JHVEPhoto/iStock Editorial via Getty Images

In June 2021, I published my last article about Givaudan (OTCPK:GVDBF) and it was actually one of the few companies I rated as “Sell” as I considered the stock extremely overvalued and not a good value. Since then, the stock declined about 10% and the sell rating seems to be correct so far. But with the business improving and the stock price declining, we can take another look at Givaudan and ask the question if the stock is reasonably valued right now.

Annual Results

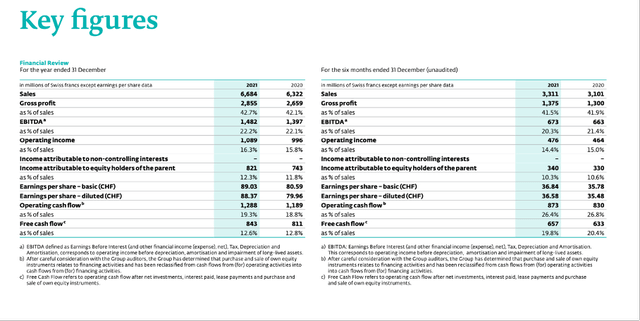

Similar to the last few years, Givaudan once again reported solid growth. Sales increased from CHF 6,322 million in fiscal 2020 to CHF 6,684 million in fiscal 2021 – representing 5.7% year-over-year growth. Operating income also increased from CHF 996 million in the previous fiscal year to CHF 1,089 million in fiscal 2021 – resulting in 9.3% year-over-year growth. And finally, diluted earnings per share increased 10.5% YoY from CHF 79.96 in fiscal 2020 to CHF 88.37 in fiscal 2021.

Givaudan Q4/2021 Earnings Release

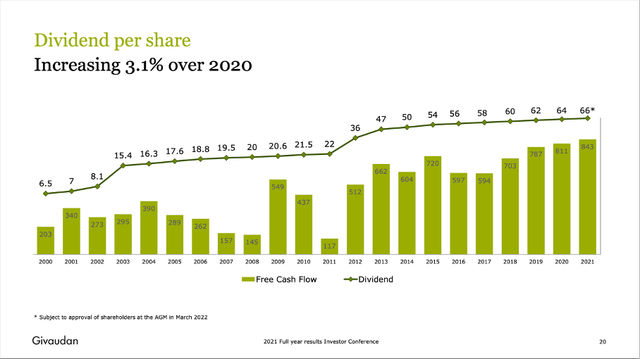

Free cash flow increased from CHF 811 million in fiscal 2020 to CHF 843 million in fiscal 2021 – resulting in 3.9% year-over-year growth. Margins also increased year-over-year with the gross profit margin improving from 42.1% to 42.7% and operating margin improving from 15.8% last year to 16.3% this year.

Givaudan Q4/21 Presentation

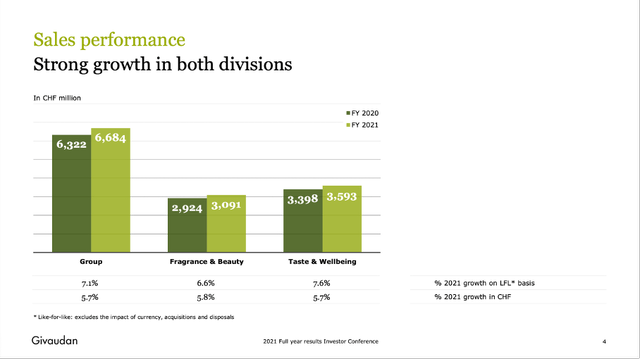

When looking at the two different segments – Taste & Wellbeing as well as Fragrance & Beauty – we can see that both segments are contributing to growth and both segments could increase revenue 5.7% year-over-year. Taste & Wellbeing increased revenue from CHF 3,398 million to CHF 3,593 million and revenue from Fragrance & Beauty increased from CHF 2,924 million to CHF 3,091 million. And while operating income of the Fragrance & Beauty segment increased only 2.1% YoY from CHF 536 million to CHF 547 million, operating income from Taste & Wellbeing increased 17.8% YoY from CHF 460 million to CHF 542 million.

