taseffski/E+ via Getty Images

The potential growth of the cannabis industry has captured the hearts of investors everywhere. Cannabis stocks have pulled back significantly over the last year or so, which caused some shareholders’ heartburn. With so many questions surrounding regulation, supply and demand, and failures in Canada’s cannabis stocks, some folks have more questions than answers. Glass House Brands (OTC:GLASF) has positioned itself to avoid many of the risks that have plagued other cannabis companies and have created a sustainable cost advantage in cultivation, which should put investor’s minds at ease.

Investment Thesis

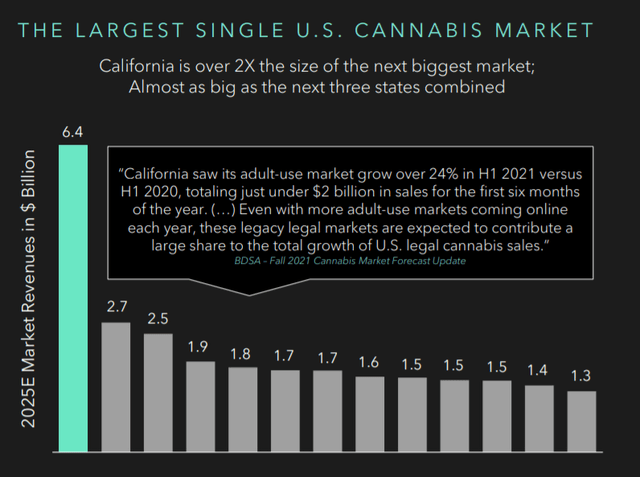

Glass House Brands is a superstate cannabis operator in California, and they want to keep it that way for several reasons. The California cannabis scene has been at the forefront of the industry since it originated in San Francisco’s Haight-Asbury district. The underground business has been evolving and developing for decades. Now, those individuals are bringing that culture mainstream. Some of them are working for Glass House. Though, the main attraction is that California is huge.

Cities and municipalities across California have been rapidly approving dispensaries during 2021. At least 92 retail licenses will be awarded after November 2021 ballot measures. Most of those licenses coming online in 2022. Glass House will stand by to fill their shelves over the next year.

In September last year, Glass House closed on one of the largest greenhouses in the U.S. Located in Ventura County (SoCal facility). The SoCal facility consists of six greenhouses totaling 5.5 million square feet. The company purchased the greenhouse from a tomato grower for around $157 million in cash and stock. A big pill to swallow for a smaller company, but a great opportunity (see this video regarding the SoCal facility).

Why does this matter? Cost advantage

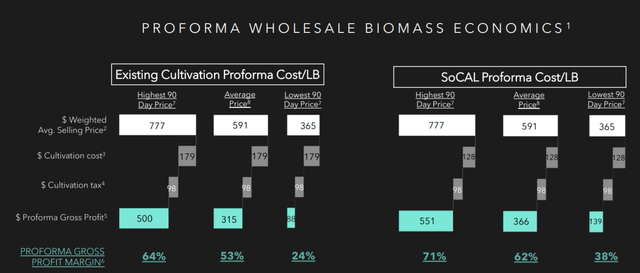

Being in Ventura County alone gives the greenhouse significant natural cost advantages. The ideal temperature for cannabis to grow is 65 to 85 degrees. Very conducive to the consistent temperature range in the area. Average sunlight in Southern California is over 12 hours per day. Greenhouses in different locations across California and the rest of the U.S. have additional costs to control heating and cooling, lighting, and humidity that Glass House greenhouses get naturally.

Perhaps the most significant cost advantage is that they own the greenhouses. Most other cultivators lease their greenhouses. Because the cannabis industry is still illegal at the federal level and has a negative (although diminishing) stigma, greenhouse rents are well above average.

Altogether, Glass House can currently produce a pound of cannabis for about $180. Management believes they can get close to $100 per pound at full scale. The average cost for smaller farmers in Californian is closer to $500 per pound.

These cost advantages will become exponentially important if/when cannabis becomes federally legal and cultivators across the U.S. compete across state borders. At that time, cultivators with higher cost structures that grow in several states could have issues generating margins and could end up restructuring. That scenario would give Glass House a dominant position in the wholesale cannabis market in the U.S. Here’s what CEO Kyle Kazan said during the Q3 2021 earnings call:

When you look at MSO [multiple state operators], and let’s say, you’re vertically integrated in 25 states, there is no other industry that has 25 state vertical integration. So, there’s going to be cleanup that every one of those MSOs are going to have to do to drive efficiency or else they are going to have some real problems. And so, I would expect that there’s going to be some write downs and there’s going to be just cleanup.

Glass House currently operates four retail dispensaries located in Berkeley, Santa Barbara, Los Angeles, and Santa Ana.

