Anna Moneymaker/Getty Images News

The debate continues daily over the Fed’s future policy. My expectation is a 50-basis point hike in a few days and another one early next year. My best guess is still a 5% terminal rate, but evidence may take that number higher. In my opinion, it is doubtful that there will be any near-term data to suggest the terminal rate will be under 5%.

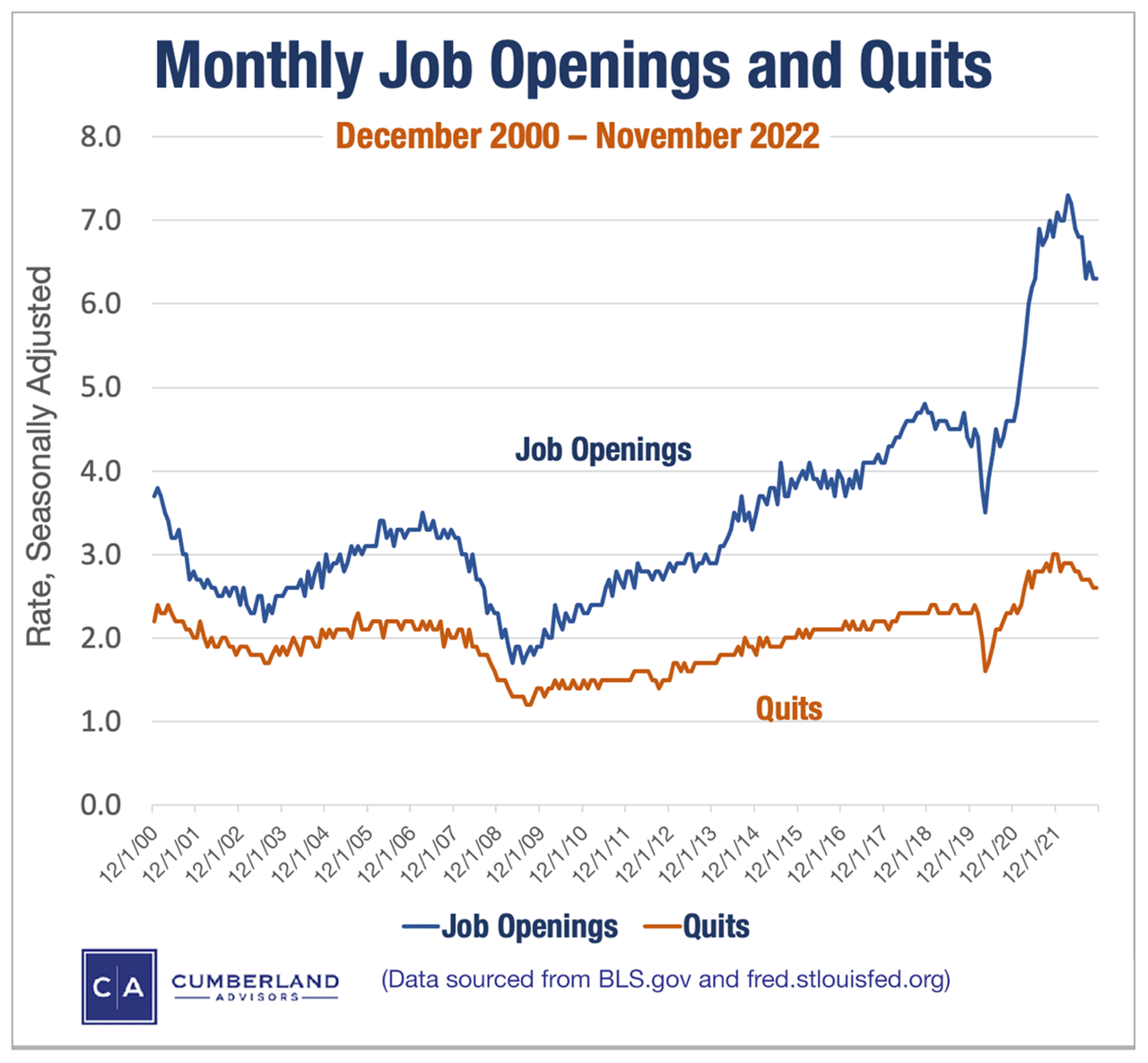

Some ask what would cause me to change my mind. Fair question. Here’s one of the many indicators we use. We track the two data series you see in the chart below. Once the gap between the quit rate and job openings rate closes to something close to normal, we expect two things to happen.

First, job changes will slow down because the incentive to quit a job and take a new one for higher compensation will be eroded. Second, the Fed will be able to make a case that there is less labor cost pressure contributing to inflation intensifying. Remember, it is the service sector jobs that are “sticky,” and they have not shown any signs of a lessening of upward compensation pressure.

Until the gap closes, we expect a tightening bias in Fed policy to continue. That means a headwind for stocks, pressure on earnings growth, and an uncertain outlook for bonds in general and credit spreads in particular.

We are still holding some cash reserves in the US Equity ETF accounts.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment