panaramka/iStock via Getty Images

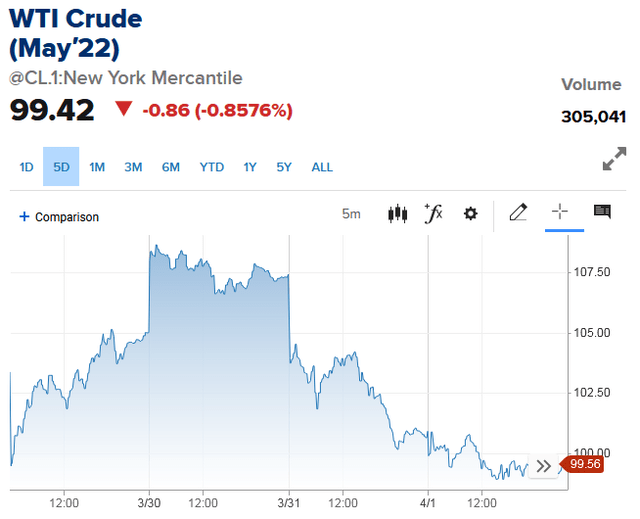

As most of you know, the global oil market has been turned upside-down by Putin’s decision to invade Ukraine and the resulting economic sanctions placed on Russia by the U.S. and its Democratic allies. While the price of WTI crude had a sharp pull-back last week (see chart below) as a result of the Biden Administration’s decision to release 1 million bpd for 180 days from the U.S. Strategic Petroleum Reserve, WTI is still near $100/bbl and that is ~2.5x the generally considered break-even point for most domestic shale production (~$40/bbl). That means low-cost producer EOG Resources (NYSE:EOG) is going to have plenty of free-cash-flow this year to reward its shareholders through both its base and, increasingly, its variable quarterly dividend. Meantime, the relatively recent Dorado discovery has excellent long-term potential.

WTI Crude Weekly Price Chart (CNBC)

Investment Thesis

As mentioned earlier, EOG has a two-tiered dividend policy: a regular, or “base”, quarterly regular (currently $0.75/share) and a special, or “variable” dividend, which was $1/share in Q1.

Given the current macro-environment, the upside for EOG shareholders is clearly with the special dividend. Note that the $1/share distribution in Q1 was based primarily on oil prices and free-cash-flow generated in the latter half of 2021. During Q4 of last year, WTI averaged an estimated $77.44/bbl. However, during Q1 of this year, WTI averaged an estimated $93.33/bbl, or more than $25/bbl higher than Q4. Considering EOG has reported it is FCF positive when WTI>$32/bbl (see page 6 of this presentation), to say that EOG is generating tons of FCF at current pricing is an understatement. That, of course, bodes well for large special dividends throughout 2022 and perhaps another significant boost in the base dividend as well.

To put this into perspective, EOG generated $5.5 billion of FCF in FY2021 when WTI averaged $68/bbl. The result – given the shareholder friendly nature of the EOG management team – was that the company doubled the base dividend and returned $2.7 billion to shareholders (~50% of total FCF) through both the base and special dividends.

If WTI averages anywhere close to the current price ($100/bbl) for the remainder of 2022, EOG could easily return an estimated $7-$8/share (or more) in total dividends to shareholders this year. At Friday’s close of $120.33, the midpoint of that estimate ($7.50) equates to a yield of 6%+.

The Dorado Discovery

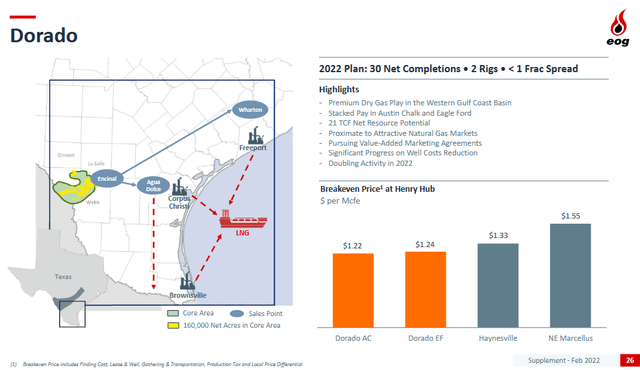

EOG’s Dorado Discovery (EOG Q1 Supplemental Presentation)

Meantime, EOG hasn’t been standing still and in late 2020 announced the discovery of a large dry-gas play in South Texas it calls Dorado. Most of you know that one reason EOG has been so successful over the years is because it has been predominately an oil & NGLs (i.e. liquids) focused company and was relatively immune from the crash in the price of natural gas. However, as can be seen by the graphic above, EOG not only believes that Dorado is a potentially massive 21 TCF resource, but that its breakeven price would be only $1.22/Mcfe – significantly less than either the Haynesville or Marcellus plays. That led EOG CEO Ezra Yacob to say the following on the Q1 conference call:

And it’s one reason we’re very excited about our Dorado prospect. We think it competes in North America is basically the lowest cost of supply, especially because of its geographic location, close to so many marketing centers, including the Gulf Coast. So we’re very excited and very fortunate to have it.

EOG has already established a dominant leasehold in the Dorado play (160,000 net acres) and says it holds 1,250 premium drilling locations. In 2022, EOG plans to roughly double activity on a yoy basis – running two rigs and a goal of 30 net well completions. It’s not difficult to see a future wherein EOG is a major natural gas supplier to Gulf Coast LNG export terminals (much of which could go to Europe).