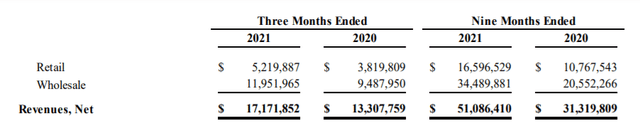

As Glass House’s retail dispensary base has come online over the last years revenue has increased dramatically. For the last quarter, retail dispensaries have grown revenue by over 36%.

Expanding retail in California is a top priority for the company. The obvious advantage is the higher-margin business for the cultivated cannabis sold through owned dispensaries.

Two more retail dispensaries in Santa Barbara and one in Dunsmuir, Hesperia, and Eureka will open before mid-year. Glass House’s revenue and margins should expand over the ensuing years.

The company is also due 14 more licenses from its former partner, Element 7. These licenses are being held up in a suit filed in February of 2021. When those licenses potentially become available to Glass House, the retail portfolio will almost triple.

Operating from a position of strength has helped Glass House navigate the challenging tax environment in California. The state is one of only two that impose a cultivation tax. This situation has been tough on Glass House, and smaller grows. Especially after considering that the tax has reset higher starting in 2022. There is a strong possibility of relief coming as early as this year. California Governor Gavin Newsom released statements indicating that cannabis tax reform will be addressed in his 2022-23 budget. His motivation is to stabilize prices in the market and hasten the illicit market’s transition to current and future licensed California operators. Reading between the lines, a current reduction in tax revenue to the state will promote the expansion of the legal cannabis market, and tax revenue grows higher in down the road.

Cannabis industry analysts in California believe that the cultivation tax will be at the center of budget discussions. They also believe that the cultivation tax could be eliminated.

The 2022 cultivation tax rate is about $160 per pound. If the tax is eliminated, it could add over $20 million to the company’s bottom line going forward. This would be a monumental lift for the company’s expansion plans.

Risks

Glass House could suffer if wholesale prices continue to decline. After a very frothy year in 2020 for cannabis, cultivation increased dramatically in 2021. Dispensary licenses and store openings did not keep pace with cultivation. Accordingly, cannabis prices hit all-time lows starting in the summer of 2021 and stayed depressed throughout the year. As noted above, retail licensure in the state will likely increase significantly in 2022. When new California dispensaries open and cultivation normalizes, cannabis prices should also normalize to higher levels. Glass House’s cost advantage is vital to surviving downturns like this.

Glass House’s plans involve substantial construction projects. Cost and time overruns are always a risk. In Q3 2021 Glass House invested close to $100 million in the first phase of its SoCal greenhouse retrofit. I believe they can easily earn a great return on that investment and future investments. If not, the stock could suffer.

Glass House became a public company through a SPAC merger with Mercer Park Acquisition in late 2021. The management team chose to go this route because it had an agreement to purchase the SoCal facility and needed a quick turnaround. SPAC stocks have generally been given a bad name and rightfully so in most cases. In addition to the stigma, original SPAC investors have tended to dump their shares after their lock-up periods end. This is not the case with Glass House. The original owners of Glass House are now on the management team and have not sold a single share.

Valuation

The market cap for Glass House stock is about $250 million. According to their insurance assessment, the replacement cost of the SoCal greenhouse is $250 million. Meaning, the company stock is available for the replacement cost of the SoCal greenhouse alone. After you add four current dispensaries and four more only months from coming online, you have a huge bargain.

Glass House will have 6 million square feet of greenhouse space capable of producing around 2 million pounds of cannabis per year at full scale. In a bear case, if the average wholesale price shrunk to $300 per pound and remained there, Glass House could produce at a cost less than $200 per pound. That’s around $200 million of gross margin on the wholesale business alone. In reality, the cannabis they sell is on the higher end of the average wholesale price, which will likely increase to a more normal level. Even buy this bear case back-of-the-envelope valuation, the shares are attractive.

A more likely base case scenario includes an increasing number of California dispensary licenses, cannabis prices advancing to a more typical price, federal legalization at some point, and tax relief to some extent. This could all lead to mid hundred-million-dollar range cash flow. At $5 per share the stock is an excellent value for a firm with Glass House’s potential. Although the stock is down, I believe that is because of the general decline of cannabis stocks, and not because of SPAC investors reaping profits.

Conclusion

Catalysts for 2022 include doubling retail dispensaries, tripling cultivation capacity, likely relief from a very burdensome cannabis tax environment in California, and potential for wholesale price recovery. Longer-term catalysts look very similar. Glass House will look to continue expanding its retail license portfolio and build out the remainder of its 5.5 million square foot greenhouse. Grab this seed before it blossoms.

Be the first to comment