Growth

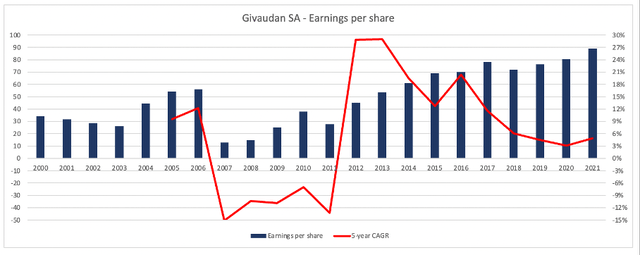

One of the major problems of Givaudan is the fact that the business must grow with an extremely high pace for the stock to be fairly valued right now (we will come back to this). And when looking at the growth rates in the past, Givaudan was not able to perform at such a level. Since 2000, Givaudan could increase its earnings per share with a CAGR of 4.62%.

Author’s work

Only when looking at the timeframe between 2007 and 2021, we get a CAGR of 14.91% and when looking at the past ten years, we get a CAGR of 12.38%. But while it might be tempting to just pick the timeframes we like, to make our point, this is not the way investing works. Or to put it differently: When we assume that Givaudan will be able to grow its earnings per share about 15% annually just because one particular timeframe is supporting this thesis, it might lead to disaster.

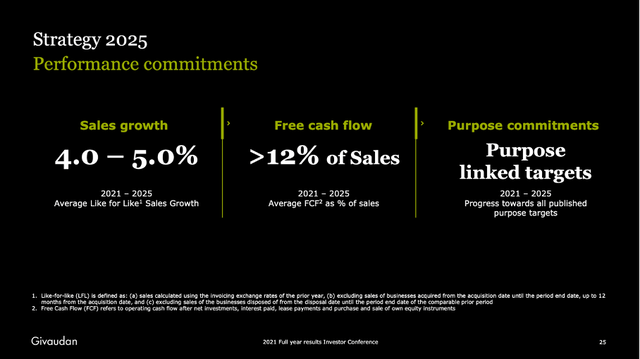

And Givaudan is also not so optimistic about its growth potential in the years to come. Management is expecting sales to grow between 4% and 5% in the years to come and while improving margins or share buybacks might contribute to EPS growth, we should not be overly optimistic. It seems unlikely that Givaudan will start buying back shares (and it would also not be a wise decision considering the expensive share price).

Givaudan Q4/21 Presentation

Another way to grow for Givaudan is by acquisitions. In December 2021, Givaudan closed the acquisition of DDW The Color House as well as the acquisition of Custom Essence. Of course, acquisitions also lead to higher revenue (and probably higher earnings per share), but DDW The Color House would have contributed about $140 million in sales and Custom Essence would have contributed about $40 million in sales. And this will add only about 3% growth to Givaudan’s business.

Balance Sheet

And while Givaudan could continue with acquisitions in the years to come to keep growing, we also must keep in mind that the company has already some debt on its balance sheet. It is not like we must worry about solvency and liquidity, but in my opinion, it would not be wise for Givaudan to make major acquisitions.

On December 31, 2021, Givaudan had CHF 428 million in short-term debt and CHF 4,239 million in long-term debt. When comparing the total debt to the total equity of CHF 3,941 million, we get a D/E ratio of 1.18, which seems acceptable. But when comparing the total debt to the operating income Givaudan can generate annually (CHF 1,094 million in fiscal 2021), it would take about 4.25 years to repay the outstanding debt.

Right now, Givaudan has CHF 273 million in cash and cash equivalents on its balance sheet, which is enough not to make us worried about liquidity, but Givaudan could repay only a small part of the outstanding debt with that amount.

Dividend

Givaudan also increased the dividend once again. Compared to a dividend of CHF 64 in fiscal 2020, the current dividend of CHF 66 is an increase of 3.1%. As we can see in the chart below, Givaudan increased its dividend annually since 2000.