Risks

The typical risks apply to an oil producer like EOG: massive geopolitical uncertainties with respect to Putin’s war-of-choice in Ukraine and the resulting sanctions on Russia by the U.S. and its Democratic allies. Higher oil prices can put downward pressure on the global economy and could, at some point, result in oil demand destruction and falling oil prices. However, for EOG’s stock and the price of oil, as we have already seen, those risks obviously have upside potential as well.

EOG could potentially drill-thru its “premium” shale drilling inventory in 10-15 years. That being the case, EOG will need to either make some new discoveries or enter the M&A market … something it hasn’t participated much in over the years (preferring to primarily add resources by buying new acreage leaseholds on its own).

Meantime, EOG’s balance sheet is pristine – ending FY2021 with almost as much cash ($5.2 billion) as long-term debt ($5.6 billion). The company currently trades with a forward P/E of only 9x.

A Word On The False Narrative About Shale Oil

Meantime, my followers know that another risk is the risk of what I have been calling the “new era of energy abundance”. A word about that, if you don’t mind.

After watching all the shale oil companies’ CEOs over the past decade market shale as a “short-cycle” resource that can rather easily and economically be ramped up (or down) due to market conditions, it give me a chuckle to see them (and many politicians and media “experts” …) now claim it is no longer “short-cycle” and would take “at least a year” to significantly increase production. That is simply false. A shale well can be drilled and completed and brought onto existing pipelines in a matter of weeks, two months at the most. That’s just a fact. Are there supply-chain issues as a result of the covid-19 crash? Sure. But one thing any energy investor knows is that any problem in the oil patch can be solved with money. And God knows there is a ton of money in the oil patch today.

I also am amazed that these energy company CEOs at the recent CERA conference were also complaining about a “lack of capital”. That is also very interesting to me also considering nearly all the major shale operators already have A-rated balance sheets, generated tens of billions of FCF last year (at much lower prices…), and are obviously generating tons of FCF at current prices. There is certainly no “lack of capital” in the domestic shale patch right now. For example, EOG peer ConocoPhillips (COP) generated $10.4 billion in FCF last year. Chevron (CVX), another major Permian producer, generated $21.1 billion in FCF for FY2021. You’re going to tell me these companies can’t afford to put another rig to work in the Permian Basin?

It’s also rather funny (other than the destruction of billions of shareholder capital …) that some of these same companies weren’t complaining about a “lack of capital” during the idiotic “drill baby drill” mantra of the recent past that saw them growing production as fast as possible into an already over-supplied market at O&G prices less than half of what they are today.

Meantime, the other false narrative is that somehow Biden, the “greenies”, or “regulations” are keeping shale oil companies from increasing drilling and putting new rigs to work tomorrow morning in the Permian Basin. Nothing could be further from the truth. First of all, ~80% of shale production comes from private land. Second of all, Biden’s lease regulations on Federal lands were delayed by the courts. Meantime, major shale oil players have literally thousands of Federal drilling permits that are going unused.

Bottom line: don’t kid yourself, the only reason U.S. oil production isn’t growing is because these energy companies choose not to. That being the case, investors need to be careful about buying into the false narratives being thrown about. Shale oil wells are still “short-cycle”, these companies have tens of billions of bbls of proven shale reserves (even at $40/bbl, let alone $100/bbl !), they have tons of capital, and there are existing pipelines to bring that oil to market straight away. So, we still live in an “era of energy abundance”, and it pains me to see the US oil industry not respond to a war-time situation and put the screws to Putin for what he has done in Ukraine (not to mention middle-class Americans who are getting hammered at the pump and by inflation in general) and the existential threat that the world’s worst autocrats pose to free Democracies. That said, the artificial constraints on US shale oil production growth means higher oil prices, and that is extremely bullish for EOG (and others), at least over the short-term.

Summary & Conclusion

EOG is arguably one of the best operators in the U.S. shale patch. It is also very shareholder friendly and could very easily pay out a $7.50/share in total dividends to shareholders this year (6%+ yield). In addition, if US shale oil production doesn’t respond faster (and it doesn’t look like the CEOs want to do so …), despite the 1 million bpd release from the SPR for 180 days, that’s only ~1/3 of the estimated reduction in Russian oil exports (3 million bpd). As a result, before all is said and done with Putin in Ukraine, we could easily see WTI hit $150/bbl this year. And that means not only will EOG shareholders be on the receiving end of excellent dividends, but they could also see a significant increase in the price of the stock as well – leading to total returns that are likely to blow away the S&P 500.

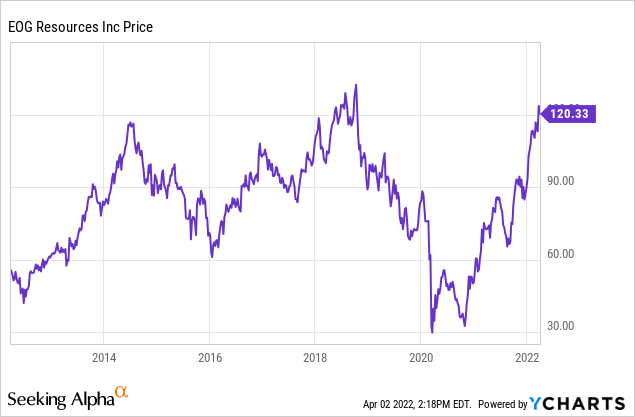

I’ll end with a 10-year chart of EOG’s stock and note the cyclical nature of the up-and-down cycles and that it is still below the price it had achieved back in 2018:

Be the first to comment