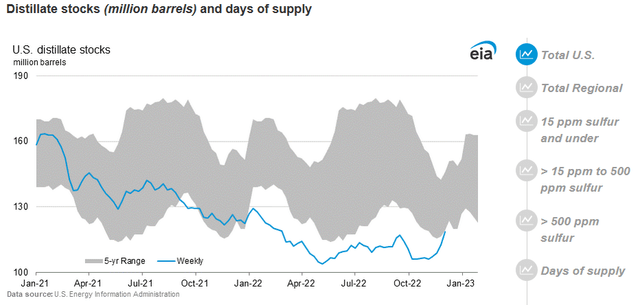

Meantime, the EIA reports that distillate stocks (diesel, fuel-oil, etc.) remain below their five-year range:

EIA

That is bullish for GLP over the near term. However, note that recently the blue trend-line has headed-up back toward the five-year range. That could mean that prices may begin to decline in the near future.

Risks

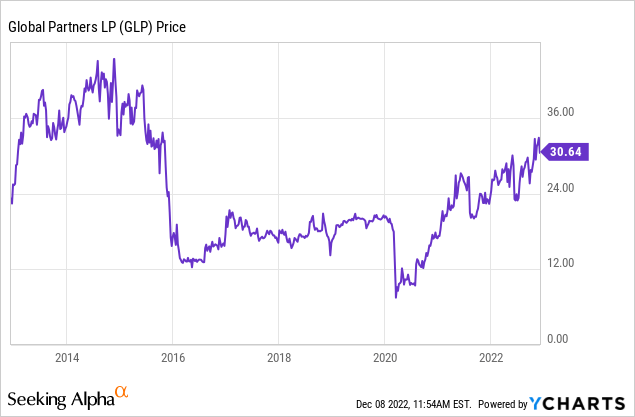

GLP operates in a commodity business that runs in cycles. Currently, I would argue GLP is benefiting from a tight global and U.S. diesel market. These markets don’t always last, and GLP’s 10-year stock chart is not overly impressive:

The point being is that – long term – GLP is primarily an income play and should be viewed as such. The transition to EVs could put long-term pressure on total volumes – both at the terminal and retail levels. That could lead to lower distributions over time.

Meanwhile, the consensus view that the U.S. could enter a recession next year could also put downward pressure on GLP’s volumes and margin.

From a balance sheet perspective, GLP has ~$840 million in long-term debt, but no near-term maturations: $400 million of 7.00% senior notes due are due in 2027 and $350 million of 6.875% senior notes are due in 2029. At the end of Q3, the leverage ratio (debt/EBITDA) was 1.87x, which – in my opinion – is quite strong and indicates this MLP is by no means over-levered.

Summary and Conclusions

Given the current global macro-environment, in which the energy crisis in the EU gets reflected back-across the Atlantic to the Northeastern and Mid-Atlantic regions of the U.S., GLP appears to be an attractive investment given its large GDSO footprint, terminal infrastructure, and strong 8.2% yield. That being the case, income-oriented investors who don’t mind dealing with the hassle of K-1s at tax-time will likely find GLP attractive, and for them I rate this MLP a buy. At the same time, I caution GLP investors to keep a keen eye on the retail gasoline/diesel market going forward as the tide is likely to go out at some point in the future.

Be the first to comment