Givaudan Q4/21 Presentation

At first look, one might be shocked a bit by the rather high payout ratio. In fiscal 2021, Givaudan will pay out 74% of its earnings as dividend and such a high payout ratio should make us a bit cautious. But when looking at the last 10 years, we can see that Givaudan always had a high payout ratio and was distributing a huge part of its earnings as dividends to shareholders. In fact, a payout ratio of 74% is the lowest number since 2010 with the other fiscal years reporting payout ratios as high as 89%.

And although Givaudan is paying out a huge part of its earnings as dividend, the stock still has only a dividend yield of 1.7% and hence the stock is not really interesting for dividend investors. And especially in the last few years, the dividend growth was also mediocre. In the last five years, the dividend was increased with a CAGR of 3.34%, and therefore, the stock is also not interesting for dividend growth investors.

And the reason for the rather low and disappointing dividend yield can be found in the extremely high stock price, which is just not matching fundamentals in my opinion.

Intrinsic Value Calculation

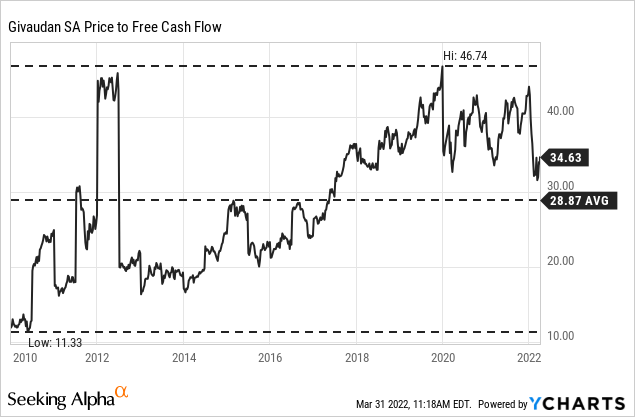

When looking at the price to free cash flow ratio, we see constantly increasing numbers over time. At the beginning of 2010, the company was trading for 11 times free cash flow, and in late 2019, the stock peaked at 47 times free cash flow. In the last two years, the P/FCF ratio was fluctuating between 31 and 44, and while I am writing this article, Givaudan is trading for about 35 times free cash flow.

While we can see that Givaudan is now trading for a lower P/FCF ratio, I still would not call the stock reasonably valued or even cheap. A company and stock that is trading above 30 times free cash flow should be able to grow with a high pace (probably double-digit growth) to be seen as fairly valued.

Aside from looking at simple valuation metrics, we can also use a discount cash flow calculation to determine an intrinsic value for Givaudan. As basis, we can take the free cash flow of fiscal 2021 (CHF 843 million). And let’s be very optimistic for the years to come and assume 10% growth for the next decade followed by 6% growth till perpetuity. When using these assumptions (and a 10% discount rate as well as 9.234 million outstanding shares), we get an intrinsic value of CHF 3,029 for Givaudan.

And although this is a slightly higher intrinsic value than in our last article (CHF 3,000 as intrinsic value for Givaudan) and the stock is trading for a lower price than last time (CHF 3,827 at the time of writing), Givaudan is still trading about 25% above its intrinsic value and we still must call Givaudan overvalued.

Not only is the stock overvalued according to our discount cash flow calculation, but the growth assumptions we used are also very optimistic. I honestly don’t see how Givaudan will achieve 10% growth for the next ten years. And even if Givaudan could achieve 10% growth, the stock would still be overvalued right now, and the company seems like an extremely risky bet right now.

Conclusion

Givaudan is without doubt a great business with a wide economic moat around its business that should provide consistency and stability for the business in the coming years and decades, and I have no doubt, that Givaudan will grow with a solid pace, but I consider it unlikely that the company will achieve the necessary growth rates (in the low to mid-teens) to be fairly valued. And the goal of investing is not just to find fairly valued stocks, but companies and stocks trading below their intrinsic value – and Givaudan is not one of them.

Be the first to comment