PeopleImages/iStock via Getty Images

Investment Thesis

Doximity (NYSE:DOCS) has seen its growth rates slow down. And alongside this slowdown, its multiple has come down significantly.

As we go through I highlight the positive and negative considerations that investors need to think about Doximity.

I put a spotlight on Doximity’s capital allocation strategy, and question whether it’s the best use of capital. While also recognizing that Doximity is resonating very strongly with its customers.

In sum, there’s a lot to like here.

What’s Happening Right Now?

We are in very interesting times. All the ingredients that got us here in the first place haven’t been solved. Namely, inflation, a slowing economy, and geopolitical tensions. And yet, there’s the belief that if the Fed stops raising rates, this will be a huge stimulus for the market.

For my part, I do not believe this. I do not believe that we’ll see a V-shaped recovery. And the high-flying unprofitable companies may be having their days or weeks in the sun again, but I believe we are in nothing more than a bear market rally.

Nevertheless, the market is starting to discern between viable businesses and those that only exist in a bubble environment marked by razor-thin interest rates.

And one clear way to figure out those businesses that are going to be long-term winners, is to figure out which businesses are either close to reaching a profit in the coming 12 months to 24 months, or even better, are already profitable, versus those that are not going to make it (”NGMI”)

Revenue Growth Rates Will Soon Stabilize

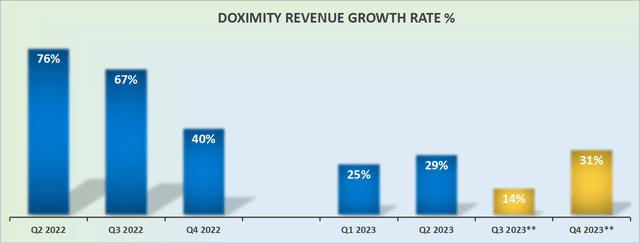

Doximity was growing at a very rapid rate last year. This year, as it compares against those tough hurdles from last year, its growth rates are more muted.

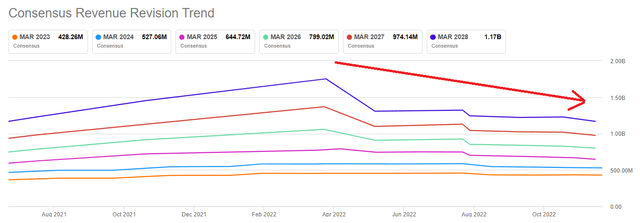

But as we get past the next quarter, fiscal Q3 2023, the comparables become a lot easier. Hence, I believe that expectations have now sufficiently reset. To illustrate, consider this:

Analysts’ expectations have come down substantially over the preceding few months. With expectations lowered, investors are offered a much improved risk-reward investment.

With this in mind, let’s discuss Doximity’s near-term prospects.

Doximity’s Near-Term Prospects

During its recent earnings call, Doximity highlights its incredibly useful app.

It’s time-saving ‘delighter’ features like Scan Number that have earned us a perfect 5 star review on 88% of our 140,000 app store reviews. And keep in mind that docs are tough graders! Most physician workflow apps get 2 to 3 stars on average. We don’t seed or pay for any of these reviews, but we do spend a lot of time listening to our docs.

And this goes to the core of the bull case. Doximity is incredibly focused on being the best at providing physicians with the tools that they need.

And while many investors have made the argument that Doximity’s total addressable market isn’t that big and that the business will soon mature, this is what Doximity declares:

[T]hird party studies completed over the last six months, our median pharma ROI has improved to over 15 to 1. That’s well above the 10 to 1 we cited last year in our S-1. This is for a host of good reasons, including our increased reach and personalization.

Again, this is a clear moat. Any time you can deliver high ROI to your customer, it becomes a no-brainer for customers to pay for your solutions. And over time, your ability to raise prices too.

Profitability Profile Discussed

What follows here is a tale of two profits. Consider Doximity’s GAAP net income margins below.

- Fiscal Q2 2022: 45%

- Fiscal Q3 2022: 57%

- Fiscal Q4 2022: 39%

- Fiscal Q1 2023: 25%

- Fiscal Q2 2023: 26%

What you see is that over time, the GAAP net income margin is trending lower. We are not giving the GAAP profitability looking ahead, because accounting for future SBC is too challenging a task.

But what we are giving is Doximity’s EBITDA margin. At the end of Doximity’s EBITDA margins, it points to 44%. That’s a substantial improvement from 41% in the prior year.

So, there appears to be a mismatch at hand. Doximity’s GAAP profitability is high, but trending lower. While Doximity’s EBITDA profitability continues to improve.

With that in mind, let’s turn our focus to the following:

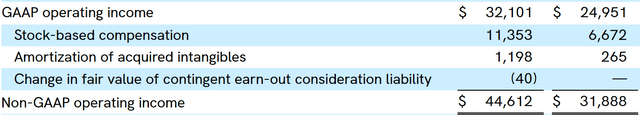

On the left, we see Doximity’s most recent quarter. On the right, we see the same period a year ago. And what you see here is that SBC expense was up 70% y/y, while revenues were up 29% y/y.

And this leads me to discuss this critical aspect. Doximity has repurchased $70 million worth of its stock over the past 6 months, and yet the total number of shares has only decreased by 1.3%.

Hence, I’m inevitably forced to ask, whether a young business facing a slowing growth rate, as well as compressing GAAP profit margins, deploying capital to buy back shares is the best use of capital?

DOCS Stock Valuation — 39x Fiscal 2024 non-GAAP EPS

The appeal of investing in growth companies is that they grow rapidly and reach scale, and their profit margins improve over time. And that’s why investors are more than willing to pay high multiples upfront.

Because those earnings rapidly grow larger. Yet, as we stand right now, that doesn’t appear to be the case.

Doximity’s GAAP profitability doesn’t appear to be moving in the right direction.

That being said, if Doximity’s profits were moving in the right direction, I believe that investors would be inclined to pay a much higher multiple than 39x next year’s non-GAAP EPS.

Put simply, amidst the tech chaos, I believe that Doximity is being offered to investors at an attractive valuation.

I believe that Doximity has already solved a huge hurdle in its business, how to be profitable. But there are still a few hairs on the story, which means that the valuation isn’t as high as it would otherwise be.

The Bottom Line

This is the one-line takeaway, Doximity has seen its revenue growth rates stabilize, while it remains highly profitable.

The expanded and more nuanced version is that Doximity appears to have lost some traction. And that if it’s able to regain momentum, I believe that we could see the business stably growing at a high 20% CAGR for a number of years.

And given that, not only Doximity has high non-GAAP profits, but GAAP too, investors in time be willing to pay up dearly for a rapidly growing profitable enterprise.

Be the first to comment